-

Overview

Reducing global greenhouse gas emissions to net zero by 2050 will require a herculean effort that needs a complete overhaul of global energy and industrial production and investment in innovation such as carbon capture technology. In total, the cost is estimated to be $9.2 trillion per annum over the coming years.

The expense will be inflationary, at least initially, as demand for the limited supply of critical resources, such as copper, zinc, and lithium, intensifies. Redesigning and rebuilding existing infrastructure will also be costly as labour and materials are redirected from other areas of the economy. Rebuilding a flooded warehouse does not add to the productive growth of the economy. The impact on the supply chain from climate events will also create supply-demand imbalances which can lead to higher levels of volatility and investment uncertainty.

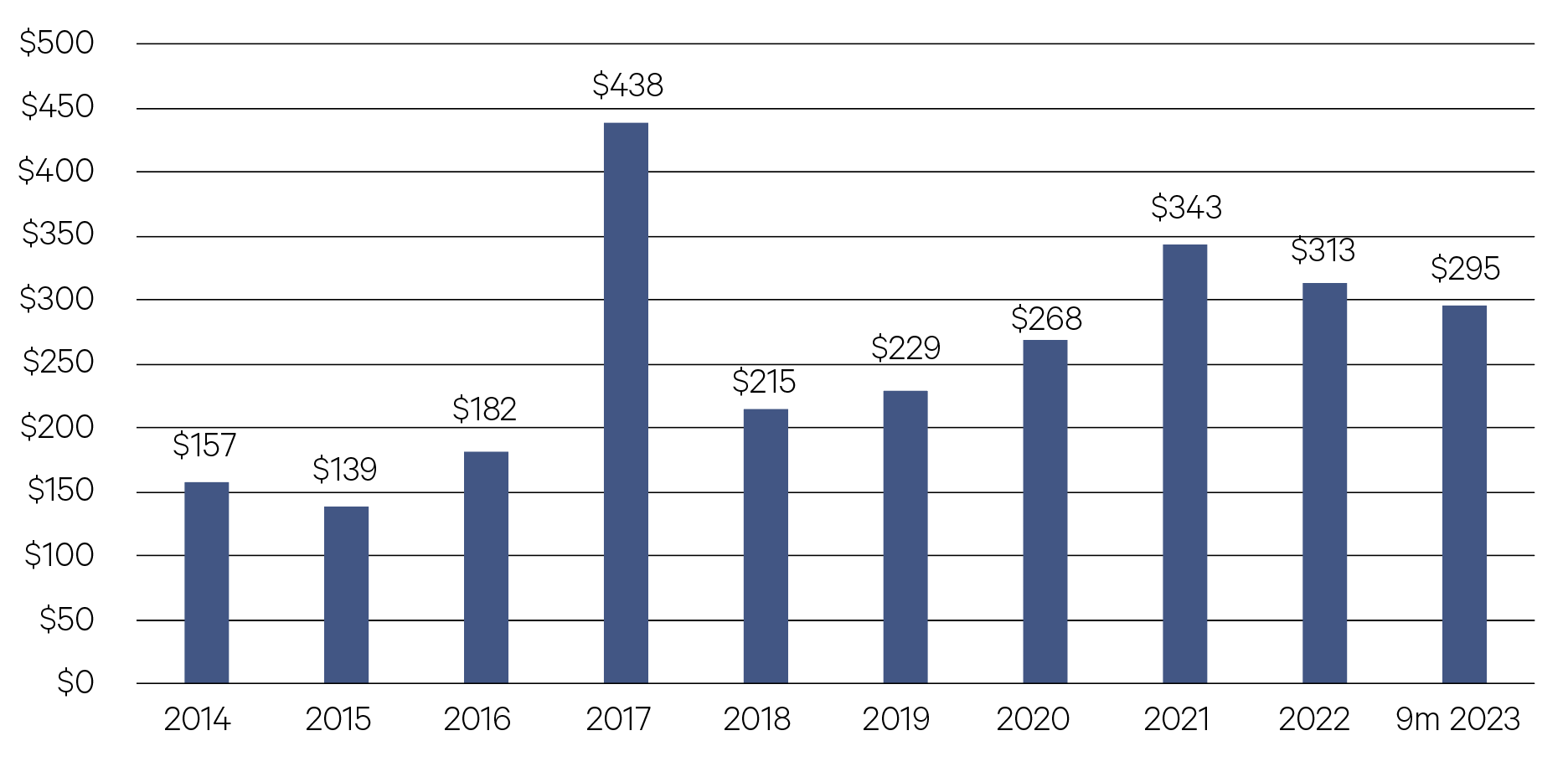

Economic cost of weather event $ billions

Source: AON, Bloomberg

—

One of the biggest burdens of climate change rests with insurers. The frequency and magnitude of severe weather events has set records every year for over a decade. Global catastrophe losses for 2023 are estimated to be above $300 billion for the third consecutive year. Insurers face increased payouts and claims due to extreme weather events. Insurance premiums are rising rapidly as a result.

The physical risks associated with a warming planet are both acute (hurricanes, floods, droughts, wildfires) and chronic (impact of gradual temperature rise and sea level rise). The implications for critical infrastructure and labour productivity are clear. Aside from the obvious threat to physical assets in flood events, heatwaves can potentially cause major disruptions to data centres, the critical IT infrastructure that underpins our daily lives.

In 2022 heatwaves caused outages to data centres for Google, Oracle and Twitter. The potential loss of revenue for data centre operators could run

into the billions without significant investment into better heating and ventilation, more energy efficient hardware and software, and more independent renewable energy sources.—

US$300bn – Catastrophe losses for 2023.

AON

—

Current spending on green initiatives is $5.7 trillion. This is still $3.5 trillion short of the $9.2 trillion annually required to achieve net zero by 2050. In the US alone the funding gap is $1.3 trillion. As part of this, spending and investment patterns will change with greater investment in new low emissions across energy, transportation and buildings.

Estimated annual spending required in a Net Zero 2050 scenario (US$trn)

Source: AON, Bloomberg

—

35% p.a. – The increase in energy transition investment required in the US to close the funding gap.

McKinsey Global Institute

—

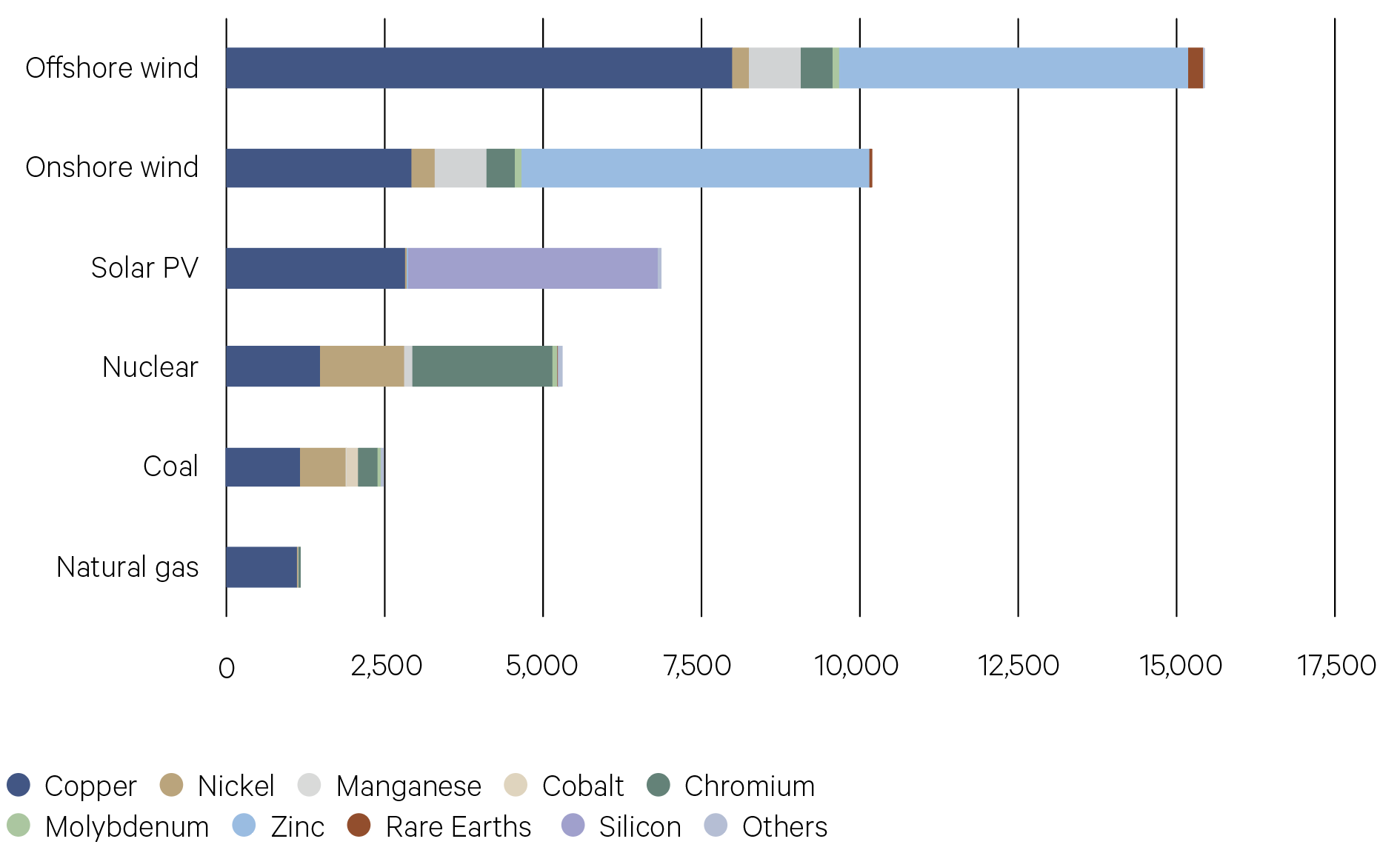

To achieve net zero, we need exponential growth in existing and new climate technologies. Wind and solar power generation would need to grow 6-fold and 14-fold by 2030 from 2021 levels respectively, whilst the number of EVs sold would need to increase by a factor of 14. All of this will require a massive amount of raw materials. Forecasts show that many critical raw materials will be in supply deficits by the end of the decade which will drive commodity prices higher.

These changes will be gradual and require patient capital. For this reason, we believe private markets investments, with longer time horizons, are best placed to capitalise on this. Specifically, alternatives such as unlisted infrastructure investments will see a significantly growing pipeline of opportunities over the coming years in renewables, energy grid infrastructure upgrades and buildouts, and EV charging infrastructure.

The transition to a renewable economy will require far greater critical raw materials (kg/MW)

Source: IEA

—

1400% – The estimated increase in solar power generation by 2030.

McKinsey Global Institute