-

Overview

Since 2020, many macro events have contributed to reveal the fragility of the global supply-chain. This includes the COVID-19 pandemic, the Russia-Ukraine war and growing geopolitical tensions. As leaders and businesses look to build more resilient supply chains, the trend toward onshoring, nearshoring and friendshoring is gaining traction.

In this new era of “de-risking” and at a time of geopolitical tensions with China, each of the G7 nations have committed to lessening their reliance on China. This process has already begun. For example, US foreign direct investment in China fell 61% from a peak of $20.9bn in 2008 to an 18-year low of $8.2bn in 2022.

—

61% – The decline in US foreign direct investment in China.

Financial Times

—

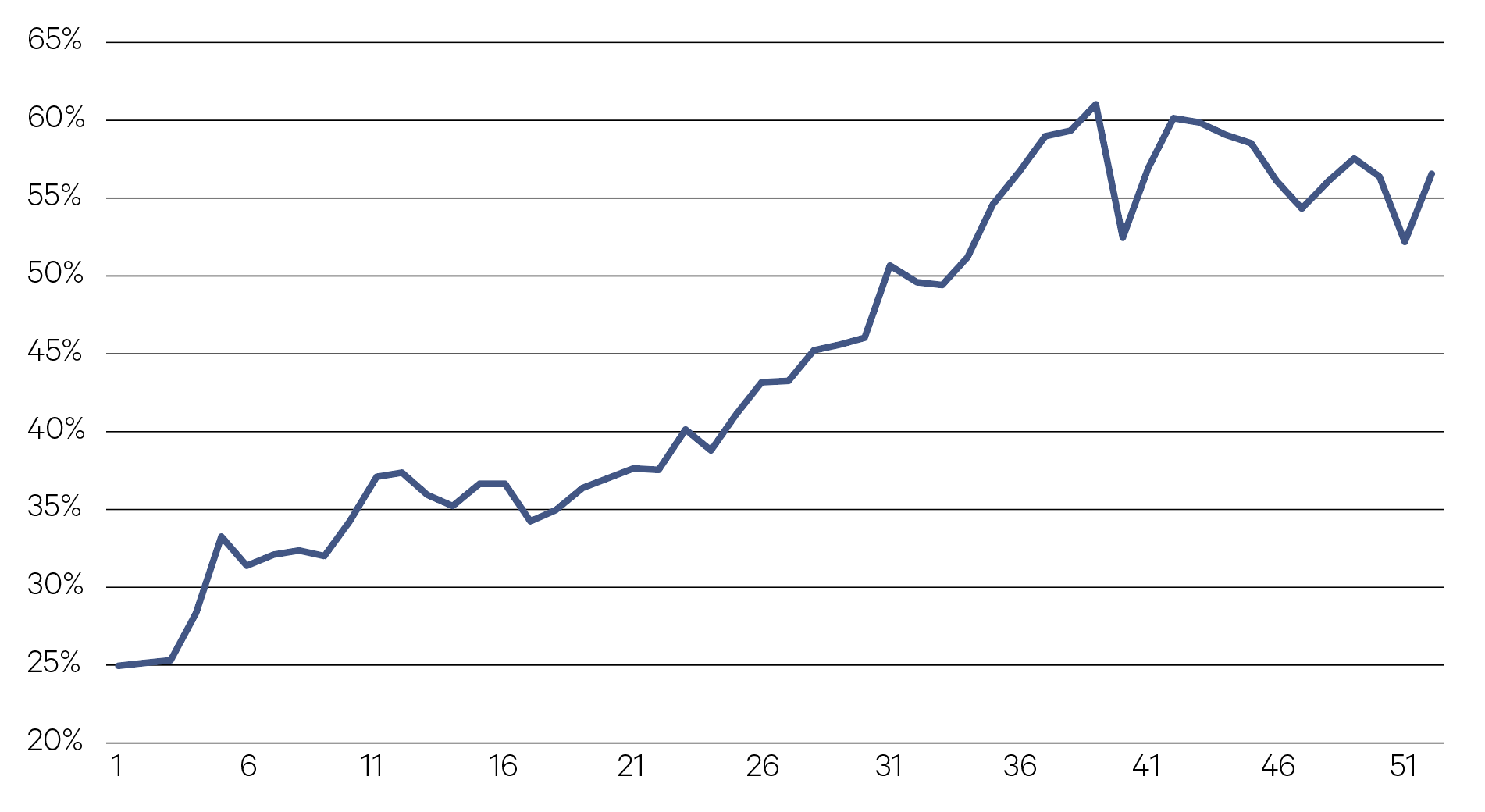

World trade as a share of global GDP

Source: Our World in Data

—

There’s no place like home

Increasingly, companies are considering “onshoring” due to the fragility of global supply chains or more favourable trade policies in the home country.

In the US, recent legislations – the Inflation Reduction Act, the Infrastructure and Investment Jobs Act and the CHIPS & Science Act – are all supportive of the development and investment of recent technologies.

The semiconductor industry is a case in point of a critical sector using onshoring and nearshoring to gain supply chain security.

—

Geographically close and politically aligned

“Nearshoring” in the supply chain refers to the practice of outsourcing business processes or services to companies located in neighbouring countries.

By 2035, 45% of supply chains are expected to be mostly autonomous, utilising automation such as robots in warehouses. The growth of automation may well reduce the necessity to offshore production to countries that offer lower labour costs.

—

45% – of supply chains are expected to be autonomous by 2035.

Macquarie Bank

—

Friends and partners

“Friendshoring” is a new concept coined by the Biden administration in which countries source raw materials and manufactured goods from other countries that share their economic and political values. One of the most recent examples of friendshoring is the Indo-Pacific Supply Chain Resilience Initiative, launched in April 2021 to share knowledge on supply chain resilience.

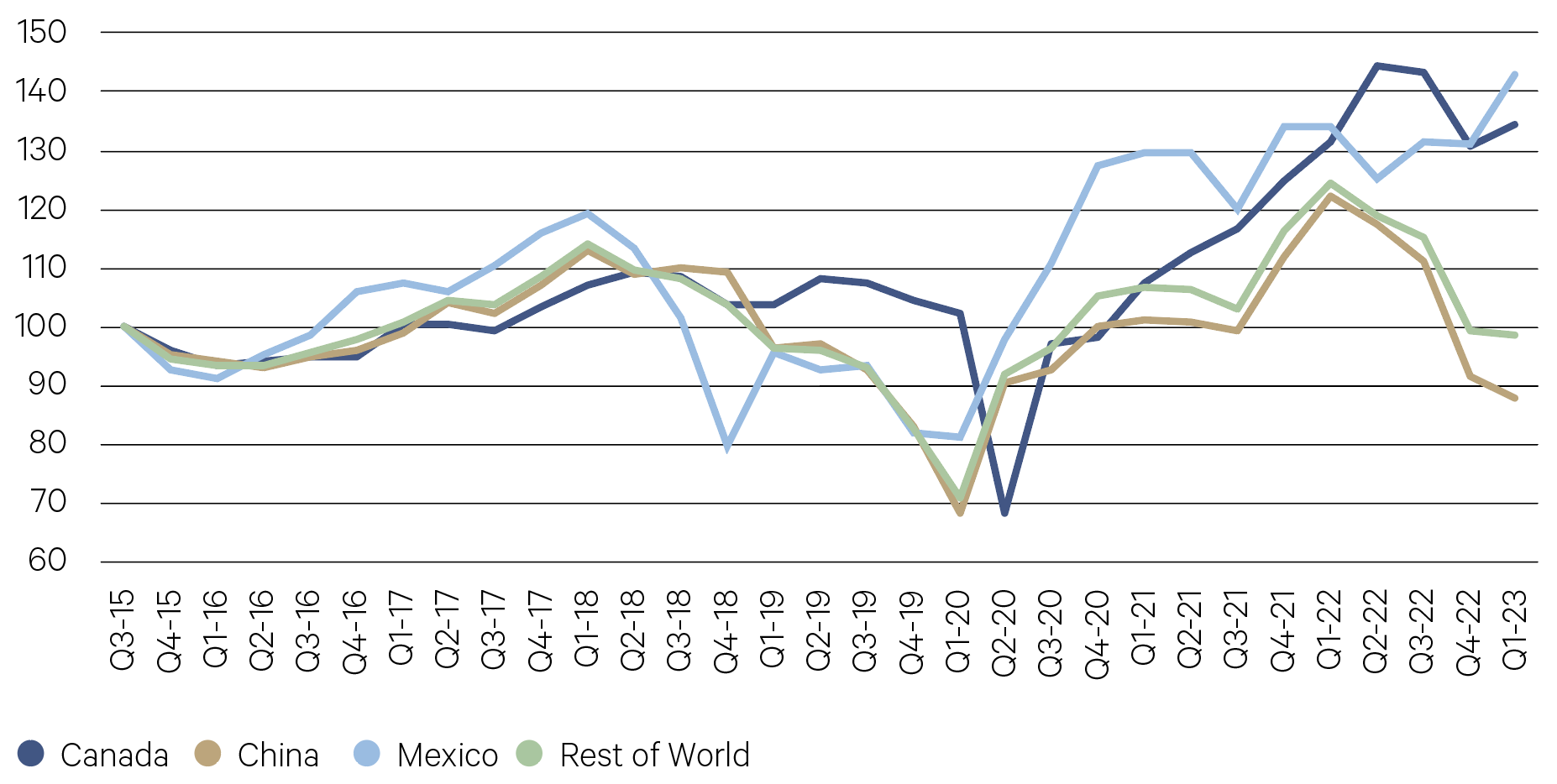

Total US trade with major trading partners (Index 2015=100)

Source: Federal Reserve Bank of Dallas

—

Globalisation has peaked, but deglobalisation is in its early stages.

TS Lombard

—

A new wave of re-industrialisation

A byproduct of a world that is becoming more regionalised and increasingly polarised may turn out to be a new wave of re-industrialisation. It started in the US with Bidenomics, the basic plan – to rejuvenate domestic industrial hubs, reorient (or “de-risk”) global supply chains and transition to new clean energy sources.

Europe, facing pressure to protect its domestic car industry from Chinese EVs and find an alternative to Russian natural gas, has no option but to respond. Similarly, Japan and South Korea have introduced subsidies for their tech and clean energy sectors.

All of this supports the thesis for continued deglobalisation, with the start of a new era of strategic industrial rivalries.

—

Investment implications

Onshoring will require years of sustained investment. Private markets are the likely beneficiaries. To manufacture efficiently requires reliable infrastructure as governments prioritise self-sufficiency and security. Onshoring will provide tailwinds to construction and engineering firms, railroads and consumer discretionary firms. Changes to the global economy are widening the scope for future infrastructure investment strategies.

A trend towards onshoring of supply chains is – and will continue to be – an additional driver of demand for select industrial property markets.

Within private equity, industrial technology will likely provide attractive opportunities as the sector moves to become less-labour intensive and more tech-enabled.