-

Overview

Over the past year there have been many eye-catching commitments to net zero but none more so than US President Biden’s Inflation Reduction Act (IRA) which has been considered the single biggest piece of policy support globally in the fight to achieve net zero. The act sets out plans for US$369bn of spending over the next decade across renewables, electric vehicles (EVs), batteries and hydrogen.

The 2021 European Green Deal, later usurped by the REPowerEU initiative following the Russian invasion of Ukraine, plans to spend €210bn in the next five years to help accelerate the transition away from fossil fuels and dependence on Russian oil and gas. Under the deal the EU aims to double the amount of solar energy produced in Europe and increase the overall share of renewables to 45% by 2027.

Rolling out a fleet of zero emission vehicles across the world will result in over 145 million EV’s manufactured by 2030 which will be powered by 105 million private charging points. Currently there are just 1.8 million charging points available across the world.

The ongoing energy crisis and the war in Ukraine has triggered unprecedented momentum behind renewables. The world is set to add as much renewable power over the next 5 years as it did in the whole of the past 20 years.

—

45% Share to renewables planned by Europe by 2027.

—

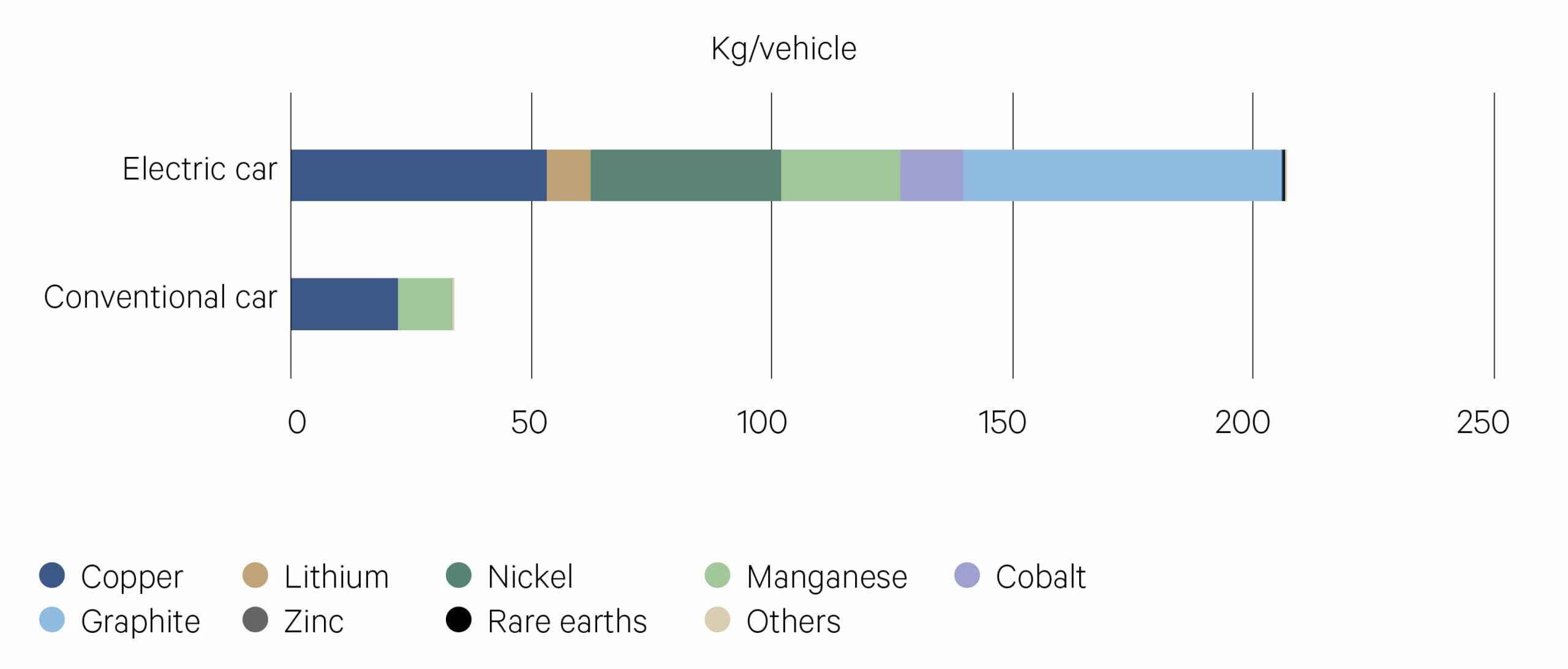

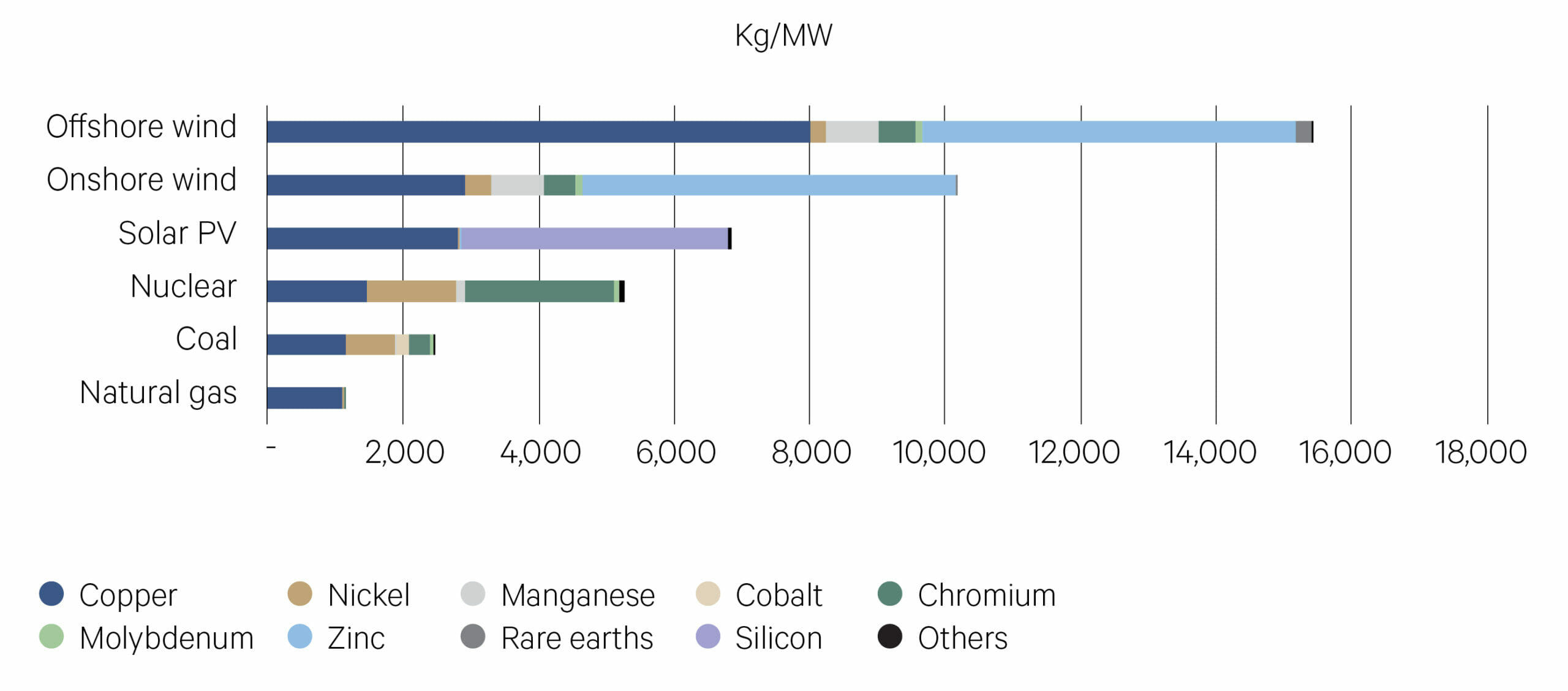

All of these commitments will require an enormous amount of raw materials including copper, aluminium, graphite, cobalt, lithium, zinc, manganese, nickel and rare earth elements. Nickel and copper demand are forecast to grow by 3,300% and 3,000% respectively between 2020 and 2040 whilst Goldman Sachs predict supply deficits for critical materials such as cobalt, nickel and lithium by 2030.

Electric vehicles and renewable energy require significantly more raw materials

Source: IEA

—

Source: IEA

—

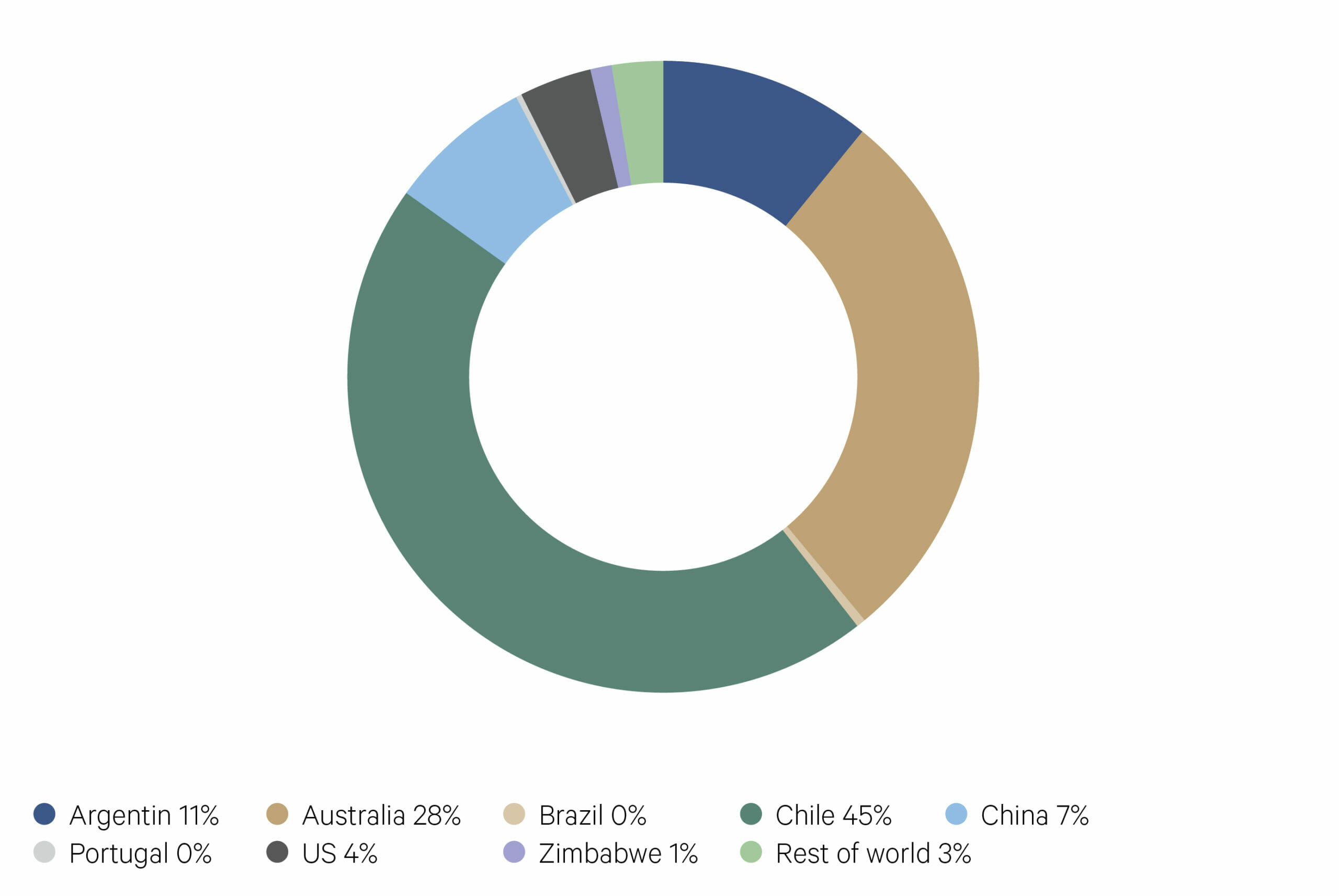

Many resource abundant emerging market economies will play a crucial role in meeting this demand for critical materials. Copper is seen as the key industrial metal of the green wave and South American nations Chile, Peru and Brazil account for close to half of the world’s current copper mining operations. Chile also has a critical role in lithium mining along with Argentina and Bolivia. The trio have become known as the ‘lithium triangle’, accounting for over two thirds of the world’s reserves of the critical battery metal. Democratic Republic of Congo is responsible for 70% of the world’s cobalt supply in 2021 and along with Russia and Cuba the trio hold over 62% of the world’s reserves.

Hydrogen is seen as a key alternative to fossil fuels in zero emission steel and cement production in the future, replacing coking coal in the smelting process. It also has a critical role to play in long-distance, heavy duty transport as a key zero emission gas through hydrogen fuel-cells. Electrolysis, which is the process of splitting water into hydrogen and oxygen, relies heavily on the platinum group metals (PGMs); with 90% of the worlds PGMs mined in South Africa.

Lithium reserves are concentrated in emerging markets

Source: BP Statistical Review of World Energy

—

66% – Chile, Argentina and Bolivia make up the “lithium triangle” accounting for 2/3 of the world’s reserves.

—

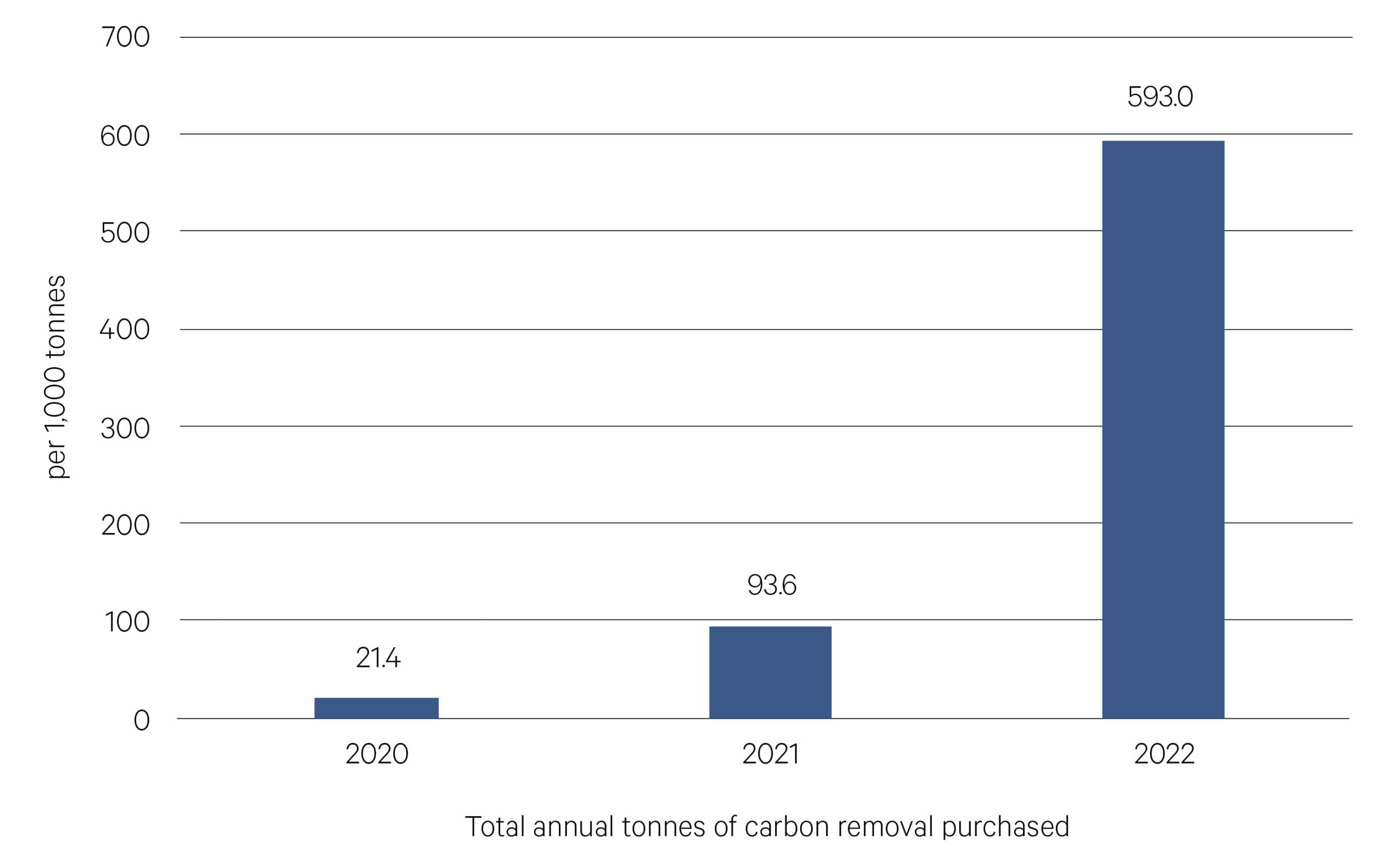

Carbon removal purchases have accelerated

Source: CDR

—

Huge progress on the production of new clean energy sources won’t however tackle the problem of existing emissions or hard to abate emissions. The EU recently recognised this and adopted a proposal aimed at promoting carbon removal technologies. Direct air capture (DAC) is one such technology, which works by using renewable energy to power big fans which collect CO2 by attaching it to a chemical compound which is then stored 500 metres underground. Investment in this early-stage space has gathered momentum in recent years with well over $1 billion invested in DAC companies. It’s a space that is already attracting purchases from some of the world’s biggest companies with Microsoft, Stripe, Square and UBS among the customers of some of the world’s leading DAC companies.