-

Overview

The COVID-19 pandemic and recent macro and climate events have underscored the importance of infrastructure highlighting the inadequacy of certain pockets of existing infrastructure and significantly accelerating pre-existing trends. Significant opportunities are also emerging for investment into next generation infrastructure such as renewable energy, decarbonisation and digitisation.

Underinvestment in infrastructure

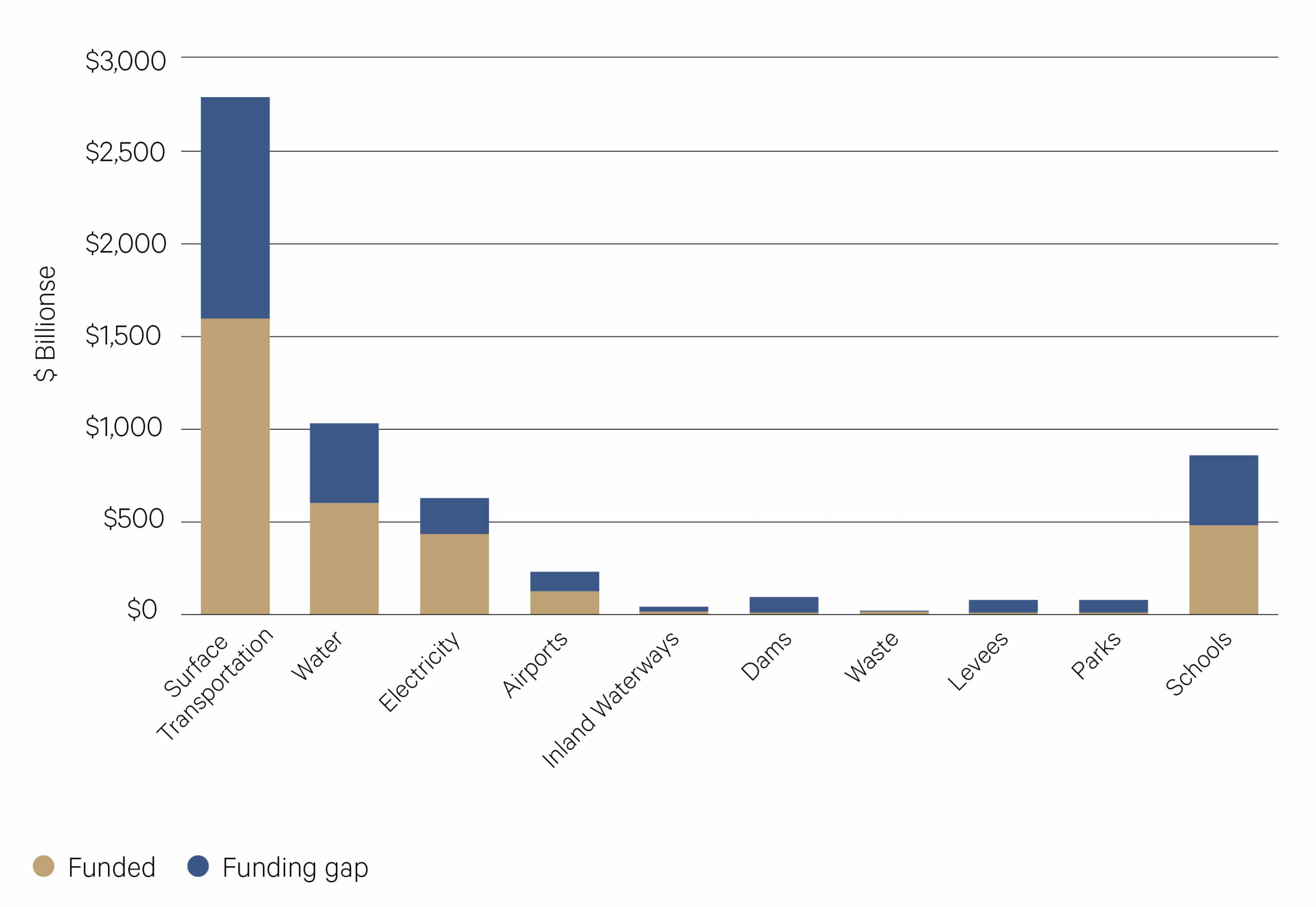

The U.S. economy relies on a vast network of infrastructure however the systems currently in place were built decades ago. It’s estimated that there is an “infrastructure investment gap” of nearly $2.6 trillion this decade that, if unaddressed, could cost the United States $10 trillion in lost GDP by 2039 according to the to the American Society of Civil Engineers.

The state of the U.S. electrical grid highlights the ageing of infrastructure assets generally. 70% of electricity transmission and distributions assets are well into the second half of their lifespans. Likewise, nearly one in four bridges are deemed deficient, with 10% categorized as structurally deficient and 14% categorized as functionally obsolete.

The European Union has identified significant infrastructure investment needs across the continent. The most recent European Investment Bank (EIB) estimates point to a combined €155bn annual infrastructure investment gap across the 27 countries..

—

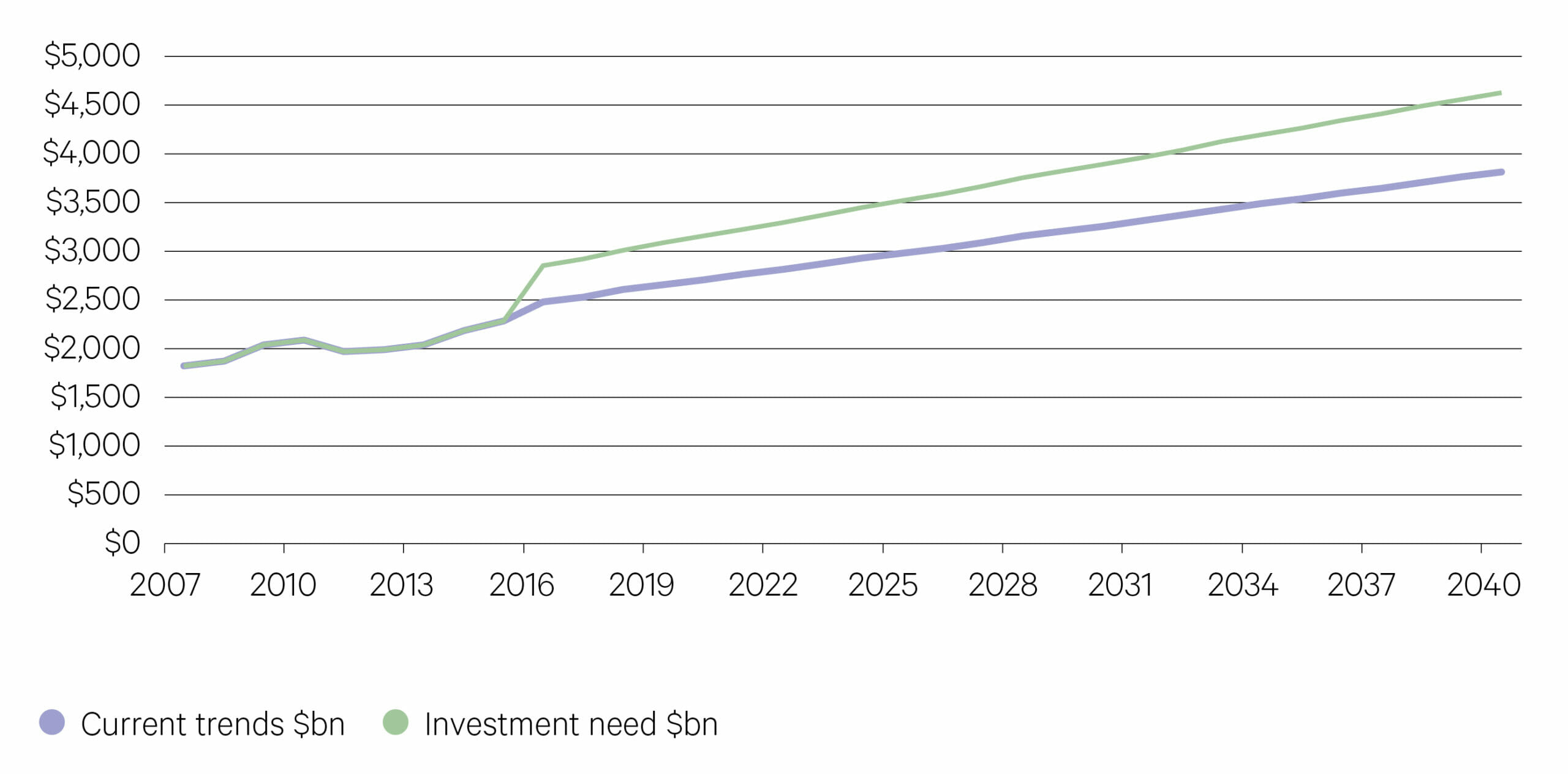

US$94trn the world needs of infrastructure investment by 2040 to keep pace with economic growth.

—

US infrastructure assets will require over $2.5 trillion on investments from 2020–2029

Source: 2021 Infrastructure Report Card, American Society of Engineers

—

Across the globe, government commitments to spending on infrastructure has picked up. In the US, the recent signing of the Inflation Reduction Act, alongside the earlier Infrastructure Investment and Jobs Act, provides a strong tailwind for unlisted infrastructure. In Europe, the war in Ukraine is spurring many governments to accelerate the transition to clean energy sources.

Whilst many governments have made infrastructure a core component of their post-pandemic recovery plans, fiscal spending on infrastructure projects won’t be enough to fill the gap for what is required leaving a big opportunity for private sector investment in many of these strong growth sectors.

Global Infrastructure Funding Gap

Source: Global Infrastructure Hub

—

Deglobalisation: A reversal of the past 30 years?

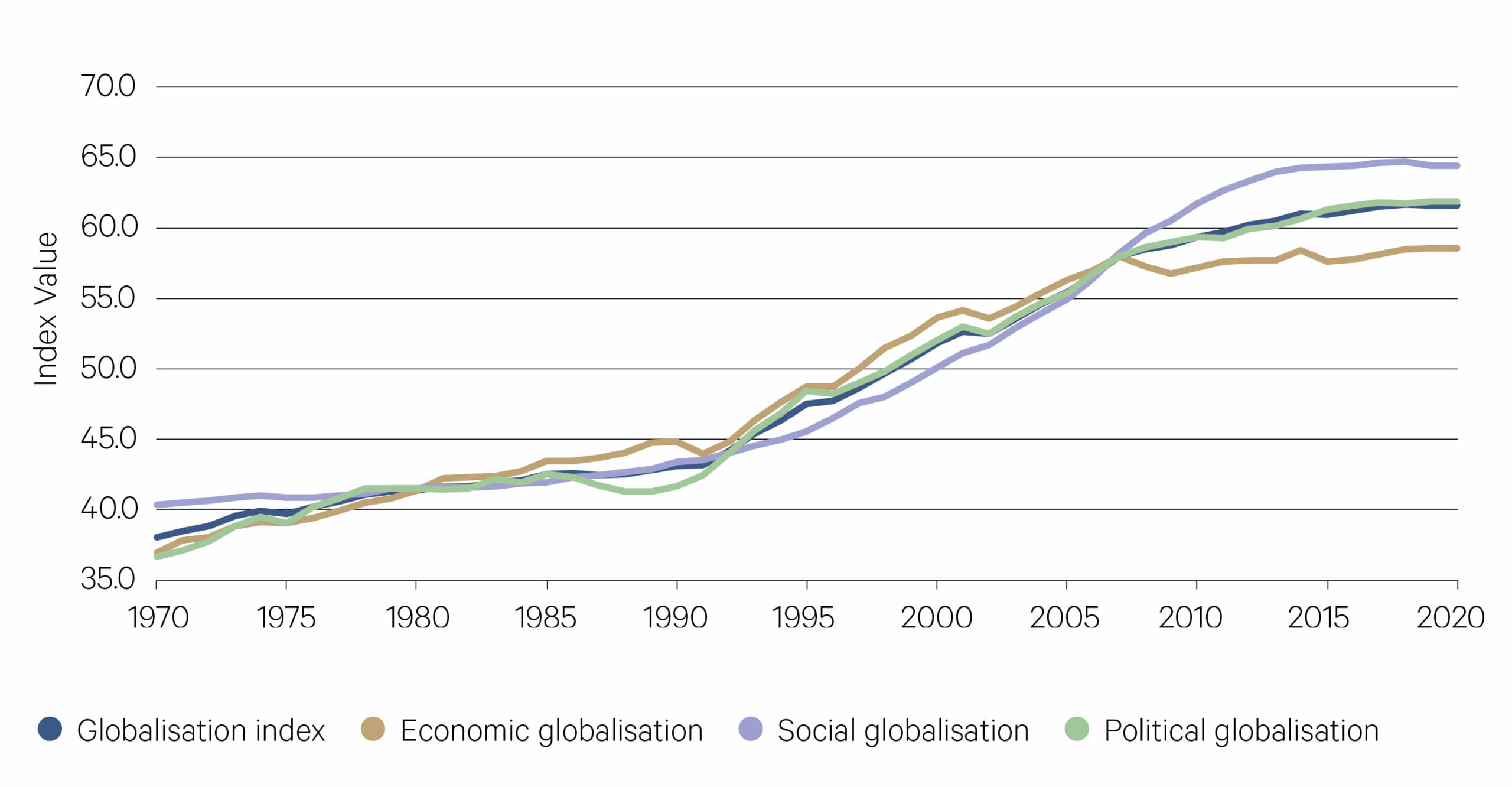

One of the most important economic themes of the past three decades was the steady expansion of global supply chains. Firms in many countries came to rely on inputs produced hundreds or even thousands of kilometres away, delivered with high reliability and for modest costs.

The COVID-19 pandemic revealed that even modest hiccups in global supply chains could lead to big problems for downstream users. This accelerated an already existing trend towards slower, or less, globalisation.

Geopolitical tensions are likely to contribute to the slowing of globalisation. For example, the spill over effect on the relationship between China and US will add to the momentum already building in onshoring manufacturing activity and shortening supply chains.

KOF Globalisation Index

Source: KOF Swiss Economic Institute 2021

—

Already, supply chain and geopolitical concerns have pushed certain industries back onshore. A notable example is the semiconductor industry, where the U.S. and Europe have announced programs totalling more than US$100 billion to expand onshore manufacturing.

—

US$100bn – US and Europe commitments to expand onshore semiconductor manufacturing.

—

Onshore manufacturing requires good, reliable infrastructure

Onshoring will not be immediate and will require years of sustained investment. To manufacture efficiently onshore you need good, reliable, infrastructure.

Likely beneficiaries of onshoring will be construction and engineering firms, railroads, and consumer discretionary firms as governments around the world remain focused on rolling out major transportation projects to both boost the economy’s productive potential and drive the economic recovery as well as support the need to achieve net zero.

Abrupt changes to the global economy are widening the scope for infrastructure investment strategies in 2023 and beyond. From roads to airports and energy infrastructure, these assets are essential to industry and households alike, and can benefit from macro trends such as the energy crisis and digitalisation.