-

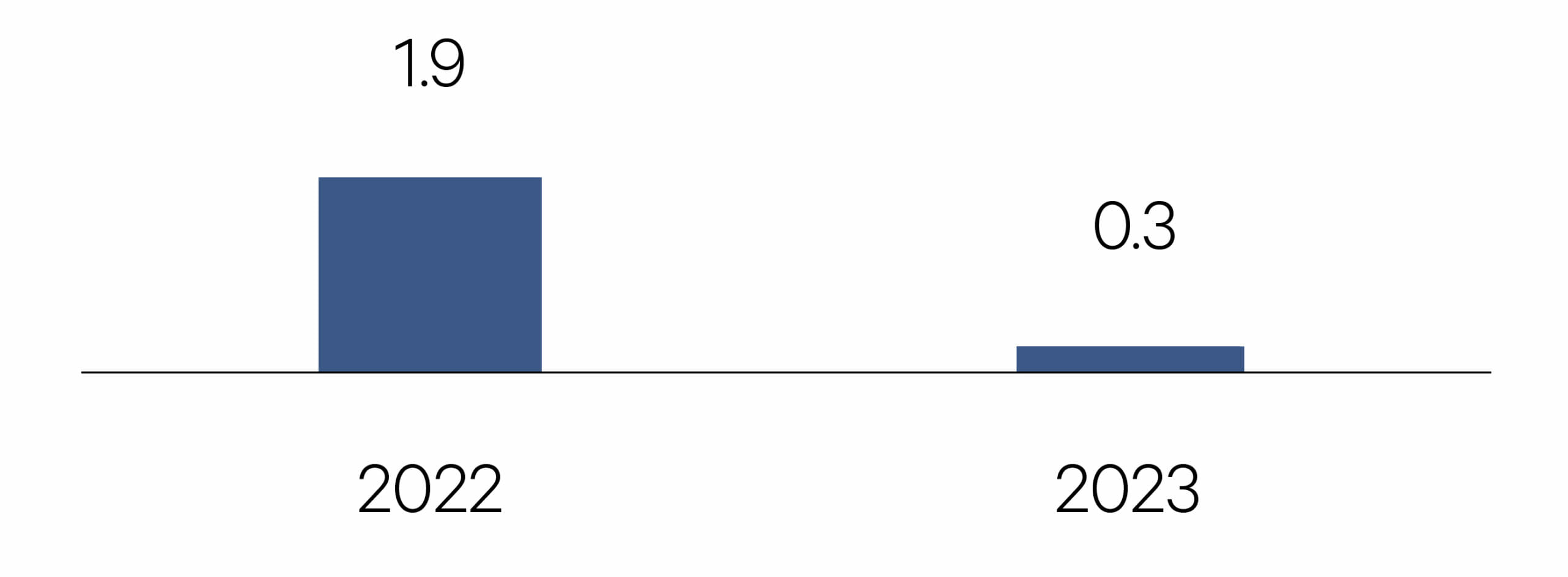

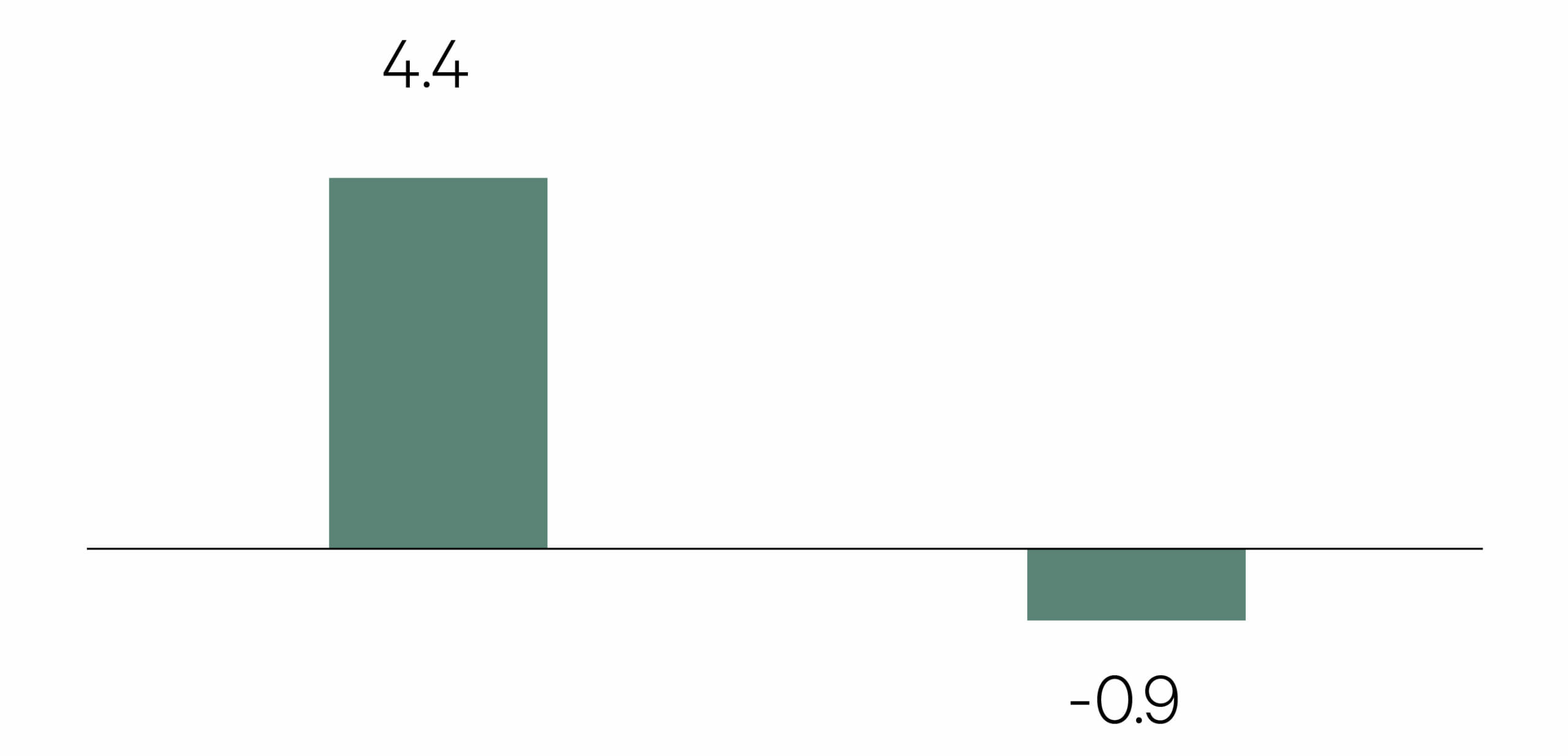

United States

The probability of recession is high in 2023 as tighter financial conditions (interest rates and the US dollar) lead to slower demand – consumption, capital expenditure and housing. Unemployment will likely rise as it has done in every US recession since 1949 pressuring already depleted household savings.

GDP %

Source: Bloomberg, data as at 31/12/22

-

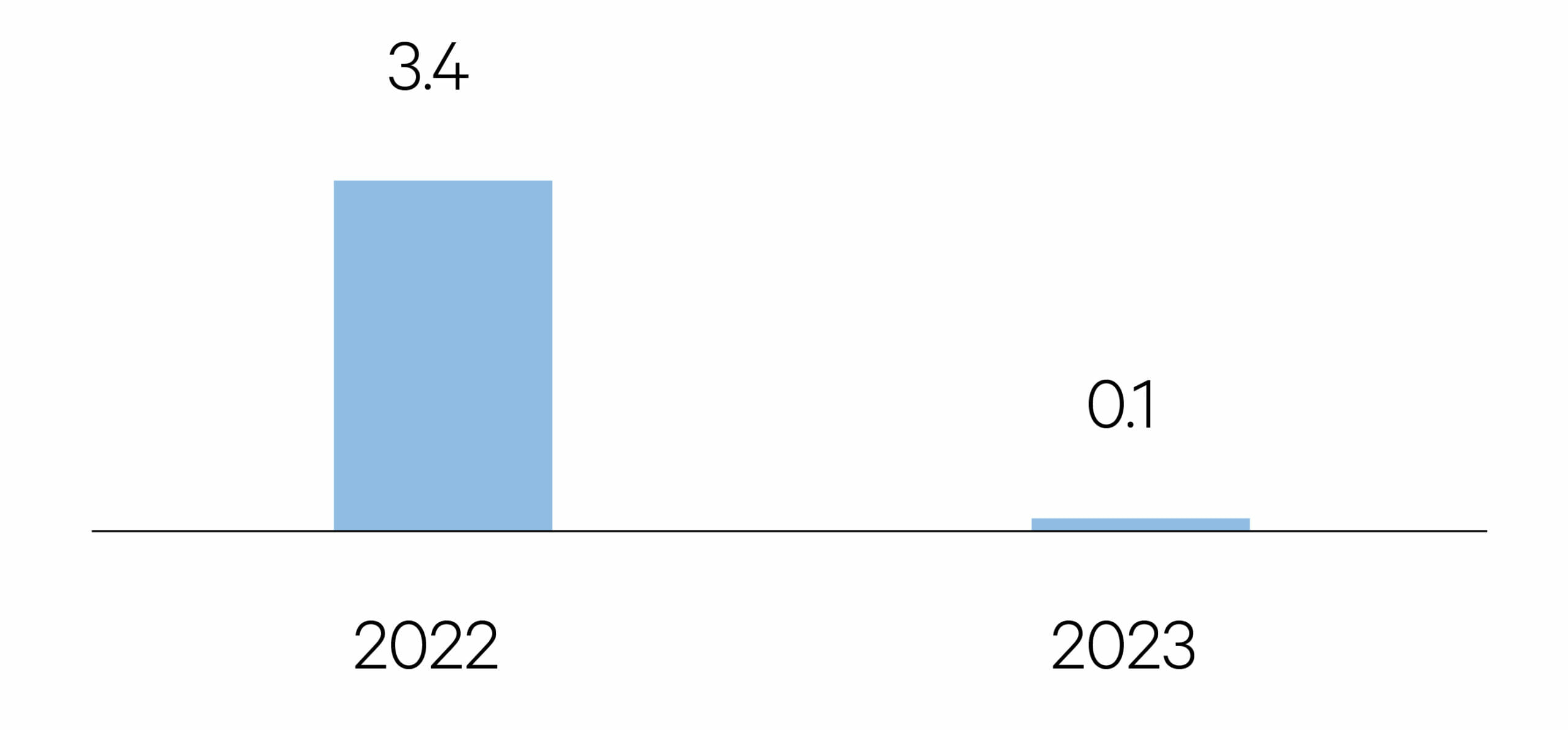

Europe

The Eurozone is already likely in recession. Europe is facing an energy shock unlike anything the region has seen since the OPEC price increases in the 1970s. Fiscal support, high household savings and tight labour markets will provide some downside cushion.

GDP %

Source: Bloomberg, data as at 31/12/22

-

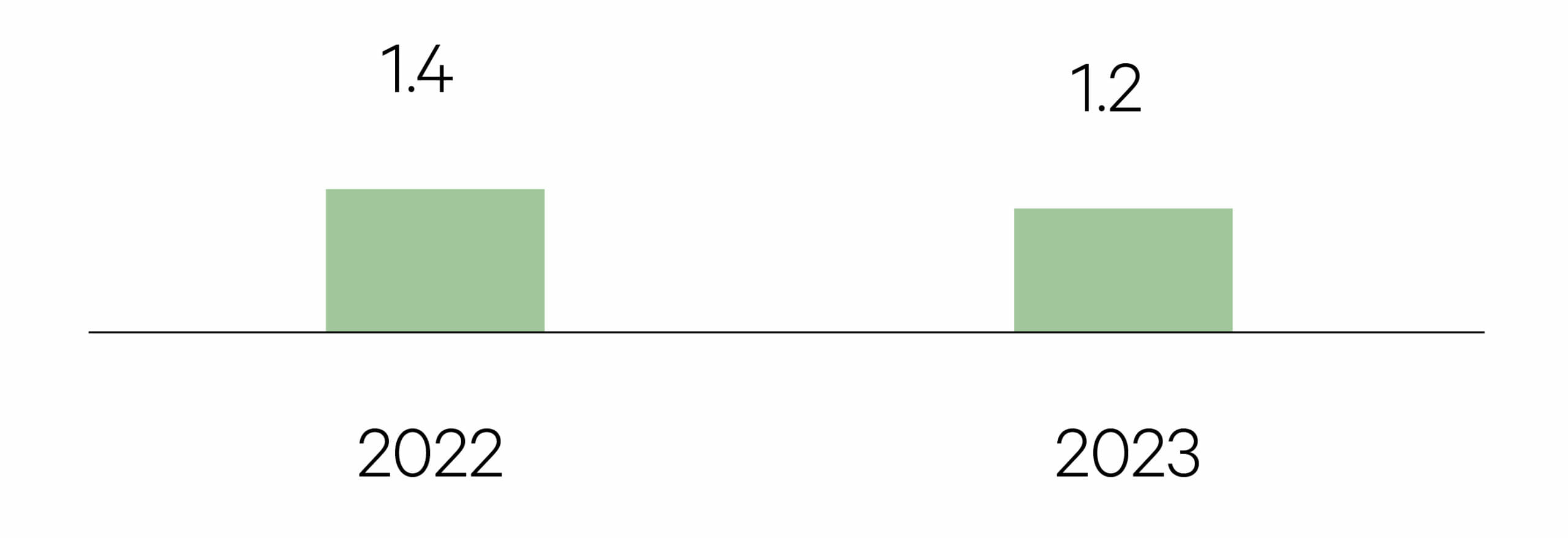

China

Growth in China is expected to accelerate this year on the back of an easing in its zero-covid strategy. China has now opened borders that had been largely closed for nearly three years. Price growth is expected to be subdued as wages growth eases. The government is also stepping up efforts to bolster the economy.

GDP %

Source: Bloomberg, data as at 31/12/22

-

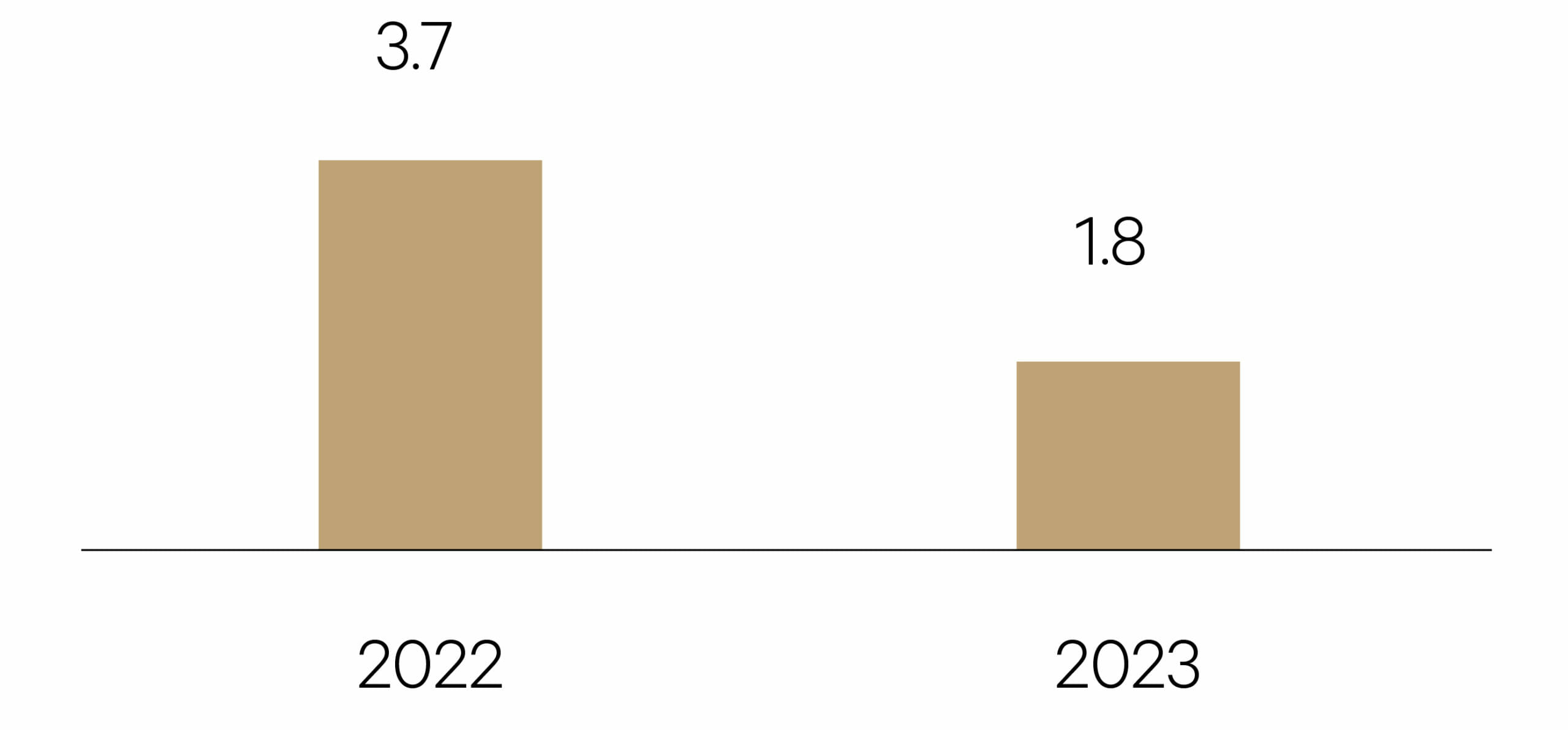

Japan

The key change in the Japanese economy is the emergence of sustained inflation and its flow through to wages. Japan’s inflation started as a cost-push phenomenon fueled by higher import prices but has spread to services. The Bank of Japan is expected to end yield curve control by the middle of the year.

GDP %

Source: Bloomberg, data as at 31/12/22

-

Australia

Inflation is likely near its peak and should allow the RBA to pause its monetary tightening cycle in the first half of the year. Growth is expected to slow as highly leveraged households pullback on spending. Downside risk lies with a global slowdown and inflation pressures that fail to abate.

GDP %

Source: Bloomberg, data as at 31/12/22

-

United Kingdom

The UK entered a recession in Q3 2022 with the size of its economy still 0.8% below its pre-pandemic peak. Large fiscal support is keeping upward pressure on prices ensuring inflation falls only slowly through the year. Curbing price gains will require further tightening from the Bank of England.

GDP %

Source: Bloomberg, data as at 31/12/22