-

Overview

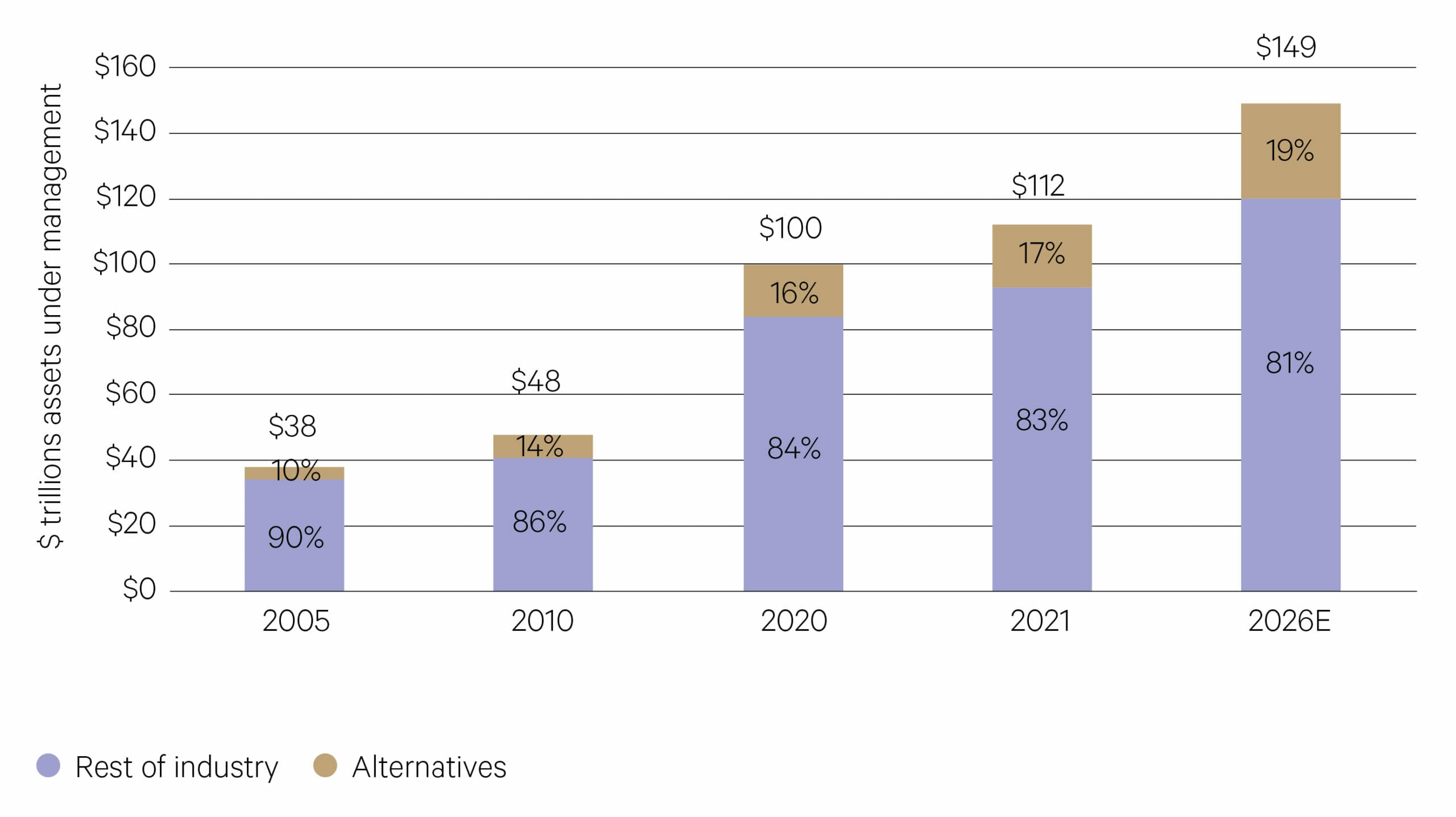

The Alternative asset class continued to grow in size in 2022, benefiting from its low correlation to traditional asset classes. Private markets have become an essential source of financing for a wide range of innovation and economic activity globally which will continue to

provide long-term tailwinds for investment into private markets. As the number of companies listed publicly across the world continues to fall the opportunity set grows in private markets.

Alternatives continue to gain a greater share of total investible assets under management

Source: BCG

—

Private equity

Private equity (PE) outperformed public equity in 2022. Less volatile private markets benefited from earnings growth while public markets suffered from a derating of price earnings multiples. History tells us that private equity often performs strongly following big selloffs in public markets. Many PE managers with elevated levels of dry powder are looking to opportunities in 2023 that will arise from depressed valuations. Secondary markets will be a focus as heightened uncertainty often leads to wide discounts to net asset values (NAV) in secondary markets. Increased volatility can create attractive entry points and mergers and acquisitions will also be a big theme for PE managers in 2023.

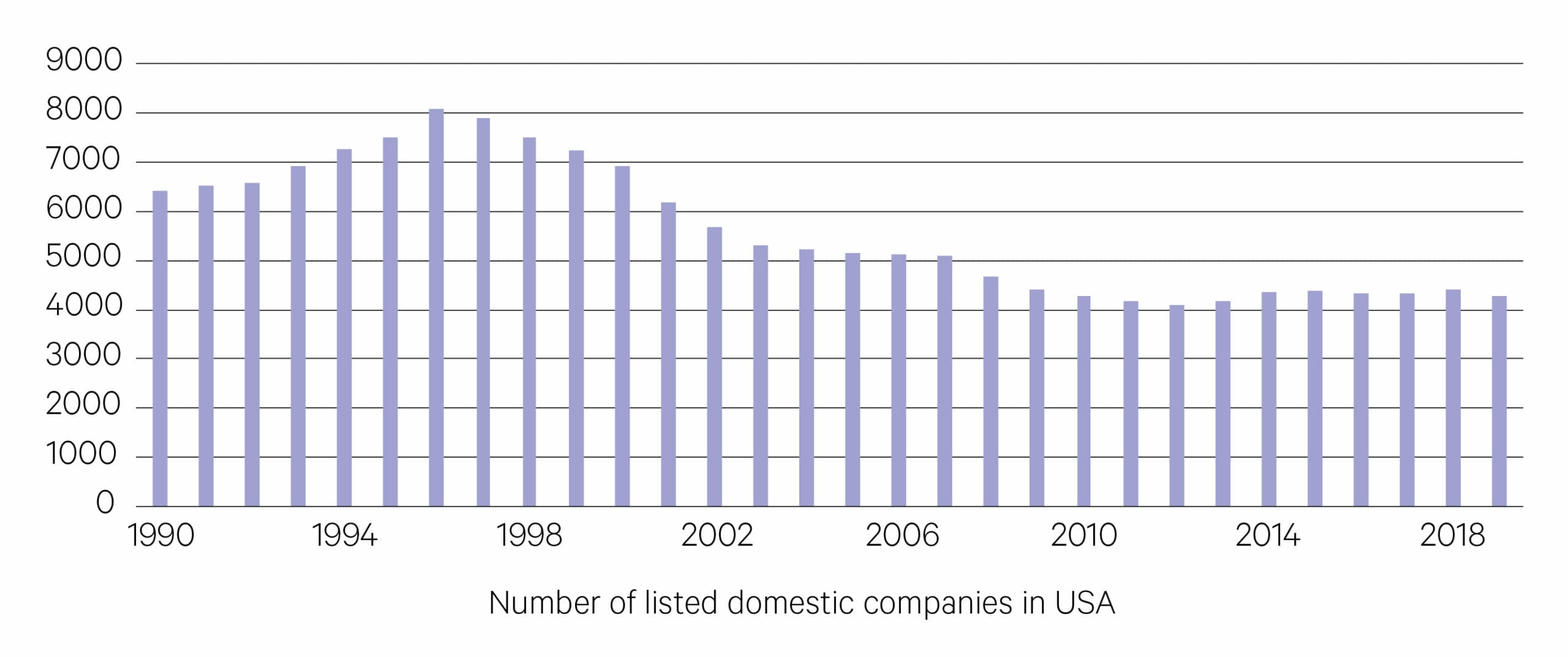

Number of listed companies in the US continues to decline

Source: Worldbank

—

47% – The decline in listed companies in the USA since 1996.

—

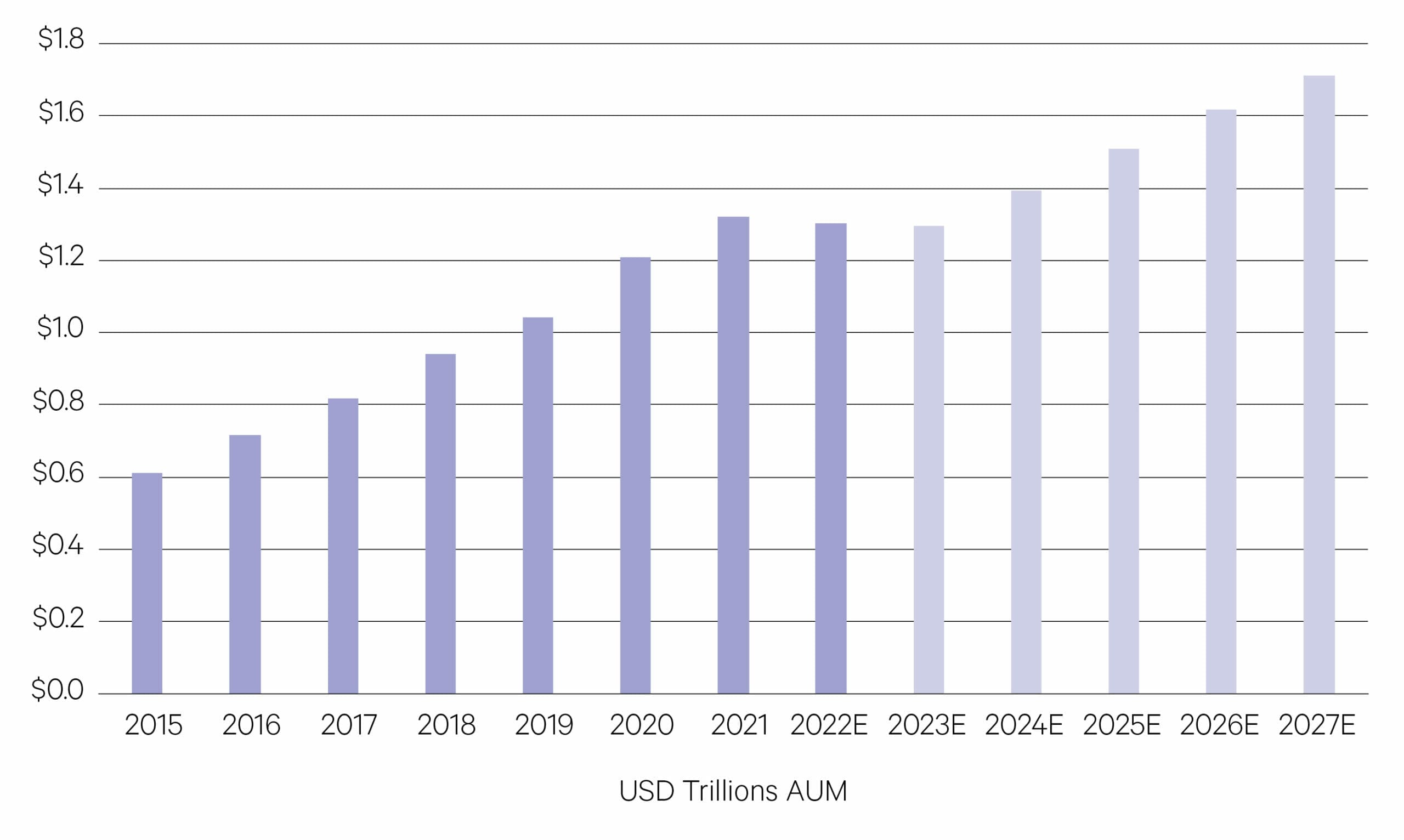

Private creditGiven its predominantly floating rate nature, private credit benefited from the rising rate environment of 2022. Focus will turn to credit quality and the ability of companies to meet higher debt payments in 2023. Default rates have remained low to date and covenants and underwriting standards are much higher than in previous cycles. The large presence of PE sponsors in the private credit market means credit quality is higher than in the past for direct lending and syndicated loan markets. Asset backed and securitised markets remain attractive going forward whilst pockets of distress will present specialised managers with opportunities in 2023.

Private credit markets forecast to grow at a strong pace

Source: Pitchbook

—

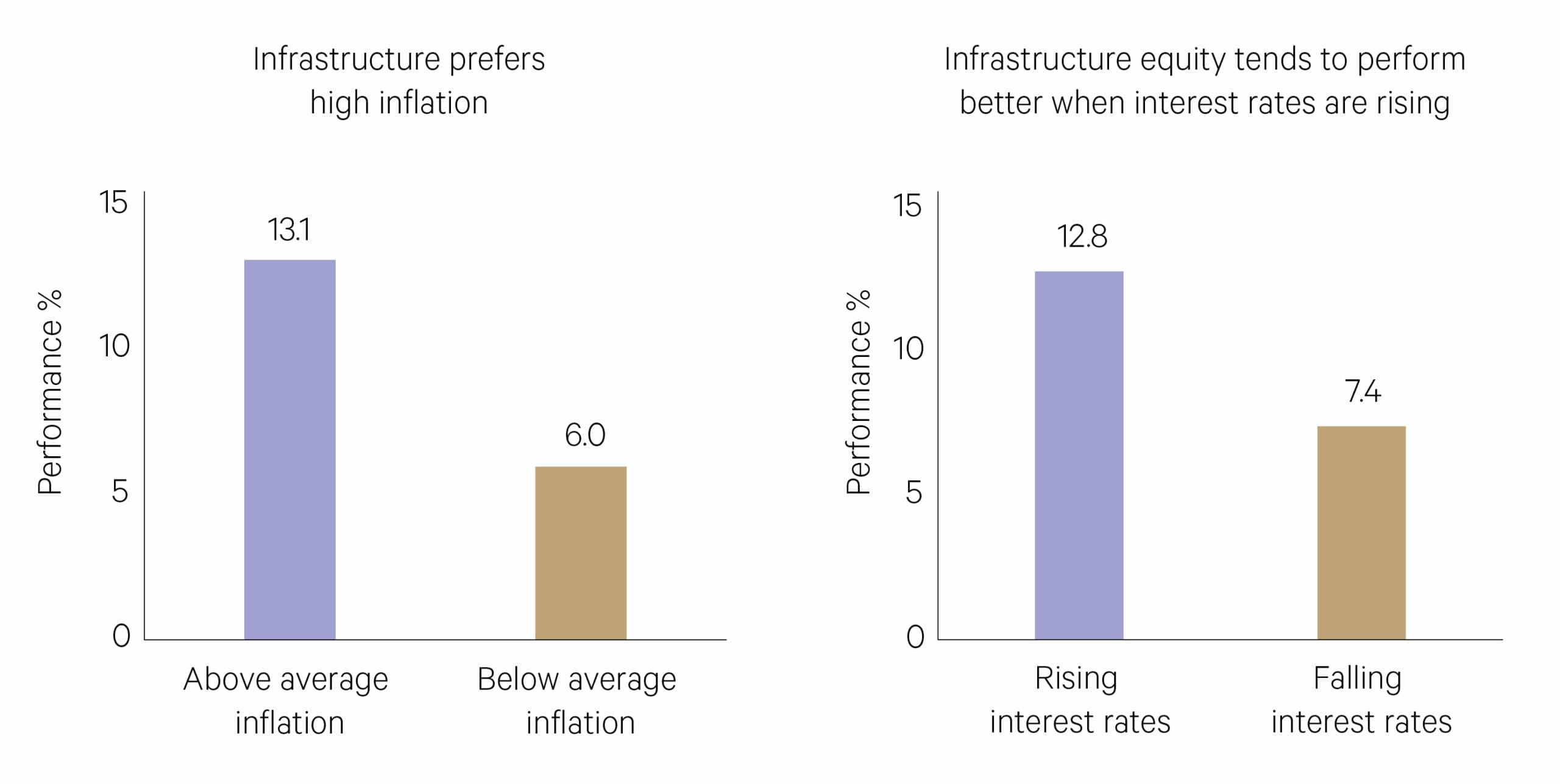

Infrastructure

The long-term tailwinds of decarbonisation, digitisation and deglobalisation continue to drive investment into infrastructure and the opportunity set continues to grow on the back of the energy crisis accelerating the transition to renewables. With inflation running at multi-decade highs investors are increasingly looking to infrastructure for protection given the ability to directly or indirectly pass-through higher costs. As renewables gain a greater share of the power grid the need for new transmission and storage infrastructure will become apparent. Digital and telecoms infrastructure continue to benefit from the rollout of 5G and the migration to the cloud whilst the broader infrastructure upgrade cycle will require significant investment.

Infrastructure has tended to outperform in high inflation periods

Source: Macquarie

—

Decarbonisation, digitisation and deglobalisation continue to drive investment in infrastructure.

—

Property

Real estate has been one of the strongest performing asset classes in recent years as demand for structural growth areas of industrial and logistics increased, and cap rates tightened to historic levels. Valuations may see some softness as cap rates widen from increased interest rates however some of this softness will be offset by the continued demand for income producing real assets and record low vacancy rates across many subsectors of real estate.

—

Record low vacancy rates across many subsectors of real estate.

—