-

Overview

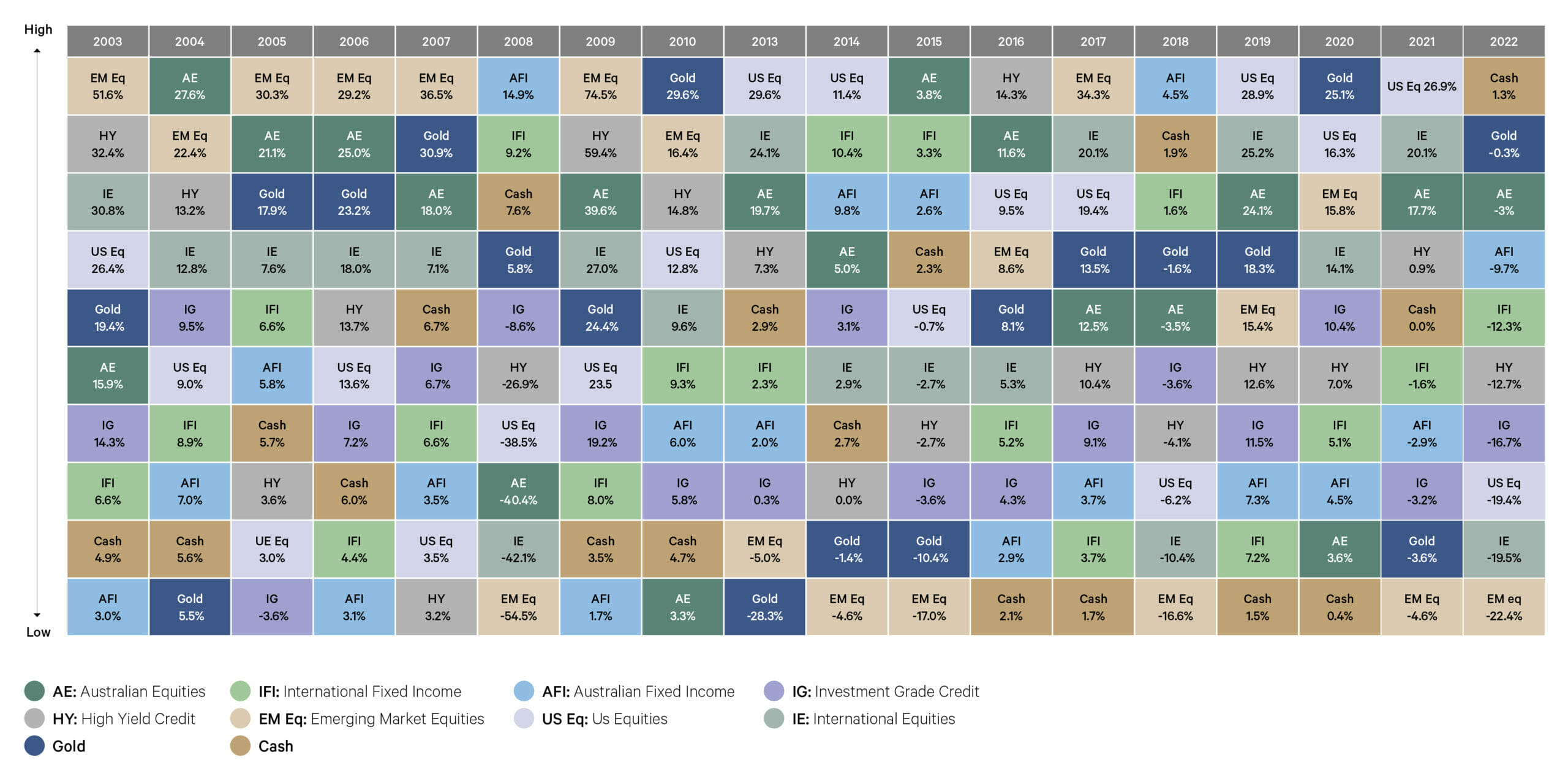

2022 was a difficult year across almost all asset classes with interest rates, inflation and geopolitics all impacting.

The US equity market suffered as higher interest rates undermined valuations. Growth sectors such as the consumer discretionary and information technology were the notable underperformers. Energy was the notable outperformer rising by 59%. The Australian equity market outperformed its global peers with only modest losses. This was helped by the 25% weight to the materials sector in the ASX index. Emerging markets were weighed down in particular by the technology-heavy Asian region.

Returns for fixed income were the worst on record as rapid increases in interest rates combined with low starting yields to generate a negative total return. Credit spreads widened as the markets responded to macro uncertainties weighing on returns for investment grade and high yield markets last year.

The most interesting observation to make from this year’s Asset Class Quilt is the limited number of places in which an investor could hide in 2022. In the past two decades, we have never seen a situation where the meagre return from cash was the only place to grow returns. Even in 2008, when US equities were down by 38.5%, fixed income provided a cushion. It was also notable that inflation, which averaged above 6% for the year in Australia, beat all investment options. This highlights the unusual nature of 2022.

Source: Bloomberg, 2022 data as at 31/12/2022