-

Overview

According to Foreign Affairs magazine we are in an “Age of Uncertainty.”

This uncertainty comes in multiple forms. The threat of war on many fronts including with Russia, China, Iran and North Korea. The threat of crisis stemming from ageing demographics, a warming climate and excessive debt burdens. And the threat posed by rapid, uncontrolled and unregulated development in advanced technologies.

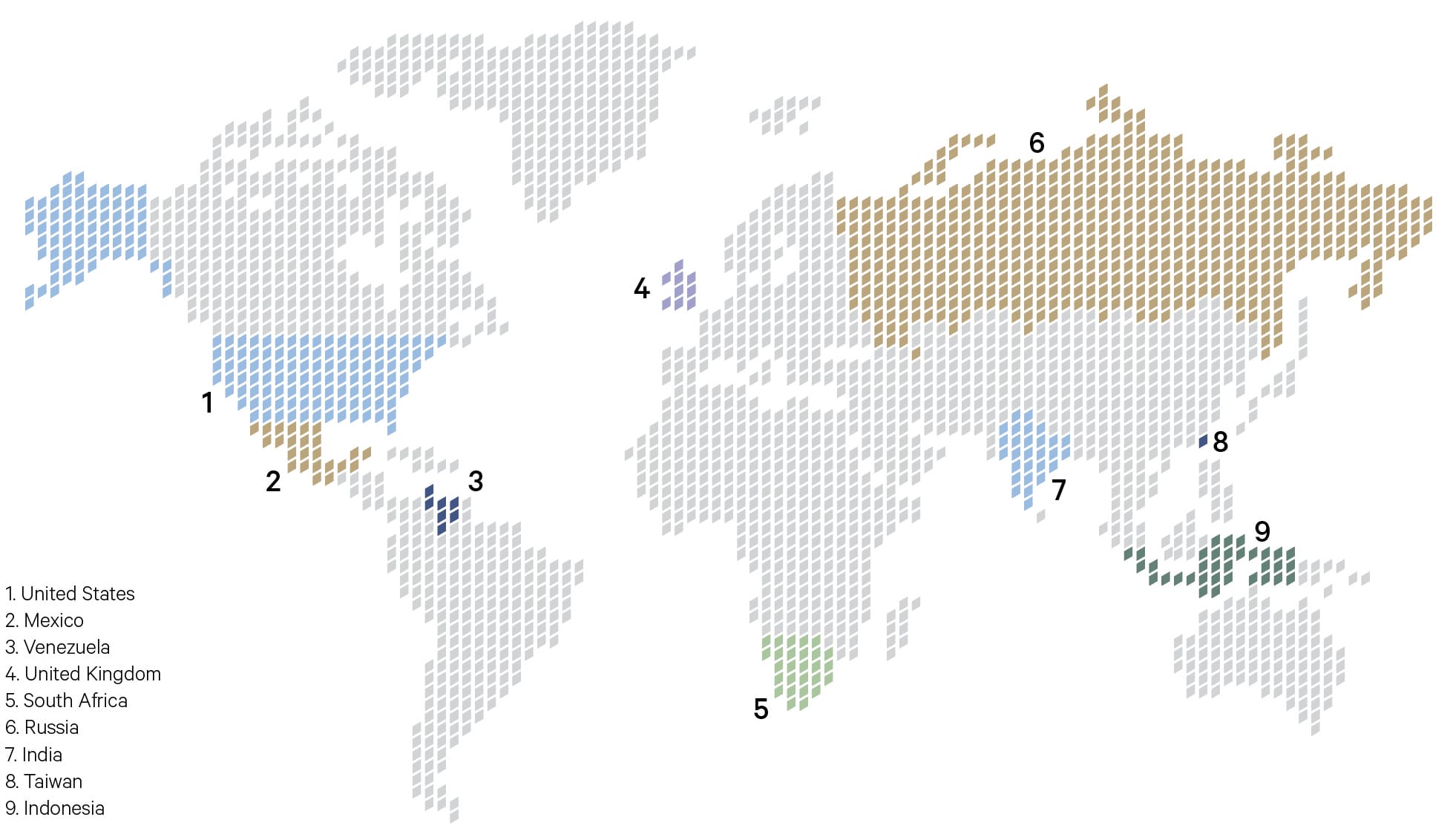

Some of the more noteworthy elections in 2024

Source: Escala Partners

—

76 – The number of countries scheduled to hold elections in 2024.

The Economist

—

Soft Landing (40%)

Policymakers achieve the impossible. Real growth remains resilient near or even above trend levels supported by easy financial conditions, while inflation converges decisively towards central bank targets. Banking woes ease and the labour market softens but remains robust enough to continue to support consumption. The US cuts interest rates as inflation cools and growth remains resilient. Favourable environment for interest rates and

risk assets. Technology, small cap stocks and real estate benefits.—

1200% The rise in Nvidia’s profits in the past year.

Bloomberg

—

Recession (30%)

Rarely do policymakers bring down inflation without causing a recession. The labour market runs out of steam, denting income and spending just when the combined weight of the fastest and most aggressive tightening cycle in four decades and depleted stimulus savings begins to mount. Unemployment rises rapidly and inflation falls, leading to a substantial easing cycle starting in Q2 2024 and extending to below neutral rates. Defaults rise, credit markets deteriorate. Risky assets correct lower, defensive sectors such as consumer staples, healthcare and utilities outperform cyclicals such as consumer discretionary, financials and materials. Longer maturity bond yields fall.

—

Stagflation (25%)

Tight monetary policy weakens growth to just above flat. Meanwhile, the labour market and real wages remain solid enough and fiscal conditions supportive enough to keep services inflation too high and persistent for central banks to reduce policy rates significantly.

Risk assets are patchy with defensive sectors outperforming cyclical sectors. High inflation prevents longer-maturity yields from falling.

–

10% The share of global GDP allocated to healthcare.

World Health Organisation

–

Roaring 2020s (5%)

U.S. growth accelerates above trend, supported by high productivity growth as the dividend of public investments, and the diffusion and commercialisation of artificial intelligence and other technologies becomes widespread. Consumers are supported by the wealth effect from higher house and equity markets. Inflation drops rapidly as productivity gains ease labour shortages and generate a positive supply shock, allowing central banks to ease policy towards a neutral stance. All financial assets perform strongly.

—

The challenge for investors is what is already priced in. The final three weeks of 2023, spurred on by growing confidence in the ultimate soft-landing scenario, was responsible for almost half of the total returns for Australian equities over the year and almost 20% of the total returns for US equities.

On this basis, it is hard to argue the soft-landing scenario is not already priced in. This means to get even better returns in 2024 we would

need to start encroaching on the low probability Roaring 2020s scenario. Sounder heads would suggest 2024 is going to be all about protecting the gains already made and resisting the temptation to take too many tactical tilts.Picking the eyes out of this market will require a deft active manager’s hand while a position in private markets will provide some protection from any politically-induced volatility.