-

Overview

2024 was the year to be invested in actively managed floating rate credit. Fixed rate bonds (which appreciate in value as long term yields fall) looked to be the obvious choice, however fewer rate cuts than expected meant long term yields rose faster than shorter dated bond yields. Higher starting yields, strong issuance and tightening credit spreads made for a ripe environment for active credit managers.

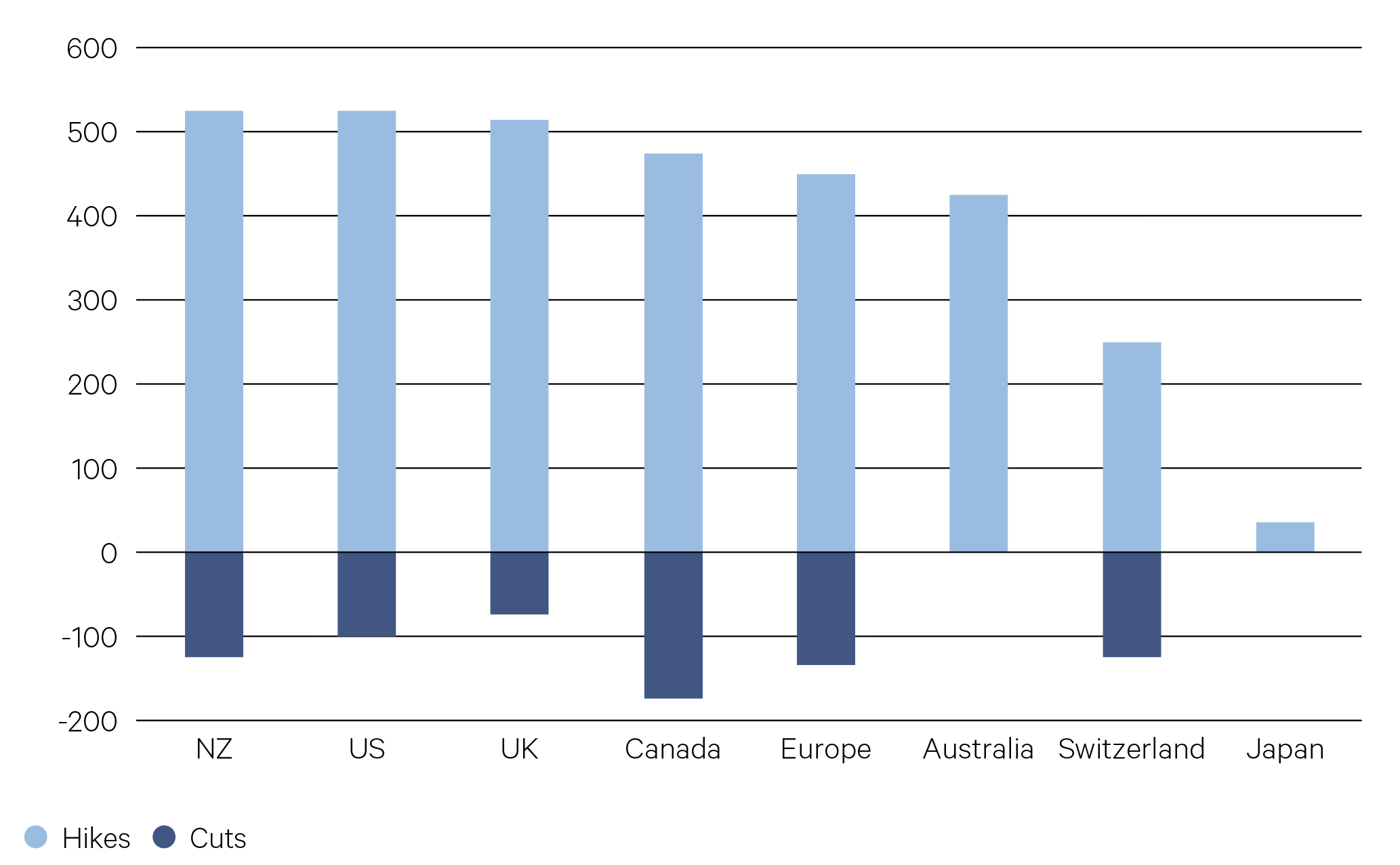

Over the 12 months, G10 central banks cut a total of 825 basis points, the highest yearly total since the GFC. Persistent inflation meant that the cuts came later and were shallower than expected. With the lid barely on inflation and a Trump presidency on the horizon, rates won’t come back to the Covid era lows in the US or Australia. The last soft landing in the US in 1995 saw rates cut only 125 basis points from a peak of 6% over the next four years, compared to an average of 440 basis points over the last forty years.

—

825 bps of interest rate cuts in the G10 in 2024.

Reuters

—

Rate changes since 2022 (bps)

Source: Bloomberg, as at 31/12/2024

—

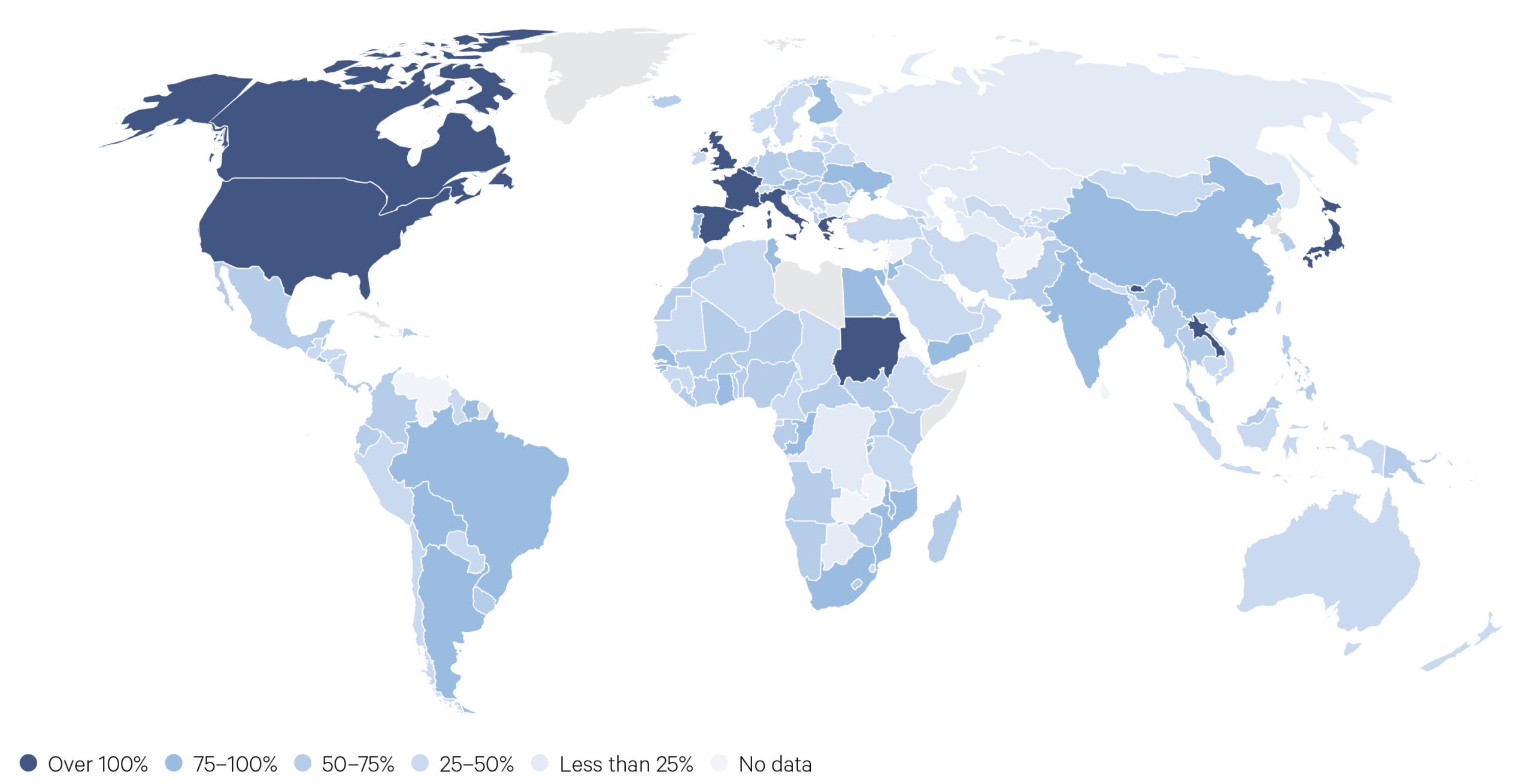

US$100 trillion – Estimated outstanding government debt at the end of 2024.

IMF

—

Mortgage holders and corporates aren’t alone in welcoming the easing of rates. Indebted governments are seeing a reduction in the cost of borrowing, but with deficits continuing to grow, sovereign debt is at its highest peacetime level in nearly 200 years. With sluggish global growth expected over the coming years, sovereigns will have a challenge meeting repayments without increasing their deficits.

Government debt to GDP (%)

Source: IMF, 2024

—

When you look at the data, you can forgive sceptics of the US ‘soft landing’ story. For 783 consecutive days, the US yield curve was inverted, surpassing the previous record of 624 days set in 1978-1979. Yield curve inversion occurs when short term bonds are paying more than long-term bonds and has signalled recession on all but two occasions – once in 1998, when the curve inverted for only a matter of weeks, and again this year.

So perhaps it’s not so surprising that, despite the fastest hiking cycle on record, borrowers have fared rather well. Defaults have increased from cycle lows but remain below the long-term average. Despite higher borrowing costs across the board, fewer borrowers defaulted in 2024 than 2023 in all regions except Europe, and more issuers were upgraded by the ratings agencies than downgraded.

In 2025, we expect demand for floating rate products to ease slightly as rates come down. A steepening of the yield curve will also pose a challenge for longer duration fixed rate bonds. Credit spreads should widen from near historic lows, undermining their total return potential.

—

783 consecutive days the yield curve inverted from 2022–2024.

Bloomberg

—

The impact of higher interest rates should be felt by borrowers in the coming year as excess cash reserves dwindle. US tariffs will impact the Chinese economy and its APAC trading partners, including Australia. However, global defaults are expected to remain below long-term averages as private credit investors offer an alternative for speculative grade borrowers.

In this environment, our preference is for short-dated, highly liquid floating rate bonds where all-in yields are still offering 6-8%. Both credit and interest rate risks are high, and investors aren’t getting paid for taking on either. Given the increased volatility in the fixed income market, investors are best rewarded by staying active and staying diversified.

—

3.5% of speculative-grade bonds expected to default in 2025.

S&P Global