-

Overview

The Australian equity market’s double-digit return was similar to that of international equity markets in 2024, though overshadowed by the mega-cap technology-driven performance of the US. It marked a second successive year of rising valuations more than offsetting softer earnings, primarily driven by a further normalisation in commodity prices from their post-pandemic peak.

—

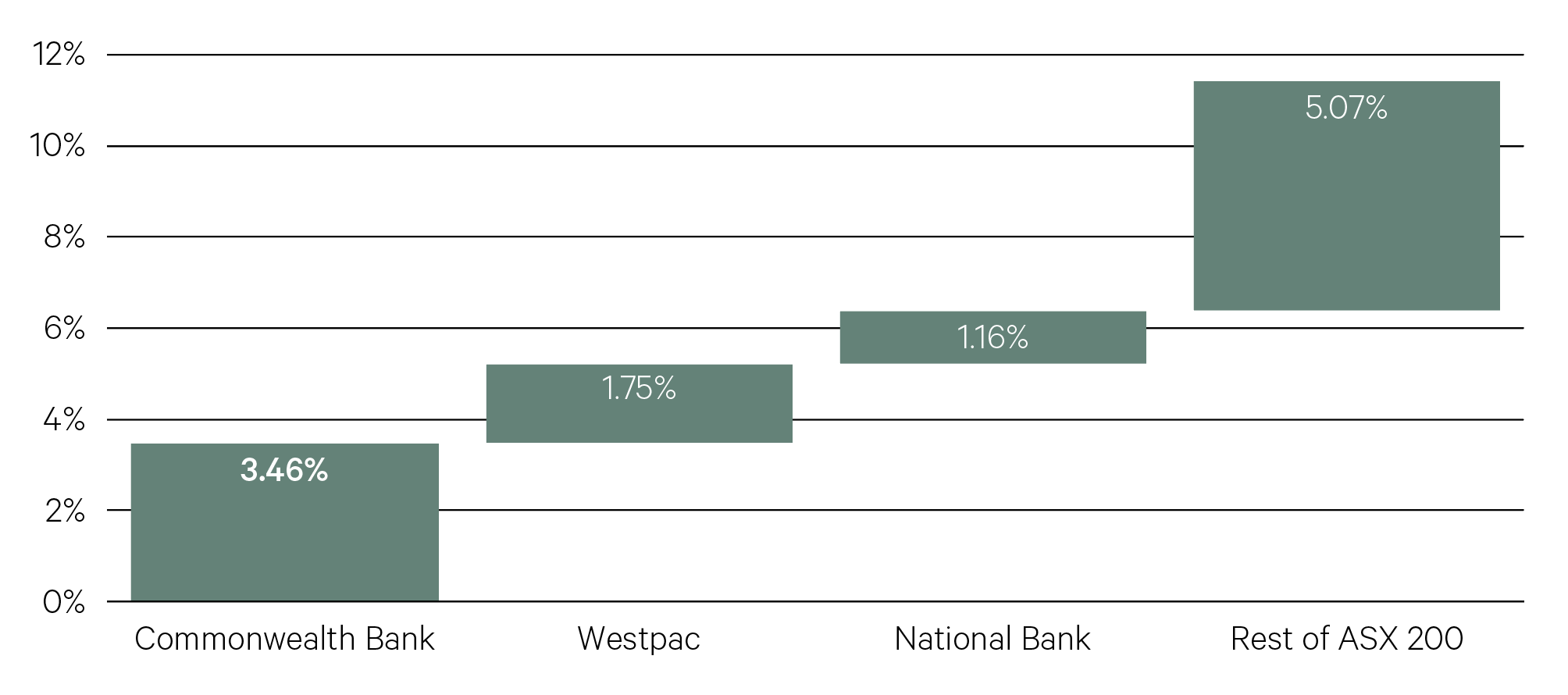

56% – The three largest banks account for 18% of the ASX 200 but together accounted for more than half (56%) of the market’s returns in 2024.

Bloomberg

—

ASX 200 2024 attribution

Source: Bloomberg

—

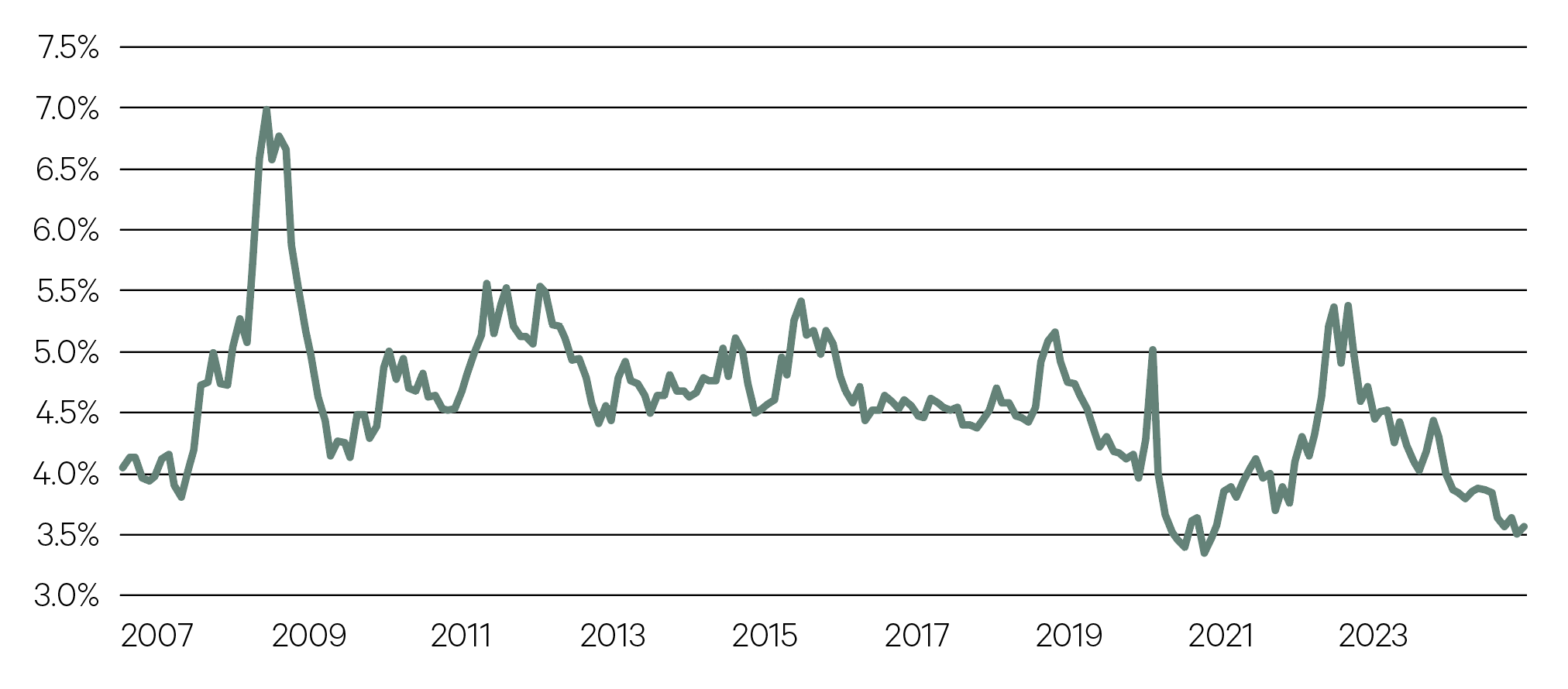

Many valuation measures now paint the market as expensive. The market’s forward P/E ratio of 18x is more than 2 points above the average of the last decade – high, but not excessively so. The forward dividend yield is now just 3.6%; the only time yields have been lower in the last 15 years was amidst the pandemic when companies had suspended dividends. Lastly, the earnings premium on equities over long term bonds has contracted from a level of 4% for most of the last decade to around 1% today.

ASX 200 forward dividend yield

Source: Bloomberg

—

3.6% – The forward yield on the ASX 200 is 3.6% and has rarely been this low in the last 20 years.

Bloomberg

—

After two years of P/E expansion, a resumption of earnings growth is a prerequisite to drive domestic equities higher in 2025 – the market needs to grow into its full valuation. On this measure, the outlook is better than in prior years, though inferior to key global markets.

What will be the source of earnings growth?

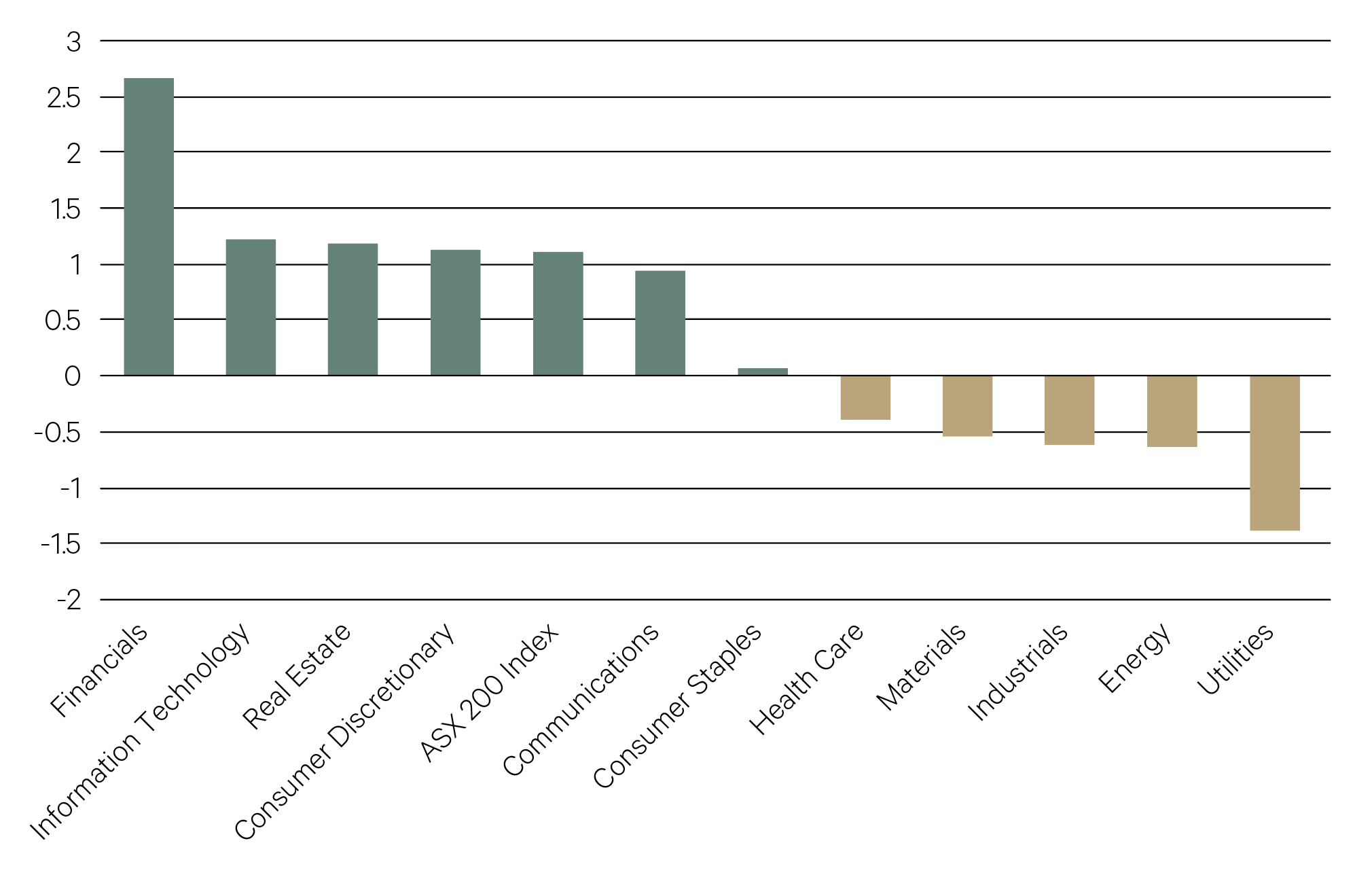

Among financials, the banks have a very modest low-single digit growth rate in the medium term, though there are better prospects among the insurers and diversified financials who are benefiting from strong investment markets. The downside among the miners now appears limited, though a rebound is dependent upon Chinese stimulus, while gold remains a bright spot within the sector. Despite representing less than half of the benchmark, the outlook for industrials is robust, with health care, communications and IT all projecting healthy growth.

—

37% – Commonwealth Bank’s share price gain in 2024.

Bloomberg

—

ASX 200 sector P/Es: Current vs 10 year average (standard deviations)

Source: Bloomberg

—

4 years – Small caps underperformed large caps for a fourth successive year, though stand to benefit from an RBA easing cycle.

Bloomberg

—

Two other factors point to some optimism for the year ahead.

There is hope for the domestic economic backdrop to improve as

the year progresses after several quarters of negative per capita growth. After lagging other economies, we are on the cusp of a cash rate easing cycle with inflation slowly moving back to the RBA target. Though the easing cycle may prove to be quite shallow in nature, it nonetheless will be welcomed by households and corporates alike and will help spur additional M&A and IPO activity. Economic-linked industrials should benefit in this environment. Additionally, the likelihood of stimulatory fiscal largesse is enhanced by the imminent federal election.Secondly, the transition to Trump 2.0, in our view, provides opportunities as well as risks. Australia’s trade deficit with the US leaves sees us far less likely than our regional peers to be hit with tariffs. Further, many of our larger industrial and technology companies have significant operations within the US that stand to benefit from US expansion. It is true that the imposition of tariffs from the US on China would have a second-order impact for Australia from a weaker Chinese economy. However, it is also equally likely that this would be cushioned by additional Chinese stimulus measures.

With valuations most stretched in the major banks and the base case assumption for resources benign amidst China’s structural issues, a tilt towards mid and small caps (who are greater beneficiaries of the factors noted above) is recommended for 2025.