-

Overview

After rallying into the end of the calendar year in sync with global equity markets, the ASX 200 managed to deliver a double-digit total return for 2023.

This outcome was commendable in an environment that presented numerous challenges, including tighter monetary policy, geopolitical risks, persistent inflation and an underwhelming China recovery.

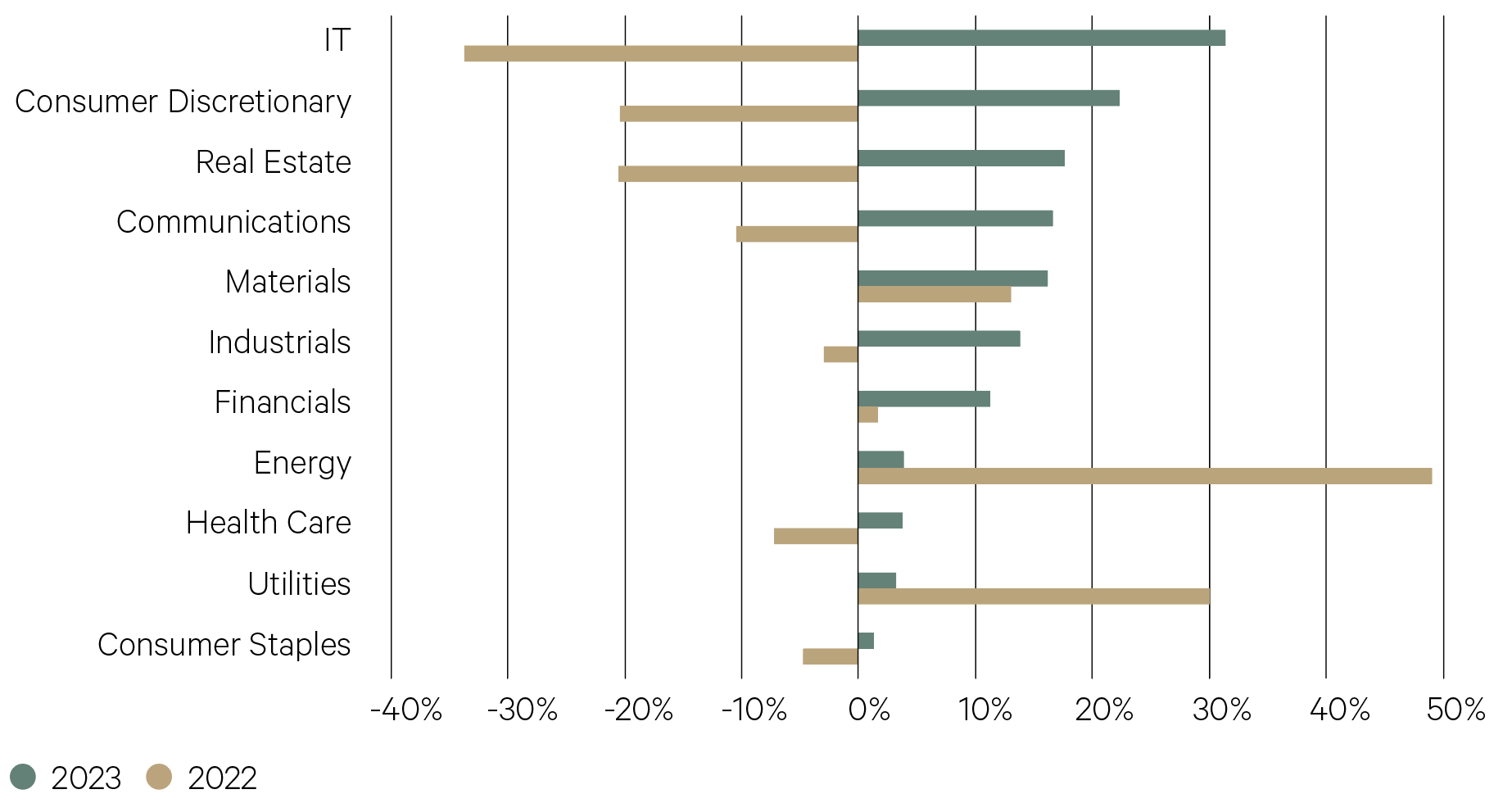

ASX 200: Sector total returns

Source: IRESS

—

While the Australian market generated a positive return for the year, returns lagged other developed markets, particularly the US and Japan. In a relative sense, Australia was on the wrong side of the key global themes that emerged, particularly artificial intelligence (AI), while the growth in GLP1 drugs (for weight loss) also had a detrimental effect on our domestic healthcare sector.

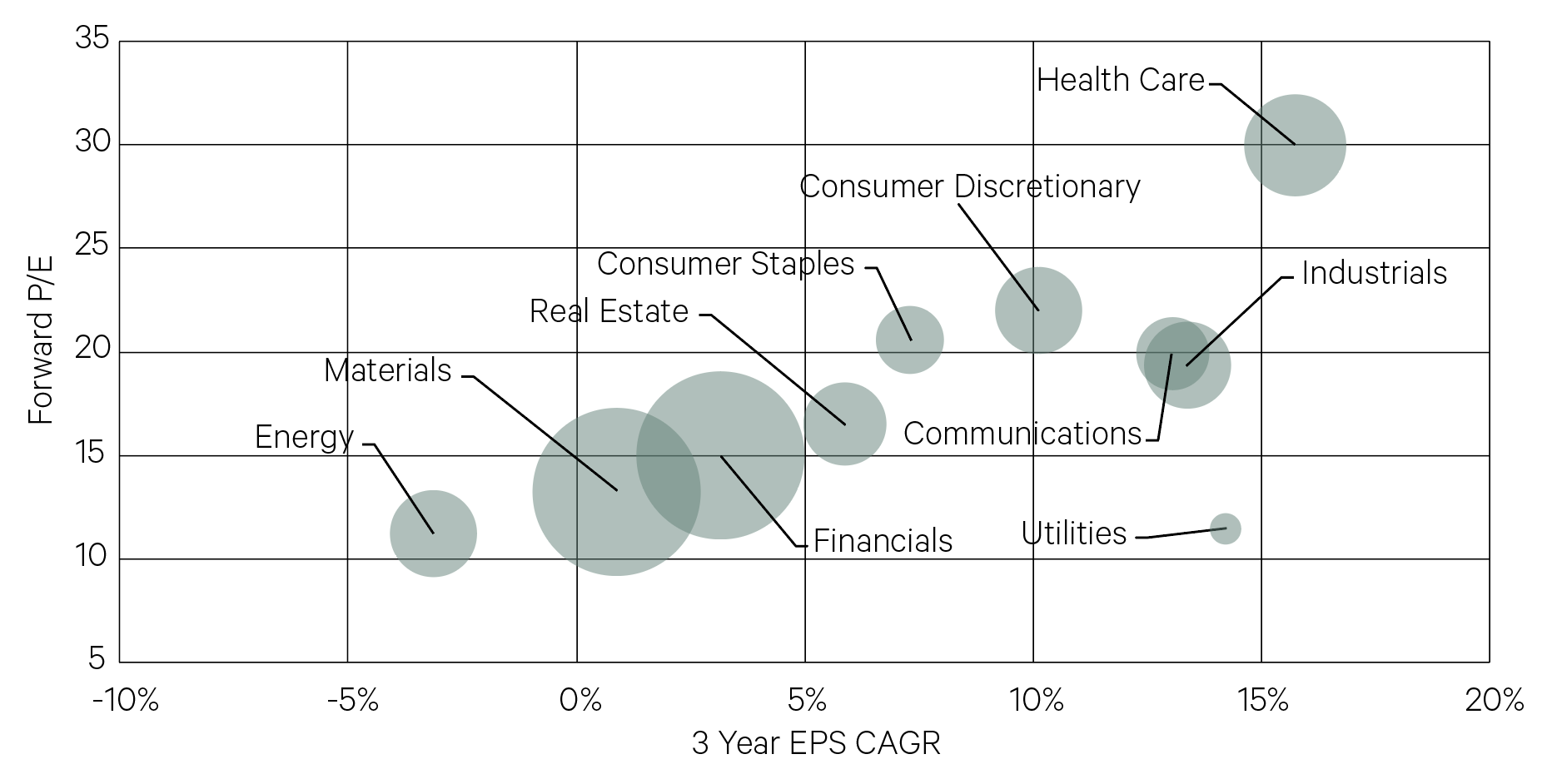

ASX 200: Sector forward P/E and earnings growth

Source: Bloomberg

—

31% – Return from IT making it the best performing sector in 2023.

IRESS

—

The last 12 months was characterised by a period of contraction in forward earnings estimates coupled with valuation (as measured by the P/E ratio) expansion. The latter occurred despite, until late in the year, upward pressure on bond yields. Yields have since fallen precipitously as investors look towards the end of monetary policy tightening and towards an eventual easing.

However, for Australia at least, it may be premature to expect monetary policy relief in the short term. Australia has been a laggard to the rest of the world in bringing inflation under control. The timing and magnitude of any rate cuts here will thus likely also lag other markets, adding a hurdle to domestic market outperformance.

This provides a difficult outlook for industrial stocks that are driven by domestic demand with below-trend GDP growth expected in 2024. There is also a question over earnings forecasts should inflation not decline as anticipated. Demand has so far been resilient due to factors including strong immigration, surplus savings and mortgages that were fixed at much lower rates. However, savings are now being depleted, consumer confidence remains low and household budgets are being squeezed by inflation.

Australia’s two large sectors – resources and financials – have modest expectations for the year ahead.

—

450,000 – The number of low fixed-rate home loans that will expire in 2024.

RBA

—

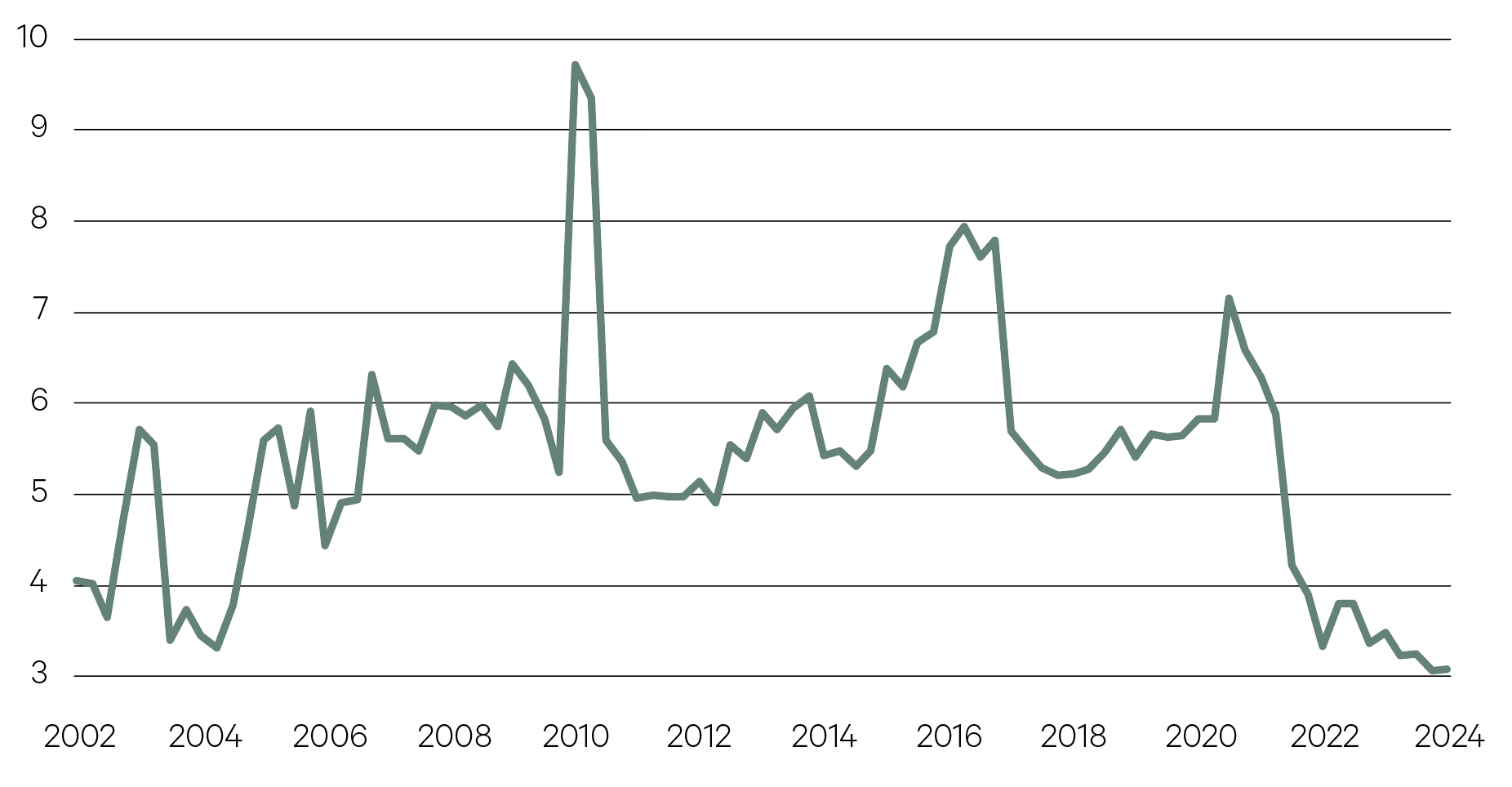

ASX 200: Net debt / EBITDA multiple

Source: Bloomberg

—

25% – The extent of the underperformance of ASX small caps to large caps over the last two years.

IRESS

—

For resources, commodity prices are elevated though are below the highs of the last two years and are unlikely to see significant demand support in 2024. Iron ore has surprised to the upside, though other commodities, such as oil, are well below cyclical peaks. The nascent lithium industry may have a long-term secular growth tailwind from the green energy transition, however spot prices have dived recently leading to considerable share price volatility, imperilling a number of corporate transactions.

The financials sector has been a beneficiary of the rise in interest rates in the last two years, particularly the insurers and banks. In a slowing credit growth environment, however, banks’ margins appear to have peaked and now are being pressured by competition.

On a positive note, Australian corporates are well capitalised, the labour market has been resilient and profit margins have held up well. Additionally, income tax relief is scheduled from July, though the economic gain will be muted by the majority of the benefits accruing to higher-income households who have a lower marginal propensity to spend.

With the Australian market trading on a slightly above-average P/E, a reduced risk premium above bond yields, a below-average dividend yield of 4.0% and downside risks to earnings, we have a cautious outlook for the year ahead.