-

Overview

Alternative assets saw continued growth in 2023, especially in areas such as private credit, private equity and infrastructure. The number of public to private transactions increased by 21% in 2023. The year ahead will see increased demand for uncorrelated strategies as the higher rate environment will lead to a more challenging growth environment.

—

21% – The annual increase in public companies choosing to go private.

S&P Global

—

Private credit

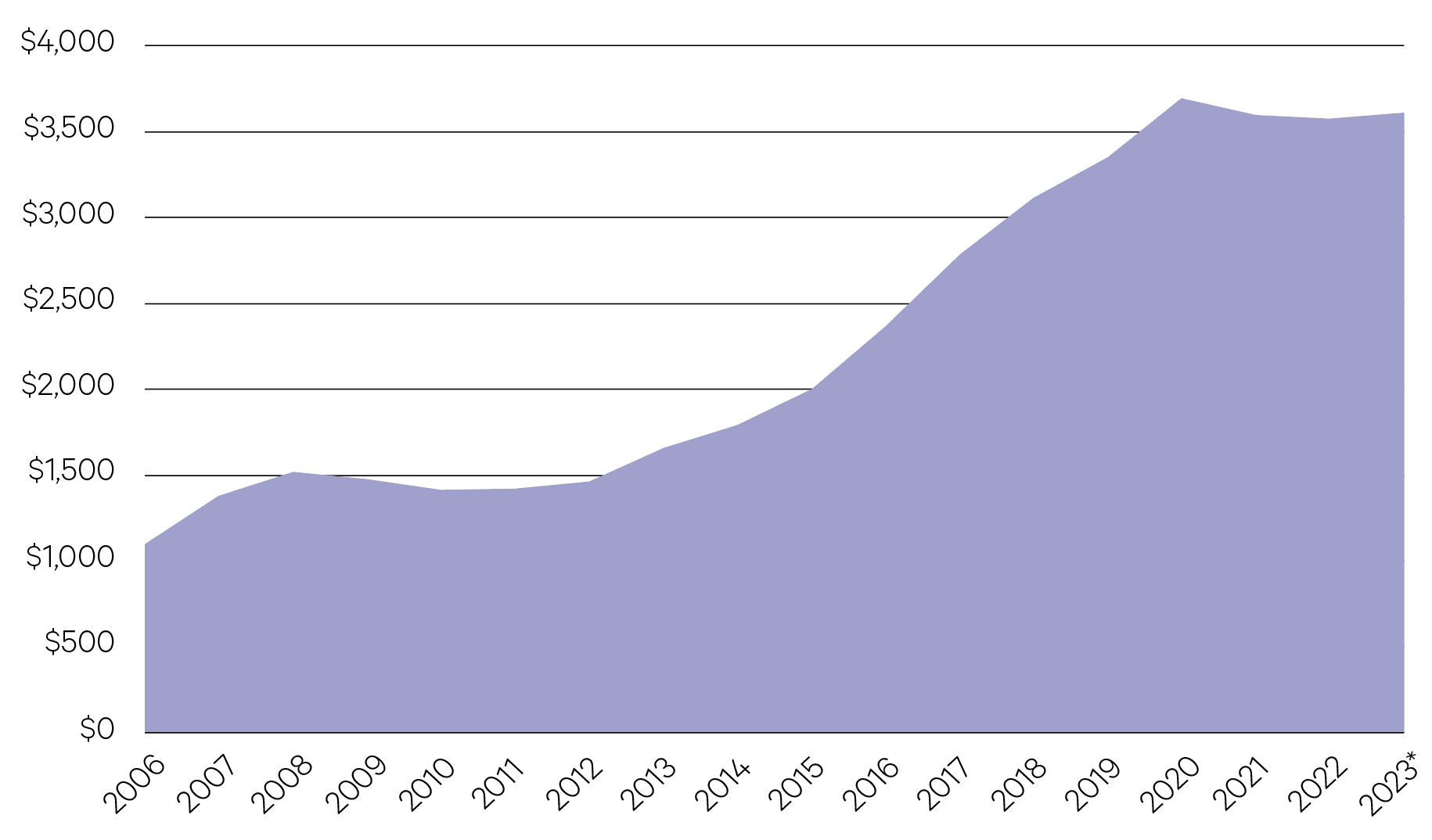

Allocations to private credit increased significantly in 2023, with higher base rates and spreads remaining stable. Yields were at their highest in many years for investors. Whilst the higher rate environment will be accompanied by a pickup in defaults, many active managers have used this time to increase the quality in their portfolios, lowering leverage ratios and increasing interest coverage. Total assets in private credit markets are forecast to grow to US$2.3 trillion by 2027 as direct lending and syndicated loans become a more attractive funding source for companies, benefiting from low

bank underwriting levels. Stresses will appear in some parts of the economy and opportunistic managers will look to selectively deploy capital here.Private markets dry powder levels (US$bn)

Source: Pitchbook

—

US$2.3trn – Expected size of the private credit market by 2027.

Prequin

—

Private equity

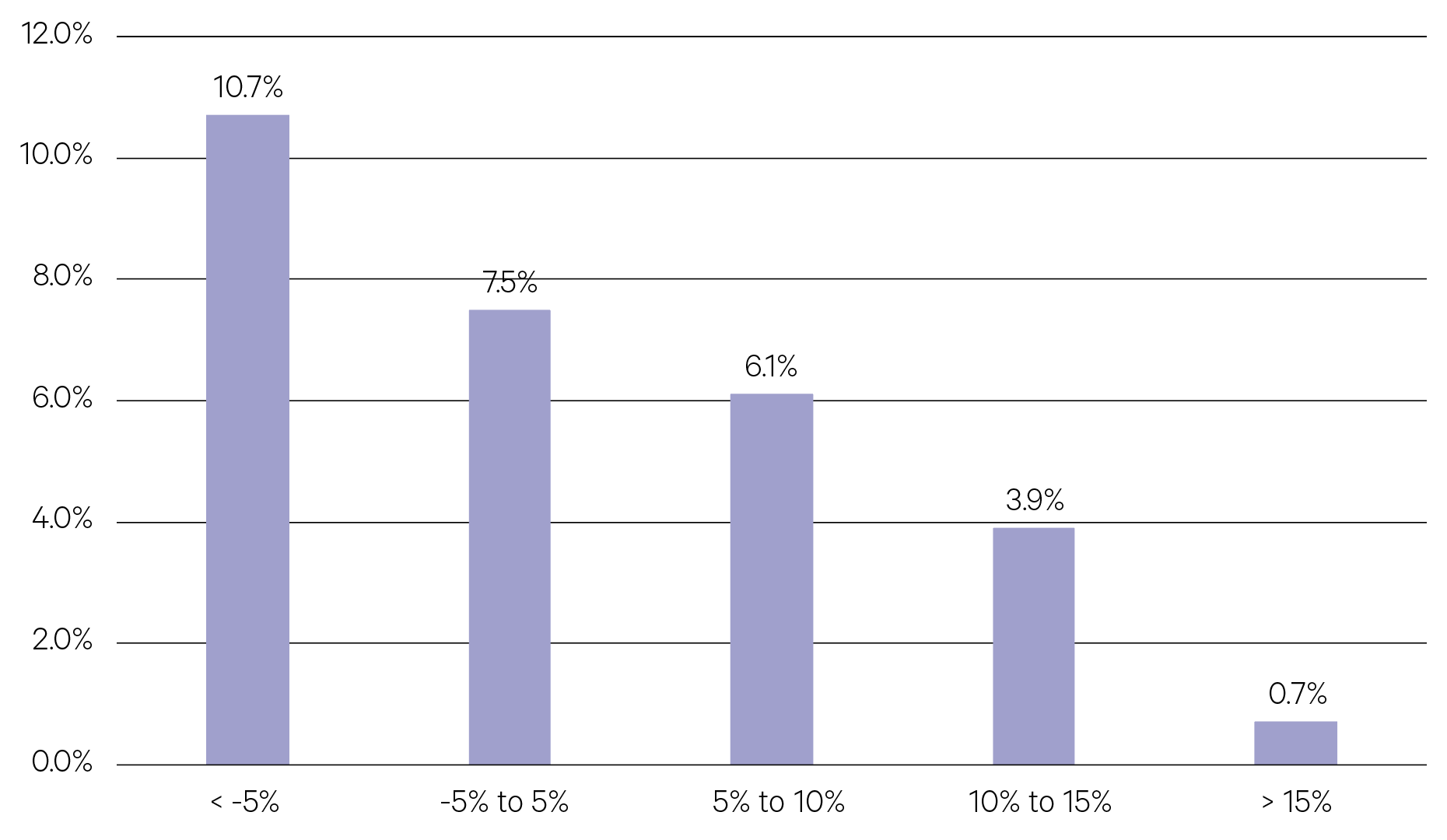

The macro driven uncertainty which caused private equity (PE) dealmaking to hit the brakes in 2023 should unwind as the outlook for further rate hikes is subdued heading into 2024. Ample amounts of dry powder on the sidelines will help transaction volumes, while valuation multiples remain attractive for deploying new capital in areas such as technology, healthcare and industrials. Managers will focus on operational efficiencies and potential add-on acquisitions for market leaders in fragmented industries. Secondaries and continuation funds will come into focus as PE managers look for liquidity solutions for investors.

Excess total return of private equity relative to S&P500 in different market return regimes

Source: KKR, Cambridge Associates, Pitchbook

—

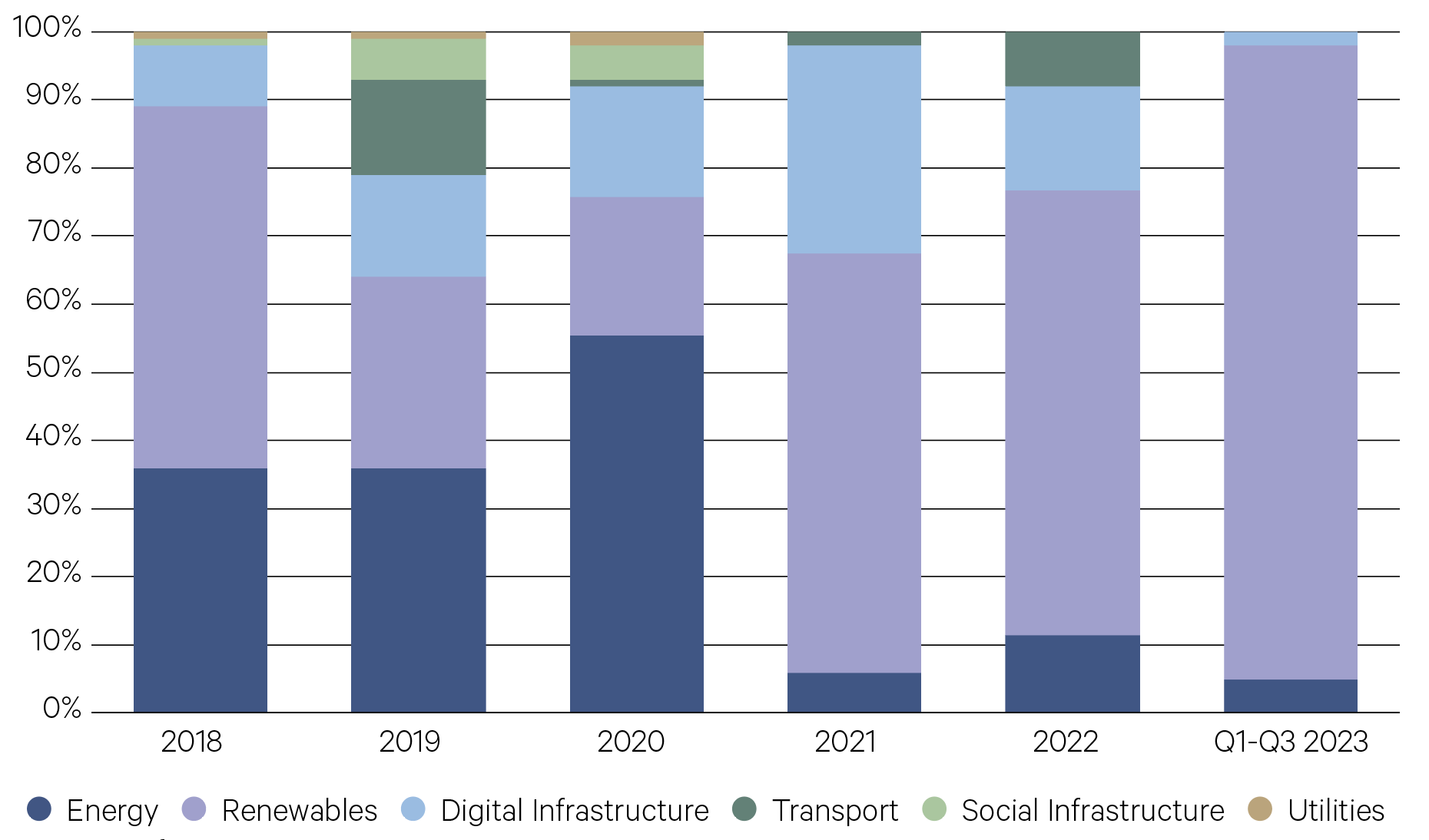

Infrastructure

Private infrastructure continues to be underpinned by long-term structural trends including decarbonisation, digitalisation and deglobalisation. Whilst fundraising has slowed, the demand for infrastructure remains helped by regulatory and government support. This is evident in the Inflation Reduction Act in the US and the European Green Deal initiative. Significant opportunities continue to open for investment into next generation infrastructure such as renewable energy and key areas of digitisation like fibre networks, towers and data centres. Long-term drivers such as decarbonisation and the energy transition will offer attractive investment opportunities for investors, while supporting the transition to a net zero emissions world.

Infrastructure sector – specific fundraising

Source: Infrastructure Investor, 2023

—

US$3trn – The global infrastructure gap.

McKinsey Global Institute

—

Hedge funds

Historically, hedge fund returns have been higher during periods of higher interest rates. Given some of the recent dispersion witnessed between sectors and stocks, the overall environment for active fundamental stock pickers and hedge funds in general remains attractive.

—

Royalties

As the range of private market strategies continue to expand, the royalty finance sector offers an opportunity to diversify portfolio risk. Royalties have low correlation to traditional asset classes, like stocks, bonds or currencies.

Royalties are long dated streams of cashflow with an average minimum of 10 years of duration and up to 70+ years in certain sectors such as the music royalty space.