-

Overview

2022 was a year that will be hard to forget for equity investors. Over the calendar year, the listed value of all global stocks fell by more than US$20 trillion. This leaves the value back to where it was at the end of 2020.

The biggest challenge for global equities in 2022 was significantly higher interest rates led by the US. Official interest rates in the US rose over the year from 0.25% to 4.5%. This increased longer term interest rates which in turn reduced the valuation of equities. The most common valuation metric is price per unit of earnings. On this basis, US equities fell from 23 price-to-earnings to just under 17 – a level considered to be around fair value. Most of that decline was driven by the fall in price rather than a rise in earnings.

The general view for 2023 is that central banks are closer to the end of their tightening cycles. This means equities are less likely to be impacted by higher bond yields. This will provide some support for valuations. Offsetting this is what happens to earnings. Corporate earnings are driven by three broad factors – profit margin, prices, and volume (or consumer demand). To date, corporate earnings have been well supported by healthy margins, high prices and reasonably solid volumes. We believe it would be complacent to expect this scenario to persist in 2023.

The Information Technology (IT) sector is an important one to watch given it is home to some of the largest companies listed in the US including Apple and Microsoft. The tech crash in 2000–03 saw IT margins fall significantly further than what we have experienced so far. We are not expecting history to repeat exactly but the IT sector was one of the largest beneficiaries of low interest rates and COVID lockdowns.

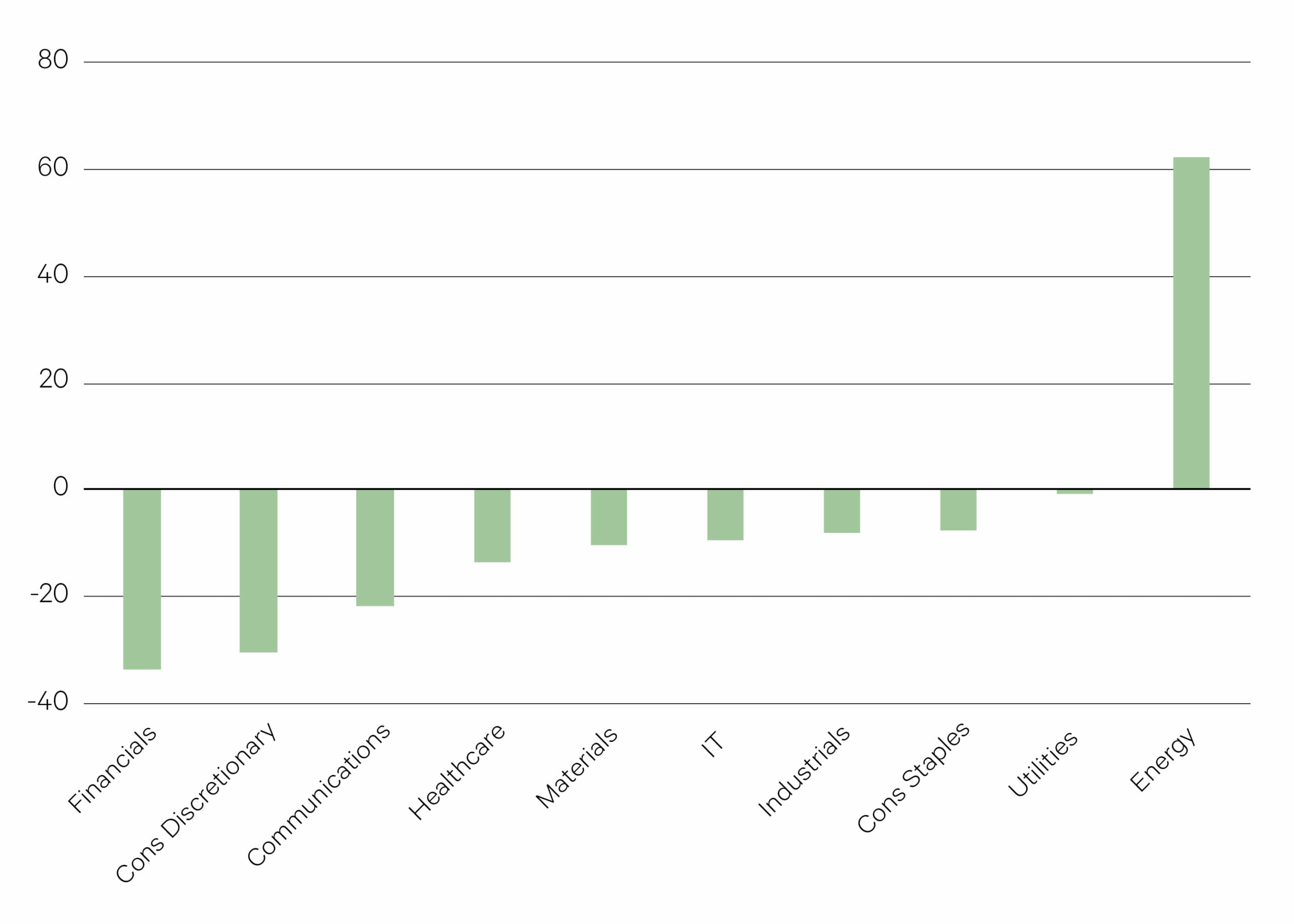

Profit margins have already begun to decline from their peak recorded at the end of 2021. This has mainly been driven by a decline in margins for the financials, consumer discretionary and communications sectors (chart). Flatter yield curves were the key headwind for financials margins last year while competition and higher costs hit margins in the consumer discretionary and communications sectors. Higher wages are the single biggest headwind to profit margins in 2023 and will hit the labour-intensive industries, such as manufacturing, retail, insurance and banking, education and healthcare, the hardest.

—

US$20trn – The value lost in global stock markets in 2022.

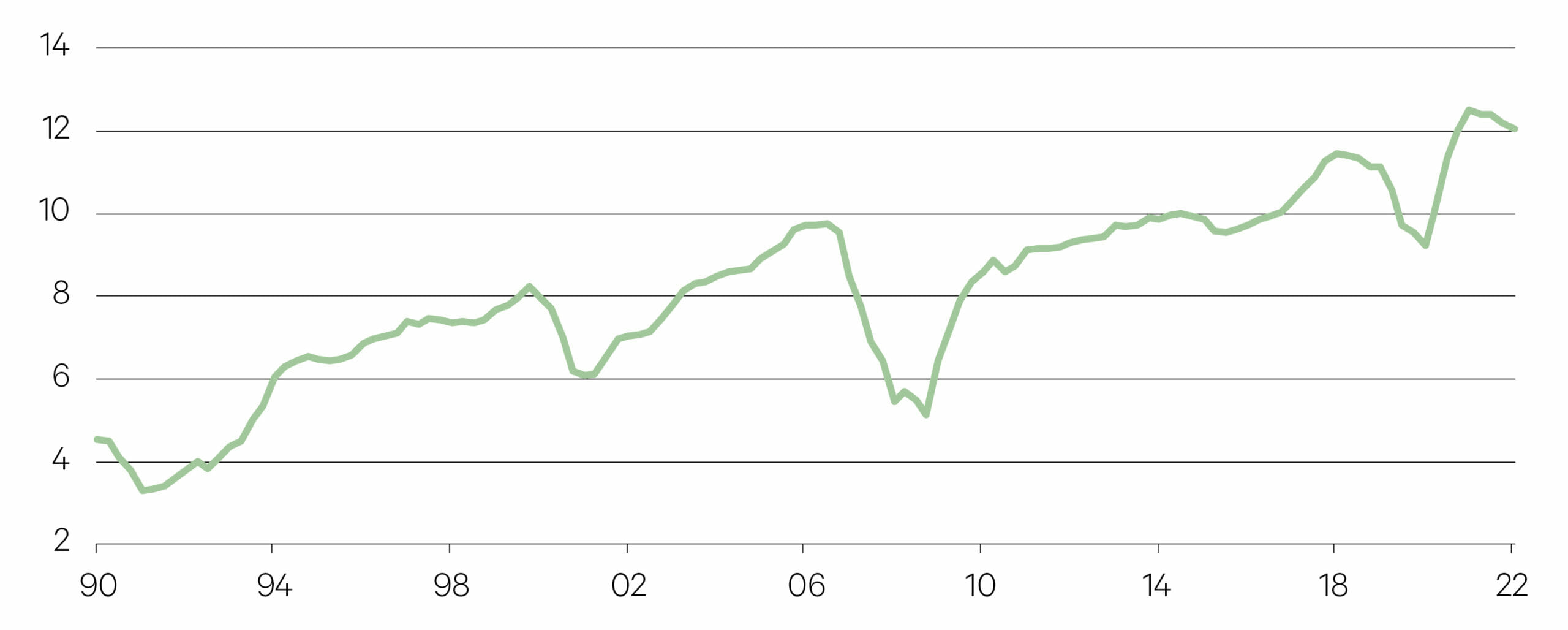

—S&P500 profit margin (profit as % sales)

Source: Bloomberg

—

The Information Technology (IT) sector is an important one to watch given it is home to some of the largest companies listed in the US including Apple and Microsoft. The tech crash in 2000–03 saw IT margins fall significantly further than what we have experienced so far. We are not expecting history to repeat exactly but the IT sector was one of the largest beneficiaries of low interest rates and COVID lockdowns.

Change in profit margins 2022/2021 (%)

Source: Bloomberg

—

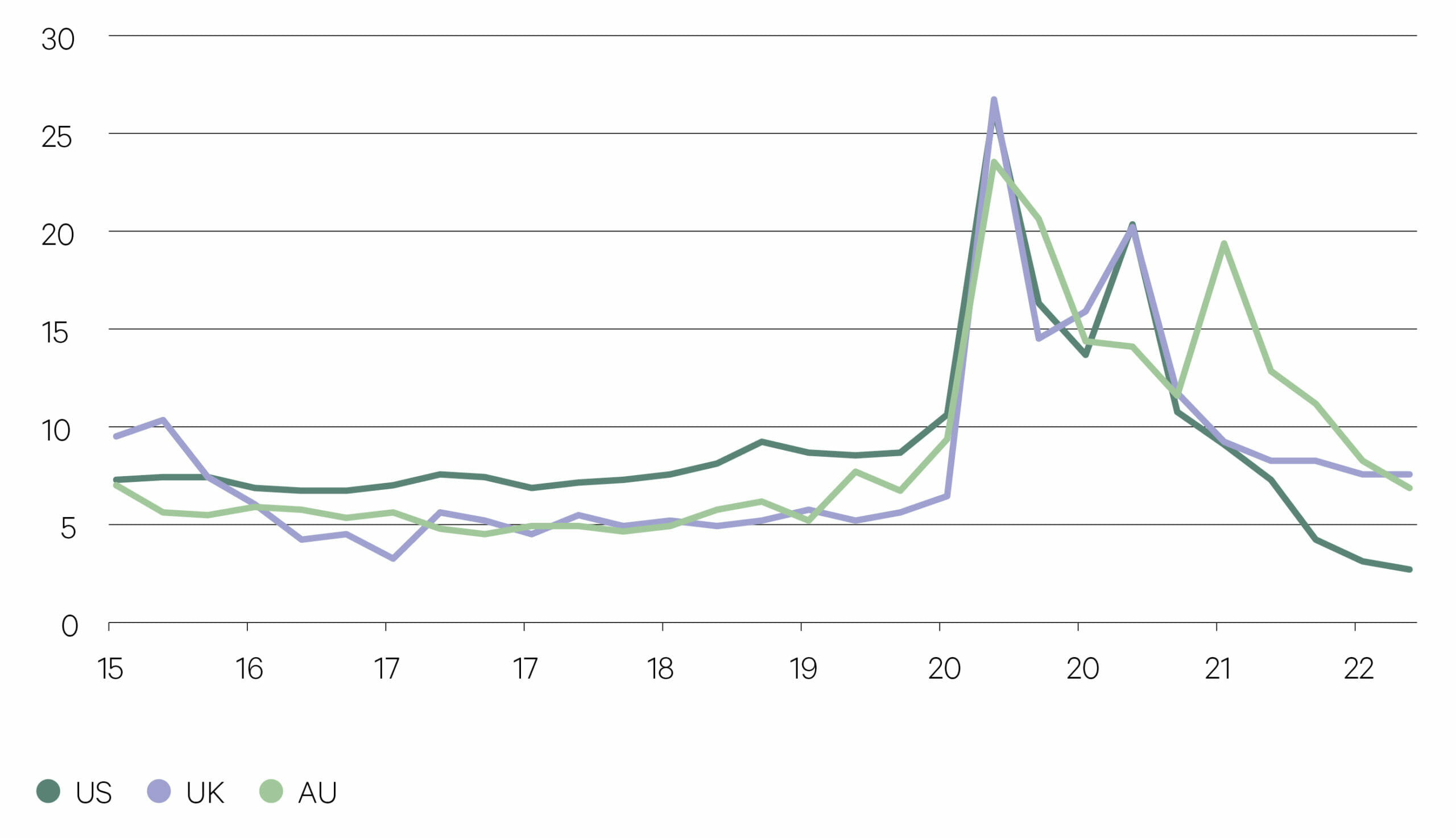

Consumer demand has shown significant resilience in the face of higher prices in 2022. This was driven by the record fiscal package handed

out by many governments around the world in the wake of the pandemic. This stimulus is running out. In the US, where fiscal support was the highest among the G20 nations, the household saving rate reached a peak of 33.8% in 2020. It has subsequently come down to 2.4%, well below its long run average of around 7% (chart). Depleted savings will make consumers more sensitive to price hikes, hampering volume growth and the ability of corporates to pass on higher costs. This will be good for inflation but bad for corporate earnings. 2022 was the year when equity markets adjusted to higher interest rates. 2023 will likely be the year they adjust to lower earnings.We remain cautious until we are confident equities have priced this outlook in.

—

US$2.4 quadrillion – The value of the global currency market.

—

Household saving rates (% Income) – The shrinking savings buffer

Source: Bloomberg