-

Overview

The Australian fixed income asset class recorded its second consecutive year of negative returns for the first time ever (as measured by the Bloomberg AusBond Composite Index). Bond prices fell (yields rose) substantially over the year in response to the fastest pace of inflation in over two decades. Global bond investors suffered a worse fate with the negative returns this year even greater. There are three reasons to expect a more positive outcome for the asset class in 2023.

First, the global sell-off in bonds means substantially higher starting yields (three-times higher in fact for global investment grade credit). This provides the most attractive yield cushion for fixed income investors since 2009.

Yield on global investment grade bonds (%)

Source: Bloomberg

—

US$24trn – The size of the US bond market.

—

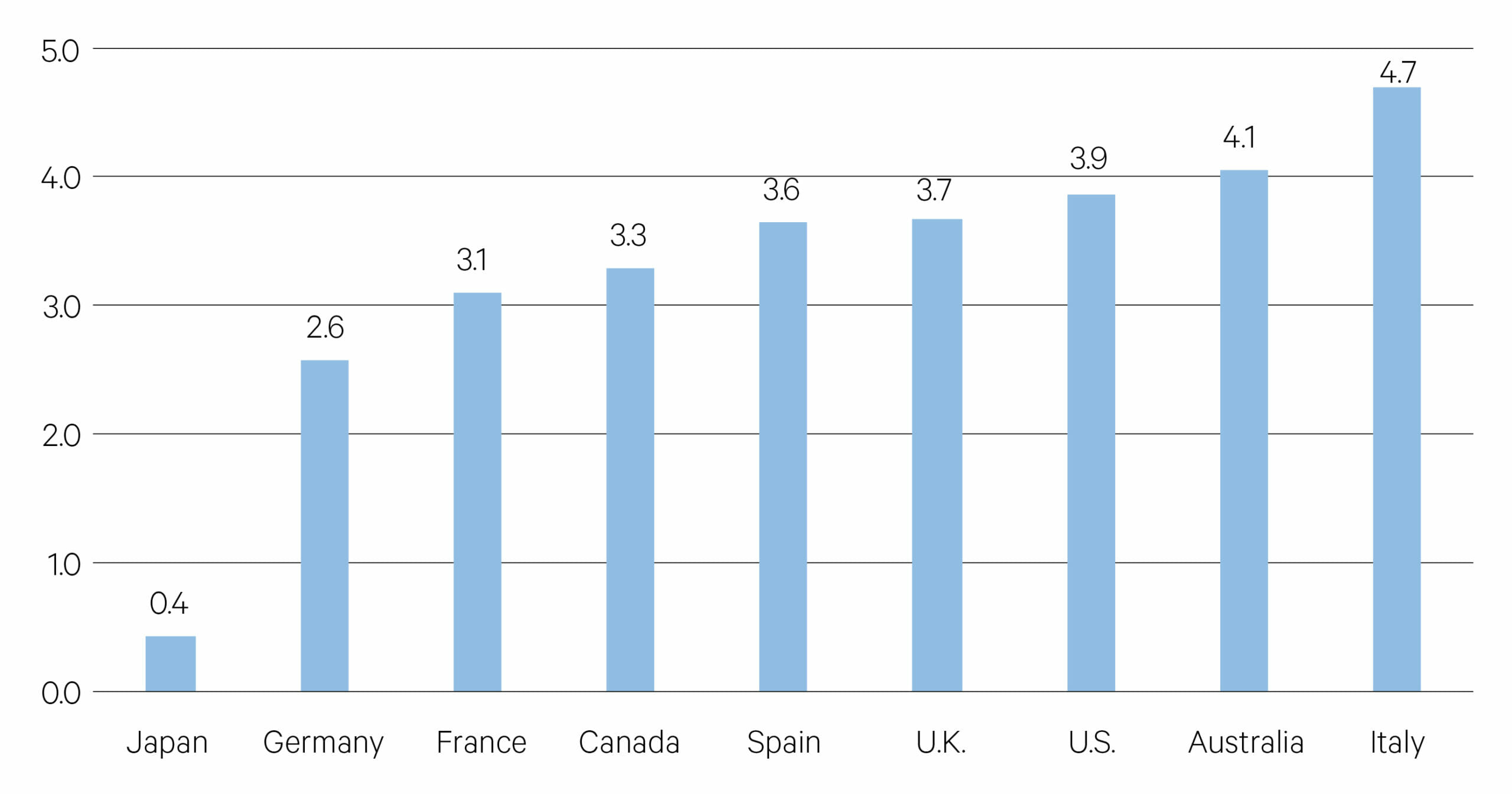

Starting yields matter for bond investors because just as a dividend yield can provide a cushion for an equity investor in the event of a decline in the stock price, the starting yield provides a cushion for a fixed income investor that can protect against further bond price declines. The chart below shows current 10-year bond yields for a range of government bond securities. Higher government bond yields in part reflect the fiscal health of the issuing government. Government debt levels in Italy, for example, are one of the highest in the world which is why it has one of the highest bond yields among its peers.

Starting yields matter for bond investors (%)

Source: Bloomberg, data as at 31/12/22

—

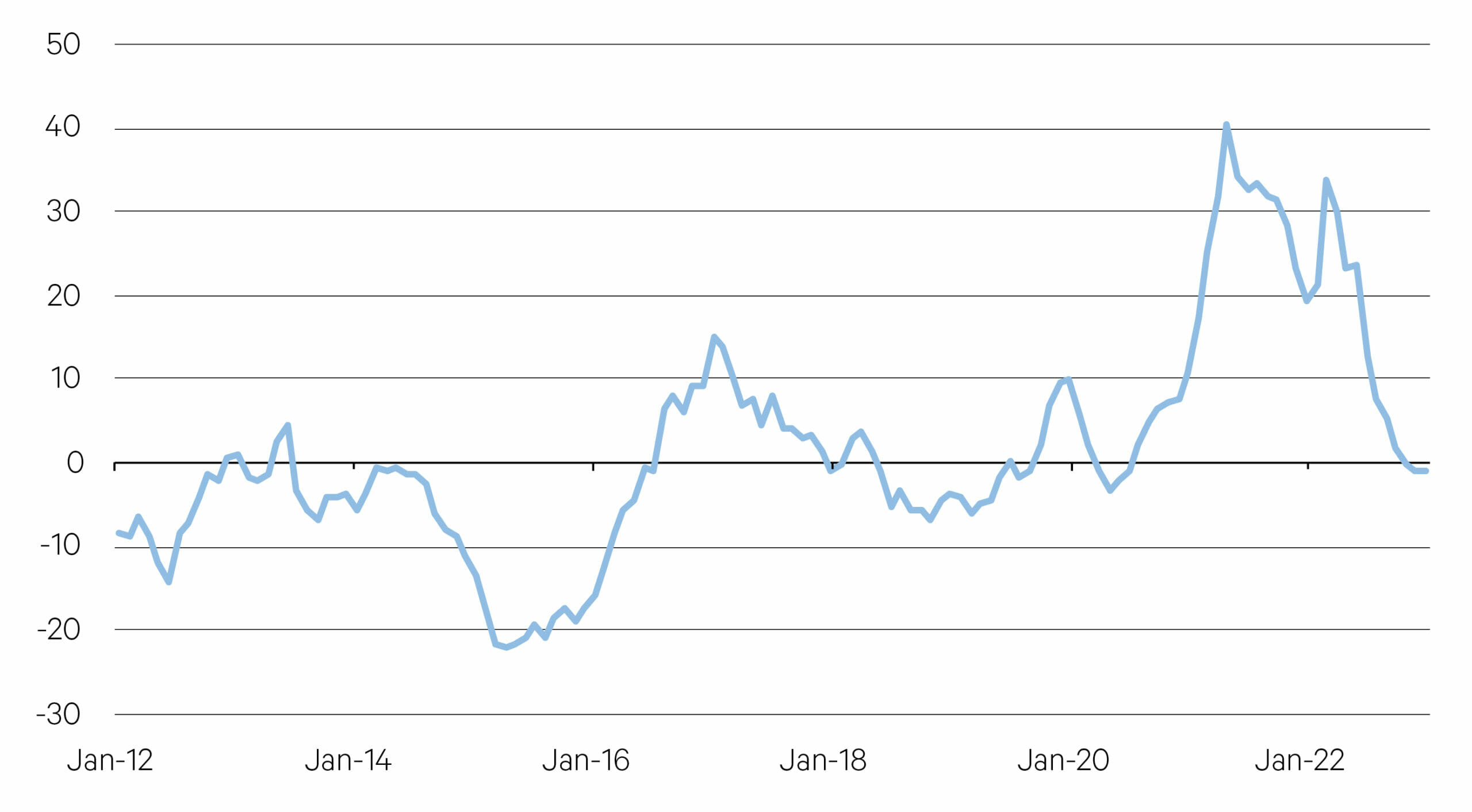

Bond yields around the world have risen over the past year as central banks worked to contain inflation. Inflation may remain higher than the average of the past decade this year (thanks to sticky service sector inflation) but there is every reason to believe it has peaked. Slowing consumer demand, an easing of supply chain blockages and a shift away from China’s zero-covid policy have resulted in a pullback in many goods prices. Even the spike in food prices following the invasion of Ukraine by Russia on February 24 has eased. This will help cap bond yields.

UN Food and Ag World Price Index (yoy%)

Source: Bloomberg

—

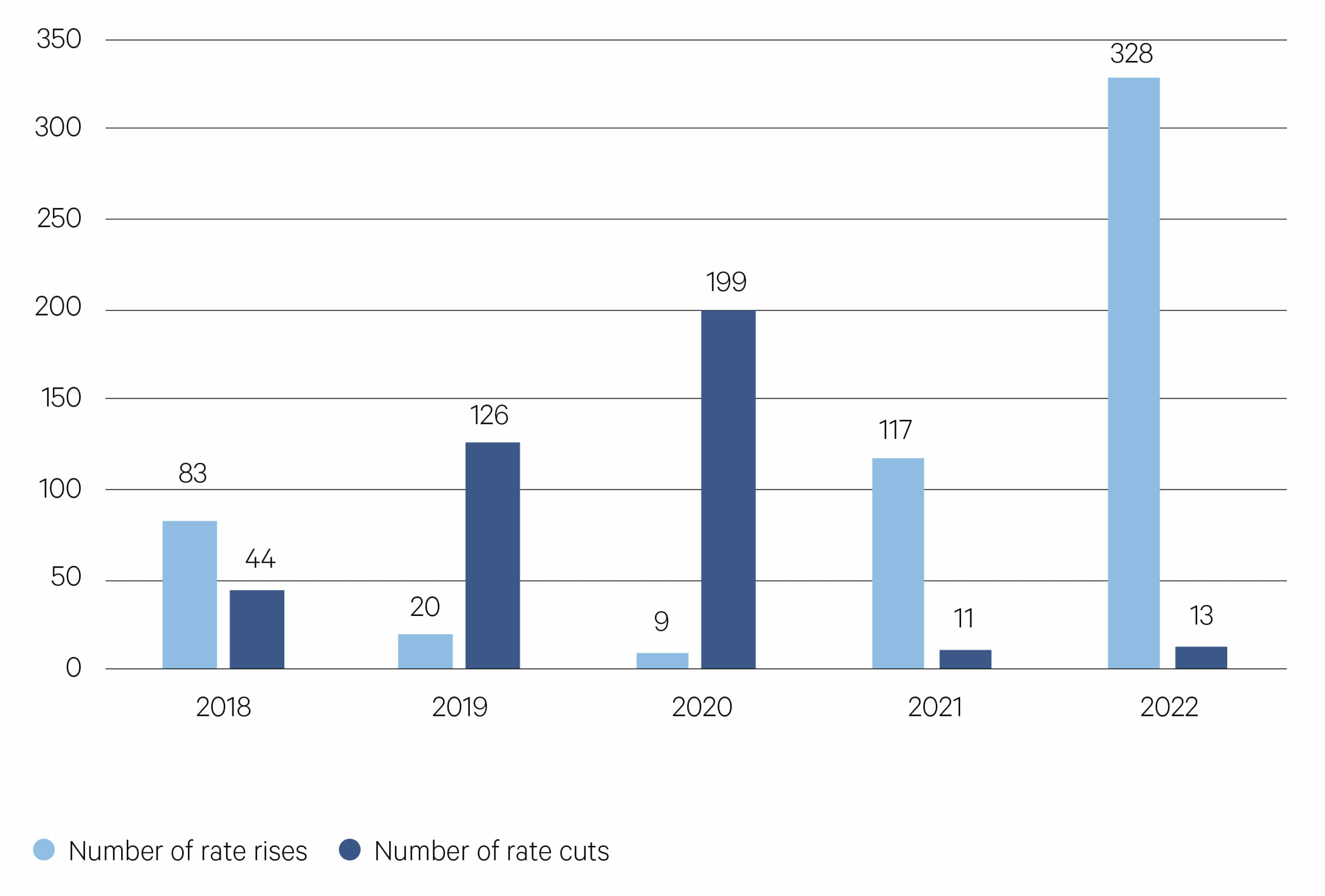

A second reason for feeling more optimistic about fixed income is the outlook for monetary policy. 2022 saw the most aggressive rate tightening cycle in the US in four decades. This resulted in long term bond yields rising from 1.8% at the start of the year to 3.9% by the end. The expectation for 2023 is an easing and eventual pausing in the interest rate tightening cycle as inflation eases. The market is pricing in a peak US official interest rate of nearly 5% and interest rate cuts in late 2023. This expectation hinges on how fast and to what level inflation falls and how significantly the unemployment rate rises.

2022 – The most aggressive rate hike cycle in decades

Source: Bank of America

—

Finally, still-robust corporate fundamentals will provide some protection for credit investors. Many companies were able to term out their debt, extending the time to maturity and raising money at low rates in recent years.

Corporate balance sheets are healthy and cash levels are high so while we do expect to see some rise in defaults, the overall level should be contained. What is more likely is a downgrade cycle as the expected decline in earnings causes leverage ratios (net debt/ EBITDA) to rise. This may result in some investment grade names being downgraded into high yield.

Even cash looks more attractive. 2023 will be the first time in seven years the rate on a one-year term deposit exceeds 3% in Australia. Income seeking investors can now afford to take less risk in their portfolio in order to achieve their target return.