-

Overview

Earnings growth in 2022 will be driven by industrial stocks that have been most impacted by COVID, while key cyclical sectors face emerging headwinds.

Following an impressive, sharp recovery from the depths of the COVID crisis, we anticipate more modest returns for the Australian equity market in 2022.

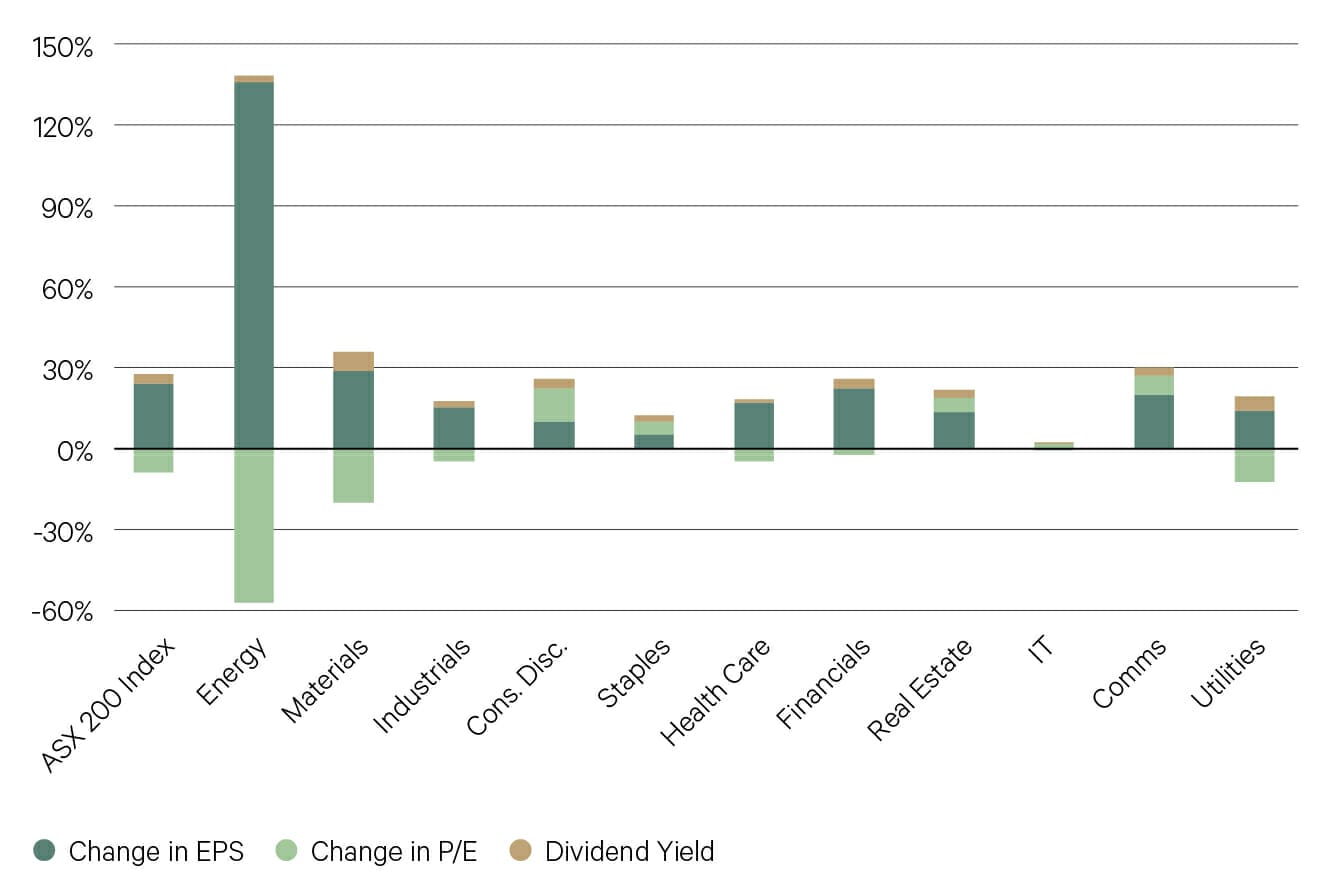

In the last 12 months we have experienced broad-based earnings growth, consistent with the early stage of the cycle and backed by coordinated monetary and fiscal stimulus. This more than offset the slight drop in valuations (as measured by the PE ratio) from elevated levels.

However, earnings momentum slowed noticeably in the second half of 2021, with some headwinds emerging in key sectors. While the initial phase of the recovery saw a wide participation across the market, we expect to see a greater level of dispersion in the year ahead.

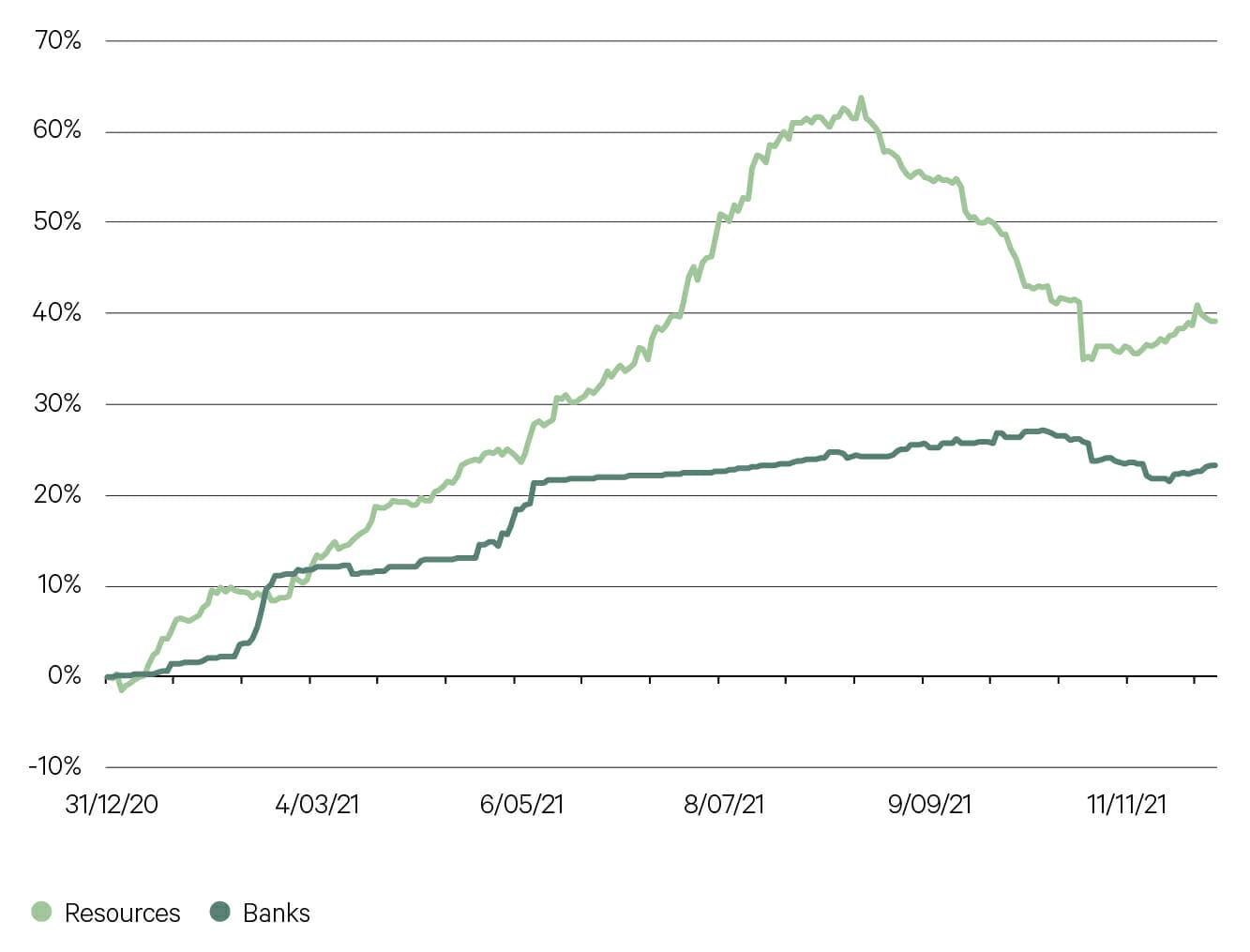

Cyclical earnings upgrades for resources and banks were very strong in the first half, though tapered into the second half of 2021

Source: Bloomberg

Some caution is warranted for the two key cyclical sectors of the market – financials and resources.

While financials are supported by stronger investment markets, the outlook for the banks is becoming more challenging, with the one-off benefit of bad debt normalisation now played out and moderating expectations for growth as margin and cost pressures are managed. Additionally, APRA has commenced the process of introducing policies to cool the housing market, which will tighten financial conditions in the market.

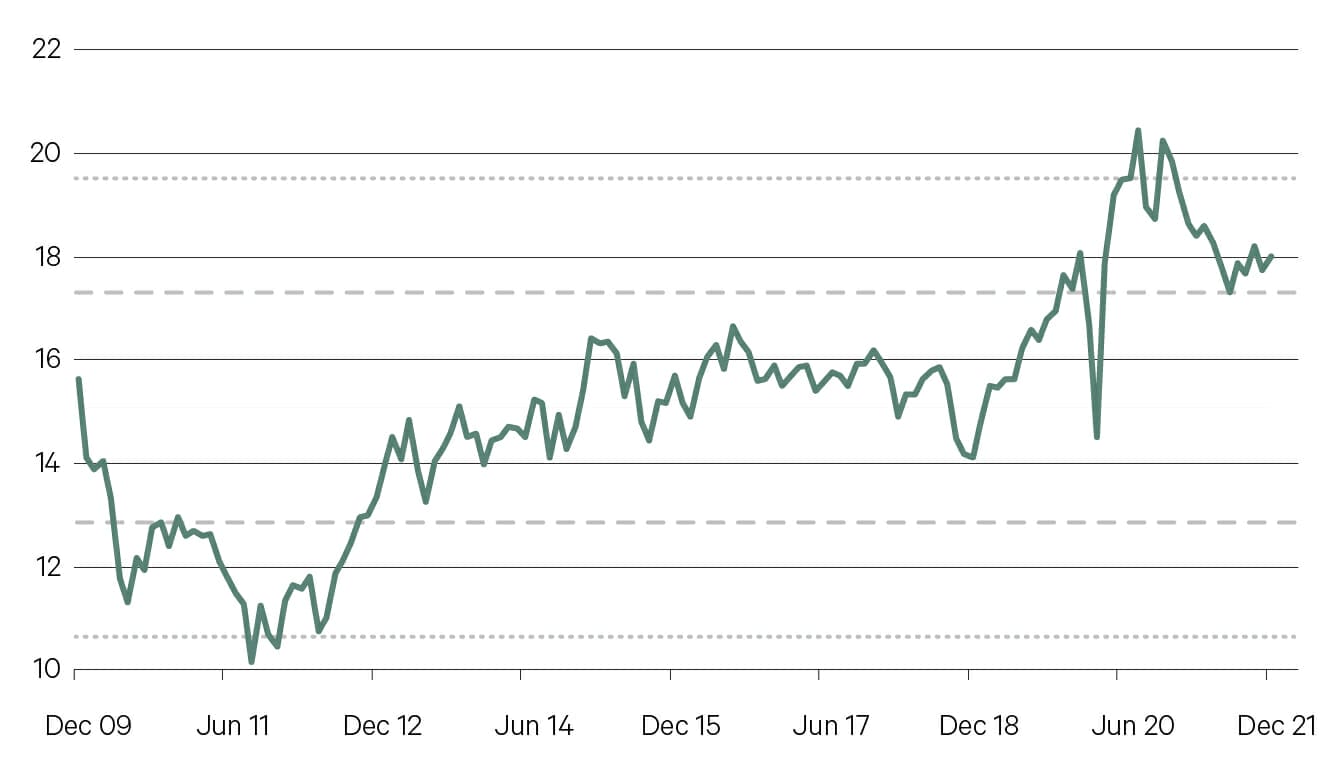

Australian equity valuations, as measured by the PE ratio, have fallen from their 2020 peak, though remain above longer term averages, supported by the low rates environment

Source: Bloomberg

For resources, while other commodities have been strong, iron ore remains the key driver. With the iron ore price halving in the second half of 2021, it appears that earnings have passed their peak in this cycle, particularly given the backdrop of China’s slowing economic growth and troubled property sector.

The outlook for industrials is split between those companies that experienced an increase in activity through lockdowns and those more services-orientated that stand to benefit as restrictions are eased. The prevailing high household savings rate as we enter 2022 should hold the latter group in good stead.

Stronger earnings were primary driver of returns for Australian equities in 2021 across all key sectors of the market

Source: Bloomberg

3.8% – The forward dividend yield of the ASX 200.

Supporting a more positive view is the strength of corporate balance sheets, a high level of corporate activity, a rebound in dividends (though dividends remain below pre-COVID crisis levels) and valuations that look high, though less so in the context of a low interest rate environment.

As always, risks abound, though are perhaps more heightened than most years, headlined by persistent COVID interruptions and the potential for central policy bank error. Currently, we hold a neutral view towards the Australian equities asset class, though the risks are tilted towards the downside.