-

Overview

Only one thing matters between now and 2030: climate change.

— Mark Blyth, Professor of International Political Economy, Brown University

It began as a niche desire. Originally, socially responsible investing (SRI) was confined to a subset of investors who wanted their investments to match their values. The process used mostly negative screens such as not investing in alcohol or tobacco. In recent years, the strategy has grown dramatically in size and sophistication and has broadened to incorporate environmental and governance standards.

Today, environmental, social and governance (ESG) investing is estimated to be worth over $30 trillion, equivalent to around a quarter of all professionally managed assets1. In many markets it is seen as an important part of a manager’s fiduciary responsibility. More recently, ESG has come into focus among financial market regulators. In 2019, the US Securities and Exchange Commission began scrutinising funds’ ESG policies.

A challenge for many years was a lack of data. Corporate disclosure on ESG issues has improved significantly with the launch of the Global Reporting Initiative (GRI) in 2000. Now, 80% of the world’s largest corporations report on GRI standards. New entrants and new technology mean the market for ESG data is maturing in quantity and quality.

Many investors now consider ESG factors alongside traditional financial analysis. At Escala, every manager that we review is investigated for its attention to ESG – not just as an overlay to investment decisions but as an integrated part of the investment analysis.

1 Global Sustainable Investment Review 2018, gsi-alliance.org

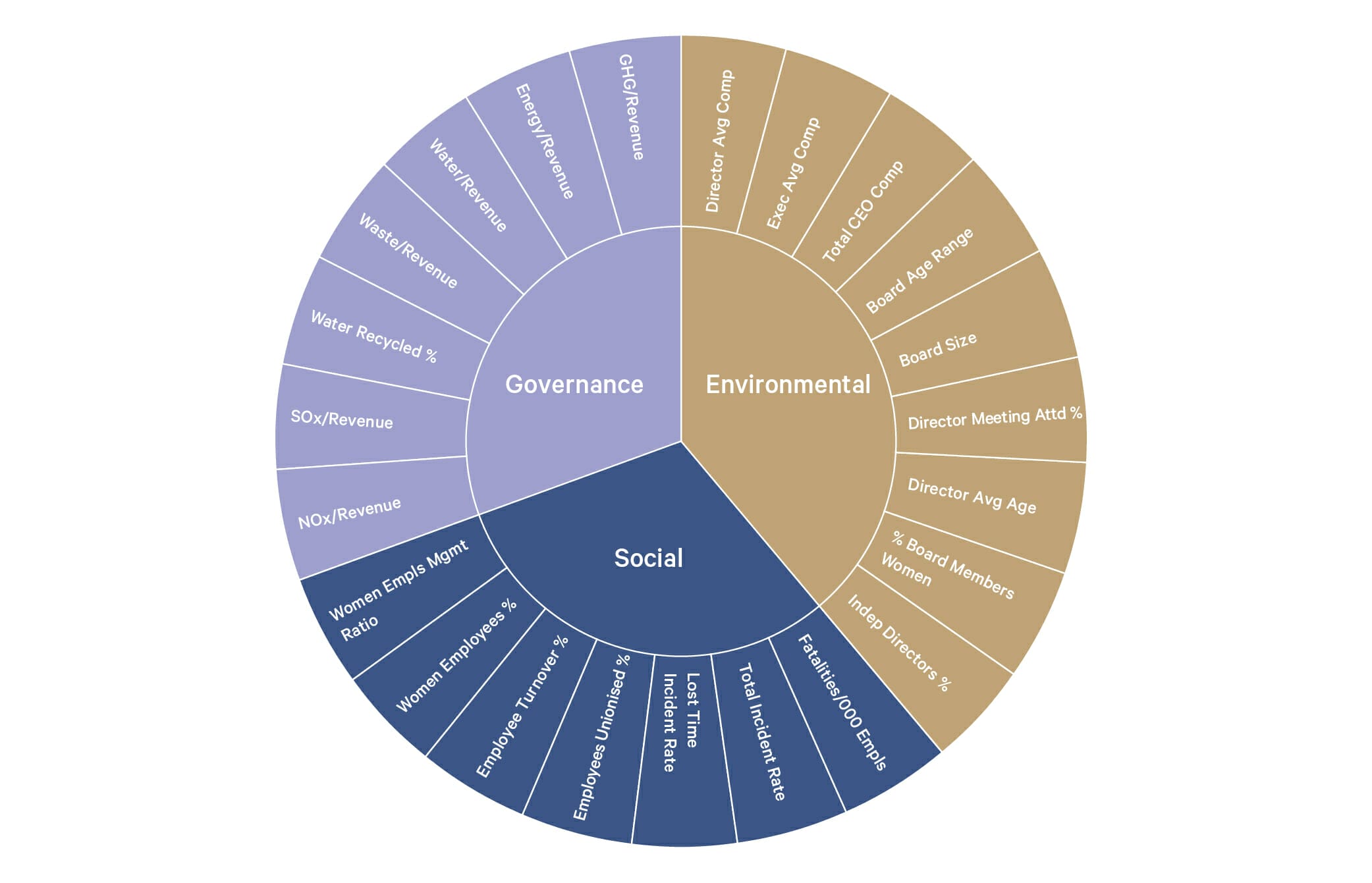

ESG Performance Metrics

Source: Bloomberg

Investors are increasingly becoming more climate aware

- BP shareholders overwhelmingly adopt climate resolution.

- Oil firm Equinor agrees climate change targets with investors.

- Shareholders call on ExxonMobil to set greenhouse gas reduction targets

Despite the strategy’s growth, lingering misconceptions remain.

-

Sustainable investing only works for equities

All asset classes incorporate ESG analysis to varying degrees. One of the metrics increasingly being used to classify bonds is sustainability. “Green” bonds are those issued for sustainable purposes while “Olive” bonds are those issued by companies that have improved their sustainability metrics. The analysis goes much deeper, however. Corporate governance has always been an important consideration for bond investors, particularly in emerging markets where there are typically higher levels of corruption and fraud and the rule of law is weaker. The size and quality of collateral backing a bond issue is a key determinant of its price in the market. Verifying this collateral is a critical role for a credit analyst. A spate of corporate bond defaults in India, for example, has given rise to what Bloomberg calls, “snatch-and-grab” finance. Where bond holders grab any of the collateral they can regardless of where they sit in the credit queue2. Incorporating ESG analysis will help to avoid these situations.

2 www.bloomberg.com/opinion/articles/2019-10-17/india-s-bad- loan-crisis-turns-into-a-melee-to-seize-collateral

-

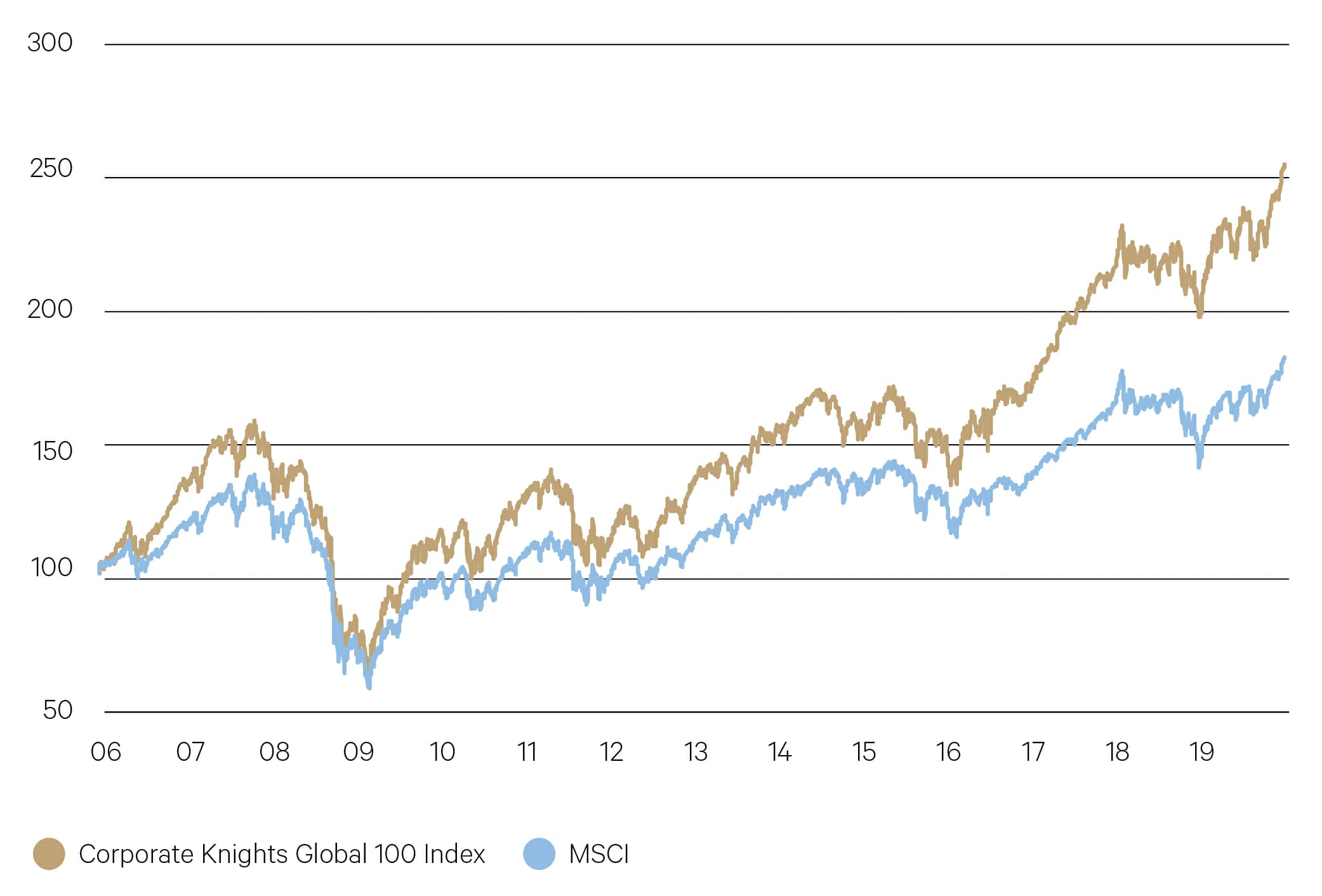

ESG underperforms traditional investment strategies

The performance of the 100 most sustainable corporations (the Corporate Knights Global 100 Index) exceeds the performance of the benchmark index. Between January 2006 and December 2019, for example, the Global 100 Index made a total investment return of 257.2%, compared to 182.9% for the MSCI All Country World Index (ACWI).

Performance of ESG vs Traditional Investment Strategies (Indexed: Jan-06=100)

Source: Bloomberg

-

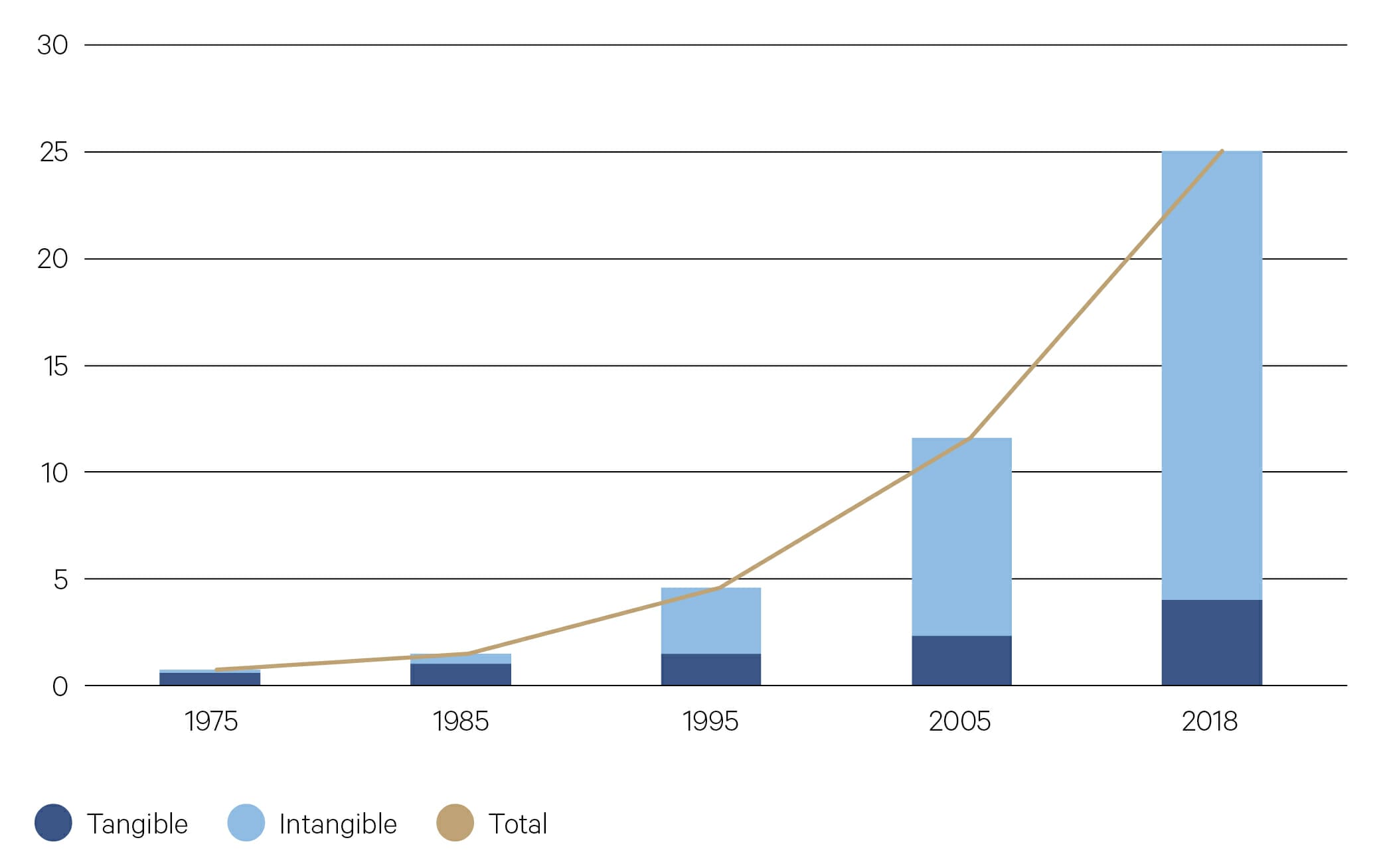

ESG is a passing fad

ESG is becoming more important with the rise in intangible assets. The proportion of “intangible assets” of S&P 500 companies, assets tied to reputation, brand and intellectual property rather than evaluable tangible assets, have reached record highs. Analysis of financial metrics simply won’t suffice anymore.

Tangible vs Intangible Assets for S&P500 ($tn)

Source: 2019 Intangible Assets Financial Statement Impact Comparison Report