-

Overview

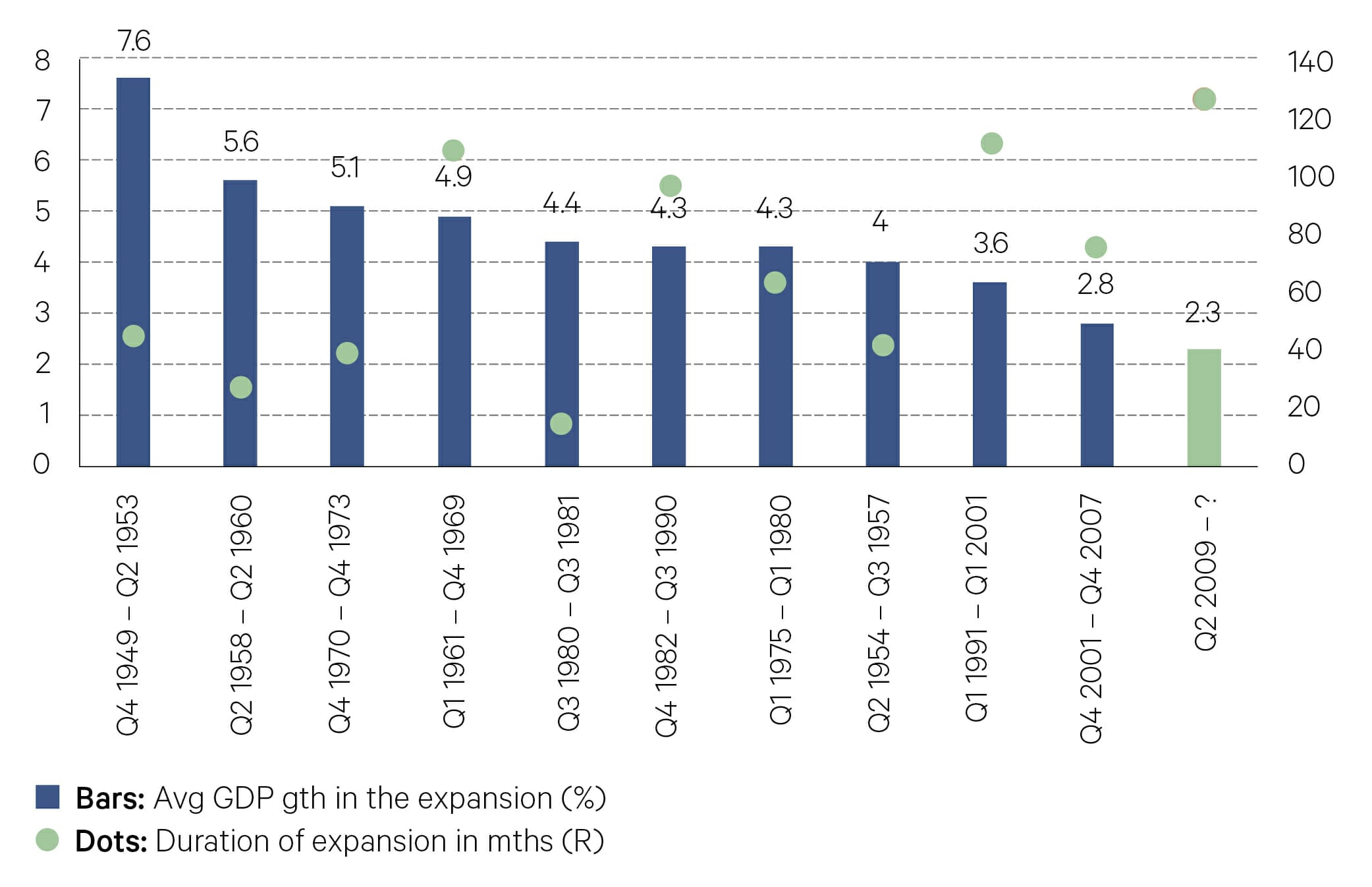

It has been the best of times and the worst of times for the US economy. While this expansion has been the longest on record at over 126 months, it has also been the weakest on record. Similarly, the equity market has had a record run, at least in terms of duration (the tech-inspired 1990–2000 bull market still leads the way in terms of total return). As we enter the third decade of the 21st century, our base case scenario for investors is that there is still too much policy support for this trend to end just yet.

“The best of times, the worst of times” Longest, but weakest recovery in post WWII era

Source: Bloomberg

We believe the key influencers of market returns in 2020 will be easing trade tensions, policy support and geopolitics. In our base case scenario, we are expecting trade tensions to ease as the focus for President Trump turns to the November presidential election.

This will support global manufacturing and trade, providing some relief for the most export-oriented economies such as Germany, South Korea and Mexico. Monetary policy will remain largely on hold (outside of emerging markets) given the benign outlook for inflation, while fiscal policy will become more expansionary, particularly in Japan, the UK and to a lesser extent Europe. Geopolitical risks will continue to cause intermittent volatility.

2019 saw the greatest number of central bank rate cuts since 2008.

The premise behind our bull case scenario is that the green shoots that have already started to appear in the manufacturing sector start to resemble trees more than weeds. The amount of liquidity pumped into financial markets by global central banks will find its way out of cash and into financial markets as confidence returns in the wake of the US-China trade deal. Emerging market economies will once again support global trade and growth will pick up in Europe and Japan resulting in a more synchronized global growth cycle.

In our bear case scenario, trade tensions re-escalate as President Trump doubles down adding Europe to his tariff hit list. Growing fears of a Democrat winning office in the US election weighs on market expectations for corporate earnings given fears of a wind back of the 2017 tax cuts. Significant expansionary fiscal policy remains wanting and so the heavy lifting continues to sit with central banks who are increasingly bereft of growth-boosting ideas.

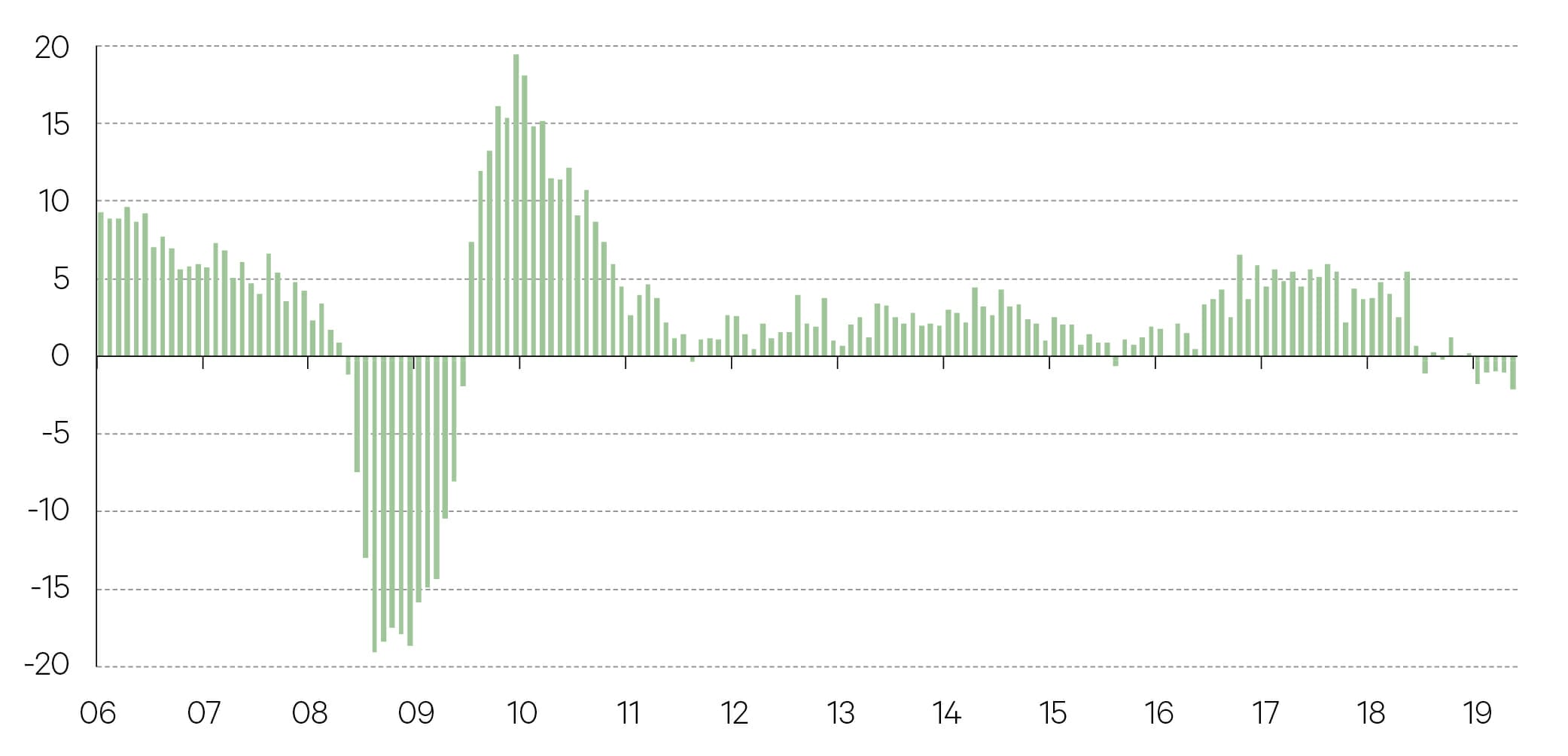

Global trade growth has weakened considerably since the escalation of the trade war in May last year. An easing of trade tensions, re-configuration of supply chains, and increasingly accommodative monetary and fiscal policy should see at least a partial bounce back in trade this year

Global Trade Volume (YoY %)

Source: Bloomberg

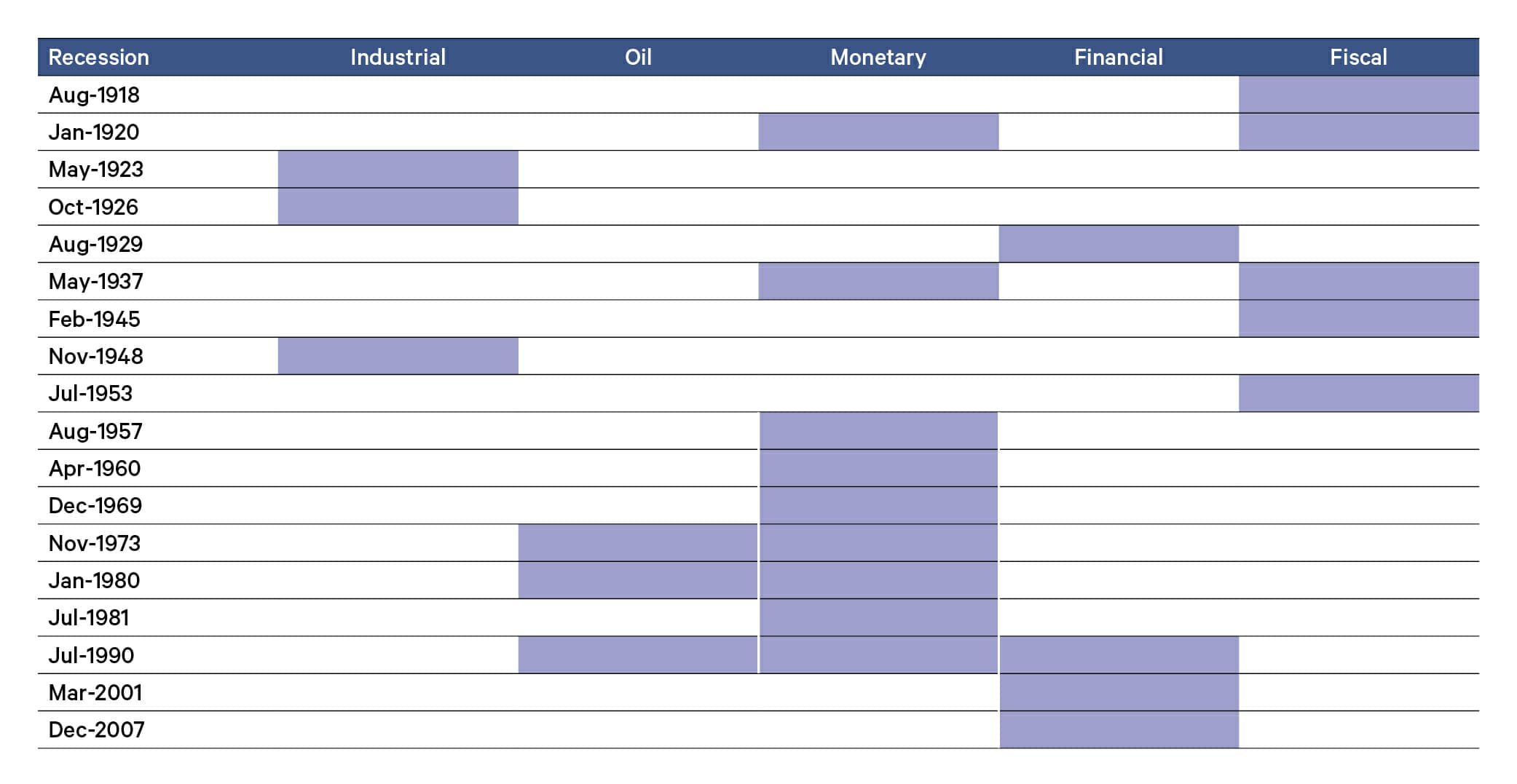

Five key causes of US Recessions

Source: Goldman Sachs

Recession risk in the US receded significantly by the end of 2019. Historically, the main cause of a recession is tighter monetary policy. Since 1955, there have been nine recessions. Seven of those were directly caused by monetary policy. The last two recessions in 2001 and 2007, caused by the bursting of the tech and housing bubbles respectively, were indirectly caused by tighter monetary policy. The about-face on policy by the US central bank last year went some way to heading off the risk of a recession in 2020.

Share of Negative Yielding Debt (% total)

Source: Bloomberg

At the beginning of the decade, there wasn’t $1 of negatively yielding debt in the world. Today there is $15 trillion worth representing 22% of total global debt on issue.

The main reason for the longevity of this cycle has been the persistence of economic slack which in turn has been facilitated by record low interest rates. While this has allowed the US and other developed economies to grow without generating significant inflation, it has resulted in a rise in what the Bank of International Settlements calls “zombie” companies – companies that subsist only because of cheap financing.” In other words, Schumpeter’s “creative destruction” is not working. It is very hard to go bankrupt when the central bank is your underwriter.