-

Overview

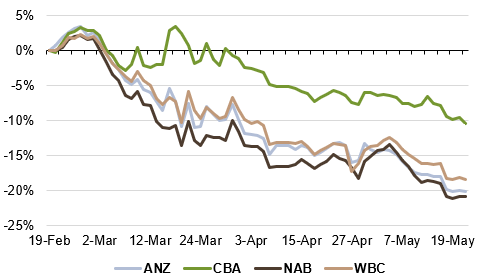

The recovery in global equity markets began in late March as a multitude of fiscal and monetary stimulus measures were announced around the world to support economies through the COVID-19 crisis. The recovery in the Australian market, however, has lagged that of most overseas markets. A key reason for this has been the weight in the ASX 200 of the major banks, which have been held back by lower earnings forecasts, primarily on higher bad debts charges.

Chart 5: Banks: Relative Performance to ASX200

Source: Bloomberg

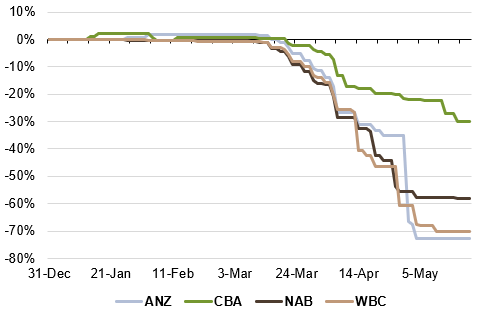

Another key development which has contributed to the underperformance of the banks has been cuts to dividends. APRA issued guidance to the banking sector in early April, expecting that the banks will “limit discretionary capital distributions in the months ahead” including “prudent reductions in dividends” given the uncertain operating environment. Consequently, in the recent reporting period, NAB cut its dividend by more than 60%, while ANZ and Westpac opted to defer dividends until the outlook becomes clearer.

Chart 6: Banks’ Dividend Revisions

Source: Bloomberg

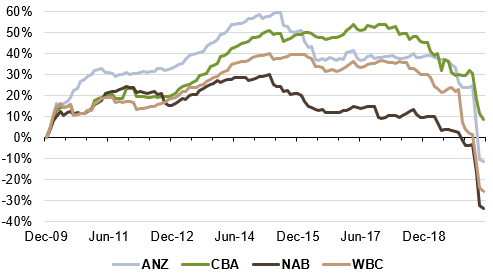

While the current issues impacting the banking sector may be somewhat temporary in nature, over the last decade the sector has struggled to generate earnings growth. A combination of low credit growth, high cost growth from IT and compliance, recent client remediation costs and the impost of higher regulatory capital requirements have all contributed to a challenging decade. In fact, since 2010, Commonwealth Bank is the only major bank to generate positive earnings growth in this time.

Chart 7: Banks’ Longer Term Earnings Growth

Source: Bloomberg