-

Overview

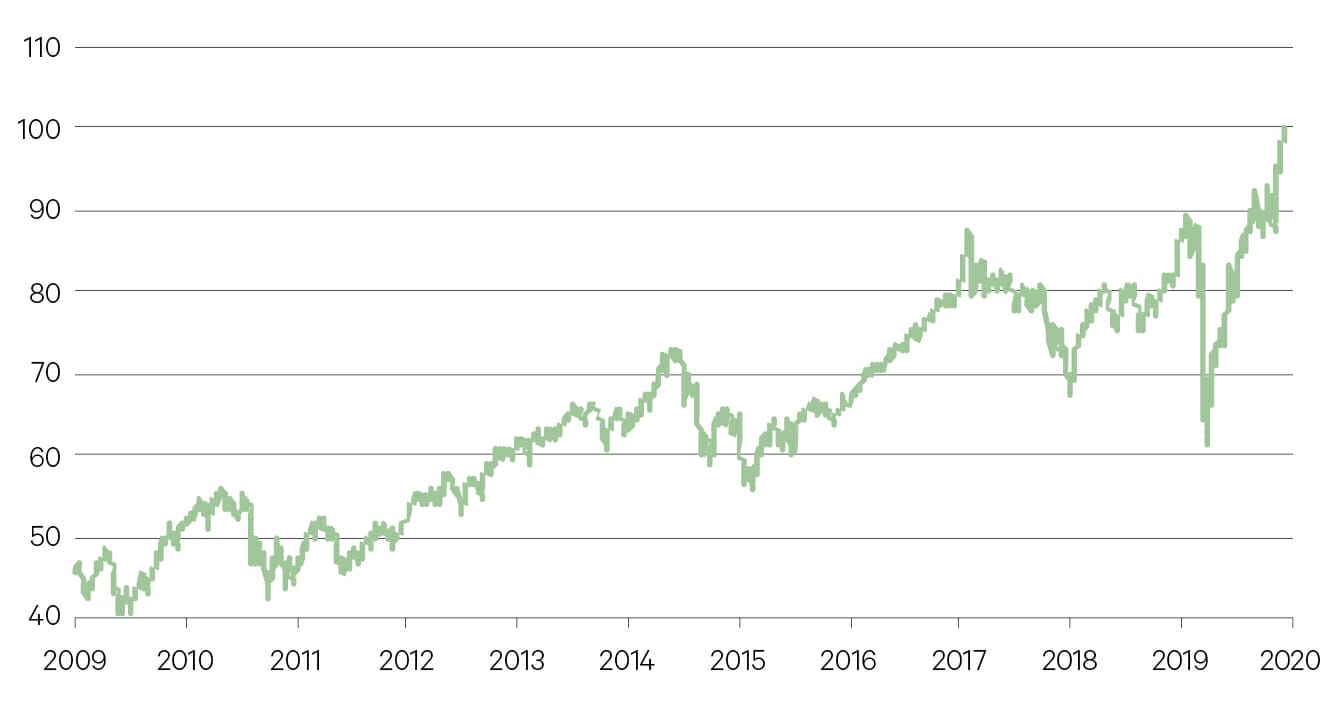

International equities are now a USD 100 trillion asset class! That is almost 300 times the market cap of bitcoin.

Market capitalisation of world equity markets (USD tn)

Source: Bloomberg

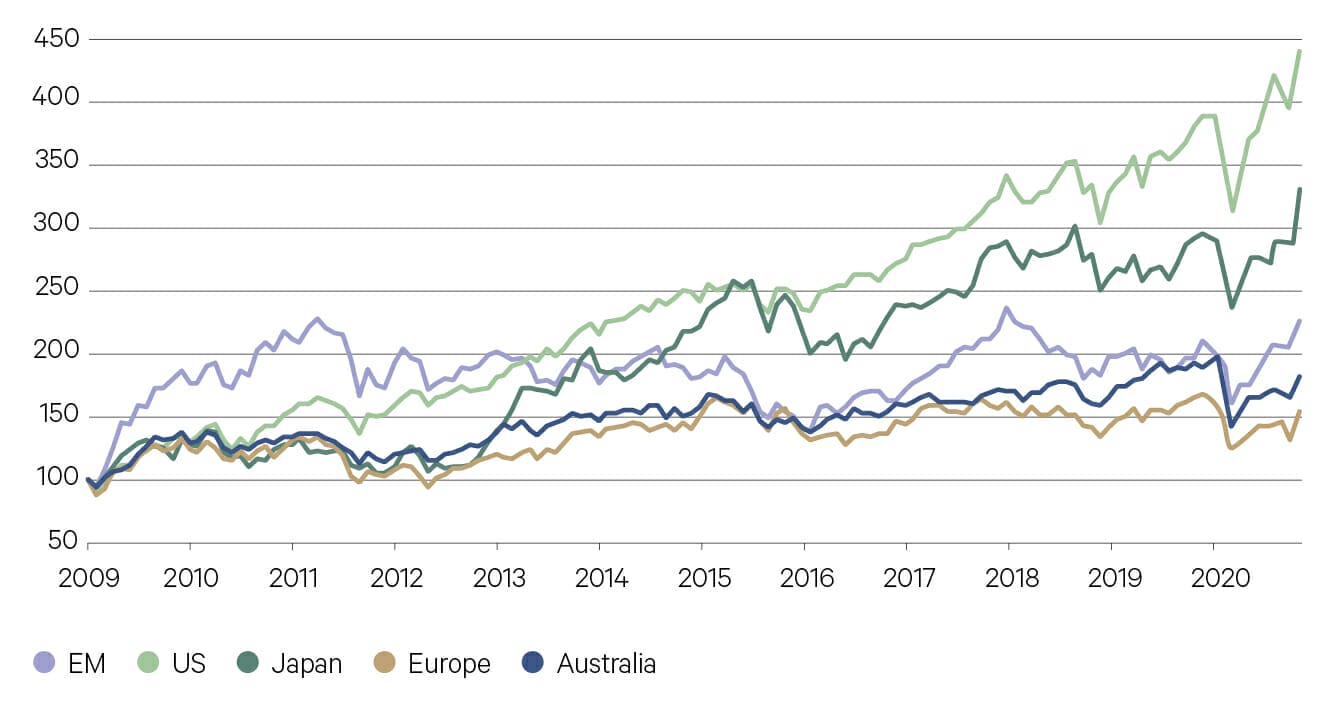

Our base case scenario remains very favourable toward global equities in 2021, particularly the cyclical sectors, small cap companies and emerging markets. The $20 trillion in global policy support will super-charge economic activity in 2021 which will lead to a rebound in corporate earnings growth.

Unlike government balance sheets, corporate and household balance sheets were largely insulated implying little repair work that could possibly impede the recovery. Indeed, debt-servicing levels are at record lows for many households around the world thanks to the aggressive cuts in interest rates. Policy actions to sustain businesses through the pandemic means excess capacity remains high. This will help to keep inflation pressures in check over the coming year.

Global equity market performance since 2009

Source: Bloomberg

2020 was the 7th consecutive year with more than $3 trillion in global M&A. 2021 is set to be even bigger.

Within the US, the Federal Reserve will continue to pursue quantitative easing (bond buying) as the primary monetary policy management tool. The balance sheet of the Federal Reserve has exploded from around $2 trillion in size in 2009 to $7.2 trillion today. Central bank ownership of the bond market in the US has reached 20%. This compares with 40–50%

in Japan and Europe and suggests capacity to continue buying more is ample.Empirical research dating back to 1933 shows that US small cap stock indices tend to outperform large cap stock indices in the 12 months following the trough in the US economic cycle. The average 12 month return for small cap companies is 55% versus 26% for large. The outperformance is even larger and lasts longer following a major market meltdown. Over a one, three and five-year period, small cap indices outperformed large for both US and global indexes following the dot.com correction and the GFC.

Within emerging markets, an expected easing of the US dollar will be favourable as will easier monetary policy by many emerging market central banks. We are looking for the TICK economies – Taiwan, India, China and Korea – to lead the emerging market recovery.

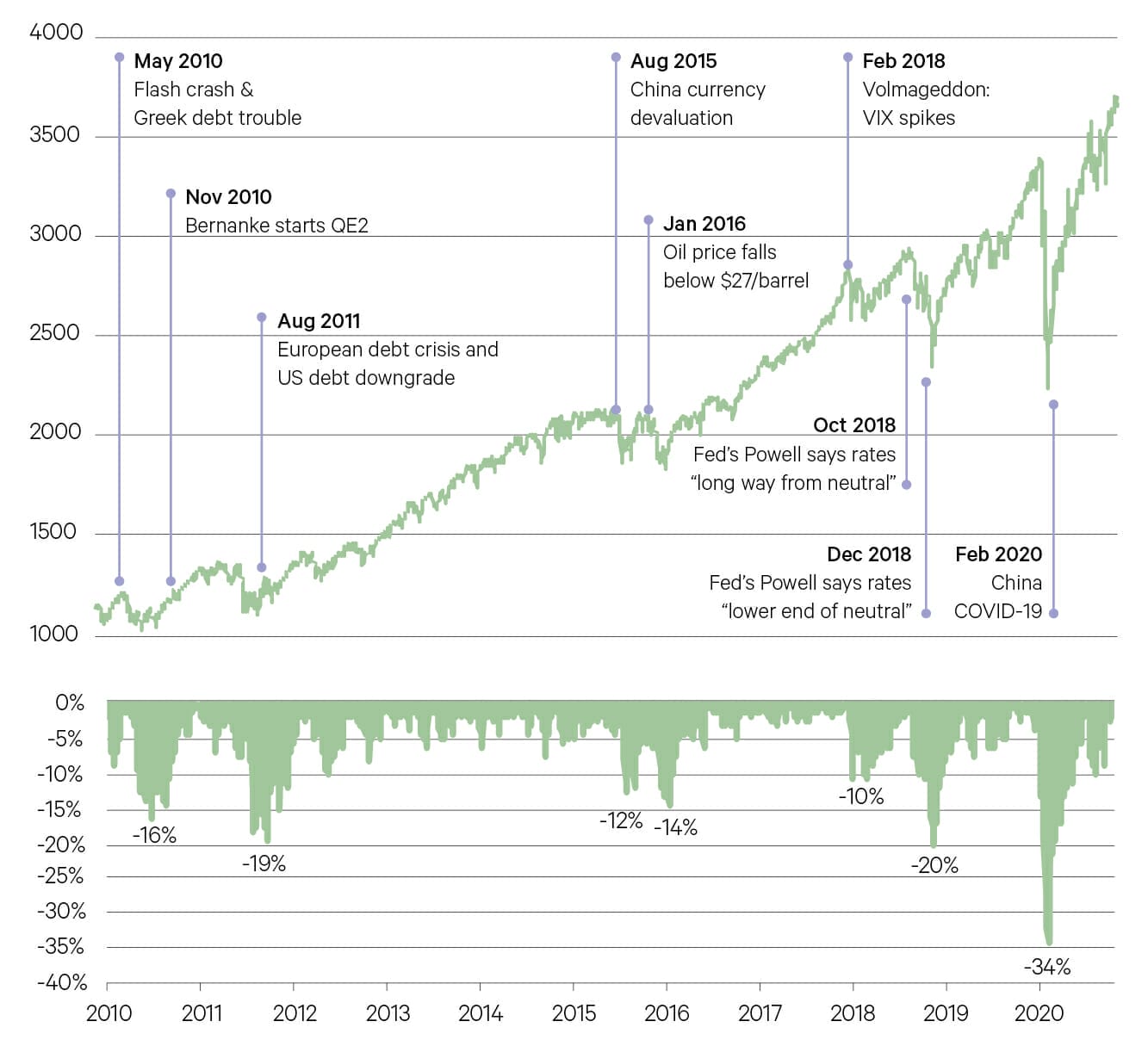

One of the biggest risks to our base case scenario is the potential for an earlier than expected retrenchment of policy support. Memories of 2018 are still fresh when cash was the best performing asset class over the year following the policy error of the Federal Reserve to raise interest rates too much.

One of the biggest uncertainties in 2021 is the outlook for the US dollar.

One of the biggest uncertainties in 2021 is the outlook for the US dollar. Aggressive quantitative easing by the Federal Reserve suggests the greenback should fall. But exchange rates are a relative game. A weaker US dollar implies a stronger euro. This is certainly possible given the close trade ties between Europe and China. But political risk will be heightened in 2021 in Europe with the bedding down of Brexit and the exit of long-term German Chancellor Angela Merkel in September.

US S&P500 – Level and drawdown (1/1/2010)

Source: Bloomberg

The US S&P500 rose by 232% over the past decade but there were seven drawdowns of greater than 10%. The 34% drawdown in 2020 was the largest since the 57% drawdown following the GFC.

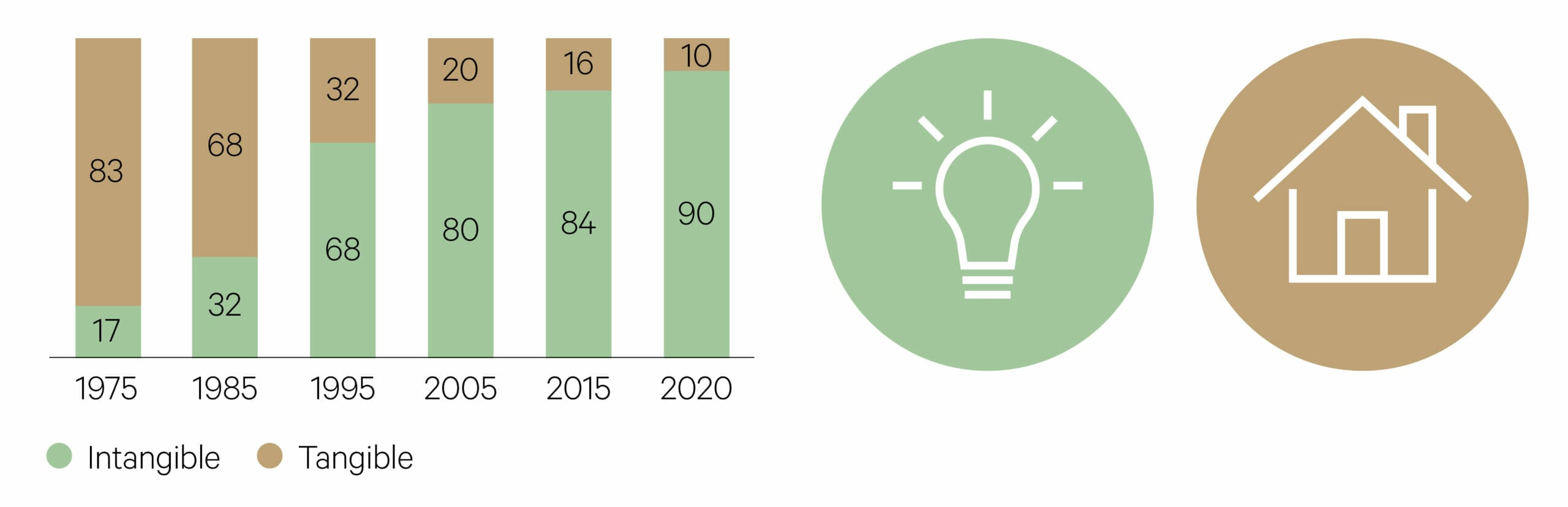

Tangible v intangible assets (%S&P500 total assets)

Source: Ocean Tomo Intangible Asset Market Value Study

The proportion of “intangible assets” of S&P 500 companies, assets tied to reputation, brand and intellectual property rather than evaluable tangible assets, have reached record highs in the US. Worth over $21 trillion, they are often difficult to value using traditional accounting practices which is why integrating environmental, social and governance (ESG) practices into company analysis is becoming so important.