-

Overview

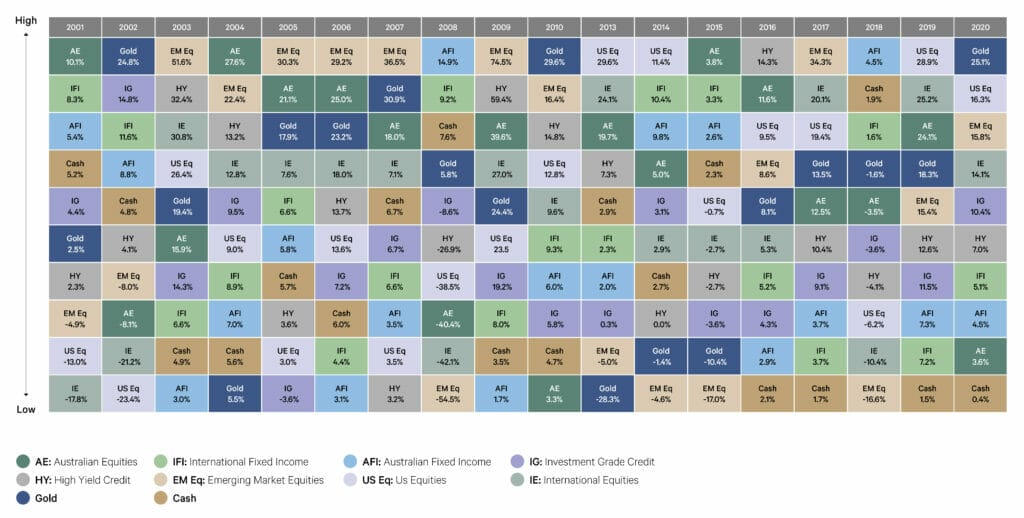

In the space of just six months, $US30 trillion dollars was lost and regained in world equity markets.

Belying this volatility, annual returns in 2020 were well within standard ranges. We saw solid returns in global shares with Asian and US equity markets (boosted by high exposures to IT and health care) outperforming. The more cyclical Japanese and European markets underperformed.

Australian shares also underperformed due to the greater cyclical exposure of the Australian share market.

Investment grade credit was well supported by the actions of the US Federal Reserve, which also helped to underpin high yield bonds.

Government bonds had reasonable returns as yields fell in response to central bank rate cuts and bond buying along with safe-haven demand – which drove capital growth.

Australian cash generated the lowest annual return ever (0.4%) in the 33-year history of the data, a fact that has not escaped the attention of income-based investors.

An important lesson from the asset class quilt is the importance of diversification. As can be seen, every asset class, at some point, has been among the best performers in that year, even cash.

Source: Bloomberg