-

December Quarter

Key Themes1. China Pivot

Somewhat of a pivot appears to have happened in China. It began after the Party Congress in October. Within weeks, Xi’s government dropped the “three red lines” on borrowing by property developers. The pivot continued in November with US President Joe Biden and Xi signalled a desire to improve US China relations at a meeting ahead of the G20 summit in Indonesia. In December Beijing loosened its pandemic restrictions that have constrained China’s economic growth since early 2020.

Chart 1: Chinese equity market (CSI300 index)

Source: Bloomberg

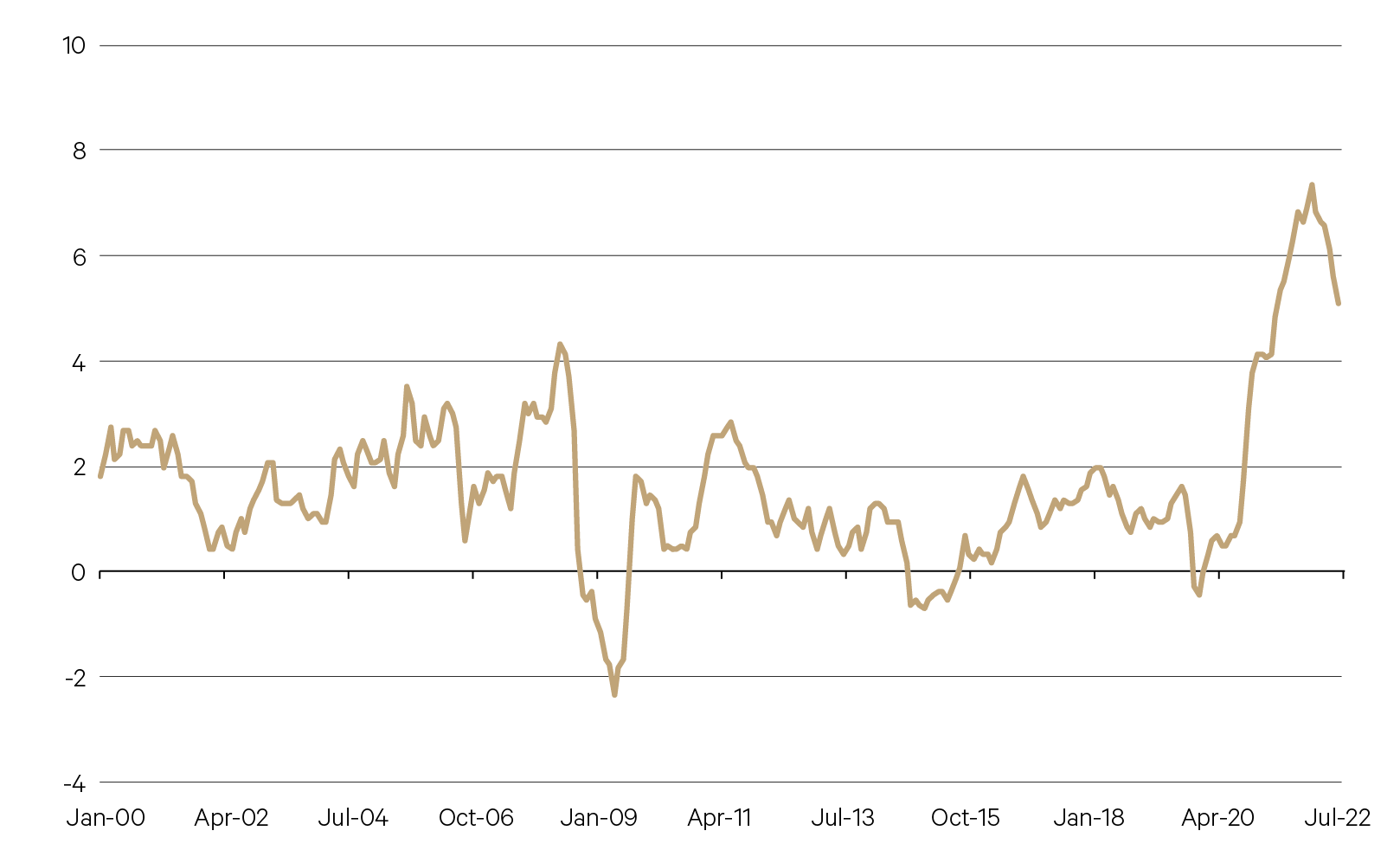

2. US Inflation Peak

In recognition of signs that inflation may have peaked, the US Federal Reserve’s final policy meeting of the year delivered a scaled down rate hike of 50 basis points (bps) after four consecutive 75 bps tightening moves. Chair Powell focusses on three main categories within the inflation release – goods, shelter and core services ex shelter. Goods prices are unquestionably cooling. Indeed, there is evidence of deflation for used cars and trucks. Shelter is still high but leading indicators point to a decline. On core services ex shelter – the stickiest part of inflation – there does appear to be evidence of a slowdown in momentum.

Chart 2: US CPI (yoy%)

Source: Bloomberg

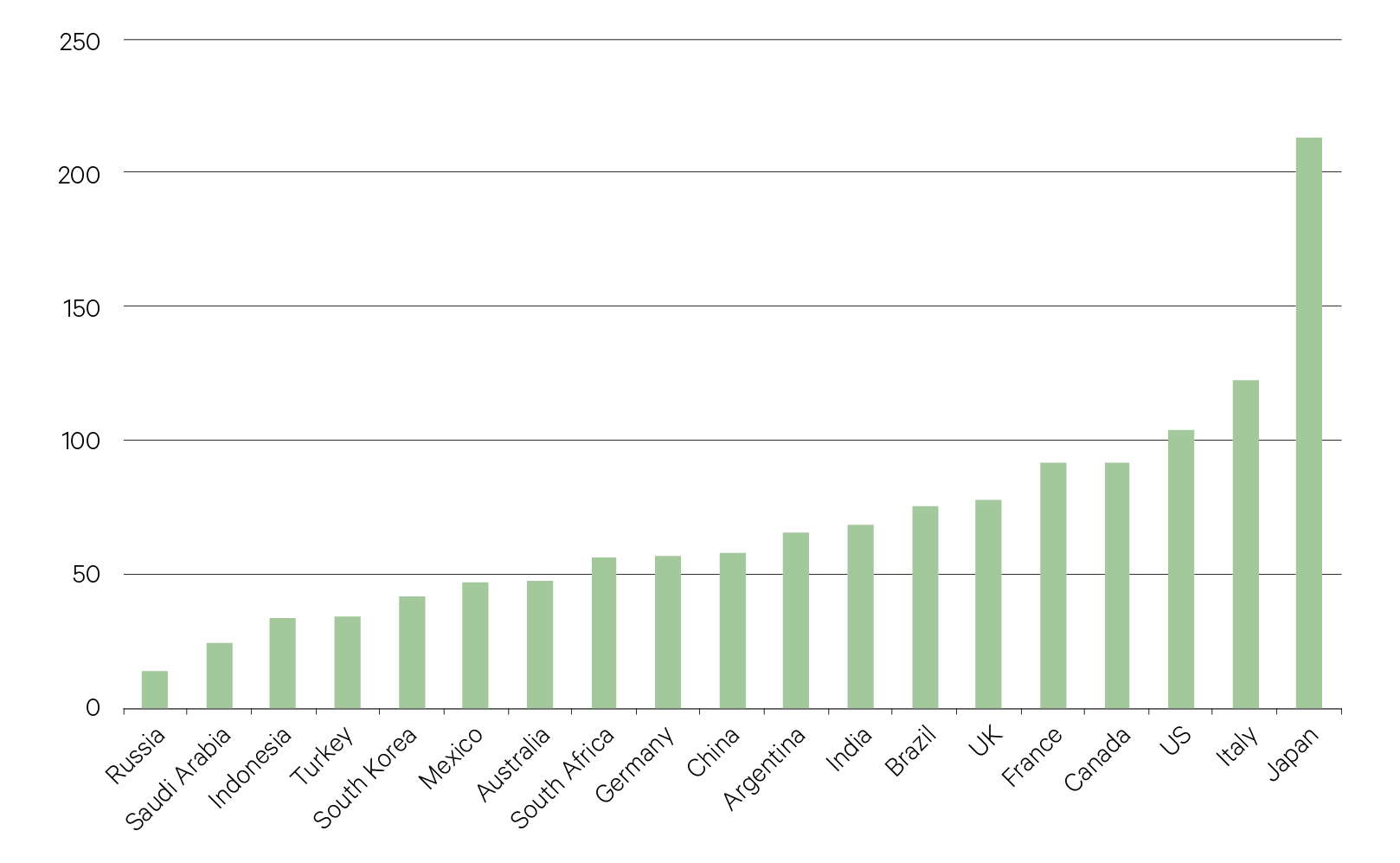

3. Tension in Japan

Inflation has returned to Japan after a break of over 30 years. This is significant because Japan is home to the world’s largest debt load. Public debt sits at 260% of GDP. This compares to Australian public debt of 58% of GDP. Since March 2021 the Bank of Japan (BOJ) has capped the yield on its 10-year government bond pledging to buy as many bonds as necessary to maintain it. Q4 saw the surprise decision by the BOJ to widen the band within which it has been maintaining the 10-year bond yield cap. This is being seen by the market as a step toward moving away from its easy monetary policy stance. The Japanese haven’t had an interest rate rise in three decades and with a debt load as large as it is, the concern is it could create volatility in markets. Japan’s $US12 trillion ($17.1 trillion) bond market is one of the world’s largest but due to BOJ buying, it is also one of the most illiquid. A high debt load, rising interest rates combined with illiquidity make for a potentially volatile mix.

Chart 3: G20 public debt (% GDP)

Source: Bloomberg

-

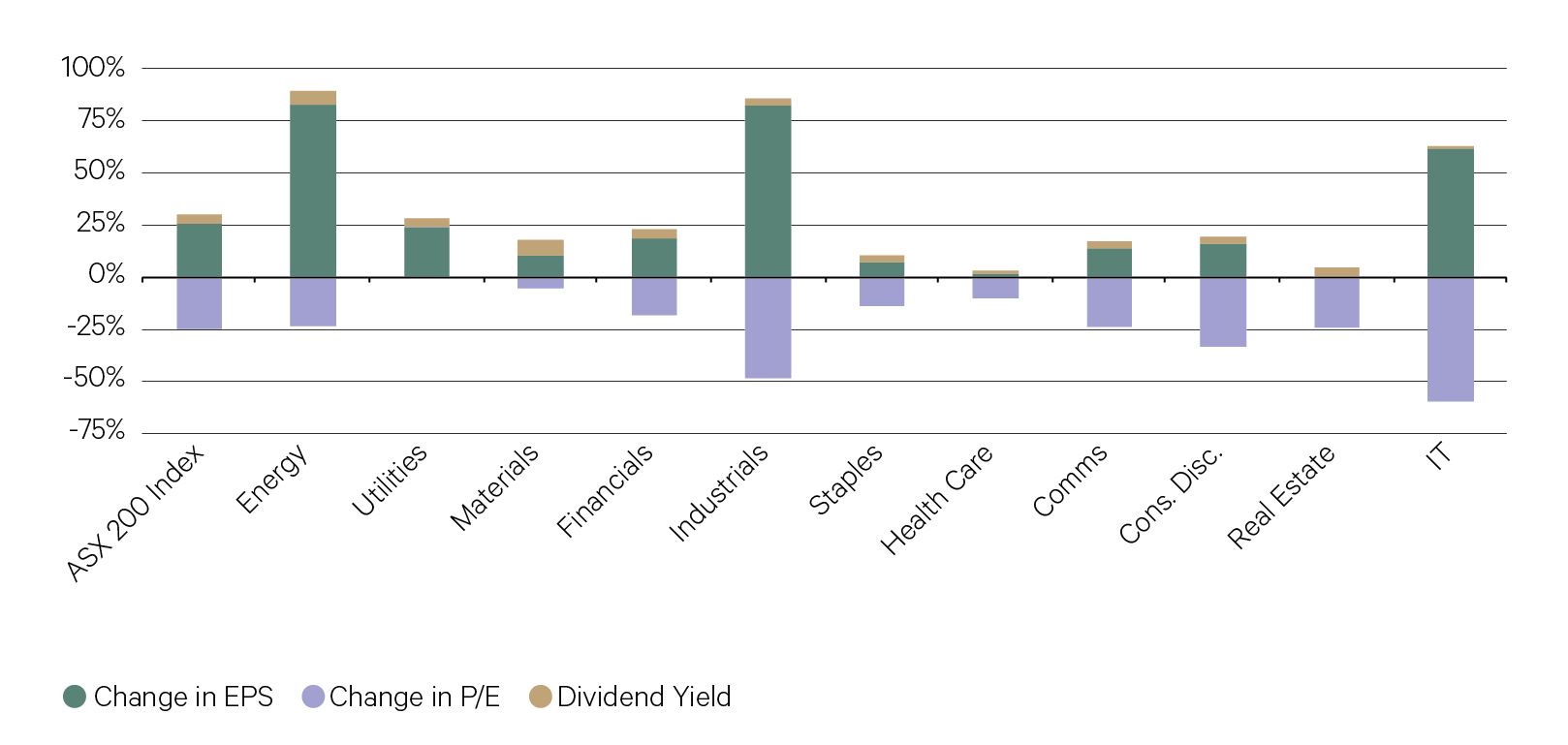

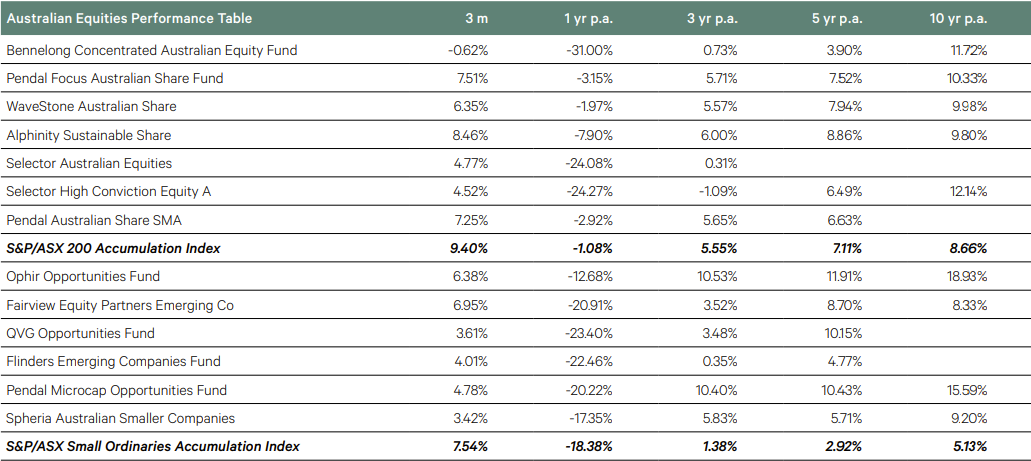

Australian Equities

While 2022 was characterised by a significant de-rate of growth equities following a sharp rise in long bond yields, forward earnings for the Australian market expanded materially through the year, providing a significant offsetting buffer for investors. In particular, the performance of the two large cyclical sectors of the Australian market – resources and financials – accounted for much of our market’s outperformance of global equities over the course of the year.

Chart 4: ASX 200: Earnings strength nearly offsets P/E de-rate in 2022

Source: Bloomberg

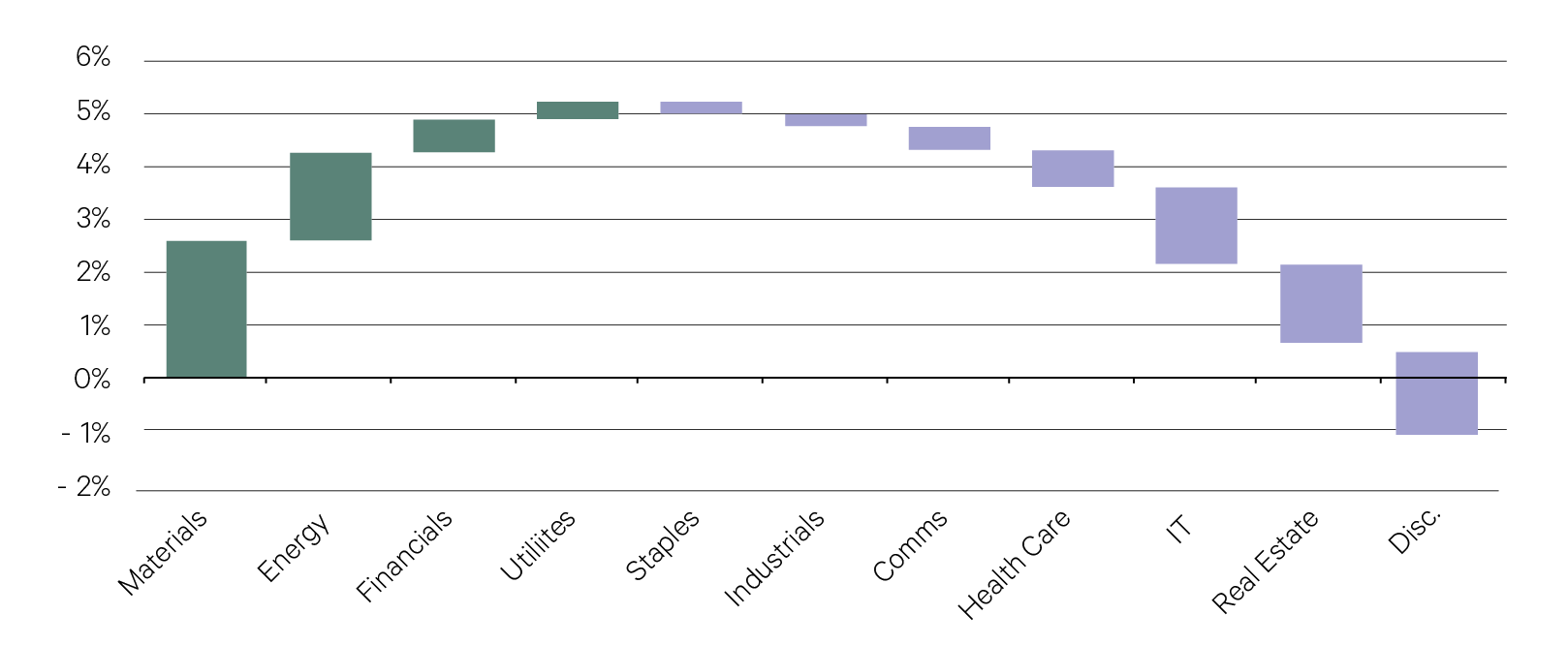

This was reflected in attribution across the year. The only four sectors to provide positive attribution for the year were resources (materials and energy), financials and utilities. The remaining industrials sectors of the market were all a drag on performance. Consumer discretionary, real estate and IT were the three biggest negative contributors. This highlighted the significant headwind that active managers (who are often tilted more towards industrials) faced in 2022.

Chart 5: ASX 200 sector attribution: Cyclicals lead the way in 2022

Source: Bloomberg

- Despite a weak performance in December, the Australian equity market rebounded in the final quarter of 2022, generating a strong return of 9.4% and again outperforming global equities – a consistent theme over the year.

- Two macro factors again were a key determinant of the domestic market’s performance. A softening inflation outlook was key, as investors anticipated the peak of the monetary policy cycle. Further, the Reserve Bank of Australia adopted a more dovish stance, helping the local market. Secondly, the Australian market got a boost as China abandoned its zero-covid policy.

- Cyclical sectors thus led the market in the quarter, with the mining sector rallying on renewed strength in commodity prices, while financials also posted strong numbers.

- Our large cap managers were broadly not positioned for this outcome, with most adopting more defensive portfolios ahead of an expected economic slowdown through this year.

- There were therefore varying levels of underperformance across our large cap managers, though those more style-neutral in their approach fared better, including Alphinity and Pendal.

- Despite long bond yields tracking sideways over the quarter, the more growth-orientated sectors of IT, health care and consumer discretionary again lagged the market considerably, capping off a disappointing year for managers aligned with this style, including Selector.

- While small caps generated a solid 7.5% return in the quarter, they again lagged large caps, further expanding their valuation gap between the two groups.

- Underperformance was also a theme across our small cap managers over the quarter, rounding out a year in which active managers struggled to match the returns of the benchmark. Over the course of 2022, Spheria was our best performing small cap fund, with the manager’s higher valuation discipline and focus on cash flow generation holding them in good stead.

-

International Equities

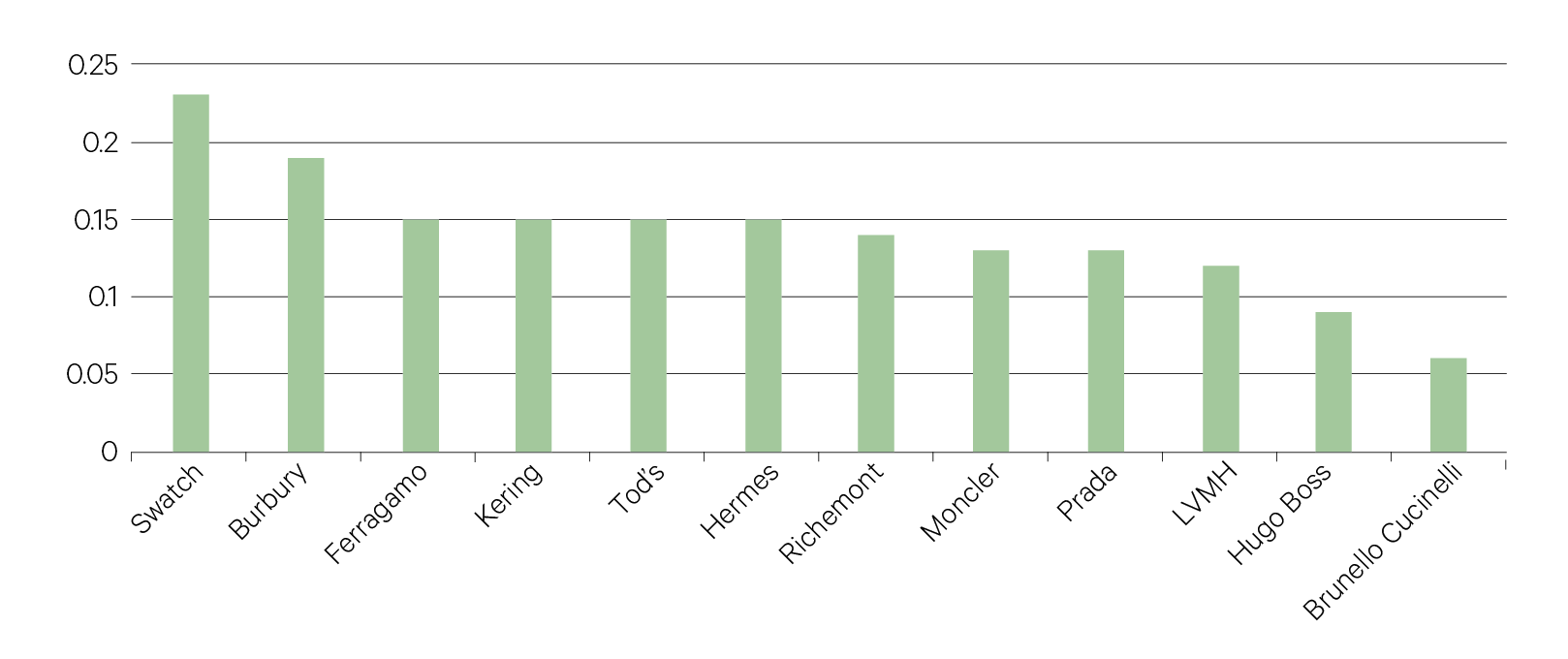

Luxury stocks in Europe are holding up despite disappointing sales reports. Luxury brands see China as a key market for future growth. China optimism has been a big driver of this year’s rally in European stocks. Richemont and Burberry both posted sales that missed estimates, hurt by a drop in China. But both companies are rising today after saying consumer spending in China is already rebounding. Burberry’s CFO pointed to “very promising signs in January” in the key luxury market. Hermes said 3Q sales surged as luxury shoppers in China returned to stores after COVID-19 restrictions

eased. The China recovery story looks poised to continue as consumer spending recovers. A continued rebound is especially important for the cyclical-driven sectors crucial to Europe’s export driven economy.Chart 6: Luxury sales to Mainland China (%)

Source: Bloomberg

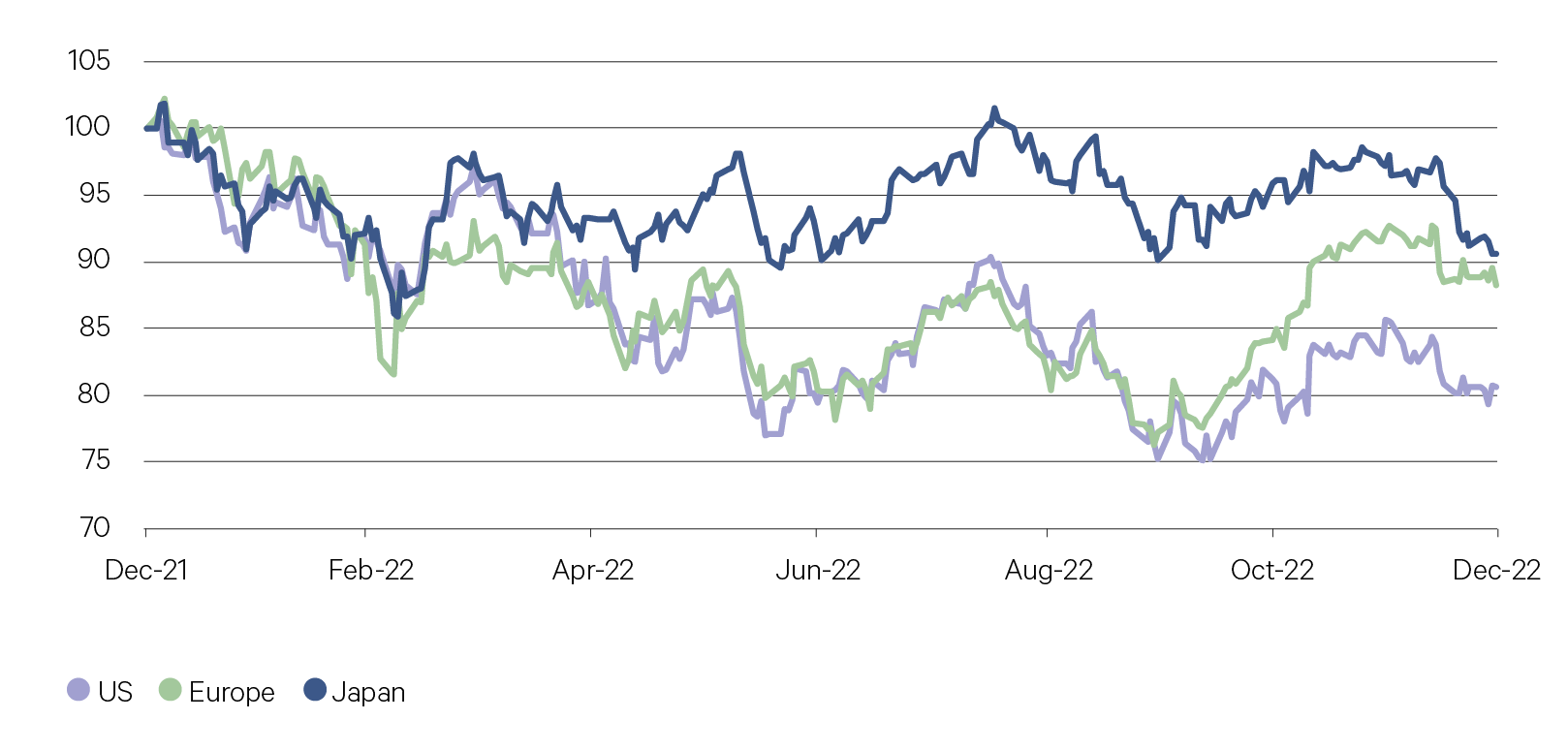

There was a “collapse” in US equity allocation in the latest Bank of America fund manager survey, with investors the most underweight US equities since 2005. But participants are also becoming “a lot less bearish” overall than in 4Q. Recession fears have peaked and investors are the most optimistic on global growth prospects in the past year. That’s spurred some re-allocation into EM and euro-zone stocks – although they remain underweight global stocks overall. The European economy continues to see some optimism as gas prices and inflation ease and China re-opens. While US stocks have posted a strong start to the year, European and EM stocks have fared even better.

Chart 7: Equity market performance 2022 (index: 31/12/21=100)

Source: Bloomberg

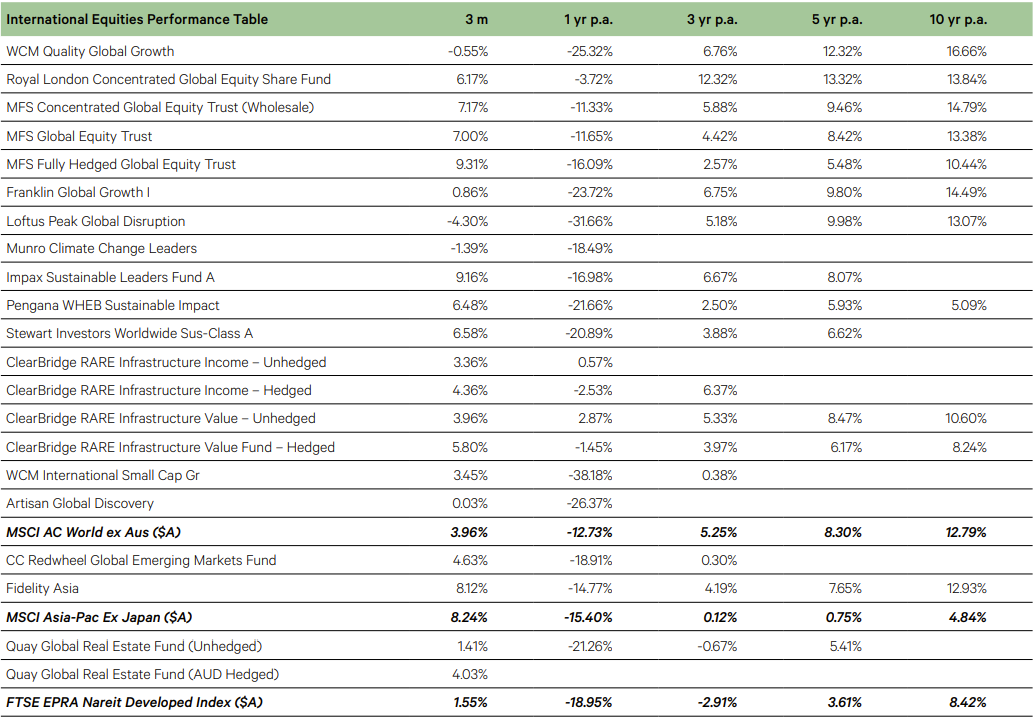

- The MSCI World Index rose 9.4% in the quarter. US investors balanced ongoing caution from the Federal Reserve (Fed) with indications that the pace of policy tightening would slow, and signs that elevated inflation could be cooling. There were also especially strong corporate earnings in certain sectors.

- Emerging market (EM) equities posted strong returns over Q4, helped by a weaker US dollar. Most of the MSCI EM index’s returns were generated in November on optimism that as policy tightening from the Federal Reserve (Fed) slowed, any recession would be shallow and markets would begin to discount the recovery. Optimism faded somewhat in December, however, when the Fed re-iterated its commitment to fighting inflation.

- An earlier than expected relaxation of the Zero Covid policy by the Chinese authorities also boosted sentiment later in the quarter. The Fidelity Asia Fund was a particular beneficiary of the positive news out of China given its 43% weight to the country. The Redwheel Global Emerging Markets Fund has a smaller weight to China but benefited from the outperformance of emerging markets generally.

- The Australian dollar rose 6.5% against the US dollar but fell against the euro, yen and UK pound. Global funds in US assets therefore benefited from being hedged. This particularly applied to the WCM Global Growth Fund which has one of the highest allocations to North America in our line-up as well as the Ironbark Royal London Global Equity Fund. The benefit of being hedged was less pronounced for funds with a greater allocation to Europe or the UK. This was the case with our ClearBridge Infrastructure Funds.

-

Fixed Income

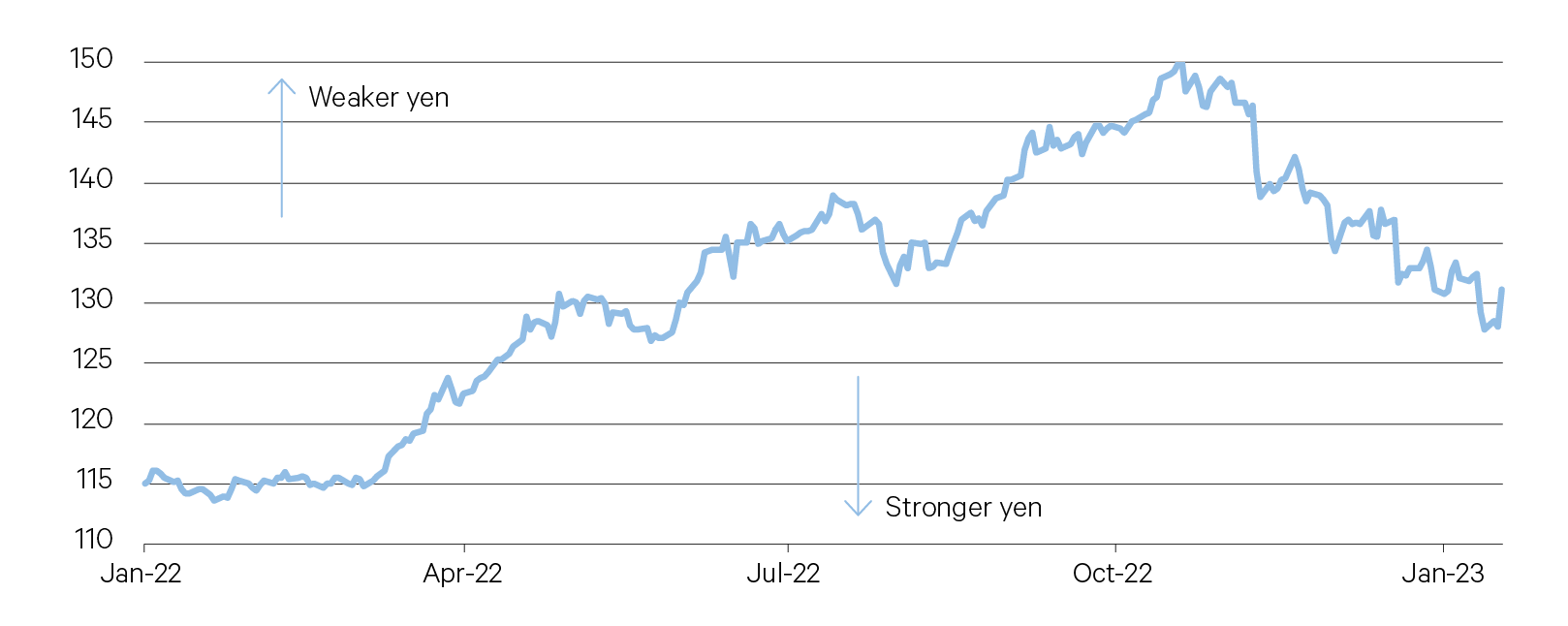

Investors are focused on the possibility of a policy shift from the Bank of Japan. A move by the central bank could spur a further jump in the yen and trigger a rise in global bond yields. The yen has already strengthened considerably against the USD following the surprise decision in December to widen the band within which it has been maintaining the 10-year bond yield cap.

Chart 8: USD/JPY exchange rate

Source: Bloomberg

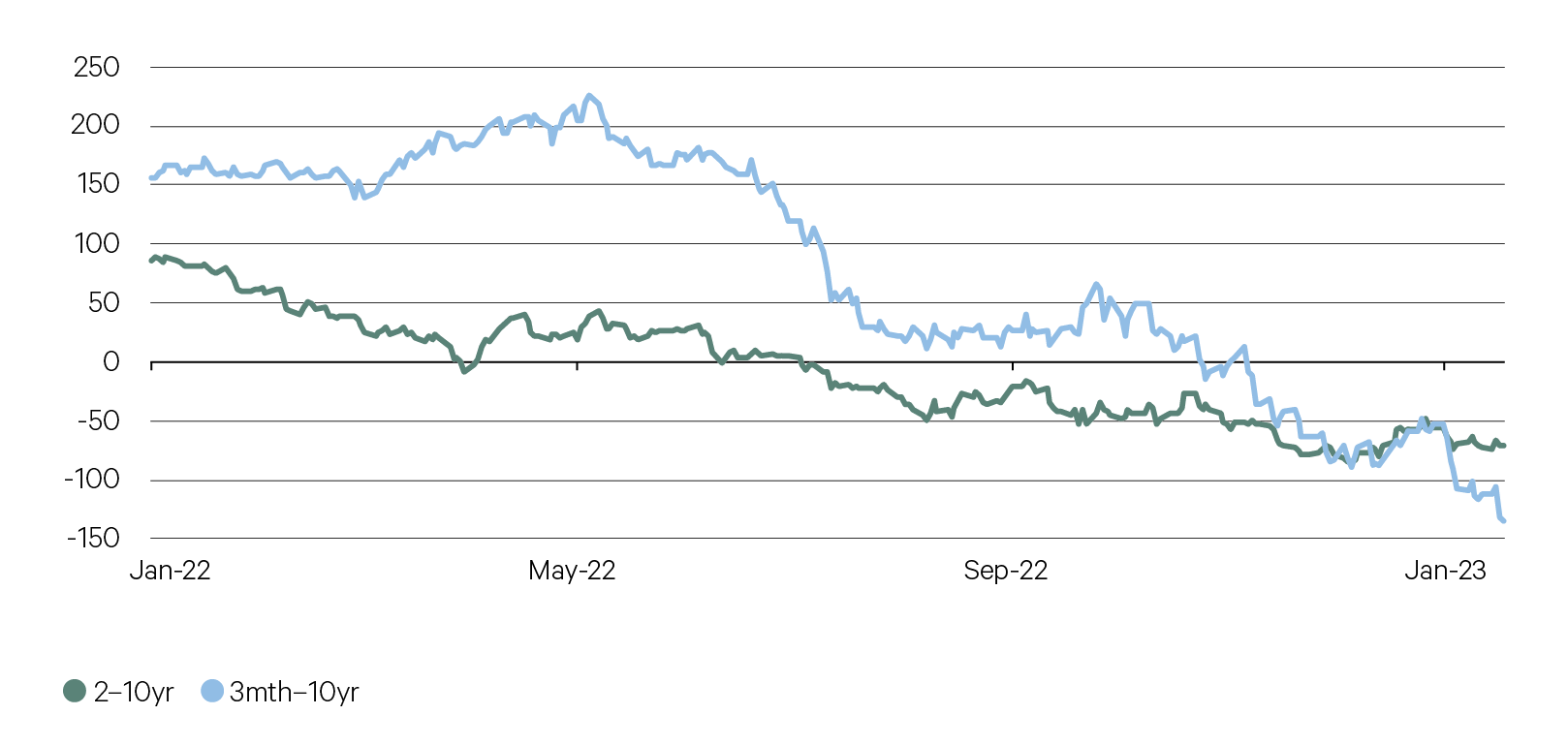

The inversion in the Treasuries curve which appeared to be unwinding at the end of last year has flipped back aggressively since the start of this year. This is a headwind for US equities and is a reflection of growing recession fears. An inversion that occurs in both the 10-year/2-year curve and the 10-year/3mth curve has historically proven to be a watertight signal of an impending recession. On average a recession has followed within 11 months in data going back more than four decades.

Chart 9: US yield curve inversions point to a recession

Source: Bloomberg

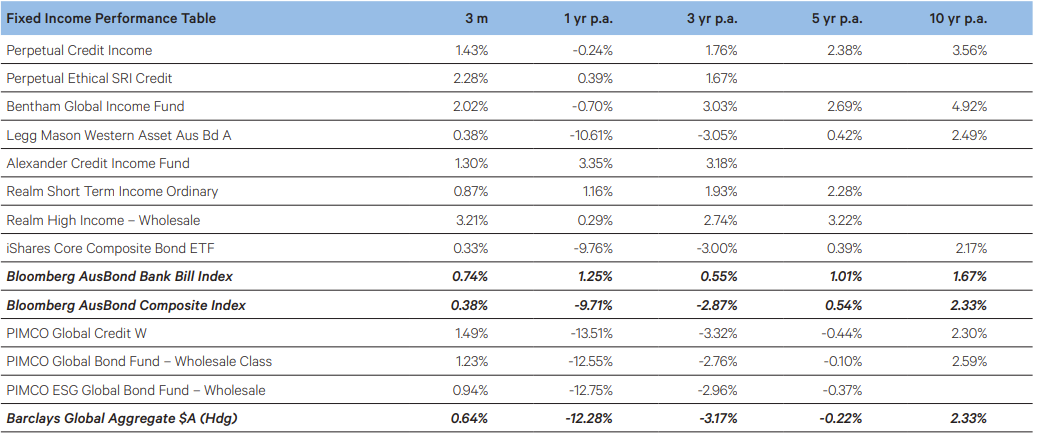

- Markets ended the year on a mixed note in the final quarter. Government bond yields edged up towards the end of Q4, reflecting some market disappointment at the hawkish tone from some central banks, despite mounting evidence of slowing economic growth.

- The Federal Reserve (Fed) raised rates twice during the quarter, ending at 4.5% while the Reserve Bank of Australia lifted rates three times by 25bpts each ending the year at 3.1%.

- Australian 10-year yields rose by 17bpts to 4.1% The 2-year yield fell slightly leaving the yield curve steeper.

- The US 10-year yield rose from 3.83% to 3.88%, with the two-year rising from 4.28% to 4.42%. Germany’s 10-year yield increased from 2.11% to 2.57%. The UK 10-year yield decreased from 4.15% to 3.67% and 2-year eased from 3.92% to 3.56%, after the country’s new prime minister reversed most of his predecessor’s ‘mini budget’ proposals, which had been very poorly received by the markets.

- Credit markets performed well on improved risk sentiment. The benefited our credit funds particularly the Bentham Global Income and Perpetual Credit Income Funds.

-

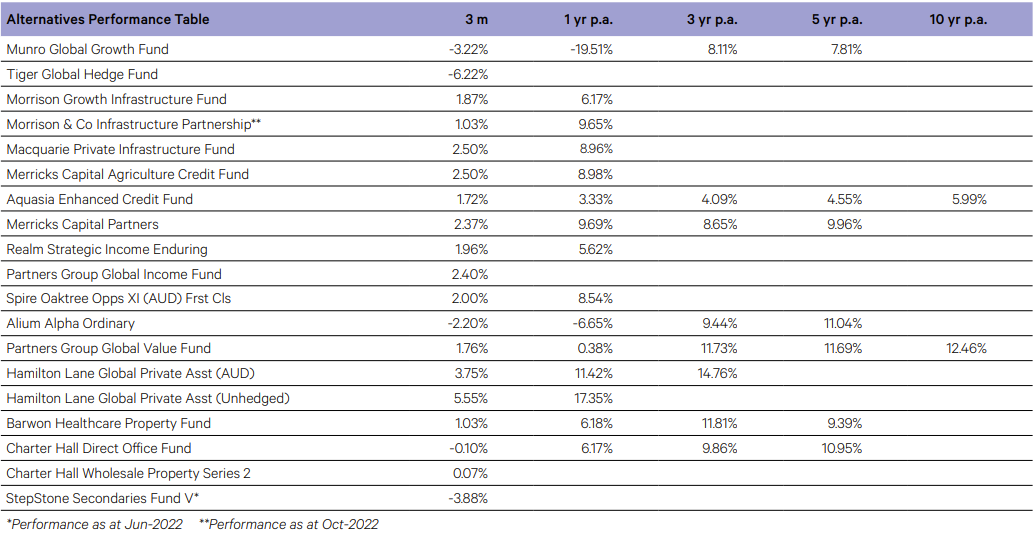

Alternatives

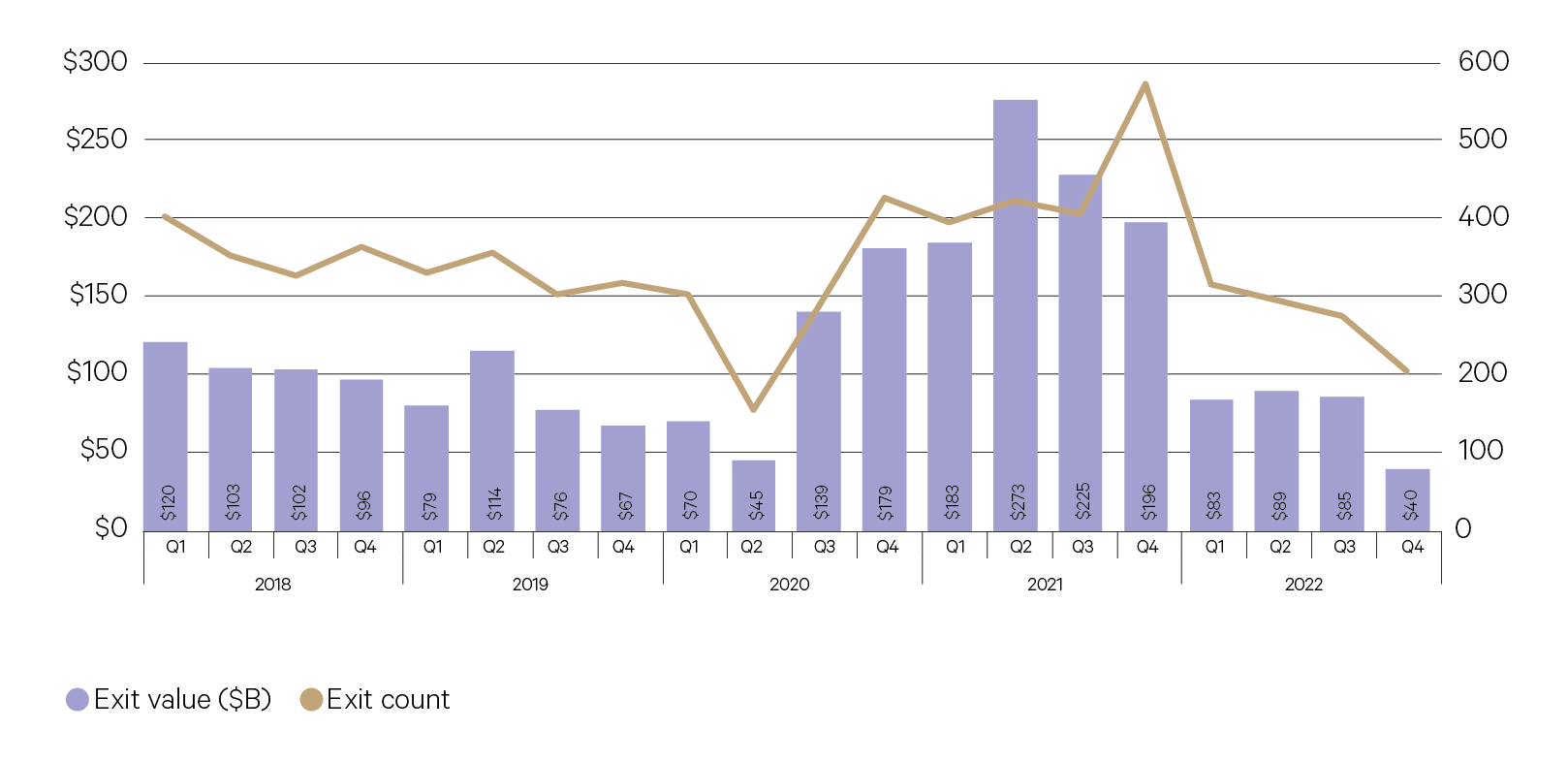

Private Equity (PE) exit activity came to an abrupt halt in 2022. Following six consecutive quarters of exits that exceeded the long term average levels, all four quarters in 2022 were below 10 year averages. With initial public offering (IPO) markets coming to a virtual standstill in 2022 after record-breaking years in 2020 and 2021, PE managers focused on corporate acquisitions or PE sponsor acquisitions instead. Mergers and Acquisitions, take privates and deals with other PE sponsors are likely to be areas of focus for managers in 2023.

Chart 10: Private equity exits hit the breaks

Source: Pitchbook

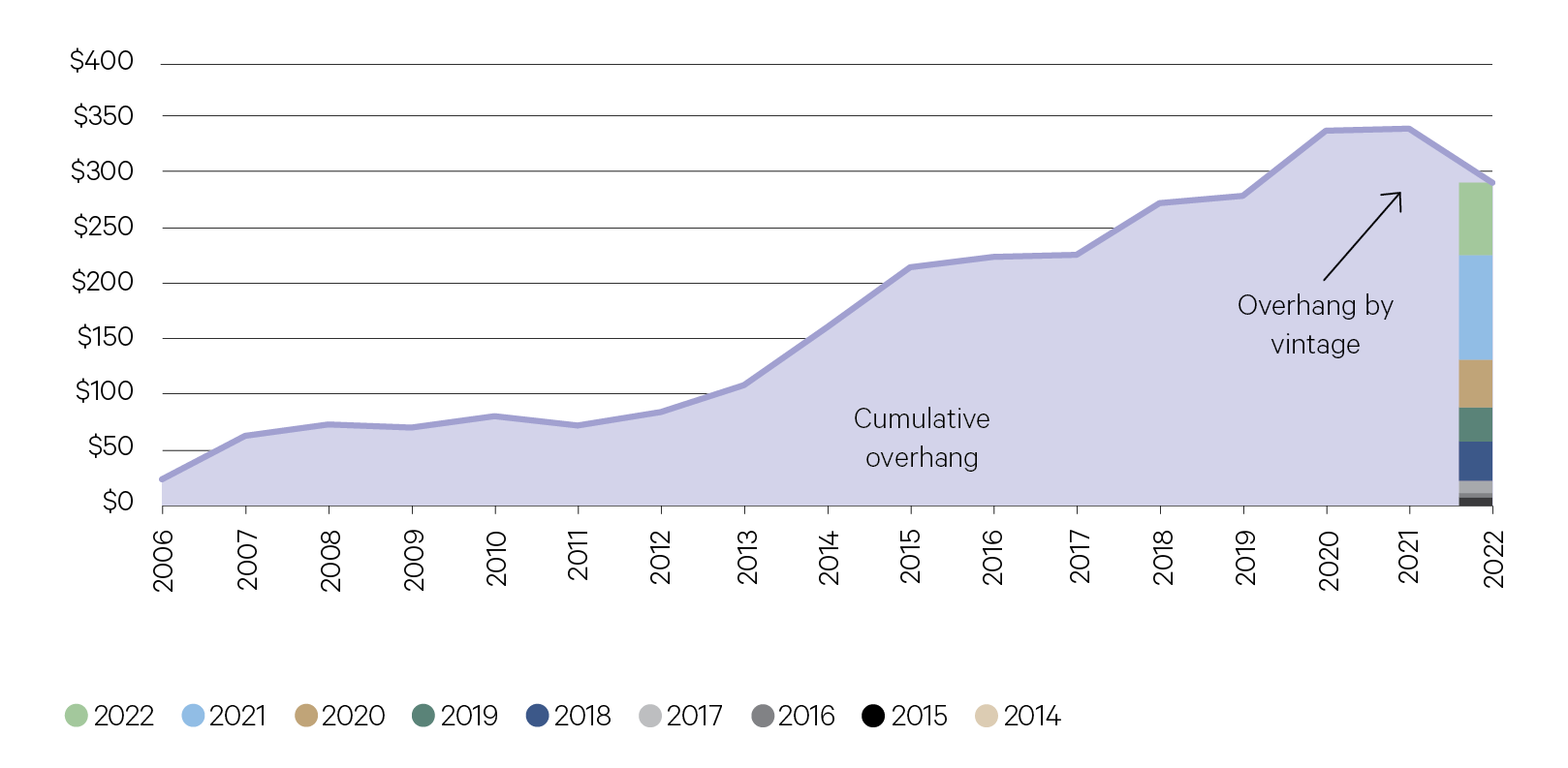

During 2022, the year’s strong infrastructure fundraising numbers were driven by increasingly massive funds, as large fund sizes are necessary to complete capital intensive infrastructure projects. There is still capital waiting to be deployed –infrastructure dry powder was still high at the close of Q3 2022, at $287.6 billion, and sitting predominantly in recent vintages. At the quarter’s close, 59.8% of dry powder was from funds in the size bucket of $5 billion or more, and another 29.8% of it was in funds in the $1 billion to $5 billion size bucket. The expectation is to see continued robust investment activity for several more years at least.

Chart 11: Infrastructure dry powder ($B) by vintage

Source: Pitchbook

- After strong gains in October and November, equity markets reversed course in December as investors became increasingly concerned about the effects of continued hawkishness from the Fed.

- Equity long short manager Munro Global Growth finished the quarter -3.2% against the backdrop of a volatile market environment. The fund’s long positions contributed positively to returns in the fourth quarter. Short positions, hedging and a rising Australian dollar all detracted from performance in the quarter. From a stock perspective, long positions in Novo Nordisk, ASML, Visa and Mastercard were the largest positive contributors to performance during the quarter. Short positions more leveraged to the macro implications of the US Fed raising rates aggressively in 2022 drove downside returns. Overall, the fund remains cautiously positioned however has started to deploy some of the portfolio’s elevated cash levels during the quarter.

- Private equity (PE) markets were not immune to the risk off sentiment that enveloped public markets and investors more broadly as PE activity hit the breaks hard in the second half of 2022. PE deal making fell significantly from 2021 highs as uncertainty around valuations meant many PE deals were shelved or scrapped entirely.

- Fundamental performance, however, driven by solid earnings for private companies meant that performance over the year for our PE managers outperformed public equities. Hamilton Lane Global Private Assets Hedged added 3.8% for the three months ending November 2022 whilst Partners Group Global Value Fund added 1.8% over the same period. Attribution for both was driven by positions in industrials, logistics and healthcare companies.

- In the private debt space, Merrick’s Partners added 2.4% over the three months ending December 2022. Underlying loan income performed strongly for the month, with floating rate loans continuing to pass through rising interest rates in Australia and New Zealand. The portfolio has been transitioned to floating rate loans over the past year. The portfolio currently comprises senior secured loans diversified across sixteen sub-sectors and is additionally diversified by geographic spread and borrowers. The quarter was another strong period for agricultural producers in Australia and New Zealand with tailwinds from La Niña rains and global commodity shortages elevating farmgate prices.

- In Infrastructure, Macquarie Private Infrastructure Fund continues to benefit from longer-term structural trends in the sector. Significant opportunities continue to open up for investment into next generation infrastructure such as renewable energy and key areas of digitization like fibre networks, towers and data centres.

- Q4 2022 was another positive quarter for property managers as rental yields continued to drive positive performance. Vacancy rates remain below long-term averages and rental yields will often be indexed to inflation, providing investors with a level of protection. The Charter Hall Wholesale Property Series No2 Fund was up 0.9% for the quarter and 6.8% over the second half of 2022 driven by strong performance in industrial and logistics positions.