-

Overview

Despite a rapidly changing macro and policy environment, international equities recorded a third successive year of stellar returns in 2025. Following a spike in volatility driven by unpredictable U.S. trade policy and a drawdown in early April, markets staged a remarkable recovery over the following months as the new environment become clearer. While market leadership evolved over the year, Japan and EM topped the tables, while the U.S. surprisingly lagged, particularly through an unhedged lens for Australian investors.

We have a constructive view on international equities into 2026, notwithstanding elevated valuations across much of the world. Underpinning our view is expected solid earnings growth and momentum, broad fiscal support and the additional lagged benefits of the last two years of monetary policy easing. Overall, the environment remains conducive for risk assets.

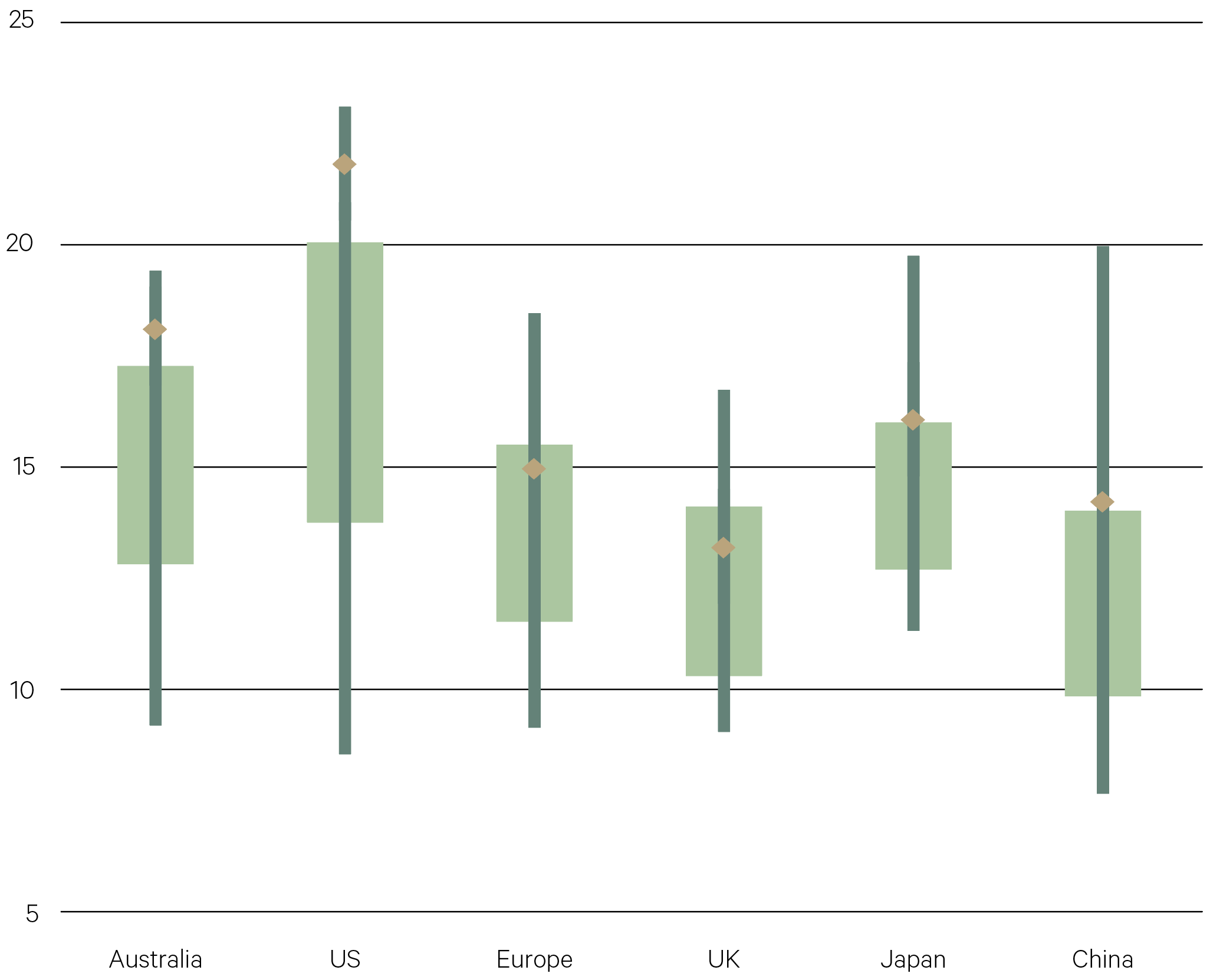

Valuations elevated, particularly in Australia and U.S. (Current P/E vs Long term average)

Source: Bloomberg

—

$527bn – Estimated hyperscaler capex in 2026, a 34% increase on 2025

Source: Goldman Sachs

—

With sovereigns bearing an increasing proportion of debt since the pandemic, corporate balance sheets are comparably healthy. Multi–year capex investment themes continue to grow and remain positive for medium term growth, including decarbonisation, defence and the enormous infrastructure spend necessary to support artificial intelligence (AI). The boom in AI remains the primary investment theme in equities, particularly given the concentration of the central players in the U.S. market.

While hyperscaler capex growth is set to continue in 2026, the increasing use of debt funding by some participants requires close monitoring. Further, we are edging closer to the day that investors will demand to see increased evidence of monetisation of this spend. Active management should be critical in the next phase of AI as a greater spread of winners and losers emerges and broadens beyond the technology sector.

Having navigated well the sharpest hikes in tariffs in many decades, the U.S. market looks well placed with forecasts of 15% earnings growth. The fiscal backdrop is much more supportive this year as the benefits of the One Big Beautiful Bill are realised, including corporate and individual tax cuts and policy incentivising new investment. M&A activity has picked up, falling energy prices are positive for households and a deregulatory agenda provide additional support. Lastly, a new Fed chair in May is expected to be more sympathetic to the Trump administration’s will for further easing.

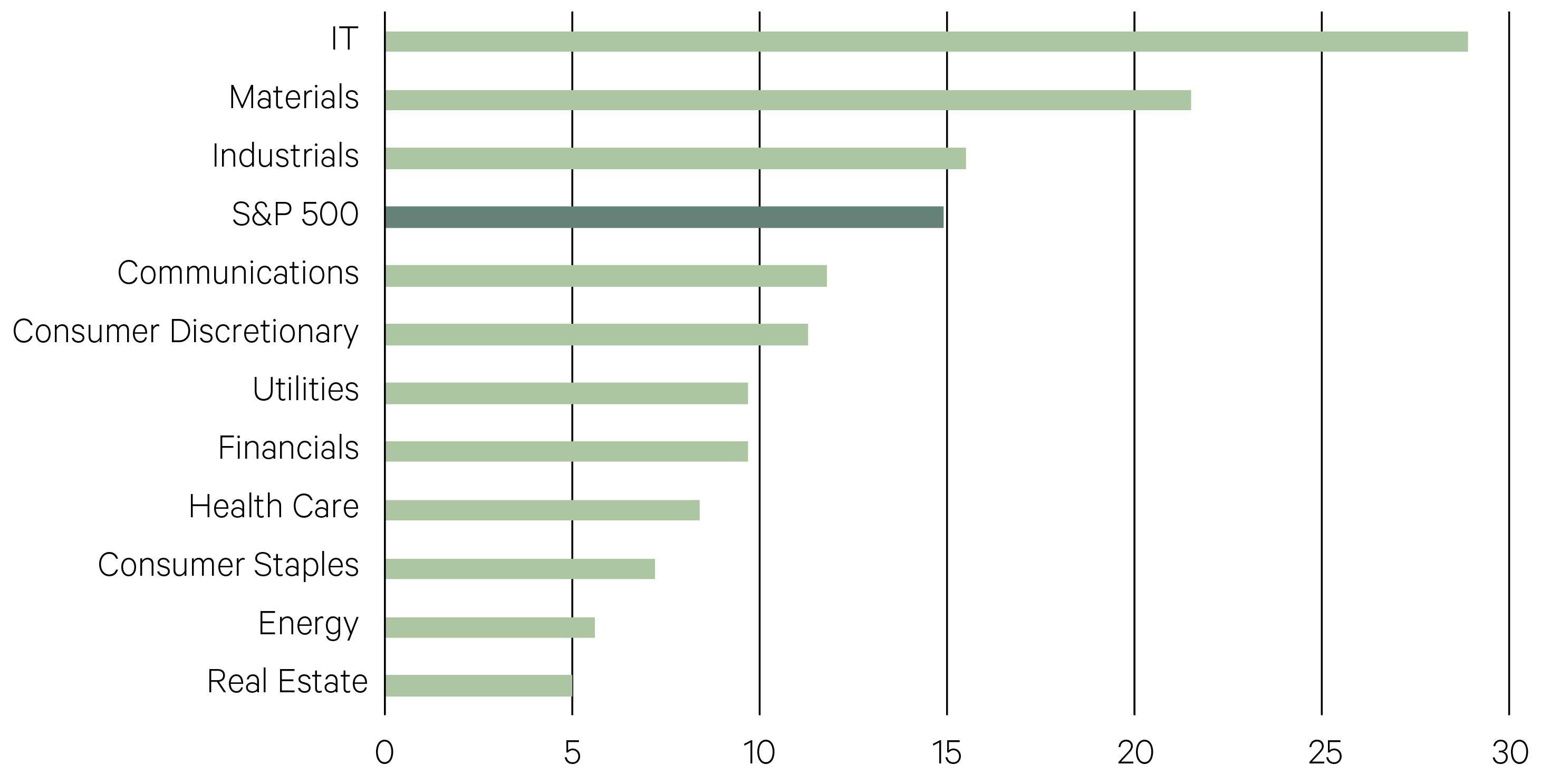

U.S. earnings broadening, but IT leading the way (S&P 500: 2026 estimated sector earnings growth) (%)

Source: Factset, as at 9/1/26

In 2025, European markets pulled forward expected benefits from the release of Germany’s debt brake and ramp up in spend on infrastructure and defence. While the outlook has improved, the region is constrained by a more fragile political environment, a strengthening euro and its export dependency as trade barriers rise.

Japan has finally broken the shackles of its deflationary malaise, with improved wage growth and now a fiscal expansionary agenda of the new Takiaichi government adding to an optimistic outlook. Value continues to be unlocked by corporate governance reform, evidenced by rising shareholder returns and returns on equity.

—

€500bn – The size of Germany’s infrastructure fund, established in March 2025

Source: Federal Ministry of Finance (Germany)

—

In emerging markets, China adapted well amidst its trade war with the U.S. and technology is increasingly being viewed as an opportunity. While its structural challenges remain, government policy has become more supportive. More broadly, valuations are attractive in EM compared to developed markets and further U.S. dollar weakness has the potential to drive gains in the year ahead.

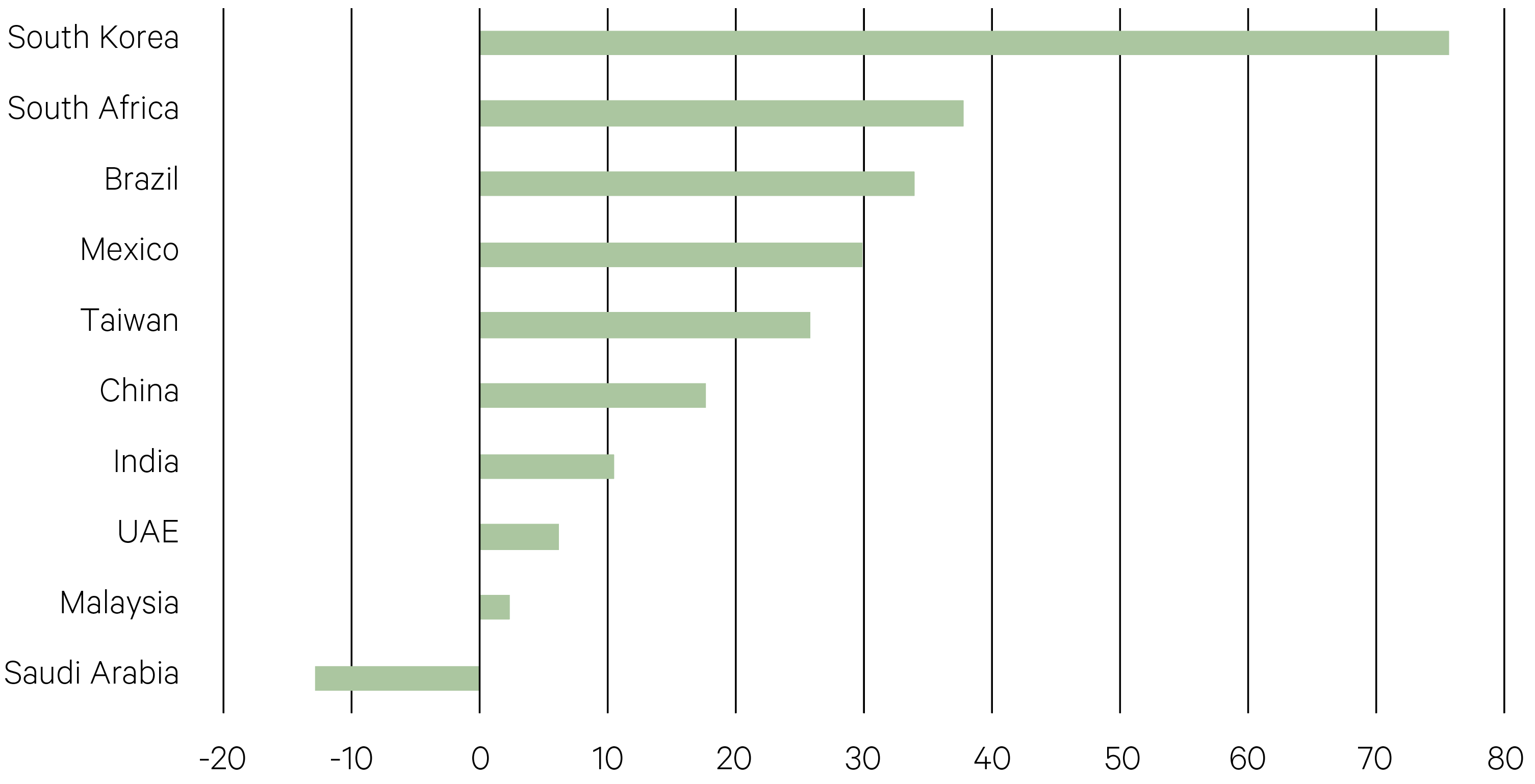

High dispersion in Emerging Markets – returns in 2025 (%)

Source: Bloomberg