-

Overview

2025 was a year of significant dispersion in the Australian equity market. Resources rallied by 35%, led by extraordinary gains in gold producers, while small caps significantly outpaced large cap returns. IT and health care, two core sectors for growth–focused investors, both fell more than 20% on a mix of idiosyncratic and macro factors. The benchmark ASX 200’s total return of 10% was quite modest given the resources tailwind.

—

-24% –Total return of the ASX health care sector in 2025, only the second time in the last 14 years the sector has delivered a negative return

Source: Bloomberg

—

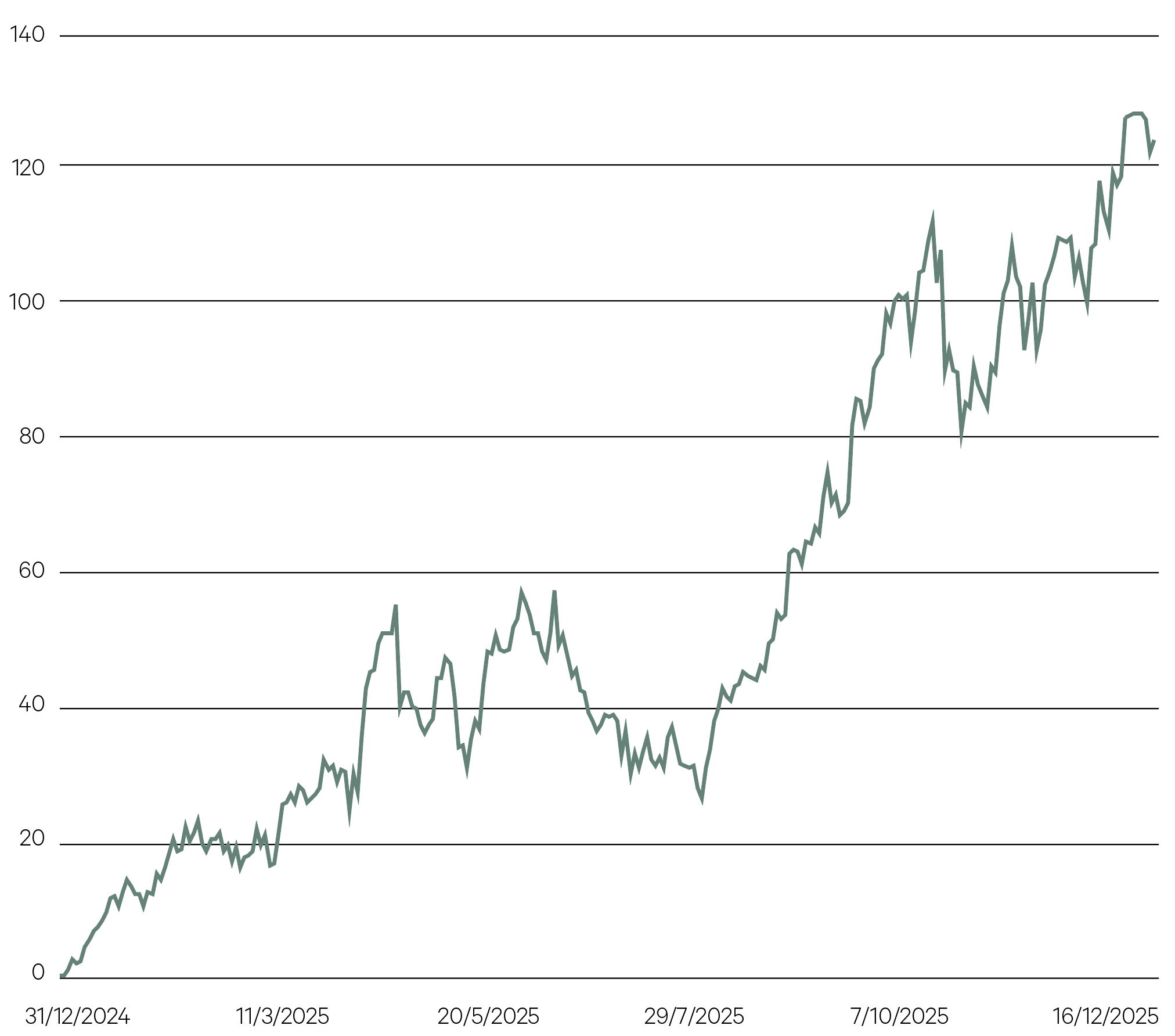

Australian gold sector rallied in 2025 (ASX All Ordinaries Gold) (%)

Source: Bloomberg

Sustainable earnings growth remains elusive for the Australian market. Equity gains in recent years have been primarily driven by P/E rerating, though a normalisation from high prices in key commodities such as iron ore has been equally significant. The recent underperformance of the Australian market has reflected its limited exposure to some of the key themes driving global equities, particularly AI and defence.

However, after three years of earnings contraction for the market, all three key sectors of banks, resources and industrials are forecast to deliver growth in the year ahead. The breadth of earnings upgrades picked up towards the end of 2025, helped by a cyclical upswing in resources. Despite this positive development, growth for the Australian market is still forecast to be below that of global markets in 2026.

Resources will again be a key swing factor as the year unfolds and the risks here are to the upside. The gold sector was a constant driver through the last year and continues to have support from rising central bank purchases, geopolitical risks and broad concerns around the level of sovereign debt.

Other commodity producers bounced back in the second half, including base metals, lithium and iron ore. Iron ore has held up better than anticipated despite China’s ongoing crisis in its property market, though may struggle to hold its level as significant new supply enters the seaborne market. Other commodities with a more favourable supply/demand balance, such as copper, have a smaller representation in the index.

—

8 – Eight of the top 10 ASX 200 performing stocks in 2025 were gold miners

Source: Bloomberg

—

Industrials had cautious optimism around August’s reporting season, as domestic–focused companies talked up improving conditions. In recent months, however, upside surprises to inflation have raised concerns with the RBA, highlighting our poor productivity growth and the possibility that the easing cycle has come to an early conclusion. This in turn may temper the expectations for the recovery to continue in a meaningful way.

The major banks again have a benign outlook for earnings, though retain sound capital positions and have been supported by a renewed surge in residential property lending, aided by stimulatory government policy. With P/E ratios high and dividend yields low, they have held limited appeal for many income–seeking investors or those with an approach based on fundamentals.

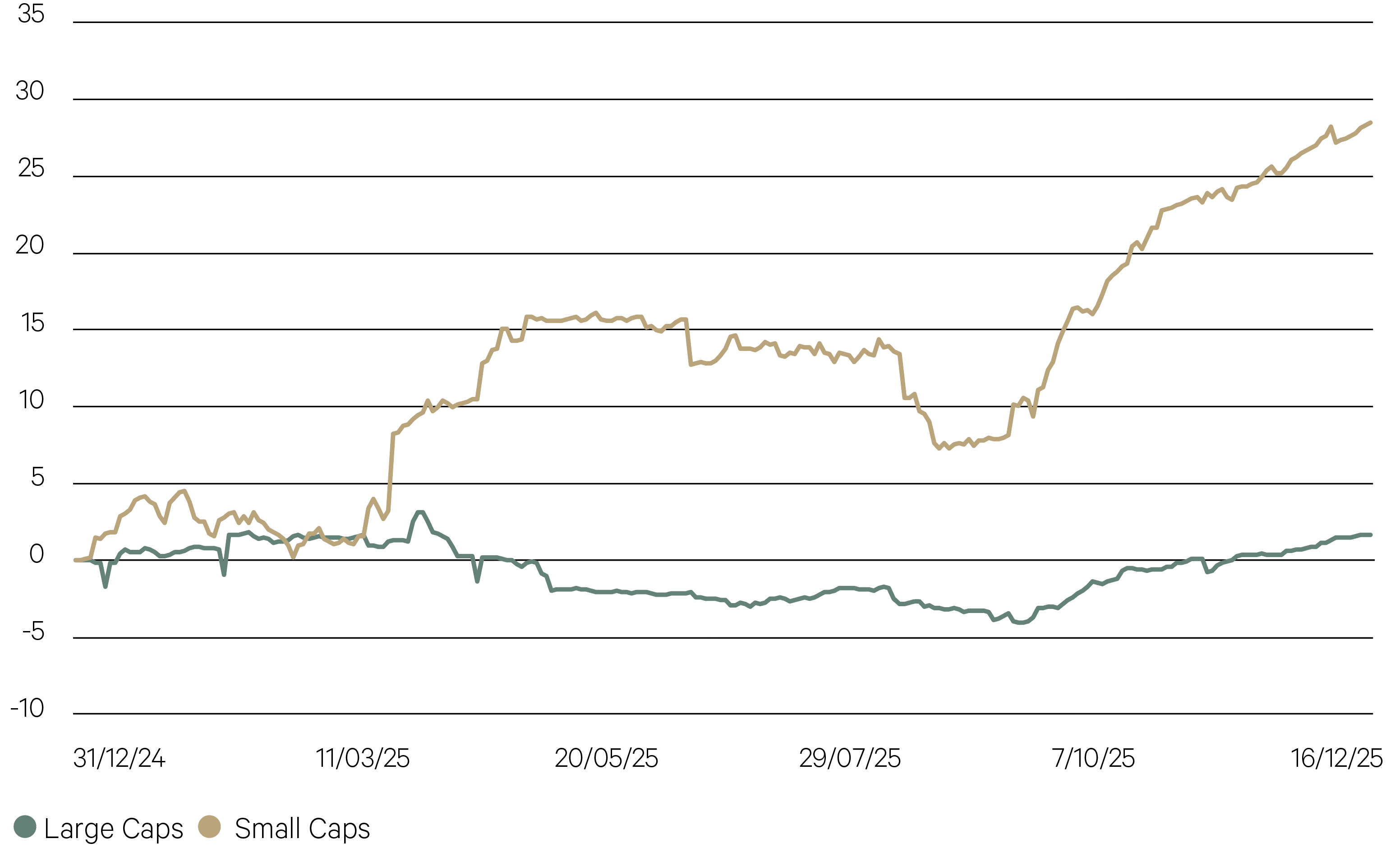

We retain a preference of small caps over large on a more attractive mix of earnings growth, valuation and overall commodity exposure.

Forward earnings revisions: Australian small caps outperformance driven by upgrades (%)

Source: Bloomberg

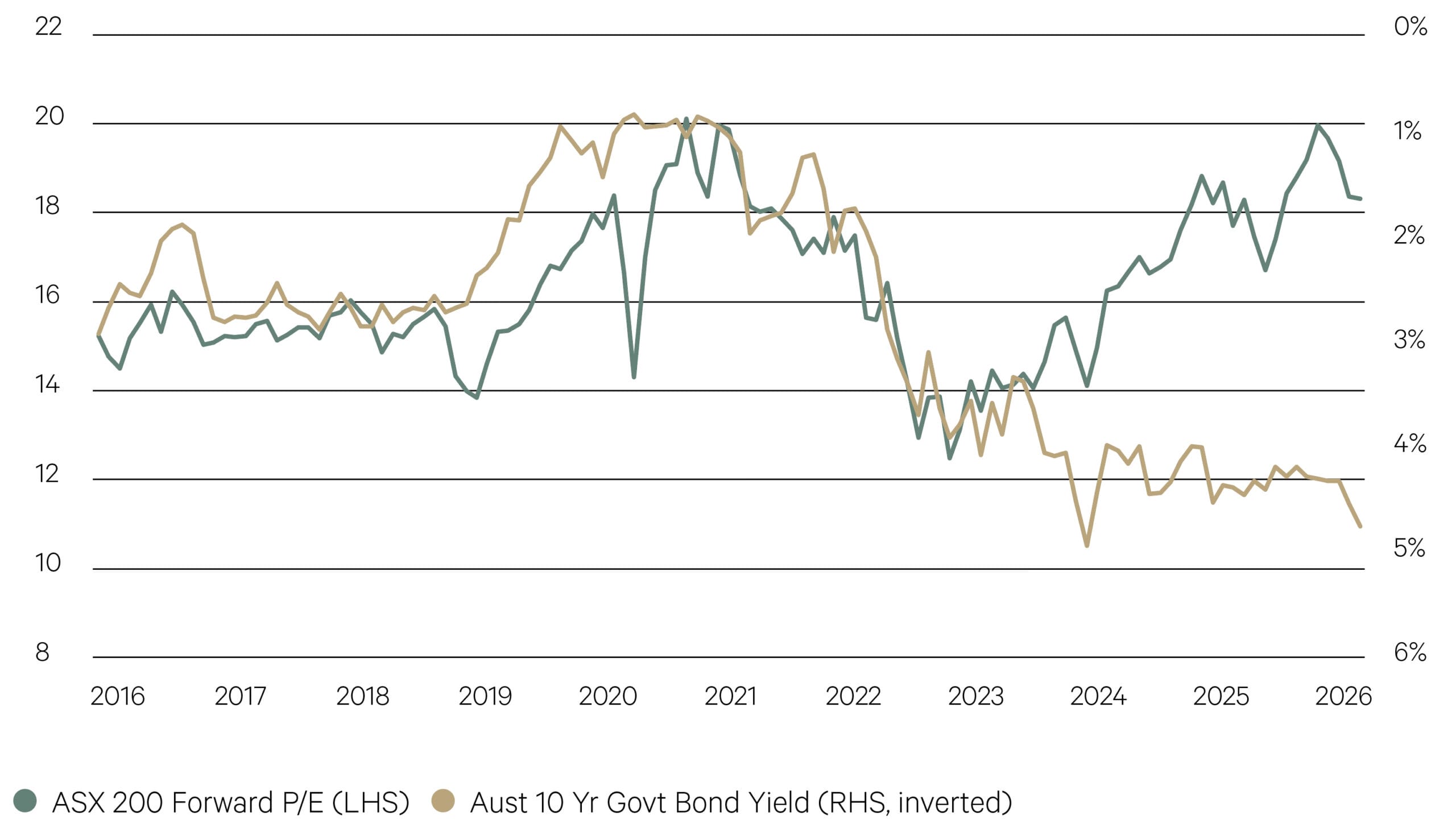

Despite a pullback in the market in November, the ASX still trades on a premium valuation which in our view is not justified by the outlook and better opportunities lie offshore. While not our base case, two factors could cause a swing back to Australian shares – a sharp correction in the AI trade, or a return of the global reflationary environment that would spur further gains in resources.

ASX P/E remains disconnected from higher yields

Source: Bloomberg