-

Overview

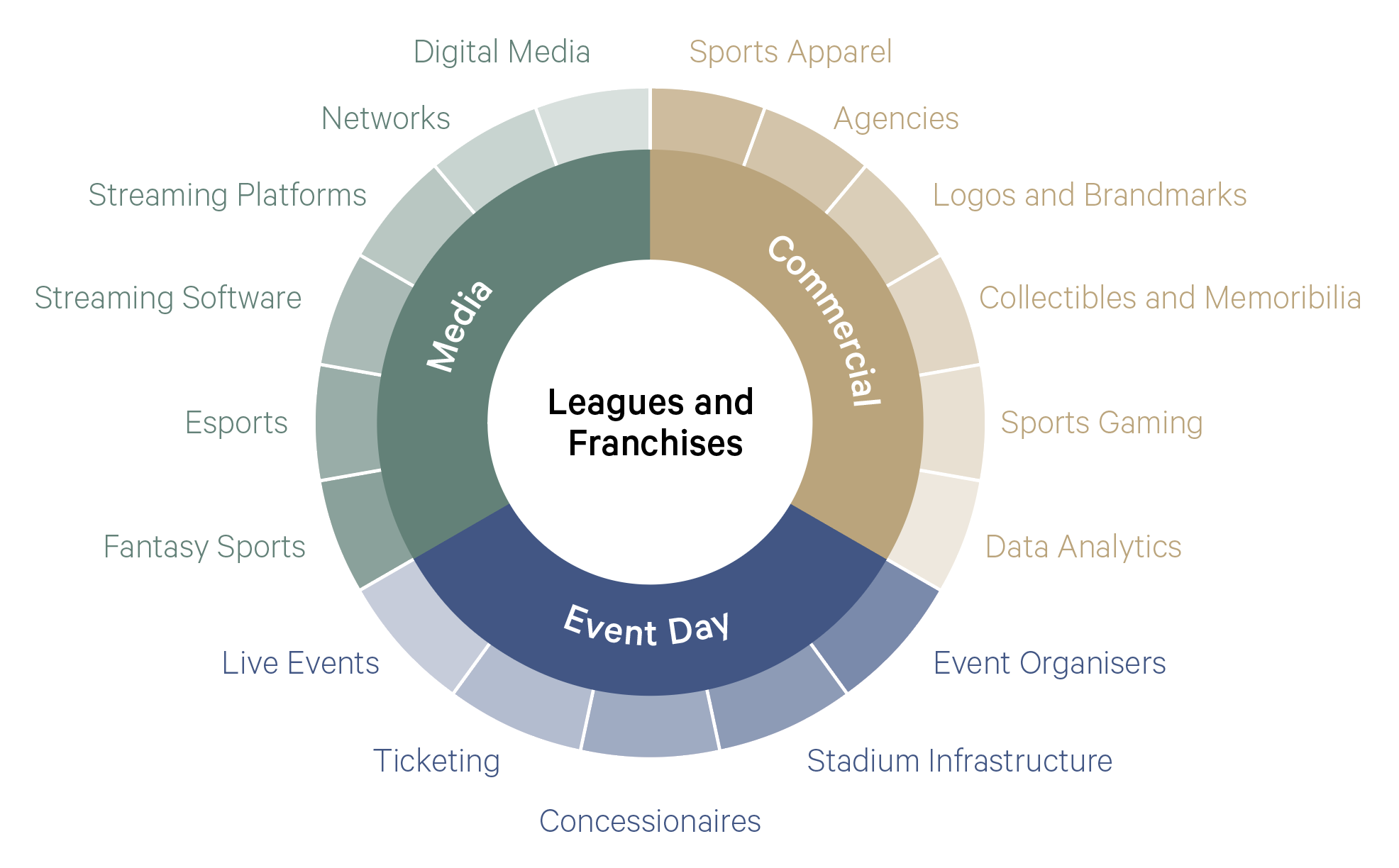

The definition of sports investing has expanded to encompass new revenue opportunities across the value chain. This broad ‘sports ecosystem’ offers more investment opportunities. Recent estimates value the sports ecosystem at $US3 trillion.

There are a range of newer investment opportunities across this broad ‘sports ecosystem’. For example:

- Data Analytics – data tracking enables the creation of a customised game experience for fans – changing the notion of a ‘game’ from a few-hour contest to encompass interactions between various platforms, partners, and entities.

- Fantasy leagues – the global fantasy sports market is valued at around $30 billion, and it is predicted to grow at a double-digit CAGR over the coming years.

- Esports – these video game competitions have taken off globally. Esports have particularly resonated with younger gamers and viewers, positioning the sector for long-term growth.

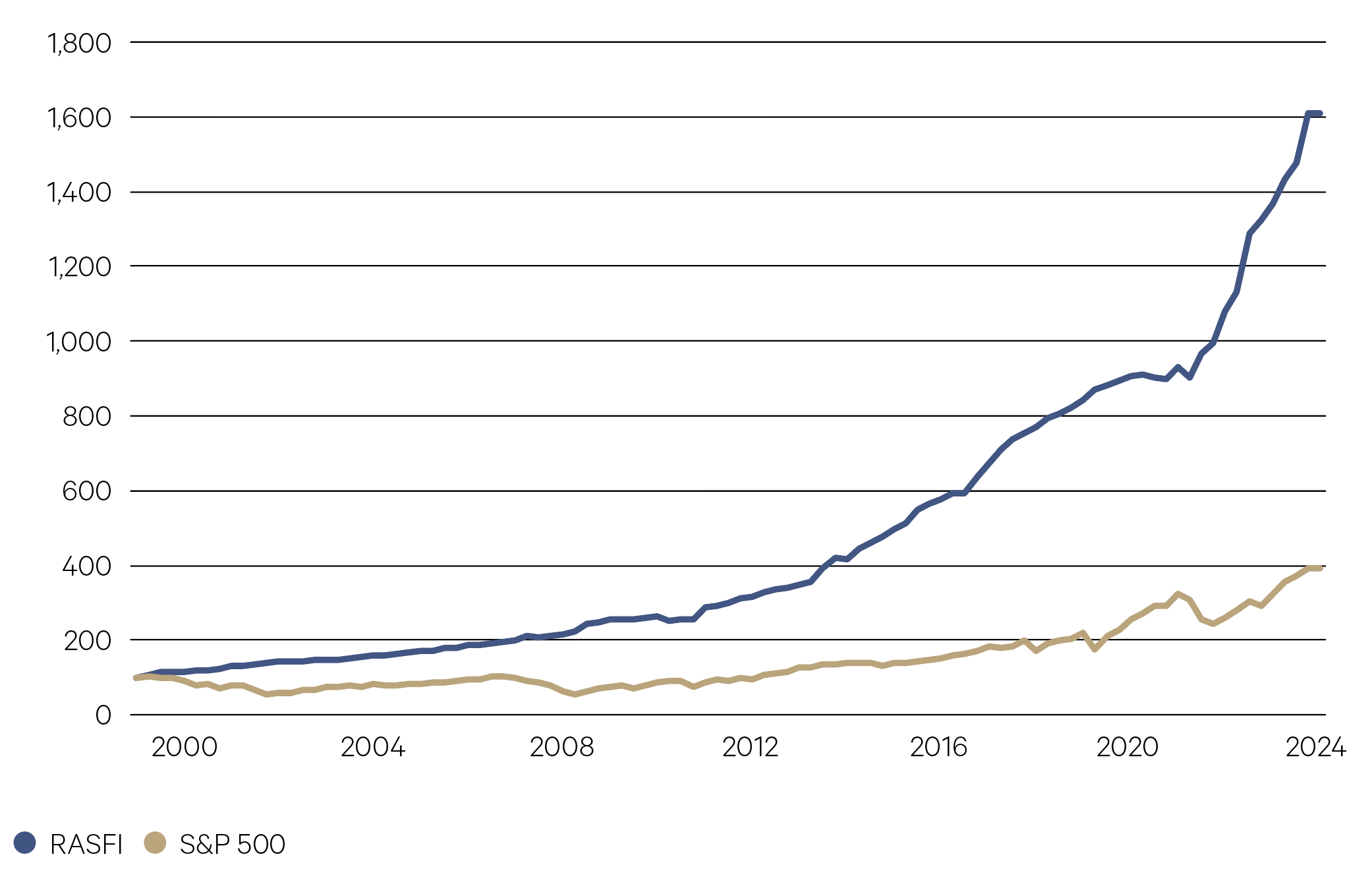

Unlike many other sectors, investments in professional sports have been non-cyclical in nature. This resilience is attributable to the unique, recurring revenue streams including media rights and corporate sponsorships – deals which are often locked in for multiple years.

Primary revenue streams for leagues and franchises from sports IP

Source: Goldman Sachs Investment Banking

—

US growth of Ross-Arctos Sports Franchise Index (RASFI) vs S&P 500, indexed to 2000

Source: University of Michigan Sept 2024, Bloomberg

—

Where to invest?

With the evolution of the sports ecosystem, the potential for monetising the unique IP that sports offers have increasingly attracted institutional investors over the past two decades.

In debt, investors can access opportunities through public debt markets, the broadly syndicated loan (BSL) market as well as private credit. Many European football clubs own their own stadium and some partner with investors to finance new construction or renovation in private credit markets. In the US, a range of sports leagues – the NFL, NBA, and MLB – tap into private credit markets.

Private equity (PE) firms are increasingly participating in sports investing. With major leagues like the NFL now allowing private equity ownership and adjacent opportunities like stadium infrastructure. For example, today, 63 teams in North American sports leagues are PE-backed.

—

63 – The number of teams in North American sports leagues that are PE-backed.

Andalusian Credit Partners

—

Why now?

The interconnection between sports, technology and digital platforms is reshaping the business of sports leagues and opening a new realm

of possibilities. For example, in golf, the Tech Golf League (TGL) recently created by Tiger Woods and Rory McIlroy, is played indoors where real golf elements are combined with virtual reality.In cricket, the evolution of shorter formats has seen unprecedented growth both at home and abroad. In 2023, the ICC Men’s Cricket World Cup registered 16 billion viewing from global viewers over the course of the tournament. The average Indian Premier League (IPL) team valuation has grown from $67 million in 2009 to $1+ billion today – outpacing the growth of NBA and NFL team values.

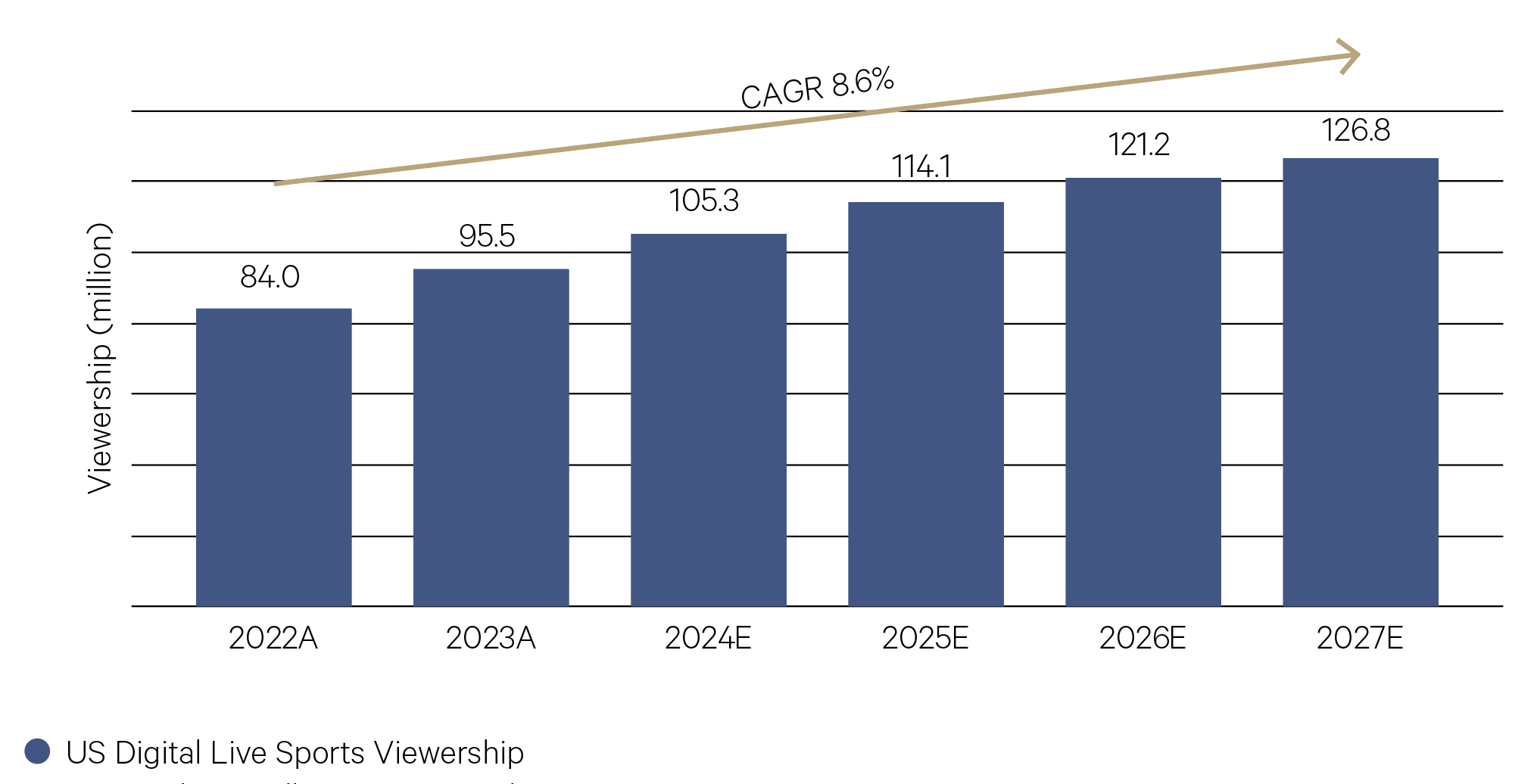

Digital platforms remain critical partners for sports leagues looking to expand their fan base in new geographic regions and reach a younger audience.

One of the best examples of a sport going global is Formula One (F1), which now runs 24 races across 21 countries and five continents watched by an average of 70 million people per race. As a comparison, the Super Bowl has an audience of 110 million.

US digital live sports viewership

Source: Forbes, Wall Street Research

—

Technological advances are unlocking further opportunities for personalised viewing experiences and enhanced fan engagement, alongside storytelling content that brings fans inside the locker room. Netflix’s Formula 1: Drive to Survive, Quarterback, and Receiver; Amazon’s All or Nothing; and Apple TV’s Lionel Messi: The Greatest, have also found success in repurposing sports content into formats catered to younger audiences.

Many emerging sports are at an earlier stage of their global and digital expansions – which may offer equity investors robust growth opportunities at attractive entry points. Elite women’s sports are projected to surpass $1 billion in total revenue in 2024 for the first time – roughly 300% higher than 2021.

—

$67 million to $1 billion – average growth in IPL team valuations.

Forbes