-

Overview

The election of Donald Trump has put the global economy on a firmer path to higher barriers to trade, weaker global alliances, and stronger nationalistic tendencies. Conflict is going up and co-operation is going down. In this sense, the world is becoming more introverted and anxious.

The shift has been driven by several factors. Decades of free-trade orthodoxy have frayed the collars (and incomes) of the working class. Years of open borders have strained infrastructure and created housing shortages and job insecurity. Wars on multiple continents have called into question Washington’s leadership in world affairs and made energy less affordable for hundreds of millions of people.

A shift to a more introverted world economy will not be done quietly or cheaply. The world is inextricably connected. Trade makes up 58% of global GDP. About 40% of the revenues generated by the largest companies in the US come from overseas. Despite being just 5% of the global labour supply, foreign-born workers are about 20% of the US labour force. The shift inward will be bumpy.

—

58% – The share of global GDP made up by trade between countries

WTO

—

What does it mean to be in a more introverted world?

a. A riskier world

Alliances will be tested. Trump’s America First instinct is already making allies of the US feel more anxious about the durability and strength of their relationship – a relationship that has been a defining feature of the global order since World War II. Threats to take over Greenland and the Panama Canal and make Canada the 51st state of America haven’t helped.

Global cooperation is under pressure. Governments are becoming more concerned with national interests and less focused on international issues such as security and climate change. An introverted world sees countries pursuing narrow self-interests rather than coordinated responses to global challenges. Multilateral political organisations such as the UN, NATO, G20, the United Nations Security Council and even the European Union are under threat. Data from the World Economic Forum shows global cooperation levels have stagnated since 2020.

National cooperation is also under pressure. Increased political fragmentation has seen a rise in coalition and minority governments. In the 1980 Australian federal election, the combined primary votes for minor parties and independents accounted for just 8%. By 2022, it had increased to 32%, the highest ever recorded. This trend is not limited to Australia. The rise of coalition and minority governments is a global trend. The depletion of political capital that comes with this makes reform harder. And reform is desperately needed, especially on the fiscal front. According to the IMF over 3 billion people are living in countries that spend more on debt interest than on education or health.

—

3 billion – The number of people living in countries that spend more on debt interest than on education or health.

IMF

—

b. A more expensive world

A more introverted world is also a more expensive world.

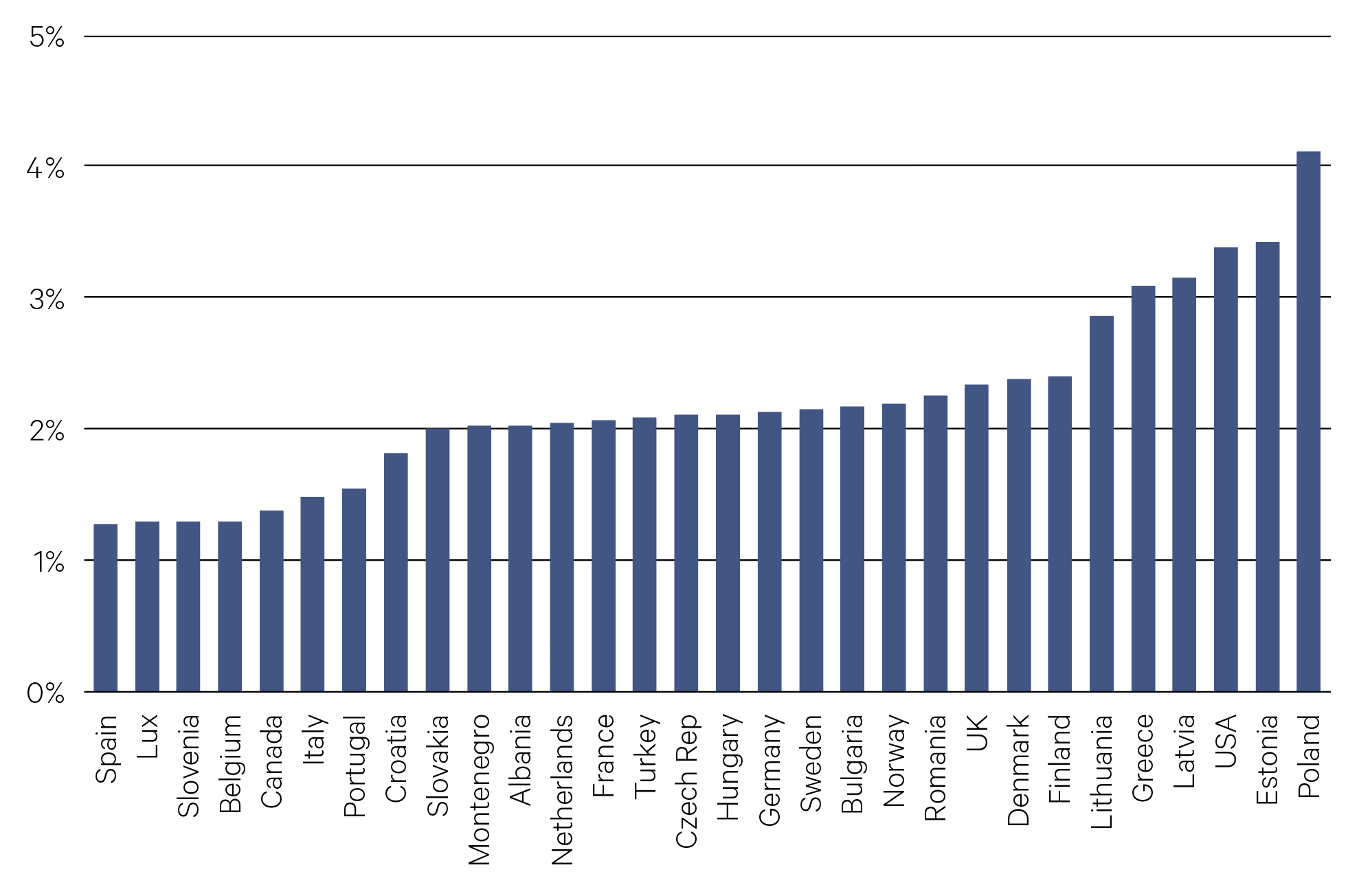

Political fragmentation and the pursuit of national interests tends to lead to conflict. Global conflict has reached its highest level since World War II. Russia’s invasion of Ukraine is approaching the three-year mark and there are ongoing conflicts in the Middle East and in Sudan. In total, there are currently 56 active conflicts worldwide. This requires more spending on defence.

President-elect Trump’s threat to withhold support from any NATO country not meeting its defence spending target, along with his skepticism about stationing U.S. forces abroad, will further intensify the pressure on defence budgets.

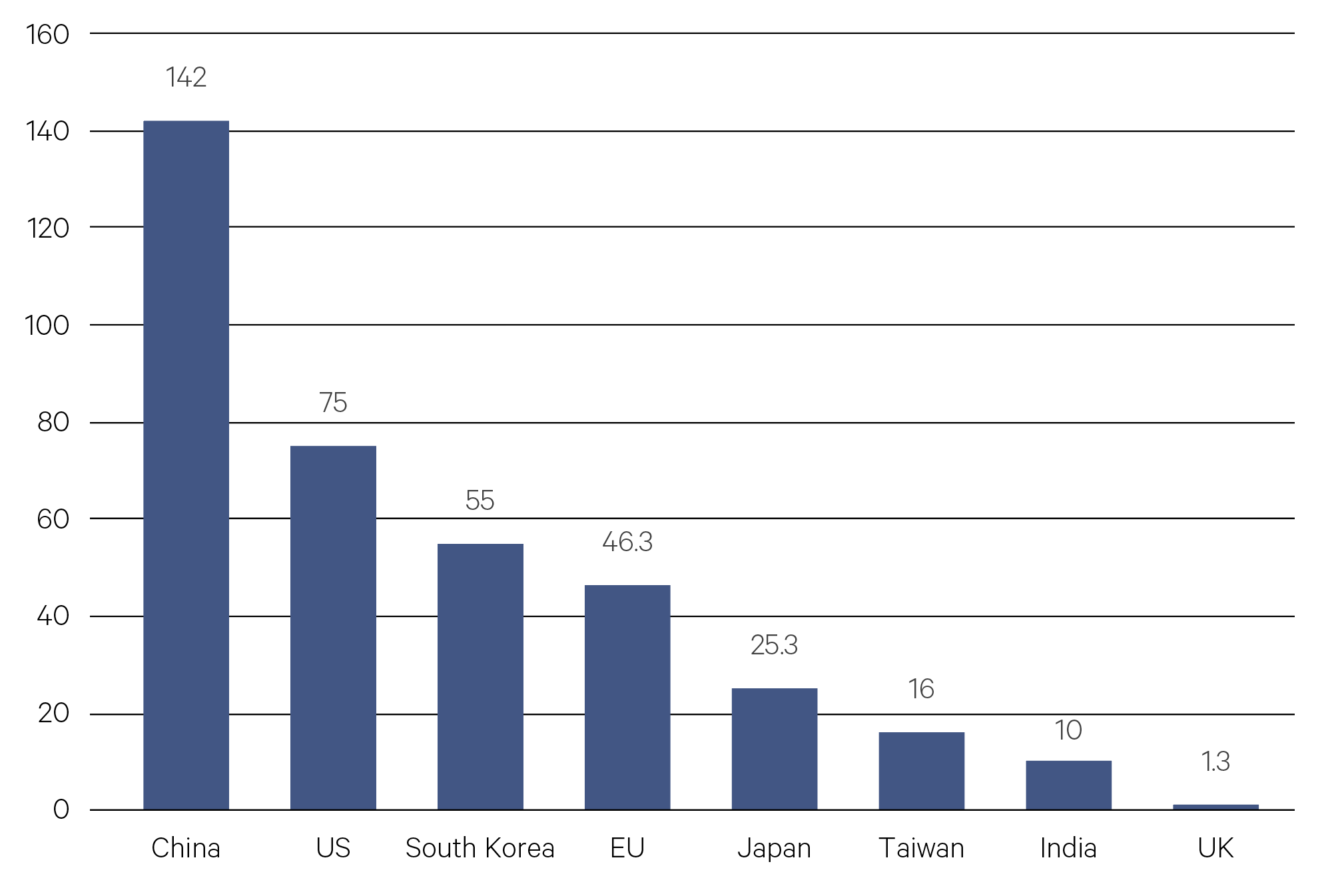

Introversion also leads to trade protectionism and the redesign of global supply chains. Redesigning or duplicating supply chains is expensive. The U.S. government is spending over $1.6 trillion in loans, grants and subsidies to attract business to the US via its CHIPS and Infrastructure Act. China has allocated $142 billion to support the domestic semiconductor industry. The European Chips Act will cost the public purse $46 billion.

Defence expenditure (% of GDP)

Source: North Atlantic Treaty Organisation

–

Government support for the semiconductor industry (US$ billion)

Source: Bloomberg, data as at 31/12/24

—

Who wins in a more introverted world?

a. Diversification

Where once a rising tide lifted all boats, now each boat, faced with its own nationalistic challenges, must navigate its own way through a course of unpredictable seas. Sovereign risk will therefore need to be priced individually, rather than collectively. Investors will need to be more discerning in their choice of where to invest. Regions will need to be broken down into country-specific opportunities.

Economic divergence and country-specific factors will create a varied landscape of opportunities. This is a positive for investors. The more levers to pull, the more opportunities to diversify risk.

—

The more levers to pull, the more opportunities to diversify risk.

—

b. Active investment management

The decline in long-term interest rates over the past 30 years or so was an environment where passive investing flourished. Lower interest rates meant lower returns meant investors needed to have a razor-sharp focus on the cost of investing. Ultimately, this trend has left around a third of the US equity market being owned by cost conscious passive investors.

A more introverted world will see a reversal of this trend. Interest rates will be higher as investors demand compensation for deploying capital into a more unsettled, unpredictable environment. A higher interest rate environment, once valuations have adjusted, will be conducive to higher longer-term returns because the starting point, the cash rate, will be higher. Investors will shift to focusing less on the cost of investing and more on risk mitigation and the broader set of return opportunities that comes with active management.

There is no doubt, the introverted world is a riskier world – less unity, less cohesion, more room for missteps. With risk, though, comes opportunity. The declining rate environment of the past few decades forced investors to crowd into cheap passive strategies. A return to a higher rate environment will reward investors for their selection of stocks based on company fundamentals rather than just membership in a passive index.