-

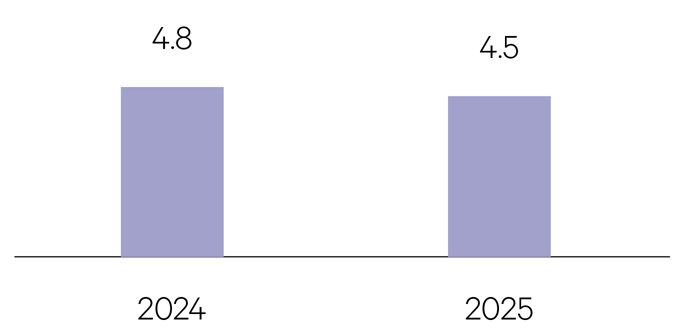

United States

The Trump administration’s policies will mostly be supportive of the economy and financial markets. Tax reforms and deregulation are likely to stimulate growth, particularly in domestic and cyclical sectors such as financials. This will be offset slightly by tariffs and immigration restrictions pressuring inflation.

GDP %

-

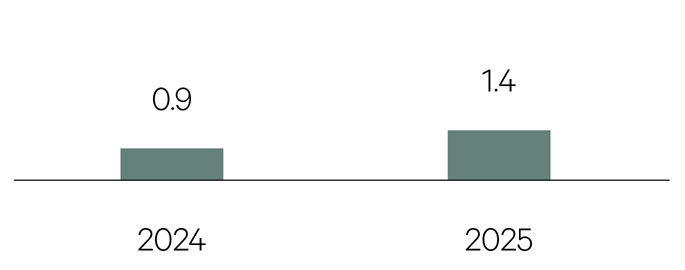

Europe

Trade policy uncertainty, a weak China, and political turmoil among the core members will weigh heavily on Europe. The European Central Bank (ECB) is likely to cut its deposit rate further to offset the tariff impact and the continued stagnation of the German economy.

GDP %

-

China

China faces headwinds from the property market collapse, excess debt, and U.S. trade restrictions. The policy response continues to be reactionary and demand-side focused, rather than one where proactive steps are taken to solve structural problems.

GDP %

-

Japan

Japan remains an outlier, supported by a virtuous wage-price spiral that will anchor inflation expectations near 2%, allowing the Bank of Japan (BoJ) to further normalise policy. Rates could rise to a 30-year high by year-end.

GDP %

-

Australia

After experiencing its slowest growth ever outside of a recession, Australia is expected to improve slightly in 2025 but the main support will continue to be public sector spending as the federal election, due in the first half of the year, promises to deliver more cost-of-living support to households.

GDP %

-

United Kingdom

The UK faces sluggish productivity growth, labour constraints, and inflationary impacts from higher taxes under the new Labour government. The Bank of England’s (BoE) capacity to ease is constrained despite surging company insolvencies.

GDP %