-

Overview

Alternative assets continued the momentum of recent years and estimates show it has now reached a total assets value of $16.3 trillion. Demand remains strong for private equity and private credit, whilst uncorrelated strategies will gain popularity as investors look to increase portfolio diversification in a more challenging environment in 2025.

—

$16.3 trillion – Total asset value of Global Alternatives

Preqin

—

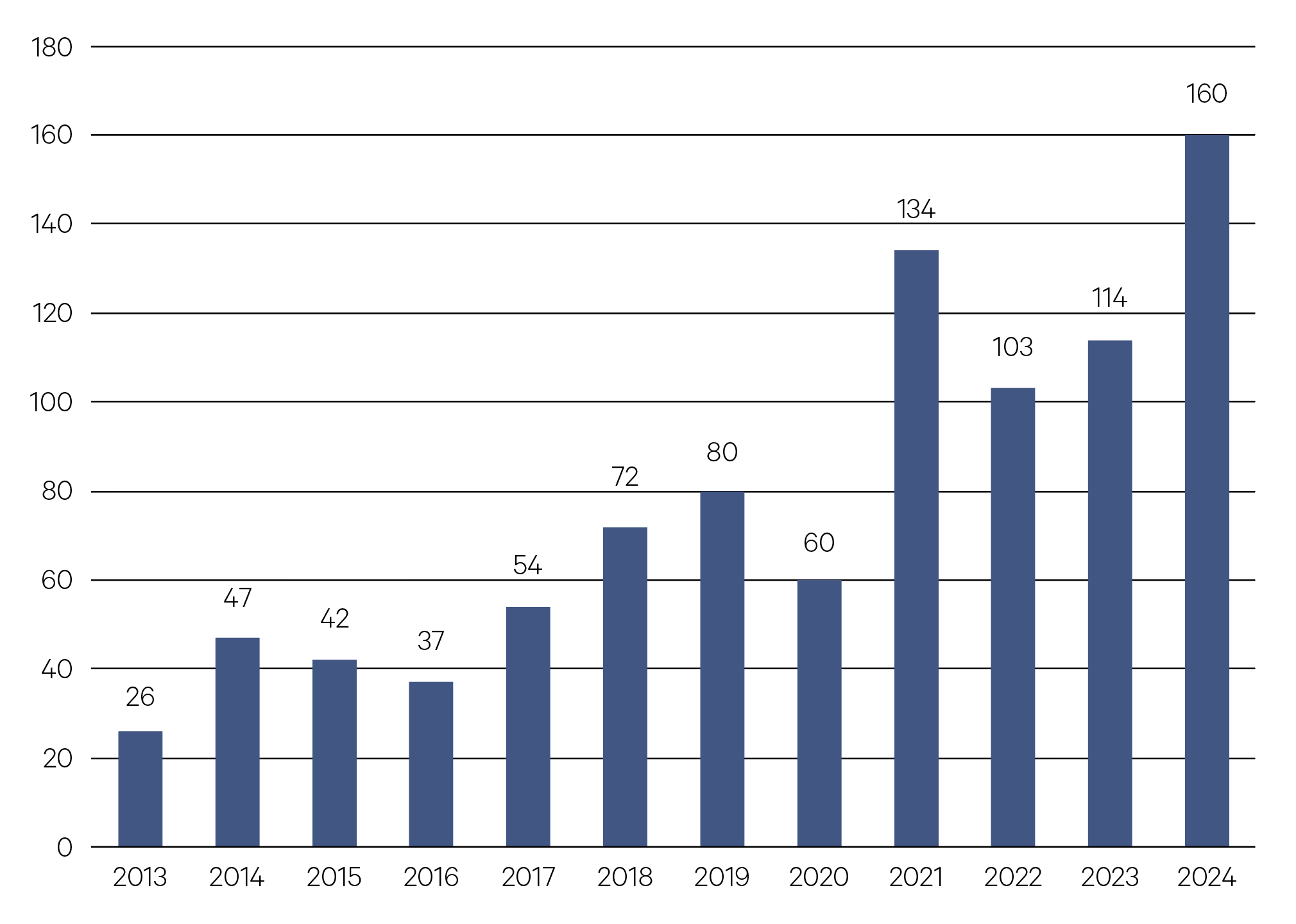

Private markets dry powder levels (US$bn)

Source: Evercore

—

New origination deal flow more than doubled in 2024.

Pitchbook

—

Private equity

With more certainty on interest rates, private equity (PE) buyer and seller expectations are likely to converge meaning the well-anticipated pick up in PE deal activity is likely to materialise in 2025. Elevated cash levels and over a quarter of undeployed capital now four or more years old means managers are eager to deploy capital in 2025. Secondary transactions have become a go-to solution for liquidity and deal flow. Deal volume in secondaries rose 73% in H1’2024 on the prior year and total year estimates likely surpassed previous records. The incoming US administration will likely create a more conducive environment for mergers and acquisition (M&A) activity. Valuations have normalised in Venture and Growth Equity markets, and both are well placed to offer access to innovative companies in their highest-growth phase.

Private credit

Private credit continues to see significant growth in activity and fundraising. Whilst refinancing and repricing accounted for the vast majority of activity last year, new origination deal flow was more than double the prior year. In 2024, credit spreads tightened significantly across the curve from public right through to private credit markets. Sourcing high quality deal flow at attractive spreads will be key this year. Our preference remains for globally diversified opportunities. A more challenging economic environment will pose a headwind for Australian-based funds.

Infrastructure

As interest rates fall, infrastructure deal activity is expected to rise in 2025. Longer term structural trends in themes such as decarbonisation, digitalisation, and demographics continue to provide an attractive backdrop in the asset class. Regulatory support for energy transition and energy security is expected to continue. In the EU, the electricity market reform adopted in 2024 should help accelerate investments by expanding the use of long-term contracts to support the green transition.

Within digital infrastructure, the rapid growth in cloud computing and data centres has been driven by the rise in generative AI – a theme forecast to expand over the next decade.

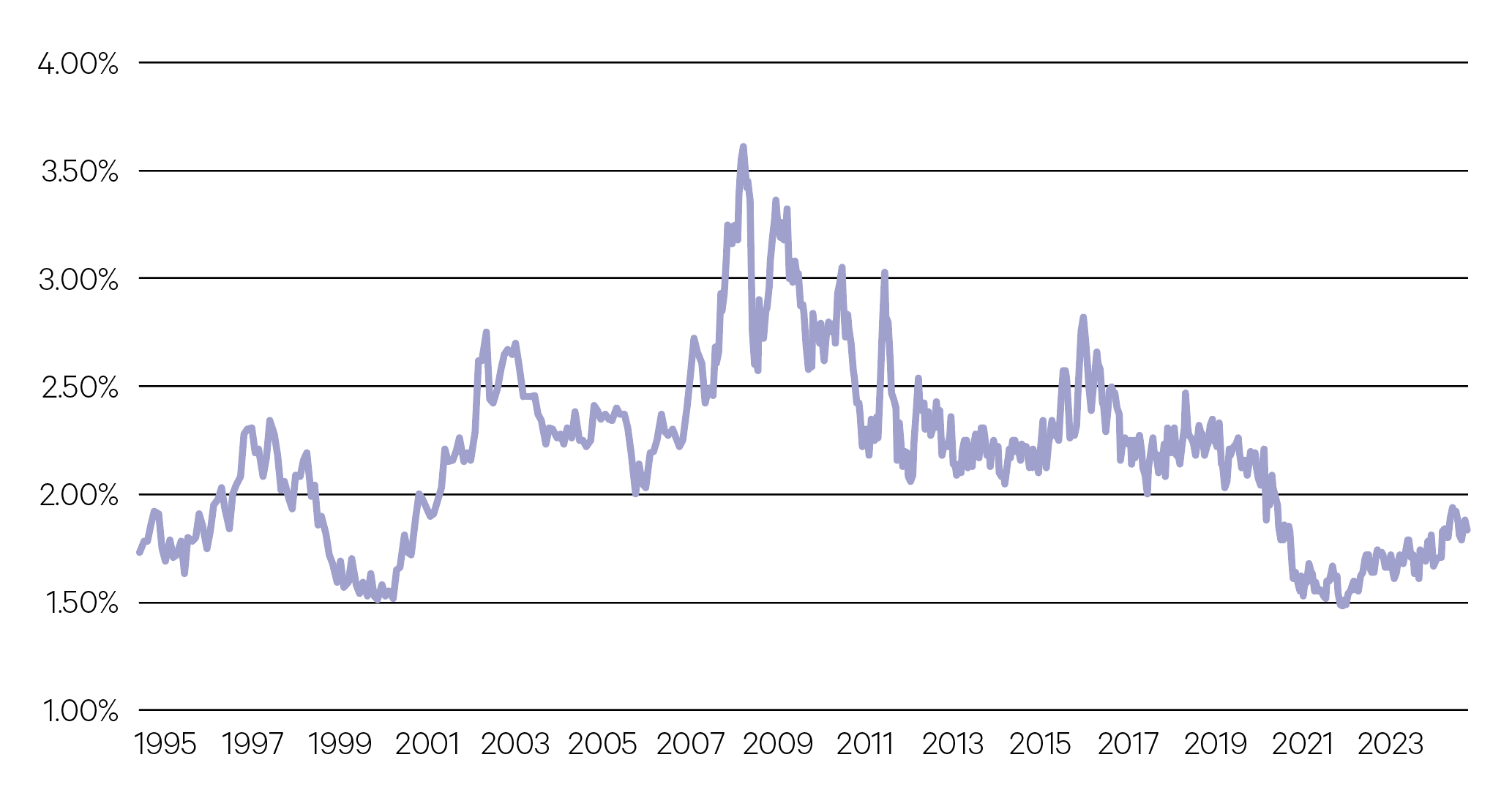

Hedge funds

Valuation distortions in specific stocks and sectors is providing an attractive landscape for hedge fund investing. A more normalised interest rate environment is conducive to fundamental security selection where higher costs of capital clarify the quality of business and strength of management. Given the large difference in earnings growth between market leaders and the median stock, this is providing a range of opportunities with the ability to invest both long and short.

Median short interest as a % of market capitalisation of S&P 500 constituents

Source: Bloomberg

—

The global market opportunity within the royalty finance space is significant.

—

Royalties

Compared to debt and equity, royalty finance offers a unique approach with a focus on revenue-linked returns and without diluting ownership or involving fixed repayment obligations. The global market opportunity within the royalty finance space is significant, encompassing various established sectors (i.e. pharmaceuticals, music, natural resources, environmental assets, media, sports, and brands) as well as emerging high-growth royalty sectors. Royalties have low correlation to traditional asset classes and provide stable, diversified cash flows.