-

Overview

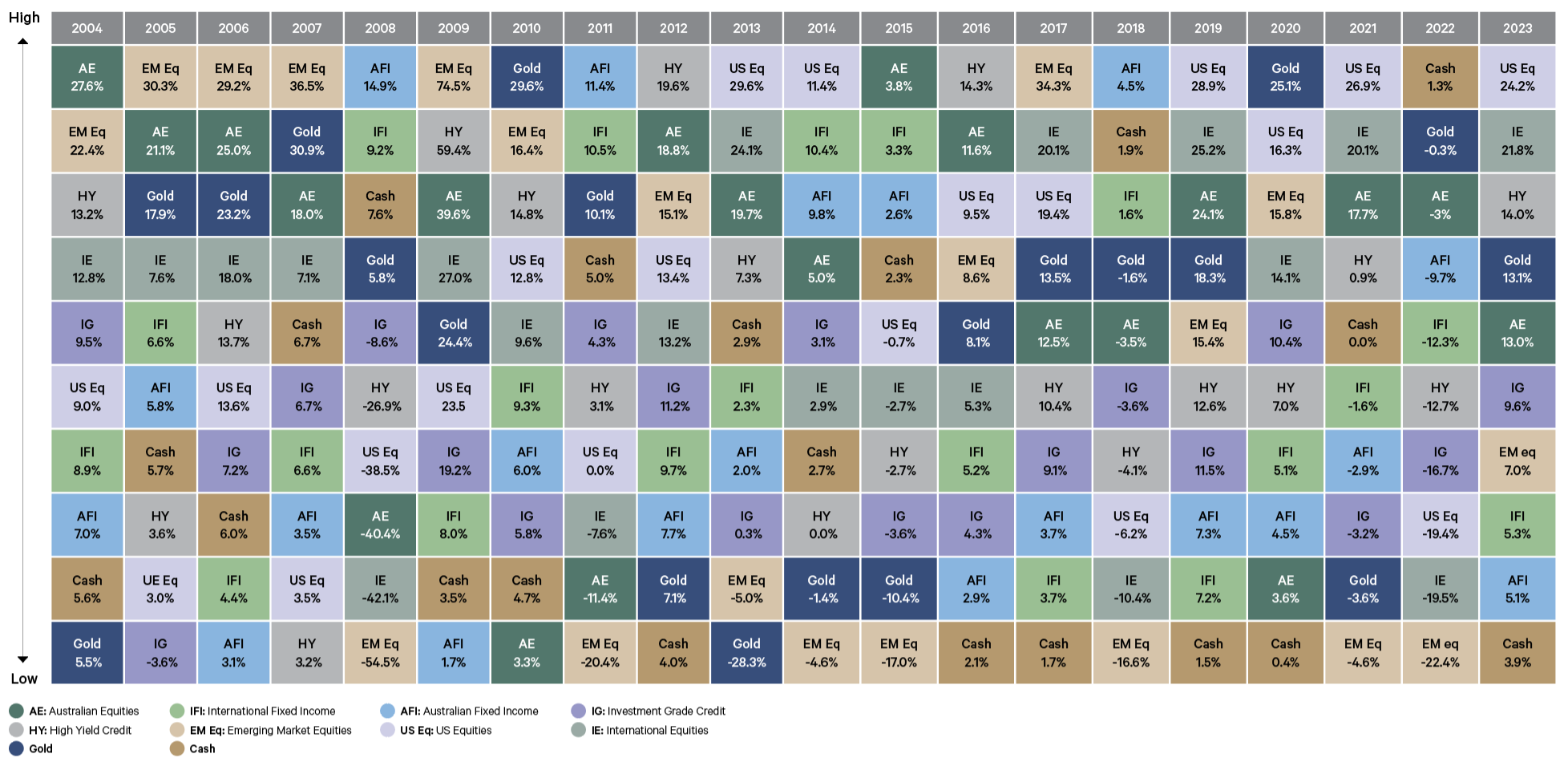

For the first time since 2020, every asset class that we monitor finished the year with a positive return.

Thanks to the performance of the mega cap tech stocks, US equities was the best performing asset class in 2023. International equities also performed well helped by strong gains in Europe and Japan. Emerging market equities underperformed on a relative basis due to a double digit decline in Chinese equities.

High yield credit bounced back strongly after recording its worst return (since the 2008 global financial crisis) in 2022. The attractive high starting yield for high yield makes it an attractive asset class still for 2024.

After two ordinary years, gold made a comeback in 2023. Geopolitical tensions ignited by the conflict in the Middle East, coupled with a continuing decline in inflation and the prospect of interest rate cuts in the United States, have propelled the rise in gold to a new all-time high.

Cash moved from being the best performing asset class in 2022 to being the worst in 2023 – albeit with a positive return. Indeed, thanks to the five rate hikes from the Reserve Bank, leaving interest rates at their highest level since December 2011, cash finished the year with its highest annual return since 2012.

An important observation to make from the asset class quilt is the importance of diversification. Every asset class, at some point, has been among the best performers, even cash.

Asset Class Quilt of Market Returns (2004-2023)

Source: Bloomberg, 2023 data as at 31/12/2023