-

Overview

Australian shares stood out from the pack in what was a challenging year in 2022. That said, portfolio composition mattered; the resources sector was the beneficiary of favourable supply and demand dynamics (a factor that was augmented by Russia’s invasion of Ukraine), while companies and sectors with a higher growth orientation suffered following a sharp rise in bond yields. Macro factors were the key determinant of stock returns over the year.

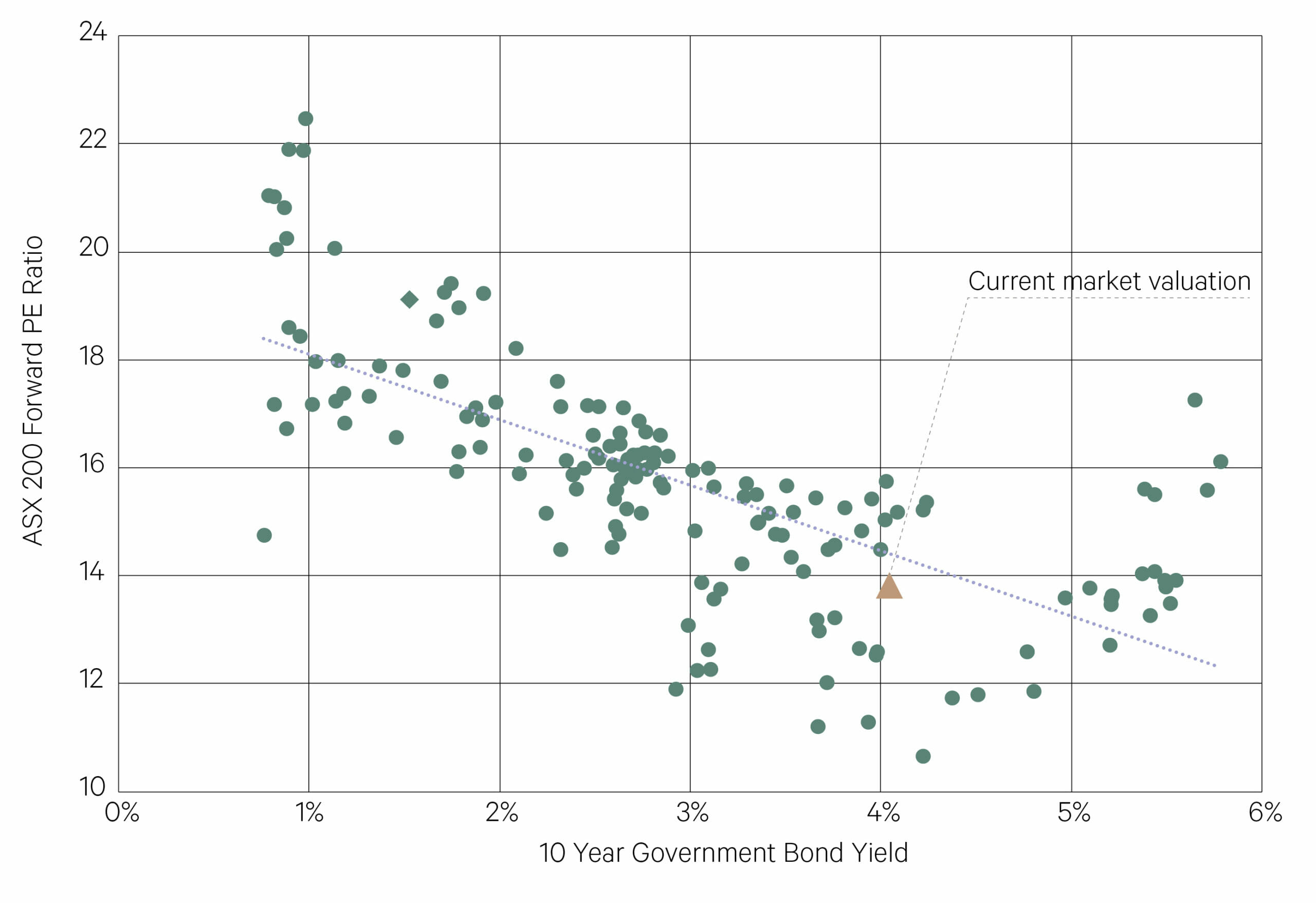

With inflation stickier than initially anticipated, the Reserve Bank of Australia (RBA) followed other central banks in one of the sharpest monetary policy tightening cycles in history. In a similar fashion to overseas equities, Australian shares have experienced a contraction in valuations, with the forward price earnings ratio of the market dropping from 18.4x (or slightly expensive) to 13.8x (or slightly cheap).

—

Resources face contrasting forces in the year ahead

—

In 2023, we believe that the path of earnings will matter most and this represents the greater risk of near-term downside to the market. Presently, forward estimates of earnings are elevated despite the prospect of weaker global economic growth as the full impact of monetary policy tightening is realised. While Australia enters the year in better health than many countries overseas who stand on the brink of recession, a downdraft in earnings would still be felt here should this materialise.

Consumer driven businesses are most at risk, which to date have been buffeted by high household savings built through the COVID crisis, mortgages that were fixed through this period and sustained strength in the labour market. The lagged impact of rate increases and the roll-off of fixed rates, however, is likely to be realised through 2023, providing downside to these sectors. House price declines have already begun feeding into the wealth effect and sentiment has peeled off sharply.

The large domestic financials sector has already been the beneficiary of an earnings tailwind as higher interest rates are incorporated into estimates. A more severe housing downturn, however, would raise the spectre of an escalation in bad debts for the mortgage-heavy banks.

Resources face contrasting forces in the year ahead. A global economic slowdown creates a headwind for short-term demand. However, this is balanced with the uplift from China’s reopening, market tightness from long-term underinvestment and the opportunities created by the green energy transition. While commodity prices have retreated from the mid year high of 2022, shareholders still stand to benefit from healthy dividends in 2023.

—

Wage inflation is less problematic in Australia

—

While earnings risk is key, we note that wage inflation is less problematic in Australia (with the RBA correspondingly less hawkish), balance sheets are healthy, the market is still providing an attractive dividend yield and we should be cushioned by one of the last ‘COVID re-opening’ trades in China.

We believe that the outlook is evenly balanced and we have a neutral view on the asset class.

—

While the forward P/E of the Australian market fell materially though 2022, this simply reflected the sharp rise in bond yields. On this basis, the market can be viewed as slightly cheap.

ASX 200 forward P/E and bond yields

Source: Bloomberg

—

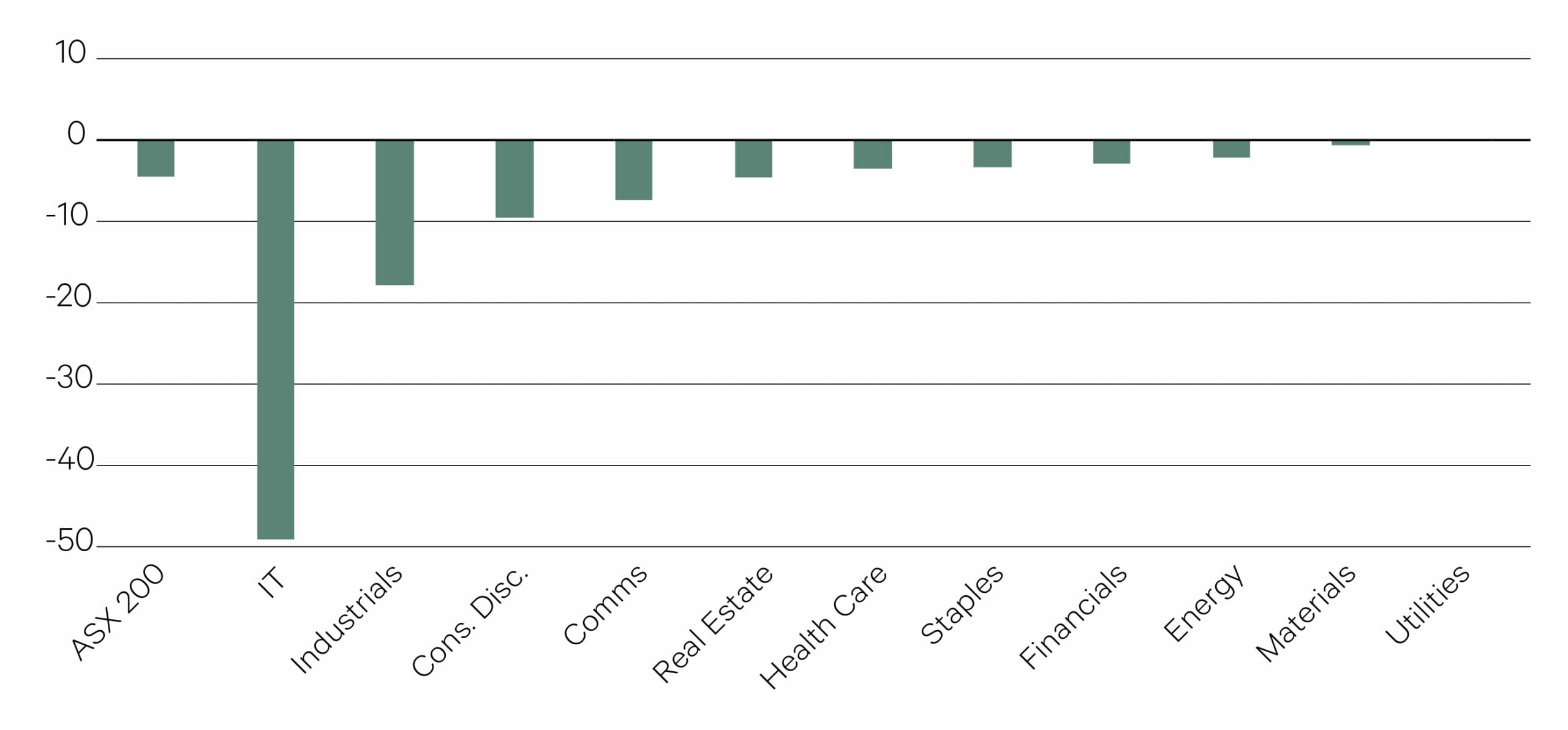

With the exception of utilities, all sectors of the Australian equity market de-rated in 2022, with the most significant revaluation occurring in higher growth/longer duration sectors such as IT.

Change in P/E in 2022

Source: Bloomberg

—

With profit margins at a cyclical high, this represents a source of downside risk for the market, particularly if companies face weaker demand through 2023.

ASX 200 Industrials trailing profit margin

Source: Bloomberg