-

ESG Background

ESG Investing in Context

Environmental, Social, and Corporate Governance (ESG) investing broadly defined includes responsible, sustainable and impact investing. It refers to a method of investing that takes into account the impact on society and the environment and gives due consideration to corporate governance issues.

As recently as a decade ago, many fund managers paid scant attention to ESG issues in their fundamental analysis. The ESG landscape, however, has experienced a significant evolution in the ensuing period. Increasingly, this is being recognised by companies as well as investors, leading to deeper pools of data and independent ratings in which an assessment can be made.

A focus on governance was historically the strength of some managers, ensuring that management was fulfilling its fiduciary duties. Gradually, many managers adopted a screening process, filtering out industries or sectors that conflicted with the views of their clients.

More and more, ESG is becoming mainstream and cannot be ignored by investors. A comprehensive, integrated ESG policy is now considered the standard across the industry.

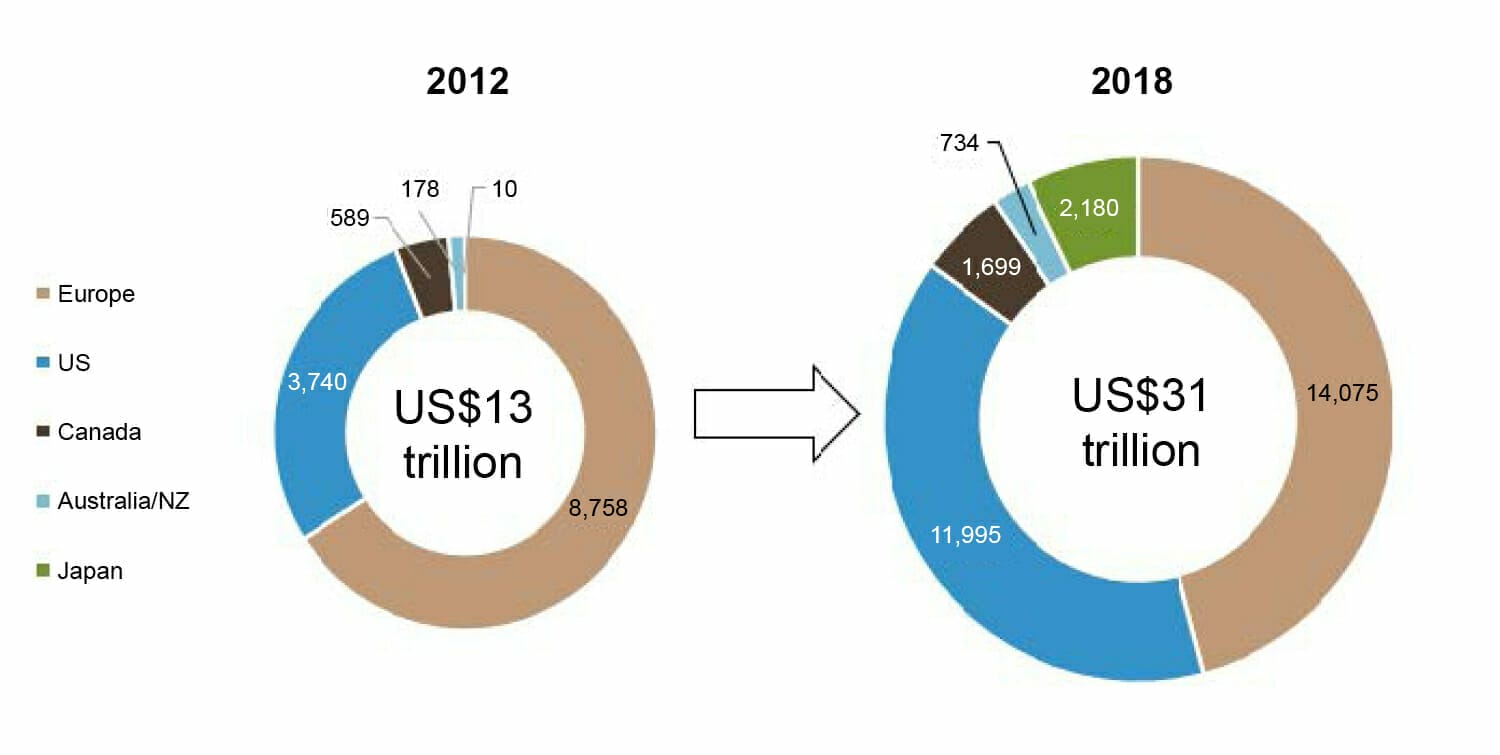

The charts below illustrate the growth in the market between 2012 and 2018. According to the Global Sustainable Investment Review, the size of the market in 2018 was US$31trn, more than doubling in size since 2012.

All regions have experienced significant growth in this time, with Europe remaining the leader in the field. As a proportion of total managed assets, however, Australian managers have now stepped up to the plate; almost two thirds of total managed assets now employ some form of ESG process, ahead of Europe (at just under 50%) and the US (around 25%).

Chart 1: Global ESG Investment Market

Source: Global Sustainable Investment Review, 2018

ESG investing is clearly here to stay and must be considered as part of a holistic investment process.

-

ESG Investing

Different Levels of ESG Investing

Escala identifies three broad levels of ESG investing.

- Negative or exclusionary screening of particular sectors of industries.

This approach is the easiest to implement and we would class this as the lightest level of ESG adaption. Screening can be useful for investors who wish to avoid investing in certain industries, such as fossil fuels, but it doesn’t discern between the good and the poor operators within, nor does it make an assessment on governance issues. Another downside of negative screening is that it precludes engagement with companies to address poor corporate behaviour. - ESG integration/corporate engagement.

Corporate engagement has been a strength of some managers for many years to ensure that management is acting in the best interests of shareholders. In more recent times, this has evolved to a more thorough integrated qualitative assessment of ESG risks within the manager’s investment process. - Impact or sustainability theme investing.

The highest level of ESG investing, this involves targeted investments in industries that are making a positive change to social or environmental problems. The problem with impact investing is the size of the investable universe is still very small.

Each of the three approaches to ESG has merit. While impact investing is a small but growing subset of ESG it has appeal for certain investors. For many, ESG integration has become the gold standard as it enables a fully informed investment decision to be made, using both positive and negative screening techniques, while at the same time enabling greater choice of investments for the portfolio manager.

- Negative or exclusionary screening of particular sectors of industries.

-

Beliefs and Philosophy

Escala’s ESG Beliefs and Philosophy

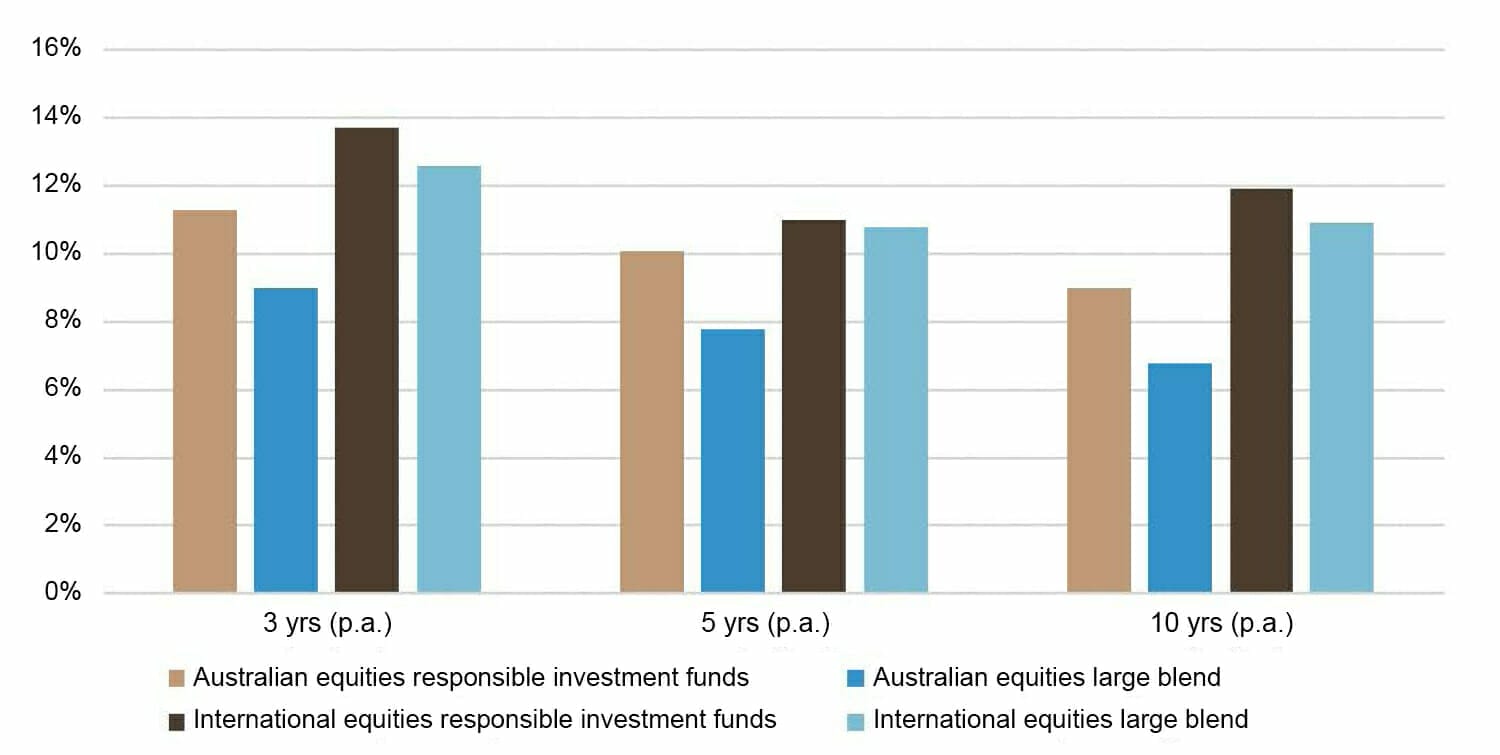

Escala believes that proper oversight of ESG issues is an integral factor in driving portfolio returns. Specifically, we believe that investors need not forsake performance for improved ESG outcomes across their portfolio. Indeed, there are numerous studies that confirm a positive relationship between investment strategies that incorporate ESG into the investment process and better returns.

For the Australian market, this is illustrated by data published by the Responsible Investment Australasia, which shows consistent outperformance across all time periods by RI funds.

Chart 2: Performance of ESG/Non-ESG Funds

Source: Responsible Investment Association Australasia, Benchmark Report 2020

At its core, ESG investing is particularly relevant for managers who have a long-term investment horizon. In essence, a robust ESG process will highlight risks that could lead to capital erosion in the future. We believe that managers that employ ESG are better able to identify the longer-term risks and opportunities from their respective markets.

Escala’s model is to specialise in asset allocation for our clients, while outsourcing the investment management of each asset class after undertaking a comprehensive fund manager research process. As a consequence, Escala’s ESG oversight is at the fund manager level and thus we seek to gain a complete understanding of each fund manager’s adherence to, and integration of, ESG principles.

-

The Escala Approach

Our investigation into a manager’s commitment to ESG integration is specific to Escala and involves both a qualitative assessment and a quantitative analysis.

The qualitative assessment includes detailed questioning of the manager into how well they incorporate ESG awareness into their portfolio. We question their philosophy and beliefs toward ESG to truly understand their commitment to responsible investing.

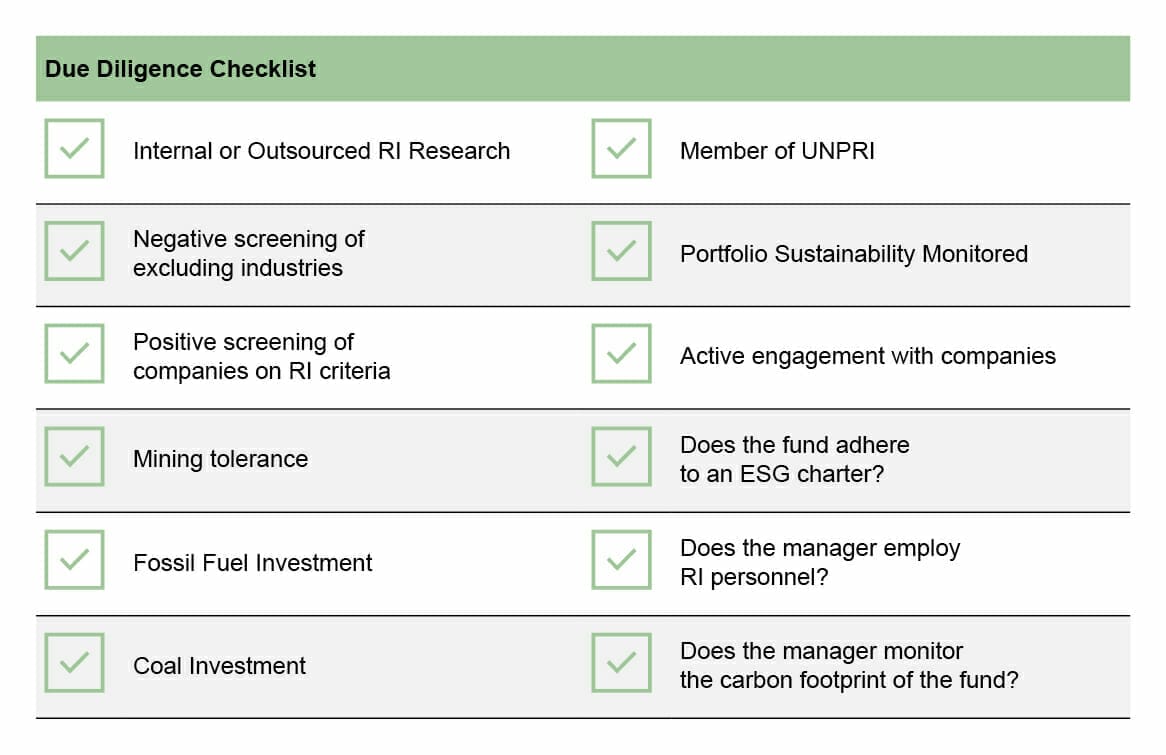

We have curated a list of practices we consider to be a best in class approach to ESG and ask our managers if they adhere to each component of this checklist.

As part of this, it is important to know whether managers have committed to incorporating ESG issues in portfolio construction by signing up to an ESG charter or becoming a member of the United Nations-supported Principles for Responsible Investing (UNPRI). Another test of commitment to ESG is the employment of dedicated personnel covering ESG. We also want to know whether the manager utilises external ESG research platforms like Sustainalytics.

Other aspects of our checklist consider whether a manager actively prohibits the selection of certain securities based on exposures to areas no longer deemed acceptable by large parts of the investment community through negative screening. Managers can also employ positive screening; that is, selecting investments that set positive examples of climate friendly products and socially responsible business practices.

Chart 3: Escala ESG Checklist

Source: Escala Partners

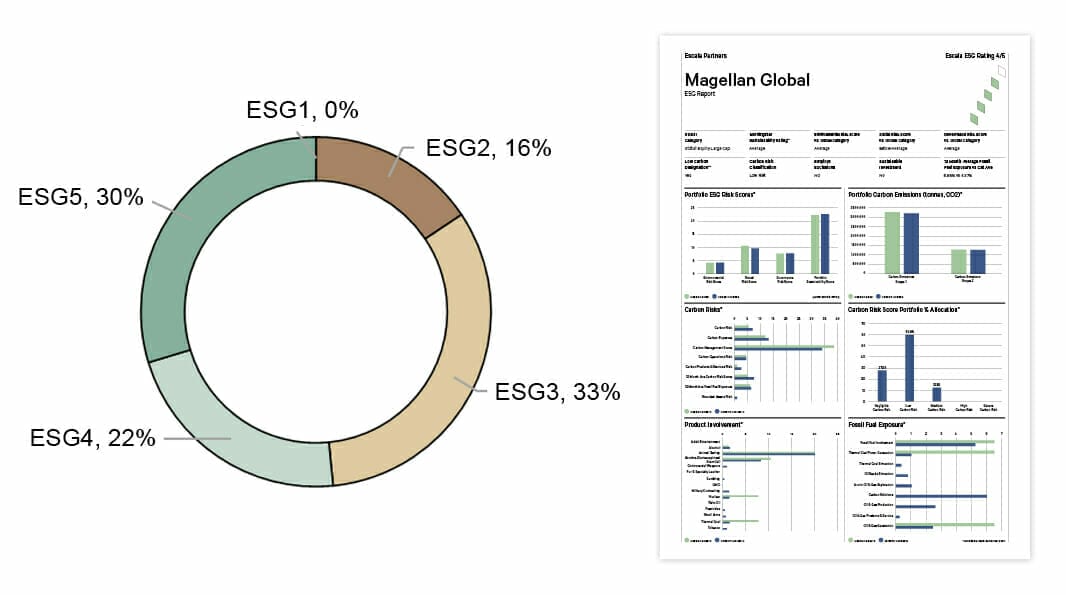

To complement our qualitative assessment of our managers’ ESG claims, we also conduct a quantitative analysis using Sustainalytics ESG research and ratings and Morningstar holdings data. This offers confirmatory evidence that what the fund managers say they do on ESG integration is what they do in practice.

Chart 4: Morningstar Quantitative ESG Analysis

Source: Morningstar

The Morningstar holdings data enables us to monitor our managers product involvement in such activities as alcohol, gaming, tobacco, animal testing, controversial weapons, thermal coal, adult entertainment, and pesticides1. We also monitor the risk scores of our fund managers to the broader categories of environmental, social or governance issues and apply a materiality threshold to each controversial practice which, if breached, will prompt us to investigate further with our fund managers.

Based on our investigations, annual due diligence meetings, assessment of the checklist criteria and the quantitative analysis outlined above we assign an ESG awareness and integration rating to each of our fund managers with ESG5 being the most aware and ESG1 the least aware.

1 This is provided for the funds where the data exists. Some funds, such as direct property funds, do not have Morningstar data.

-

A practice, not an event

Being ESG aware is a practice, not an event.

We need to be constantly vigilant of ESG issues as they arise within the portfolios or with the fund managers themselves. When ESG issues are flagged they are investigated, discussed and assessed quickly. We hold our managers to the same standards as we expect the managers to do with their underlying portfolio companies.

Monitoring for ESG issues is part of our ongoing fund manager due diligence process. This monitoring includes:

– Annual due diligence meetings;

– Quarterly performance meetings;

– Constant news flow monitoring to identify any issues in real-time;

– Updates from investment research houses such as Lonsec and Morningstar; and

– Conversations with other financial market practitioners.

Any potential breach must be thoroughly investigated by the Escala Chiet Investment Officer in conjunction with the asset class specialist to see if the issue constitutes a rerating of the manager. A recommendation will then be put to the Escala Approved Product List Committee where the matter is discussed further and a final, unanimous, decision is made.

Our commitment to transparency on all ESG issues means that we will communicate the outcome of any such investigations to our clients, outlining the issues raised, the implications for investors, and investment recommendation made following our investigation.

-

Escala ESG Reporting

Based on our investigations, annual due diligence meetings, assessment of the checklist criteria and the quantitative analysis outlined above we assign an ESG awareness and integration rating to each of our fund managers (ESG1 = low integration; ESG5 = high).

Currently, 52% of the funds on our Approved Product List have an ESG rating of 4 or 5. Our intention is to grow this percentage.

Chart 5: Escala APL ESG Awareness Profile and sample fund report

Source: Escala Partners, December 2020

We provide an ESG dashboard report to our foundation and not-for-profit clients annually.

The report monitors our managers product involvement in such activities as alcohol, gaming, tobacco, animal testing, controversial weapons, thermal coal, adult entertainment, and pesticides.

We also monitor the risk scores of our fund managers to the broader categories of environmental, social or governance issues and apply a materiality threshold to each controversial practice which, if breached, will prompt us to investigate further with our fund managers.

-

Conclusion

The market and the environment for sustainable, responsible investments is changing rapidly. New products and services are being launched, regulatory changes are being announced, and new industry standards are being published at an unprecedented rate.

A comprehensive ESG policy is now considered standard for all managers in the investment industry. Incorporating ESG into the investment process need not come at the expense of performance. Indeed, there is ample evidence to confirm that managers who have a robust ESG approach will outperform in the long run.

We believe it is essential that as fund managers move to incorporate ESG awareness into their investment process, investment advisors should be doing likewise with their manager selection process. Consistent with this, Escala is committed to the goal of achieving and maintaining an approved list of funds that reflect a high level of ESG awareness.