-

Overview

Pver the 10 years to October 31, the difference in annual returns, measured on an accumulation basis, between global equities (hedged or unhedged) and Australian equities is a line-ball at a rather disheartening 4 per cent to 4.5 per cent.

If that is discouraging, take some time out, as by this time next year, the 10-year numbers will likely look even more ordinary as we get closer to the peak before the 2008 meltdown. Then, of course, they will soon look good, given the basing effect.

It’s a constant reminder that data is only a number unless it has context.

But the similarity in returns over that timeframe raises the question of why one should bother with global equities if local can do the same, as the mantra on diversifying risk loses relevance. What is lost is the dispersion of return in global equities from regional, but increasingly, sector outcomes.

The US and Asia-Pacific Ex-Japan gave a meaningful 1 per cent a year greater return than the MSCI All Country index. On an unhedged basis, the dispersion of returns was 0.7 per cent a year from MSCI Europe up to 5.8 per cent a year from MSCI Americas (even higher from the S&P 500).

The breadwinning stocks

On a sector basis, the winner has been consumer staples with 8.8 per cent annual return over 10 years. Conversely, those who banked on financials are poorer, with a minus 1.5 per cent a year outcome.

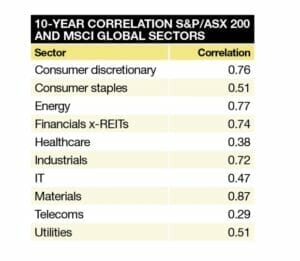

For local investors, getting diversification from the Australian market structure is more important than the country decision. The correlation data between the ASX sectors and MSCI sectors is proof.

Materials and energy sectors are tied to the commodity price, so it’s no surprise local and global stocks move in unison, even if there are differences in their operations. Consumer discretionary, financials and industrials follow a similar pattern, but the rationale is less obvious. Across the world, financials have become beholden to interest rates and regulations, while the correlation disguises the better performance from the local sector. But given that a financial-heavy investment portfolio would show a relatively similar pattern in the cyclical movements, it may not be the best outcome to have both local and global stocks overrepresented.

Eclectic Bunch

The tie-up of consumer discretionary stocks is light. The Australian index is dominated by gaming companies, while the global sector is dispersed between auto, internet retail, entertainment and luxury goods, among others. Yet the performance is driven by the perception of growth, or risk-on momentum, which is the likely explanation of the linkage. The same argument would apply for industrial companies.

The least correlated sectors of healthcare, telecoms and information technology are an eclectic bunch. Local healthcare stocks have been used as a currency proxy given that many earn considerable global revenues.

But it has been the stellar contributions from CSL and Ramsay that have done much of the hard work. This may be a time to switch allegiance as global healthcare stocks have been sideswiped by a number of issues.

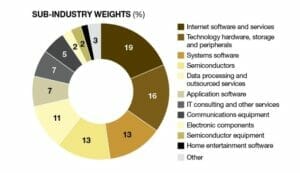

Telecom and IT are structurally different in global indexes. Telecom is almost always local, while IT is perhaps the iconic global sector. It stands to reason global funds will find something of interest to pursue with the variety of companies on offer.