-

Summary

A falling rate of business investment points to slower economic momentum into 2020. Fiscal policy and a degree of reversion from weak data may imply growth is to resume, but we are of the view it will be short-lived.

Domestic demand is expected to be the primary determinant of growth as the prolonged rise in globalised trade comes to an end. This also heralds the end of synchronised economies where monetary policy had a global effect.

Nonetheless, there are insufficient indicators or systemic problems to imply a sharp fall, and a combination of new forms of government support as well as another round of easing financial conditions should moderate any downturn.

-

Asset allocation recommendations

At present, we are holding our equity weights, though we recognise that without an improvement in earnings, the upside is limited. Dividends yields are attractive, as income assets and equities do offer a liquid and diverse set of companies that represent some of the major changes to consumer trends. Yet valuation is a long-standing anchor that should not be ignored. We have made no changes to our recommended equity weights this quarter.

Global bond yields are too low to warrant a meaningful allocation, though US Treasuries can still be inversely correlated to equities in the event of an unexpected downturn. Credit offers pockets of reliable returns and we concentrate our defensive holdings in this segment at present. We recommend taking profits in selected hybrids where the pricing no longer offers an adequate risk/return and instead favour liquid credit funds.

Select alternative investments can be important to achieve an investor’s goals. Risk assessment should come prior to assuming targeted returns will be achieved.

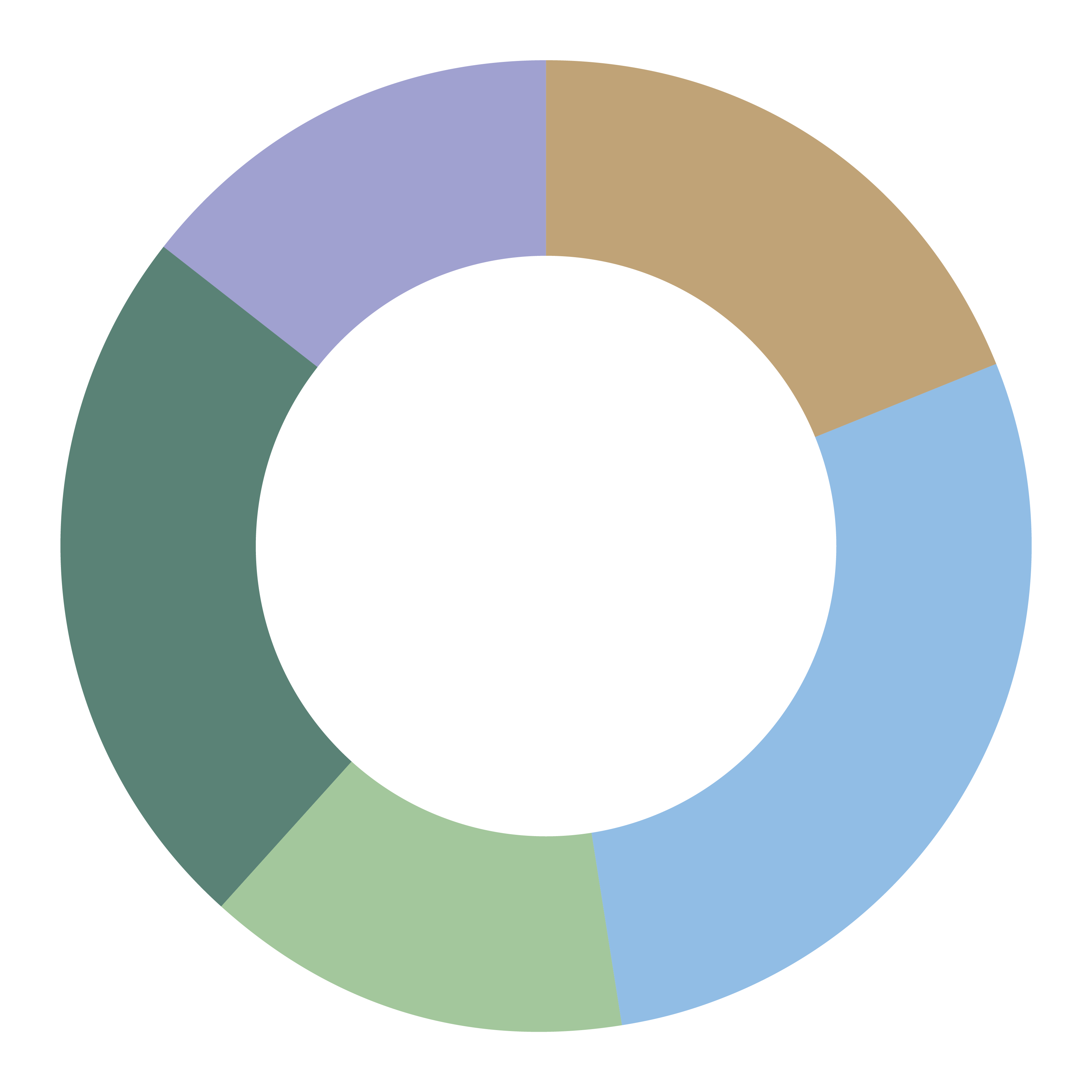

Asset Allocation

Source: Escala Partners

Expected index return (excluding alpha and franking)

Source: Escala Partners

Expected return (including alpha and franking)

Source: Escala Partners

-

Economic Outlook

Global Outlook

Two major influences on global economies have changed in the past half year. Firstly, the expectations of a resolution in the tariff dispute has now moved to a widely-held view that there will be no reversal and instead an uneasy truce will ensue. Secondly, central banks are nearly universally dovish, signalling their intent to keep rates low. Relatively stable demand has come from the domestic component in most major countries, particularly services, while private investment activity is at recessionary levels.

We view the outlook as unclear. The base case is for more of the same at present, but with a fine balance for a change in the trajectory. Subduing the trade tension would be supportive of the corporate sector, but businesses may elect to maintain a defensive stance given the consistent change in direction from the US administration. Additionally, a decline in interest rates and easier monetary policy is widely regarded to be far less effective than previous rounds.

It is increasingly likely global economies will move further into a weakening growth cycle in the coming 18 months, absent a major change in policy and private sector confidence.

Since 2009, global economies experienced two downturns, in 2012 and 2016. In both circumstances central bank policy was able to support financial conditions. We see some scope for a mild revival in liquidity-supported activity, but struggle to identify the key to a long term cyclical

upturn. A significant increase in productivity is the most probable thematic that can underpin a future phase in global economic trends.

In this context, commentary on the potential to change provision of healthcare and other services using technology is gaining momentum. Services have struggled to improve productivity and are a growing proportion of most economies.

We are not outright bearish. The household sector has a respectable balance sheet, outside notable examples including Australia. The corporate sector has positive cash flow, along with access to credit markets which have not shown any widespread stress. Industry sectors that have been affected by trade (for example, semiconductors) have been the most vocal on the impact and, separately, transport goods manufacturing has been dented by the issues at Boeing and weaker demand. Other industries are still exhibiting decent demand, with some temporary weakness due an inventory build-up from prior to the imposition of tariffs. Absent a systemic event that could be confronted by a liquidity gap in debt markets, it is more likely that economies will gradually soften than fall sharply.

Australian Outlook

Locally, the RBA ‘put’ appears to have stabilised the downtrend in housing, though activity levels have yet to plateau. The tax cuts and combined state and federal spending are another floor that offsets weak private sector investment. However, the indebtedness of the household sector (household liabilities to income are at near 200%, the highest in the developed world) is a meaningful cap on likely growth.

In reflecting on what might transpire over the coming 12 months, we note the following possibilities:

· Central banks cut rates and then remain sidelined, absent a significant change in circumstances or a change in liquidity in lending markets.

· There is much debate on the role of fiscal policy, with central banks now calling on governments to take over the baton. Modern Monetary Theory (MMT) is the catchphrase, simplistically this is where governments hand out cash to households. For a kickstart, it can be effective. Infrastructure spending is also on the radar, but usually takes time to feed its way into activity.

· The attention of the US administration is on settling (or at least deferring) the trade issues in favour of focusing on domestic issues such as healthcare into the November 2020 presidential election.

· Europe faces a difficult stretch and there seems little appetite to embrace change. The balance between monetary policy (already accommodative) and fiscal (hamstrung by restrictions on deficits) does not add up to a proactive outlook.

· The sentiment towards emerging economies has been hard hit by trade, yet the focus is unduly on this factor. The internal management of the economy is more important in the longer term and with disruption to many countries from external events, we foresee increasing attention on local policies.

· Australian household spending may see a Christmas rally due to tax cuts and lower rates; in our view this is likely to be short lived unless there is a commensurate pick up in wages.

-

Central Bank Policies

The bull case for Australian rates is that the RBA further lowers the cash rate as warranted by economic conditions, arguably in an attempt to depreciate the AUD. While it may cut another 0.25%, we are of the view that the domestic bond rally is close to bottoming out. The profitability of lending banks is coming under pressure with every rate cut. Monetary policy’s effectiveness is diminishing, as 75% of mortgages are paying principal and interest and are unlikely to alter monthly payments to free up disposable income. Medium-sized businesses are still struggling to access capital due to tighter lending standards from the banks, therefore the net benefit of rate cuts is in favour of large corporates and the government. As noted, further stimulus is needed to support the Australian economy rather than rates.

In the event data points to a more meaningful reversal of economic trends, yields could move quickly in response given what is already priced in. This points to the uncomfortable risk in local bond markets.

Offshore, the US scenario is for one, and at most two, rate cuts within the rationale that inflation is so subdued in the face of tight labour markets that the level of interest rates to sustain stable growth potential is much lower than in the past. Any deeper cuts signal distress; hardly conducive to regenerating confidence for households and businesses.

The new head of the ECB, Lagarde, is expected to follow the policies as currently set. It is notable that businesses are cautious on the benefit of lower rates and the banking system faces potential earnings contraction in the event of a meaningful fall in rates.

-

Investment Markets

For the first half of 2019, equities and bonds reflect different views of the macro environment. Bond markets tend to be more vigilant than equities in judging a transition and the significant fall in yields through this year implies that conditions are not up to scratch.

While a change in earnings expectations is not highly correlated with short term equity performance, growth is required to validate longer term momentum. Conversely, the current moderation in earnings growth is supportive of credit markets; there is no problematic sector (as was the case of leverage in energy companies in 2016) and supportive cash flows from high profit margins imply default risks are far from elevated.

Earnings versus Price Multiples for the MSCI World Index

Subdued flows into risk assets and the stronger performance of traditional protection investments such as gold, the Yen and bonds, indicate that many are seeking to retain existing holdings in equities, but create a buffer to accommodate a sudden change in attitude.

These are challenging times for traditional investment portfolios. The relatively long and coincidental bull markets in equities and bonds have provided high returns in the face of financial and economic uncertainty. It is unreasonable to expect these conditions to repeat in coming years.

Investors may have to choose between aiming for higher returns via non-traditional investments or accepting a low return, defensive stance.

Capital defensive portfolios can still reflect core strategies and hold higher cash weights. In our view, the returns are likely to be in the 3-5% range.

The optimal investment portfolio for income and growth may not fit a standardised model at this time. Industry convention uses benchmarks such as the MSCI All World Index for global equities or the Barclays Aggregate for global fixed income. We already have an allocation to hybrids that is not part of any index and alternative investments are difficult to corral into a representative model.

As investors seek higher returns and income, while also limiting listed equity exposure, there has been a shift to differentiated products. The most common example is private lending markets where there is a significant pickup in income yield, while acknowledging the risk and illiquidity of such investments. With an appropriate recognition of these issues, higher allocation to these products can be incorporated in a portfolio, but we encourage a relatively large cash weight as well to offset the illiquidity.

Unlisted investments show apparent price stability as there is usually no potential to trade the asset. Listed equities, bonds and most investment grade credit can be traded at will and therefore carry the brunt of sentimental shifts to risk.

In the following table we have updated our reading of the consensus and contrarian views on segments of financial markets and considered which we view as likely.

Source: Escala Partners

-

Global Equities

Earnings and valuations

Estimates for global earnings growth in 2019 have pulled back to mid-single digits, though the forecasts for 2020 are still elevated at 11% and likely to trend down to around 7%. Nonetheless, near-term earnings revisions have run their course, subject to stable policy and commodity prices. Margins are tightening due to wage increases, partially offset by productivity gains and early signs of a lower rate of employee growth in some industries.

Equity bulls have been right about the market but are now confronted with an earnings gap that even the optimists recognise will be hard to regenerate. Slowing business investment will have to prove that it is temporary and that the uniformly bearish stance to non-US trends is unfounded.

The foundation of equity valuation is often based off the risk-free rate and an equity risk premium. At the current US bond yield, it is 5.6% (based on the widely used methodology of the Stern Business School), around the average of the past ten years, but well above the rate that applied prior to central bank quantitative easing, while for Europe it is even higher. Similarly, dividend yields are measurably higher than those from investment grade credit and bond markets and global dividend growth has averaged 8% since 2010. However, these aggregate metrics disguise the growing dispersion within the market and message from bond markets.

Bull and bear opinions

Equity bulls suggest that the market can grind higher on the back of the return to dovish central banks, the relative value compared to credit, a decent dividend yield and the absence of broadly-based flows. The base case is therefore to hold at least a neutral weight in equities.

The consensus suggests most regional indices are around fair value on a P/E basis, with the US tracking at above its historic average, but offering the best structural features. The opinion on which region should be overweighted is now far from uniform.

The concern rests on the high valuation now attributed to growth companies and low volatility sectors such as utilities and consumer staples. They appear to represent the best of both worlds. On one hand, participation in disruptive technologies and on the other, the safety of relatively stable demand. Few believe they are currently good value. The dilemma is that it is hard to make a case for other sectors, short of the fact that they have missed out.

Some signs of irrational exuberance are emerging. We note an uptick in initial public listings (IPO) of consumer tech companies in the US which are mostly loss-making and are trading at high multiples of their sales, M&A activity and activist shareholders. Conversely, established companies where flaws have inevitably been exposed are often treated as though they are certain long-term losers.

Equity bears are modest in their underweight allocations. US valuations trouble many, especially given higher corporate leverage. Conversely, the case for overweighting other regions has to be in a relative sense as it is unlikely these will move without some participation from the S&P 500. Those with a domain negative view on equities prefer credit.

Our preferred managers have reduced their holdings in growth companies where they can no longer justify the share price. Yet they continue to invest in notionally expensive companies where they view the long-term earnings potential as yet to be fully recognised. In turn, they are rotating into select stocks that have been left out of the recent rally or have been restructuring.

· WCM, as a growth style manager, has been adept at limiting its holdings of companies that have rallied beyond fair value, while MFS Global Concentrated is a highly regarded GARP (growth at a reasonable price) fund manager which we believe is positioned for this era. State Street Global is value-oriented, with a quality overlay, and will lag growth cycles but not to the extent that returns are excessively compromised. Its shorter time frame and dynamic hedging is a differentiated lens on the index.

· The current valuations of utilities and REITs limit further upside and these sectors can be expected to lose support if a more broad-based cycle develops into 2020. RARE Infrastructure Income Fund may see a retracement of its recent strong performance while still delivering stable income. In our view, Quay Global Real Estate still warrants a full allocation for defensive portfolios.

If the bull case and a final (possibly prolonged) leg of the investment cycle comes through, riskier or neglected components of the market may move sharply. We believe Emerging Markets (EM) will accrete flows compared to Europe or Japan, though the UK could rally if Brexit concerns can be ameliorated. The longer-term outlook is relatively sound for EM compared to these regions as there is a better mix of high growth companies and policy is less likely to be a hurdle, allowing for the wide number of countries that fund managers can select from.

While the US market is relatively expensive, we do not believe it will miss out on the cycle, albeit it may underperform a global rally for a period. We suspect that the household sector in the US is likely to invest locally rather than diversify offshore in light of the past year and are more likely to be willing to add to equities as bond yields fall.

Given the near-universal aversion to European equities, it would not be surprising that, if a small upturn in global activity eventuated, these stocks may move quickly; absent a further cycle, we believe this will be short lived.

· Long only managers are generally close to index weight in the US, while underweight Europe and Japan. Invariably, Asian equities round out the portfolio, skewed towards the better known stocks listed as ADRs in the US. Of our managers, MFS and State Street limit their universe to the MSCI World, while WCM is based on the broader MSCI All Country Index. Therefore, exposure to Emerging Markets via our two recommended managers, RWC and Somerset, do not overlap the weighting in EM.

Commentators have focused on financials which have underperformed, yet some regions (especially in the US) have sound fundamentals in capital structure and mortgage demand. The interest rate structure limits the scope for net interest margin and it is difficult to envisage that equity flows will move to this sector now. Nonetheless, the whole sector is often tarred with the same brush, while there is plenty of differentiation in their prospects. The average dividend yield is 4.6% and close to all time highs; a supportive level in a low yield world.

Global Financial Sector Dividend Yield

Source: Longview

Other segments that could see a revival are semiconductors, which have been impacted by the trade dispute and tech restrictions out of the US. Finally, energy stocks are trading at below their historic multiples yet their balance sheets are in good shape and some catch up capex may be required to replenish reserves.

· Both Platinum International (unhedged) and Antipodes Global (long/short) have a differentiated style to our other managers, which is a cyclical value bias. We recommend a smaller allocation to these managers within global equities.

-

Domestic Equities

The Australian equity market joined in the global rally in shares throughout 2019, with a sharp v-shaped recovery, more than reversing the decline of the final quarter of 2018. Broad macro factors have lifted the index higher, in particular the adoption of dovish central bank policy (the RBA has now cut the cash rate in successive months) and the lack of concern for unresolved issues such as trade as Australia to date seems mostly unaffected.

Local factors have assisted returns. The iron ore has climbed on the back of limited global supply. Secondly, the federal election, with the Coalition’s win interpreted as more favourable for the listed market. Examples include the housing market (negative gearing retained), consumer (tax cuts) and the retention of franking credit cash refunds. Finally, the ASX 200 is skewed to defensive sectors that have gained favour this year.

Earnings have softened…

The ongoing advancement of the market has occurred despite an increasingly soft earnings environment, after a disappointing half year reporting season. The pace of earnings downgrades has accelerated over the last few months, with recent stocks to lower their guidance for FY19 including Wesfarmers, Star Entertainment, Flight Centre, Caltex, Adelaide Brighton and Costa Group. Weaker domestic demand was the common thread through most of these announcements and foreshadows a difficult backdrop for a large part of the index as we approach August’s reporting season.

Over the course of the financial year, the FY19 forecast for the industrials sector (i.e. the market excluding resources) has fallen from 10% growth 12 months ago to closer to flat today. While the trend of downward revisions over the course of a year is not unusual (i.e. analysts start the year overly optimistic), the quantum is of concern.

…with resources the exception

The notable exception has been the resources sector. The large diversified miners. BHP and Rio Tinto have enjoyed upgrades to forward earnings in the order of 40-50% due to the rise in iron ore prices and for pure-play Fortescue Metals, it has been in excess of 100%. After benefiting from capital management (buybacks and special dividends) in recent years, investors should now expect further additional returns in upcoming reporting periods.

Given the above, it is not surprising that the market’s returns have primarily been driven by an expansion of P/E multiples. This has not been limited to one segment (such as those that are most sensitive to falling interest rates), but observable across most stocks. While information technology has seen the largest re-rate, followed by communications (largely Telstra), some growth-orientated sectors such as health care and consumer discretionary have re-rated less than average but are still at higher multiples than 2018.

P/E expansion

The one year forward P/E of the market has consequently lifted from 13.7x in late December to 16.5x today. The valuation is on the expensive side, with the current multiple above its longer term average and at the upper end of its recent range. While there is some justification for a higher multiple from lower interest rates, presently this does not appear to be balanced with a potential lower growth outlook that the bond market is signalling. For the market to push higher from here we will require broader evidence of a respectable earnings growth pattern.

Dividend yield

The index rise through this year has also resulted in a sharp contraction in the forward dividend yield, which is now at 4.3%. With a general lack of broad earnings growth and payout ratios already high (at around 75-80%), dividend forecasts have been largely unchanged through this period. While the yield is lower at an absolute level, the relatively high predictability of dividends and the gap to safe income asset options (such as the benchmark 10 year government bond rate) remains attractive for investors who can withstand the associated capital volatility of equities, even more so once franking credits are added back.

Cyclical pick up

As we noted in the economic outlook, there is a prospect that domestic conditions will pick up into the second half of the year from a combination of interest rate cuts by the RBA, recent tax cuts (with low/middle income households the beneficiaries) giving a boost to consumer spending and some support for stabilisation in the housing market. Our base case view is that this is more likely to be a temporary phase given prevailing high household debt levels.

Companies that are exposed to the domestic cycle would benefit in this scenario and as the chart below illustrates, these stocks are currently trading at a significant discount to their defensive peers. This trend has been in place over the last few years as the domestic outlook has softened. In our cyclical basket we have included building materials, travel, casinos, retailers and diversified financials, while defensives cover several sectors from supermarkets to property trusts and infrastructure.

Median P/E of Domestic Cyclicals and Defensives

Cyclicals: BLD, CSR, FBU, BSL, QAN, FLT, CTD, SGR, CWN, BAP, HVN, JBH, PMV, WES, SUL, MQG, AMP, CGF, MFG Defensives: COL, WOW, MTS, CCL, TLS, AGL, TAH, SCG, DXS, MGR, IAG, AMC, ORA, TCL, SYD, APA, AST Source: Bloomberg, Escala Partners

Under a bear case scenario, it is likely that this valuation gap would extend further, with defensives holding up on lower rates and cyclicals facing more significant negative earnings revisions.

· Of our domestic equity SMA portfolios, we view Martin Currie to have the highest cyclical exposure to the domestic economy, with a mix of discretionary retailers, media and tourism companies in its portfolio.

Sector outlook

Within other sectors of the market, the banks still face headwinds on multiple fronts, including customer remediation costs, additional regulatory capital in NZ (still to be determined) and weak credit growth. While the recent rate cuts by the RBA may support the housing market, the downside to net interest margins from this development is only now being recognised by investors.

Resources have been a key positive call for domestic equities and we retain this view on account of positive earnings momentum, a disciplined approach to capital management, strong balance sheets and reasonable valuations. Additionally, in the current cycle, a falling AUD has provided an additional boost to earnings, which is typically a headwind given the correlation between the currency and commodity prices. While it is not the base case, in the bear scenario of a global recession, the downside for resources is obviously greater given their status as price takers.

The high growth and high P/E industrial cohort has attracted much attention for their outperformance of the rest of the market for some time, helped by a falling rates environment and a relative scarcity of growth options in the ASX. Through this year it has been a narrower select group of smaller companies that have driven this theme rather than the more well-known large cap names, although the latter have also done well.

While we note that earnings estimates have held up better than the rest of the market across growth stocks (outside of a few exceptions such as REA and Seek), the short to medium term risk remains one of a realignment in how these stocks are valued. Recent history would suggest that they can be subject to a rapid change in investor sentiment and their high beta nature would see them underperform in a correction.

· Given the above, we believe that managers that follow a ‘growth at a reasonable price’ (GARP) approach, such as Wavestone, appears sensible in the current environment, protecting the downside risks.

We noted in a recent research note that small cap industrial companies are now priced at a significant premium to large caps, notwithstanding the different earnings drivers and sector exposure. The aforementioned high growth segment of this market goes some way to explaining this discrepancy, although discussions with our preferred managers highlight that few now have a significant exposure to these stocks with stretched valuations. A diversified mix of managers and styles remains appropriate given the opportunities on offer and higher volatility nature of small caps.

-

Fixed Income

Rates

A cursory glance at the inverted U.S. yield curve suggests that bonds are factoring in a recession. Markets are pricing the fastest pace of rate cuts in more than 30 years, absent the financial crisis. This is a swift turnaround given that just six months ago rate hikes were expected. A deteriorating growth outlook and muted inflation may warrant a couple of “insurance cuts” but with more than that already in markets, there is a case valuations have run too hard.

The recent release of the Fed’s medium forecast for rates proposes a much shallower rate cycle than the market is pricing. Trade tension has been high and US data is patchy, but the impact of uncertainty can be overstated. Bears suggest a correction with yields to track higher.

The bull case for bonds is that, absent a catalyst to reverse market sentiment, prevailing pricing can endure, and expensive bonds can get more expensive. Yields in the US are higher than in Europe and Japan (the regions that house a quarter of global bonds in negative territory) and offer a pick-up in returns for these investors on an unhedged basis. US Treasuries are attractive as a safe-haven asset and as a diversifier to risk assets. In addition to rate cuts, the Fed has other tools, including relaunching quantitative easing (QE) which will keep yields low and may justify current market pricing. Continued concerns on growth will keep yields low, and our base case is for rates to trade in a tight range in the lower bound.

Long duration in Europe does not appeal given negative rates (German rates hit their lowest level ever with yields negative out nearly 20 years) even though the ECB is likely to do whatever it takes to lift growth and inflation in the area. Yields are likely to stay extremely low and global bond funds may opportunistically tactically trade positions.

As discussed in the economic section we think that yields will soon bottom out in Australia. The managed funds we use to access Australian duration have performed exceptionally well in the last 12 months as the RBA lowered rates (JCB Bond fund and Henderson Australian Fixed Interest fund). While it is a challenge to pick the bottom, we think further capital appreciation in domestic bonds will be limited and there is more downside risk to owning duration.

Shift in Australian Rates in 2019

Source: Bloomberg, Escala Partners

We are not bullish rates,but suggest maintaining a limited exposure to US duration over other jurisdictions (including Australia) as we recognise that US bond yields will be capped on the upside due to low inflation, subdued growth, trade rhetoric and supply/demand dynamics. They serve as a hedge against an unexpected deterioration in growth and offer diversification within portfolios that may be overweight risk assets.

We are mindful that the interest rate sensitivity of the overall bond universe (duration) is at an all-time high (which if bond yields move higher would generate greater losses than previous years) therefore the risk/reward for holding bonds is skewed. That said, exposure to US duration is mostly through investment in corporate credit and mortgages that are benchmarked to US government bonds. The US market offers a broader product suite relative to Australia to add duration style strategies.

· For this we recommend the Pimco Global Bond Fund and we rely on the portfolio managers to manage the outright duration positioning.

Low growth and inflation feed accommodative policies by central banks, pushing down bond yields and tightening credit spreads. As valuations get stretched investors inevitably search for yield.

Sovereign bonds from Emerging Markets (EM) offer high real yields and are often beneficiaries as yield starved capital gets deployed. Investment can be in EM sovereign bonds that are denominated in USD (hard currency) or bonds issued in local currency. The latter takes on local currency risk and, given many EM currencies are still considered undervalued, may offer additional upside. USD denominated EM bonds are linked to US Fed policies which profit as rates fall.

The bear case for EM is that trade uncertainty creates a persistent headwind for growth in those economies. Tariffs undermine capex and damage supply chains, putting growth and confidence under pressure. EM remains linked to the growth cycles of developed market economies and policy easing and fixed income is a way to gain some relatively safe exposure.

· On balance, we suggest a neutral weighting to EM. Given tight valuations elsewhere (e.g. credit) it offers a better risk reward than many other assets at this time. Spreads have contracted significantly over June, taking them from ‘cheap’ to ‘fairly priced’, where they now trade close to their historical average. Our recommended fund is the Legg Mason Brandywine GOFI fund.

Spreads on Emerging Markets Bonds and US Credit

Source: Bloomberg

Credit

Loose monetary policy is a favourable environment for credit markets, as borrowers can refinance and repay bonds. This has resulted in a run up in price for most credit products. Bulls continue to like credit, noting investors demand income even as interest rates fall and credit offers a higher coupon than government bonds. Capital values should be supported due to conservative corporate behaviour, low interest rates and constrained supply.

· We prefer a defensive stance in credit, favouring higher quality names and shorter maturities where possible. Specifically, this means dialling down exposure to any high yield (JP Morgan Strategic bond fund) and riskier sectors of credit (Bentham global income fund) which may roll over if the warning signs from the bond market prove correct.

· Investment grade (IG) credit also has tight valuations, but we like the liquidity in these bonds and are of the view that short duration IG credit offers a safe resting place for capital while we wait for better investment opportunities in other asset classes. We use the Kapstream Absolute Return Income Plus fund and Macquarie Income Opportunities fund.

· To achieve a higher return for portfolios we remain comfortable with investment into opportunistic credit funds such as Aquasia and Alexander. These blend investment grade credit with unrated loans (mortgage warehouse lending and consumer loans) and add to portfolio returns without taking on too much risk.

Local hybrids have become very expensive, with trading margins falling shy of 3% (including franking) on 5-year maturities. The discretionary nature of coupons, position on capital structure and potential for conversion to equity is not being rewarded, in our view. We suggest waiting for a better entry point, with the catalyst for higher spreads potentially coming from a fall in the equity market or new supply in the market. We are tactically underweight hybrids.

-

Alternatives

Growth in Australian private debt funds are on the rise as regulatory changes have resulted in banks retreating from certain types of lending. Non-bank mortgage lenders have come to the fore, as have funds that specialise in private corporate loans (mainly to companies that are unrated and cannot access public markets), consumer finance and construction loans. Private loans are riskier given the inferior credit quality of borrowers versus rated companies, but the investors gain a meaningful uplift in rates to compensate for the increased risk.

Our preferred option is for senior secured 1st lien construction finance lending. Our previous concerns of the falling property market and tighter lending standards for pre-sale buyers have abated. The election result has stabilised property prices, as has APRA’s change to the serviceability criteria for assessing home loans and the RBA rate cuts. In addition, loans are secured against hard assets and have a feasible exit strategy for repaying the investment loan. Risks remain for this sector such as the bankruptcy of builder and/or developer, potential over supply and rising construction costs. Good operators undertake diligent credit and feasibility assessment to invest in secured structures with low LVRs (Loan to Value Ratios). Merricks and CVS Lane are our preferred providers.

The main hazards for funds invested in private corporate loans is the ability to correctly assess credit worthiness of these unrated companies. It extends further to judging sensitivity to the economic cycle, the illiquidity of loans and the refinancing options at the end of the term. Unlike offshore private loans that are usually self-amortising, Australian private loans have a bullet maturity, which could be challenging to repay, especially given ongoing funding costs of between 15-18%. At the end of the term the company may need to find another financier, or have their loan extended which may not be that easy given the shrinking appetite from banks and reliance on private funding.

· In this sector we prefer funds that lend to a large diversified pool of stable, better quality companies at lower interest rates such as Metrics Credit. Funds that are more concentrated and lend to lower quality companies at double digit interest rates are only recommended for highly sophisticated investors that understand the risks and are prepared to accept a potential drawdown in capital in the pursuit of higher returns. One such offering is Dinimus.

Private equity is infrequently on offer, especially in a format that suits non institutional investors. Given listed equity valuations and a large amount of free cash to apply to investments already in private equity hands, we are cautious on the segment. Local options that focus on narrow segments where larger institutions are unable to gain scale can be attractive, when available.

· The Partners Group Fund is a liquid global alternative where we have a favourable view of their conservative approach.

Our Australian equity alternative funds have, in general, experienced a challenging period over the last 12 months and have lagged the returns of the broader equity market. We retain the view that these are a useful diversifier for portfolios and are particularly relevant when valuations are high (such is the current case), and driven more by macro calls, stock selection and various factor biases, with little correlation with market movements.