-

Overview

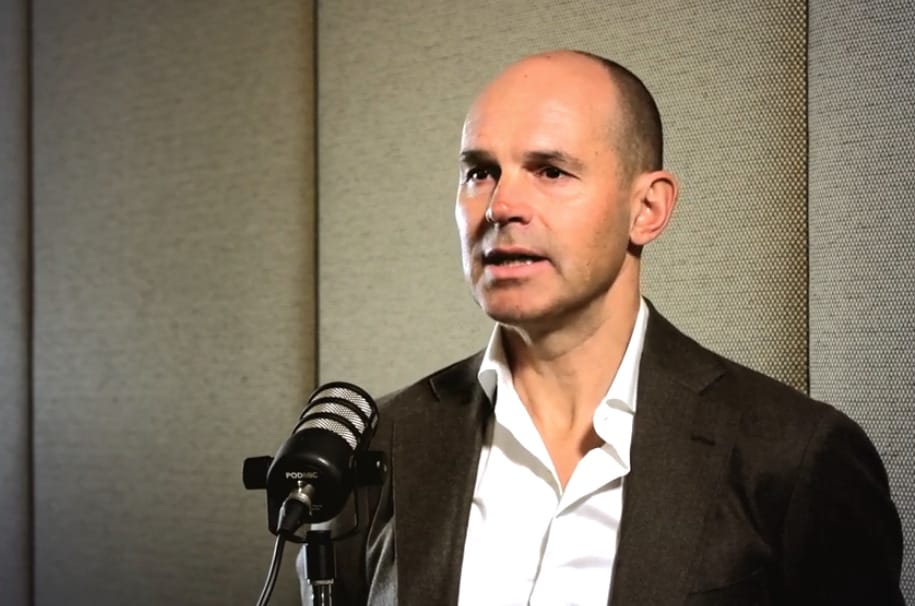

Ben Potter, adviser at Escala Partners

When I first met Jim and Marjorie about 20 years ago I’d only just started in the industry. He has a real thirst for knowledge and liked talking about stocks so we got along famously from the start. I recall he had an Australian share portfolio that we managed and over time we transferred that to a more rounded portfolio incorporating all the asset classes with a wider spread of risk. He was happy to discuss other asset classes but it took him a while to understand the need for them. I guess he’d been conditioned to invest purely in the Australian share market.

I think he’s always been a bit of a risk taker. He’s not one to boast but Jim was regarded as the best merlot maker in Australia for many years. He’s been in the wine industry a long time and had to take on risk in his own business, so he was happy to do the same with certain stocks.

Every three months or so I’ll travel from Melbourne so we can have a nice lunch in the Barossa and talk about stocks for a while, but after 10 minutes we usually end up talking about wine, travelling, our respective families… everything really.

I guess the relationship has extended beyond the traditional adviser client dynamic to a friendship. What I like about Jim is he’s turning 87 but still wants to know about the newer investments like WAAAX stocks. He likes to be involved.

Occasionally he’ll send me a newspaper clipping of a particular stock and it’ll come with a beautifully handwritten note asking me if we should consider it for the portfolio, which is nice to receive.

Sometimes we add it to portfolios and sometimes we don’t; ultimately Jim employs us to manage the portfolio and part of my job is to steer him away from speculative stocks that might not fit their goals.

Now they’re a bit older we’ve helped them transition from a balanced to a more defensive portfolio and they’re comfortable with that. One of the challenges for us in this low interest rate environment is to get income coming through to help fund their lifestyle, which is why we’ve positioned their portfolio more defensively.

Jim’s probably the most active 87-year old I know, he rarely sits still and always seems to take a genuine interest in the people around him. He’s very humble and generous, they’re both just lovely people.

James (Jim) Irvine, client and winemaker

We started investing when I was just barely 50, in 1983. I knew nothing about it, I was too darned busy building a brand in the wine game. Ben was quite young when we first ran into him, not quite in short pants but not far off it! I recall thinking he was very likeable. He gave us a lot of confidence even though he might have been a lot younger than some of the other consultants going around. Anyway, we got cracking with Ben and stayed with him wherever he’s moved. I’ve been in the wine game for 70 odd years. In the early stages I was working with Hardy’s, and in 1982 I went out and consulted in a general role in the wine industry, which was wonderful because you got such a buzz out of doing the very best for your clients.

The wine business took us into buying our own block of land and building a vineyard in Eden Valley. There was a mystery about this thing called merlot around 1980, it was expensive in Europe and unheard of in Australia. We planted a small patch of merlot and soon realised we had a little gem on our hands, because of the 1500 winemakers in country at that time only about six of them made an unblended merlot. We shot off around the world pushing merlot, and three times we had the world’s best.

Our requirements have shifted over the years – when we started it was growth, growth, growth. We were typical of many people at first, we just wanted to look at the banks. Ben was very open to listening to what we wanted but able to gently steer us into diversification.

We don’t disagree too often. Ben might point out that something doesn’t fit with the plan because it’s speculative, and he’s quite right a number of times. Occasionally I’ve put my foot down and I’ve stuffed up.

The major thing Ben’s taught me is to not look at the share price every day, to be in it for the long haul because that’s the way the plan is established. He’s also started to help our younger daughter, which is nice. He’s become a family friend.

I must be a bit of a pain in the backside to Ben because I’m a contrarian, plus I want to see where the future is – even though my future is likely to be a bit shorter! But he’s always had the knowledge and understanding we needed. I’ve never doubted the depth behind his suggestions.

Source: Professional Planner