-

Overview

Following the financial crisis, investment markets have been supported by easing monetary conditions and progressive rebuilding in business and consumer confidence. Market valuations have reflected this recovery with higher multiples in equities and falling spreads in fixed interest, generating capital gains alongside income yield. The combination of solid returns from a relatively risky asset class, equities, combined with a higher than historic average outcome in low risk fixed interest has been rewarding over the past three to four years.

A change in conditions over the coming few years will require a different approach. Interest rates are likely to rise and restrict returns from fixed interest. In turn this will challenge the ability of a portfolio to manage volatility while still achieving satisfactory returns.

Relative to a strategic benchmark, we recommend overweight allocations to equities and underweight to bonds with neutral cash and other assets. However, we believe portfolios should not only be established on asset weights, but also on a range of other criteria.

Our approach is to revisit portfolios through five key tenements:

- Preserving the capital value against major loss

- Ensuring income can be achieved in line with requirements

- Maintaining longer term growth and real value

- Understanding the liquidity

- Managing the costs of the portfolio

We will discuss each of these in detail below.

1. Capital preservation

Fixed interest has historically been able to achieve nominal total returns and low volatility in most circumstances and therefore is seen as a way to achieve capital preservation for portfolios. However, conditions today are unique, with central bank cash rates around the globe at the lowest levels in 40 years. Official rates are expected to rise over the coming few years, but at a slow and measured pace. Nonetheless, investment assets have reacted sharply to the hint of a change in monetary policy. This now requires the approach to the asset class different to a normal cycle in order to prevent potential capital loss as the yield buffer is low.

Recommendation: Investment selection based on absolute real returns rather than traditional benchmarks. High weighting to floating rate instruments; low weighting to interest rate sensitive securities, i.e. duration. Retain balance to highly rated instruments or funds rather than reduce the quality in search for higher yield.

There are two other risks to fixed interest returns which, whilst we remain vigilant of the possibility, we consider low probability at this time. They are firstly, inflation and secondly a sharp and unexpected rise in interest rates, such as occurred in 1994. The concern regarding inflation is due to the recent expansion of central bank balance sheets, or quantitative easing, and therefore the prospect of prices driven by liquidity. However, until there are signs of constrained capacity, particularly in labour, inflation is unlikely to be a meaningful issue (globally or locally), as there is no way for prices to rise. At this time there is greater concern of deflation, such as has been the case in Japan, than a period of heightened inflation. In Australia the risk to inflation may come from a very sharp fall in the AUD, but that would be a relatively temporary phenomena. Imported products are only a modest proportion of the CPI, with the bulk accounted for in services and food.

This, in part, also means an interest rate shock is unlikely; low economic growth is forecast and therefore central banks are very unlikely to destabilise financial markets with a meaningful rise in rates.

Recommendation: Inflation linked investments are not recommended for capital preservation. Cash proved to be the only major asset class which exhibited positive performance in 1994. We do not believe it is critical to hold high levels of cash to protect against an interest rate shock.

Lower yield than in the past leaves little to buffer capital movements to achieve a positive return. Capital preservation may not be possible in short term periods, and investors should be prepared for occasional negative returns. However, we do not believe Fixed Interest will deliver a negative outcome over a rolling 12 month time frame if the portfolio is not bound by benchmark constraints.

Recommendation: Assess investment merits on the total yield to maturity. Be prepared to accept a higher level of volatility than recent experience. Longer maturity, higher yield, securities will tend to increase the potential for the portfolio value to be subject to volatility.

We recommend an underweight allocation to Fixed Interest, with the construct of the asset class holdings a critical decision.

Equities can assist in capital preservation with appropriate selection of investments. The historic range of returns from equity indexes show that this asset class is usually responsible for most short term capital loss, but also for most long term capital gain. We believe it is possible to construct an equity portfolio which exhibits lower risk of capital loss, though investors should expect such a portfolio to underperform the index in periods of substantial revaluation. Equity portfolios managed from a ‘value’ perspective have a better chance of avoiding major losses.

Recommendation: Avoid sector or regional concentration risk. The Australian equity component requires consideration of the high index weight in financial and resources.

Global stocks will assist in diversifying industry exposure, for example IT and healthcare, as well as the potential for the currency to reduce overall equity volatility where unhedged.

2. Income requirements

Fixed income cash flow can be expected to fall from the 6-8% range to 3-5% over the coming couple of years. There is sufficient liquidity in financial markets and appetite for credit, allowing issuers to price their bonds and securities at relatively tight margins.

Recommendation: Avoid high yield securities to compensate for a fall in rates, or offset with a lower equity weight. In limited circumstances, longer dated bonds with fixed yields can be considered, recognising the risk of capital loss if realised before maturity. Flexible manager mandates may be able to extract additional income.

Higher yield in equity can signal risks in the corporate or industry structure. On balance it is preferable to have securities with growing dividend payments than just high current yield.

The perception is that equity income is delivered only by dividend distributions. However, investors can implement a strategy where realisation of equity can supplement dividend income. Investors should, in this case, be conditioned to realising on a regular basis.

Recommendation: Maintain a disciplined approach to valuation by noting alternative metrics to dividend yield in determine holdings. Balance equity holdings between secure relatively high yield and corporates with forecast growth in free cash flow where dividend increases are likely.

Investors can consider option strategies to complement yield. This can be achieved directly or through funds.

3. Maintain growth and real value

It is likely most fixed interest will have achieved a modest level of capital gain in recent years as yield spreads narrowed. From this point onward it is possible those capital gains will be unwound and if securities are held to maturity, capital losses may eventuate as many are trading above their redemption value.

Recommendation: For investors sensitive to loss of capital value, realisation of selected securities at this time is recommended. We stress that the total return (due to the coupon yield) may be adequate to remain invested.

Short duration (low interest rate sensitive) portfolios combined with a relatively short maturity, will go a long way to allow the fixed interest component of investment assets to hold real value. Further it provides the opportunity to recast holdings relatively quickly when interest rates normalise. Selected fund managers provide such opportunities.

Recommendation: Given modest economic growth and low inflation, real value can be sustained through funds which offer conservative short duration strategies yielding approximately 5%.

Equities are the core of real value, and in our view most investors should be aiming to achieve real returns on a rolling 3-5 year period. This is not as easy as it may appear, given that equity typically has to contribute capital gains in lieu of other asset classes which are unlikely to do so – fixed interest and cash.

The historic volatility of equities means that any data on returns should be treated with some caution as the investment entry point, prolonged periods of high and low returns, regional and sector differences and currency impact have a major bearing on the data. Nonetheless, in general equity returns have been between 6-10% per annum over a 30 year time frame across a range of regional markets. Depending on the inflation rate through the decades, the real return from equities is in the order of 4-6%.

To assess the potential and stability of returns from equities it is worth summarising the key factors:

Nominal economic growth underpinning corporate earnings is typically assumed to be in the order of 2-3% inflation and 2-3% GDP. However, as the chart for Australia shows, the profile has been a lot more variable than the longer term assumption would suggest.

Australian Nominal and Real GDP growth % change yoy

Source: ABS Cat No 5206

The pattern is very similar in the US, but importantly the breadth of the economy and lower inflation have reduced the volatility of growth and the disparity between real and nominal growth. This is one of the reasons the S&P500 tends to trade at higher valuations than the ASX200.

US Nominal and Real GDP growth % change yoy

Source: Reserve Bank of St Louis FRED

Recommendation: In our view it is unreasonable to expect high economic growth in the next few year given the multitude of constraints at this time. Many reports have commented on the particular transitional phase faced by the Australian economy and it is appropriate in our view to discount the probability that the recent mining driven rate of economic expansion continues.

Listed corporations should earn more than nominal economic growth over a cycle as they can use leverage, do not represent a component of low growth sectors largely in the government sector, actively manage their asset base and generally represent better than average business opportunities.

Real returns do require investment to increase the productivity of their asset base. If a company has a high dividend payout ratio, low retained earnings may limit the company’s ability to sustain its real earnings.

This degree of value add from the listed sector is an important assessment of equity returns. In the past 2-3 years, US corporations have been notable in adding value with earnings growth well in excess of nominal economic growth.

Recommendation: We are optimistic that corporations will maintain conservative balance sheets for some time. Debt ratios may rise as companies add assets, but as funding costs are low, debt service cover is expected to be high. On the operating side, we have seen a pattern where management are reassessing their business entities and realising those which do not fit or deliver high enough returns. Finally cost reductions continue to be supported by benign inflation. These issues summarise the core of our positive stance to equities for the next 2-3 years.

Following this tread, there is a much greater emphasis on cash flow and capital management. Naturally investors are keen to receive high dividends and corporates around the world have noted this investment need. In this context, it is important to distinguish the recent strong performance from yield stocks from a concept that high yield will always perform well. Indeed, referring to the expected change in the interest rate cycle in coming years, that is unlikely to be the case unless the company can demonstrate growth in dividends.

Perhaps at times an understated data, yet the valuation tool of choice for many fund managers, cash flow is essence of equities. A corporation which is able to generate internal cash in excess of its ‘stay in business’ needs, can then make decisions on reducing debt, growing its business, distributing to shareholders or buying back its equity. It is important that the application of free cash flow is appropriate to the business and the conditions that reign at that time.

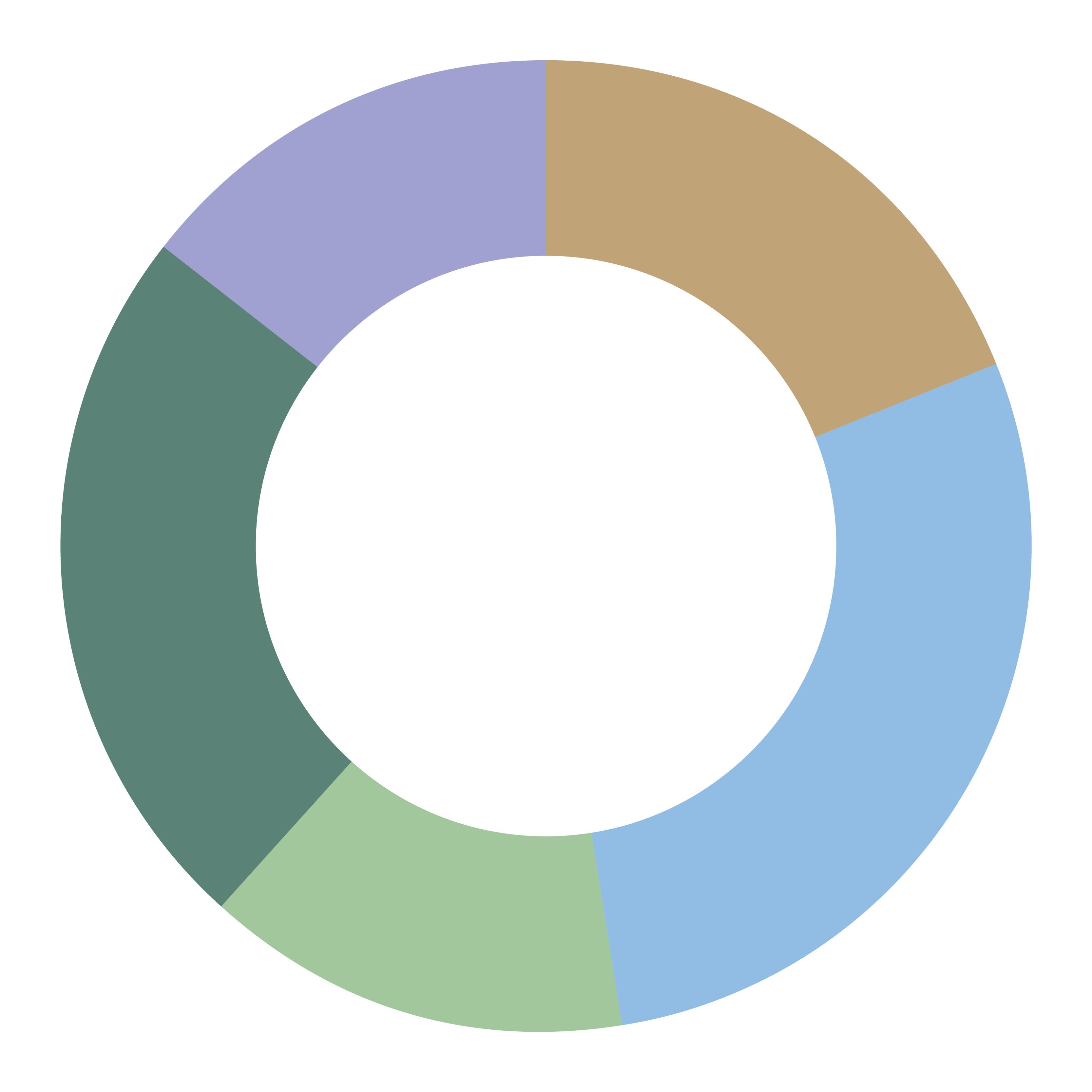

Australian companies have skewed cash flow to dividend payouts such that the payout ratio of earnings now averages approximately 80%. This does benefit shareholders in providing relatively high income and, for many, additional income from the franking component. However it is worth bearing in mind a large proportion of investors (funds and global participants) do not value franking credits.

The global payout ratio is in the order of 45% and in the US is touching just 30%, with many companies electing not to pay dividends or to undertake buybacks in preference. Buybacks have the advantage that they are flexible and a company can dial up and down the buyback depending on the share price, shorter term cash flow and capital needs. A buyback can increase shareholder value through its impact on the balance sheet and lower share count.

[image 4]

Recommendation: Corporate cash flow and management is expected to make a better than historic average contribution to equity returns. Australian equities have the benefit of high payout yields which may in turn restrict capital growth; in other domains yields will be lower but with greater potential growth. Take a cautious stance to higher yield equities given likely operating pressures.

The final component of equity return is valuation or the P/E ratio applied to earnings. While many try to find a mechanistic way of judging the P/E the market should trade at, history shows that P/E’s vary greatly over time and are far from predictable. Those who read widely in financial markets will see reference to Shillers P/E, a 10 year trailing valuation intended to capture cycles. Others will use ‘through the cycle’ P/E, 1 year forecast or longer time frames. Even the earnings used for reference is often subject to adjustment. Our view is to use a range of valuation metrics – P/E for stocks and sectors rather than the market to recognise different conditions, assessment of the expected earnings growth, dividend growth, discounted cash flow and dividend discount models.

Recommendation: Equity markets are about fair value at this time. Recognising that markets are very rarely at this level, we are comfortable taking the view markets are likely to move into an overvalued range in the coming year or two. This should not be overly concerning, but does imply that returns will be lower than the past couple of years, and that setbacks and volatility are likely to rise. Further, sectors can be expected to become more differentiated in performance. Active management of the portfolio with specific attention to long term growth themes should assist in maintaining real asset value.

4. Understanding liquidity

In the event of unexpected disruption to investment markets or changed circumstances for an investor, a high level of liquid assets is required. During a downturn, the inability to realise asset classes or components of a portfolio have wide ranging repercussions. In 2008/9 lockups were enacted as asset managers could not fund redemptions and on the other hand highly liquid assets got sold off to compensate.

Today, investors and fund managers are mindful of any restrictions and restraints on liquidity. To state the obvious, if the underlying asset has some degree of liquidity, it is essential for the investment horizon to accommodate this.

Property is an illiquid asset, and even with an intended date to realise the capital value, this may prove difficult given the unknown market circumstances at the time.

Term deposits are structured as illiquid assets. We believe investors should be paid a return to invest in illiquid assets. The longer the time to realising the asset, the higher the return required. In particular, we would discourage investors from term deposits of more than 12 months, in fact the value for more than six months is questionable.

Recommendation: Investing in liquid low duration fixed interest is a way to keep options available while achieving a higher rate of expected return. The investor has to accept a level of volatility in the unit price. Special rate term deposits are becoming uncommon.

The other aspect of liquidity to consider is the nature and breadth of participants in the market for the assets and securities. Data shows that global investors are starting to realise high allocations to bonds and credit. Given expected returns, there are few buyers and therefore the prices of the bonds are proving more volatile than the fundamentals suggest.

Locally we are conscious of the fact that the bulk of listed hybrids are held by private investors, as institutional investors have chosen to allocate to high yield and other debt securities. Further, these funds generally do not value franking credits and hybrids do not form part of any index against which they are measured. If private investors choose to sell down their holdings for any reason, there are few buyers to take up the slack, and the prices may prove to be volatile at that time, exhibiting equity like characteristics.

Recommendation: It is important investors do not allow an asset class or sub-segment to become a substantial part of a portfolio, especially if it is performing due to short to medium term rather than structural factors. We recommend trimming positions in advance of full value to capture gains and reduce unexpected changes in direction.

5. Managing the costs

The risk/return trade-off is the core of any portfolio and requires careful consideration. Increasing after tax and after fees is gaining attention as a potential source of value.

With the rise in ETFs the investment sector is being subject to heated internal debate on whether managers or individuals can outperform the underlying index. Paying fees to managers is potentially a large ongoing cost.

In our view fees are warranted where the fund can demonstrate a process which over a reasonable period achieves the intended outcome. This may not always mean the fund outperforms the underlying index. An example is an equity income strategy which may underperform the benchmark when growth stocks and small caps rally. Similarly a fixed income fund may target a stable level of return rather than the benchmark.

The level of fees should be commensurate with the uniqueness of the strategy, its ability to consistently deliver its intentions and the complexity of the asset class.

Finally, certain funds charge a performance fee or have a benchmark unrelated to their investment universe. In general, we are not in favour of performance fees even though the intent is to incentivise outperformance. If these fees are able to accrue due to structural issues rather than informed judgement, they are clearly an unattractive outcome. An example is an Australian small cap manager measured against the small cap index which includes a sizable pool of resource stocks it also specifically precludes from its mandate. Certain funds use a cash benchmark while the volatility of the fund is inevitably much higher than cash. We believe these are in most cases inappropriate.

Recommendation: On balance, a combination of direct holdings, select global equity ETFs and judicious use of funds can create an outcome which limits fee leakage while reducing investment risk by outsourcing to specialists. On the other hand fees should not limit the asset allocation in particular an aversion to realising direct Australian equities in order to invest in global options.