-

Finish line in sight:

The finish line for the event that stopped the world came into sight in the fourth quarter of 2020 after three potential COVID-19 vaccines showed promising test results and later were cleared for emergency use in several countries. Mitigating the event that sent the world into a tail spin in March clears the way for a cyclical recovery. Over the quarter we saw emerging markets outperform developed; small cap companies outperform large; and the heavily sold-off value stocks outperform growth.

1. Emerging has emerged

The COVID-19 crisis was a global event that resulted in a global economic recession (93% of global economies fell into recession in 2020) that called for a global policy response ($20 trillion in fiscal and monetary stimulus). Coming out of the event will result in a global economic recovery.

Synchronised growth recoveries are not only rare they are particularly supportive for emerging markets. Synchronous growth creates a positive feedback loop for emerging economies. With developed markets accounting for 60% of emerging-market exports, as import growth accelerates in the former, exports rise in the latter boosting income which in turn supports domestic consumption.

Chart 1: Emerging market growth follows the US consumer

Source: Bloomberg

2. Small is big

If the end is indeed in sight for the event that stopped the world, then it is highly likely that the trough for this economic cycle is in. There is a strong historical precedent, looking back over the past 90 years and 14 recessions, for small companies to outperform large at this point in the cycle. The outperformance is longer and larger following major market meltdowns such as what we experienced early in 2020.

Chart 2: Small vs large cap indices post market meltdowns

Source: Bloomberg

3. Value has value

Talk of a “rotation trade” out of growth stocks and into value escalated following the vaccine news in November. An effective vaccine could bring the global economy back to life, helping sectors that were battered by the pandemic and boosting cheap stocks. In our view, the outperformance of value over the quarter was more a catch-up trade than anything more long-lasting. The key ingredient for value to consistently outperform remains absent ie higher official interest rates.

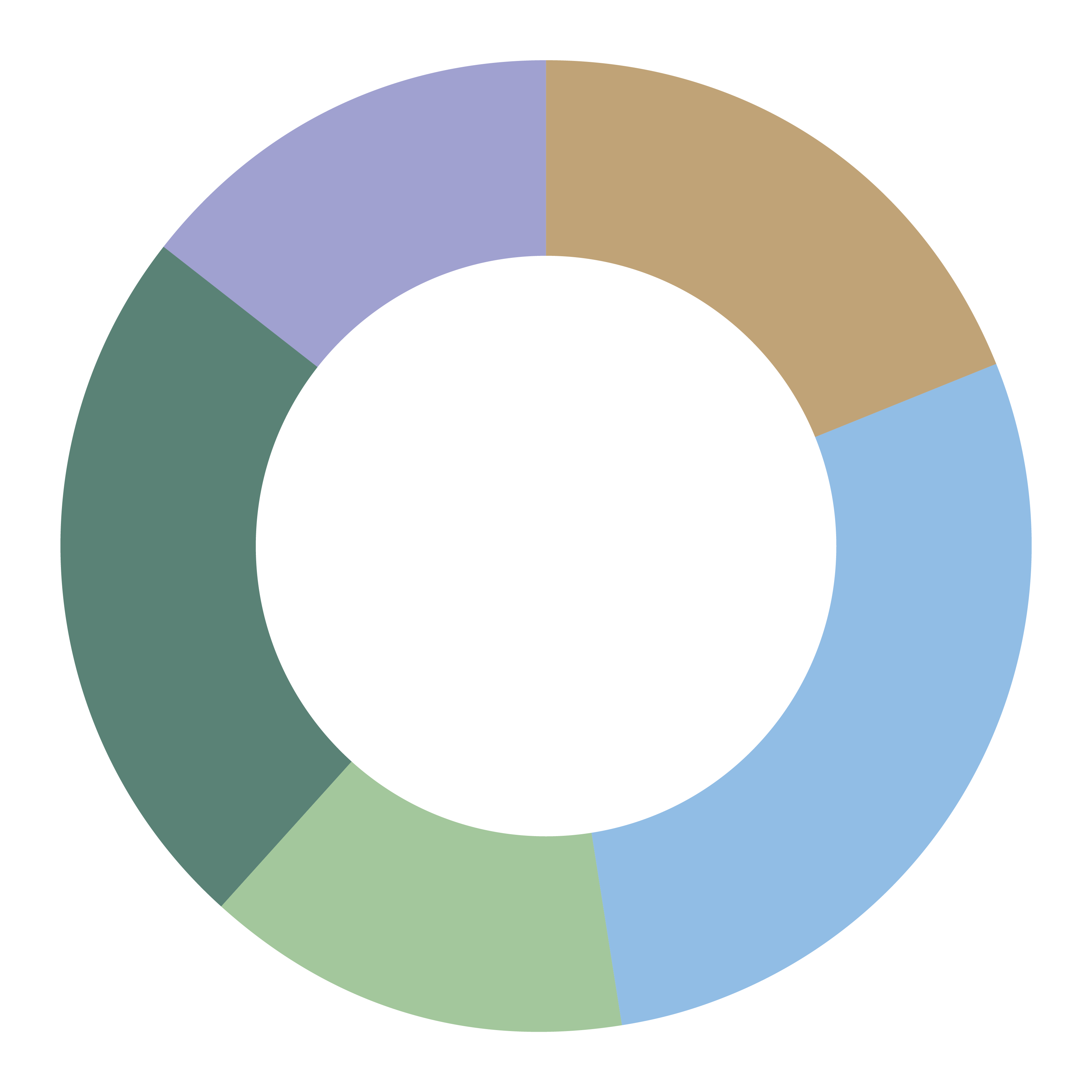

Chart 3: Ratio of Russell Value Index to Russell Growth Index (Index: 1/10/20=100)

Source: Bloomberg

-

Australian Equities

– The Australian equity market’s recovery out of the COVID-induced economic disruption continued in the December quarter, with benchmark indices posting strong gains and leading to a slight positive return for the calendar year.

– Newsflow throughout the quarter was very positive for equities. Victoria was able to get on top of its second wave of COVID cases while other states kept case counts contained; the Federal Budget provided ongoing stimulus to support the economic recovery; while the Reserve Bank cut the cash rate rate to a record low of 0.1% and introduced a quantitative easing program.

– Key commodity prices, particularly iron ore, continued to rebound, underpinning the returns of the resources sector.

– The key catalyst, however, was undoubtedly the announcement of positive news on the COVID vaccine front, paving the way for a domestic rollout starting from February.

– The vaccine announcements in November were the catalyst for one of the more significant and sharpest rotations in market leadership seen for some time. With uncertainty and downside earnings risk receding, low PE ‘value’ stocks and those most impacted by COVID lockdowns rallied the most, while defensive and growth-orientated stocks underperformed.

– Among our large cap strategies, the Pendal Australian Shares SMA was able to navigate this environment the best, outperforming the benchmark index. Strategies with more of a focus on growth stocks, such as Bennelong Concentrated and Selector, lagged the market, detracting somewhat from the strong alpha generation in prior months.

– The drivers of small cap stocks were similar to their large cap counterparts, with the Small Ordinaries Accumulation Index generating an almost identical return to the ASX 200 Accumulation Index. ‘Value’ stocks and those most leveraged to economies reopening performed the best, while a strong resources sector (ex-gold) provided a challenging environment for relative performance for many small cap managers.

– These settings were ideal for Spheria’s funds, with the Smaller Companies and Microcaps both generating solid outperformance. Other managers, with more of a growth bias, lagged as expected, although performance across the calendar year was generally quite good.

-

International Equities

– Global equities were up 13.6% in the December quarter 2020 leaving the annual performance for the year up 14.1%.

– For the second consecutive quarter, emerging markets outperformed developed markets with the former rising by 19.3% over the final three months of the year for an annual return of 15.8%. This was driven by the tech-heavy South Korean market (up 23.4%) and the highly cyclical markets in Brazil (up 25.8%) and Spain (up 20.2%).

– For the first time since the December quarter 2018, value outperformed growth. The Russell 2000 Growth Index rose 11.2% over the quarter compared to a rise of 15.6% for the Russell 2000 Value Index. It is no surprise then that the US market underperformed its major developed market peers in Europe and Japan. France and Italy both put on 15-16% while the Japanese Nikkei added 18.4%.

– The Australian dollar rose 7.4% against the US dollar in the quarter to be up 9.6% over the year. The rise in the dollar meant hedged international equity funds outperformed unhedged over the three months.

– Pleasingly, most of our international equity managers generated positive returns and outperformed the overall market in the quarter. The one standout was the negative return for the Magellan Global Equity Fund. This was due to the Fund’s position in Alibaba which fell over the quarter following the anti-trust actions by the Chinese authorities.

– In general, our small cap funds outperformed our large cap managers; our emerging market funds outperformed our developed market funds; and our hedged managers outperformed unhedged in the quarter. The best performing fund was the RWC Global Emerging Markets Fund. The net return of 25.8% was helped by the Fund’s exposure to the electric vehicles and e-commerce markets in China (via holdings in Nio, Huayou Cobalt and Pinduoduo) and oil and iron ore producers in Brazil (via holdings in Petrobas and Vale).

-

Fixed Income

– The RBA cut the cash rate in the quarter and also introduced a quantitative easing program for longer dated bonds. This occured despite the strength of the domestic recovery surprising to the upside.

– In Europe, an escalation in new COVID-19 cases saw investors move to the relatively safety of fixed income. Bond yields as a result moved lower. In contrast, bond yields in Australia and the US finished higher by 18 and 23 basis points respectively. This move up in yield capped the performance of government bond funds such as the Legg Mason Western Asset Bond Fund.

– Credit-oriented funds performed better as credit spreads continued to retrace lower after the blowout in March. Bentham with its large allocation to bank loans and high yield was a standout in this regard.

– The allocation to investment grade credit was the largest contributor to performance for Macquarie. Investment grade credit spreads narrowed over the quarter.

– Our low risk liquidity managers Ardea and Realm performed as expected with Ardea adding 0.8% net while the Realm High Income Fund added 1.6%. The Realm Short-term Income Fund also added 0.8% over the quarter. Positive fund flows continue into this fund with its size now sitting at $132m.

– The PIMCO Global Bond and Global Credit Funds benefited from the allocation to senior and subordinated financials, agency and non-agency mortgage backed securities and a preference for duration in Eurozone peripherals, particularly Italy where yields fell 32 basis points over the quarter.

-

Alternatives

– The rotation observed in equity markets over the quarter was a key driver for long short hedge fund managers with those that had underperformed year to date benefitting from the rebound in cyclical sectors of the market. Platinum International (+13.3%) and Antipodes Global Fund (+9.3%) were two such beneficiaries with many out of favour stocks rising significantly in the travel, industrials, and consumer cyclical sectors.

– This rotation was seen to be a relative move rather than an absolute rotation given growth stocks still managed to post positive returns for the quarter. Munro Global Growth (+7.2%) benefited from allocations to structural growth themes like climate change through Orsted and Vestas and high performance computing through TSMC and ASML.

– Market neutral manager Bennelong Long Short suffered most from the relative rotation as some of the fund’s strongest pairs year to date reversed direction on the catch-up trade for many value stocks.

– Private equity funds posted strong three month returns to the end of November as both Partners Group and Hamilton Lane were up 8.31% and 8.25% respectively with private market activity picking up into the year end. Drivers of performance for both came from direct equity holdings in healthcare, education platform providers and software industries.

– Emerging companies manager Alium Alpha posted a strong end to the year with the portfolio up 6.23% in the quarter. The fund benefited from positions in unlisted companies Koala and Beforepay, both completing capital raisings at a premium to previous valuations. IPOs for Cleanspace and Cashrewards also added to performance for the fund over the quarter.

– In direct property, Barwon Healthcare Property Fund and Charter Hall Direct Office Fund posted quarterly returns of 1.33% and 5.37% respectively. Barwon Healthcare paid a quarterly distribution of 1.26% and reported 100% rental accruals over the December quarter. Charter Hall continues to benefit from a higher allocation to A grade office buildings with above average lease terms and a strong tenant profile with the 12 month yield on the portfolio currently 5.6%.

– Private debt manager Merricks Capital returned 2.0% for the three month period ending 30th November and had a twelve month return of 10.2%. Loans to the agriculture and residential construction industries contributed positively to performance in November.