-

Overview

The way we invest is being revolutionised. Within the next three to five years, private wealth clients will have the option of investing in funds that sit inside their ‘digital (that is, on the blockchain) wallet’. This brings significant benefits for investors – immediate settlement, lower cost, higher returns, and so much more.

The ability for investors to do this has been around for some time. Using the analogy of a railroad – the tracks had been laid in the form of blockchain. This has been around for the past 15 years or so. The train and its associated shipping containers have been around for around 10 years in the form of tokenisation. Even the currency to pay for the cargo in the form of stablecoins has been around for 6 years.

Despite all of this, the willingness of investors, particularly high net worth and institutional investors, has been absent. Tokenisation turned real world assets into investable products. Stablecoins gave investors the ability to transact in those funds ‘on–chain’ instead of using ‘off–chain’ cash. The missing piece was regulation to give confidence in the ‘on–chain’ way of investing.

That has now changed with the GENIUS Act.

U.S. law enacted in July 2025 created a federal regulatory framework for U.S.–dollar–pegged stablecoins. This legislation requires stablecoins to be backed 1:1 with cash or short–term high-quality assets.

—

T+0 – The settlement time for ‘on-chain’ investing

Source: SEC, December 2025

—

Specifically, the Act:

- makes stablecoins a regulated payment asset

- it allows regulated banks, credit unions and qualified non–banks to issue and handle stablecoins.

The legislation finally gives regulatory certainty for stablecoins in the U.S., something institutions have long awaited.

To borrow another analogy, the early invention of the internet only allowed bank customers to check their balances online. They couldn’t transact because banks couldn’t safely move money. That changed with the introduction of end–to–end encryption and methods of verifying identity online. Now we move money online every day.

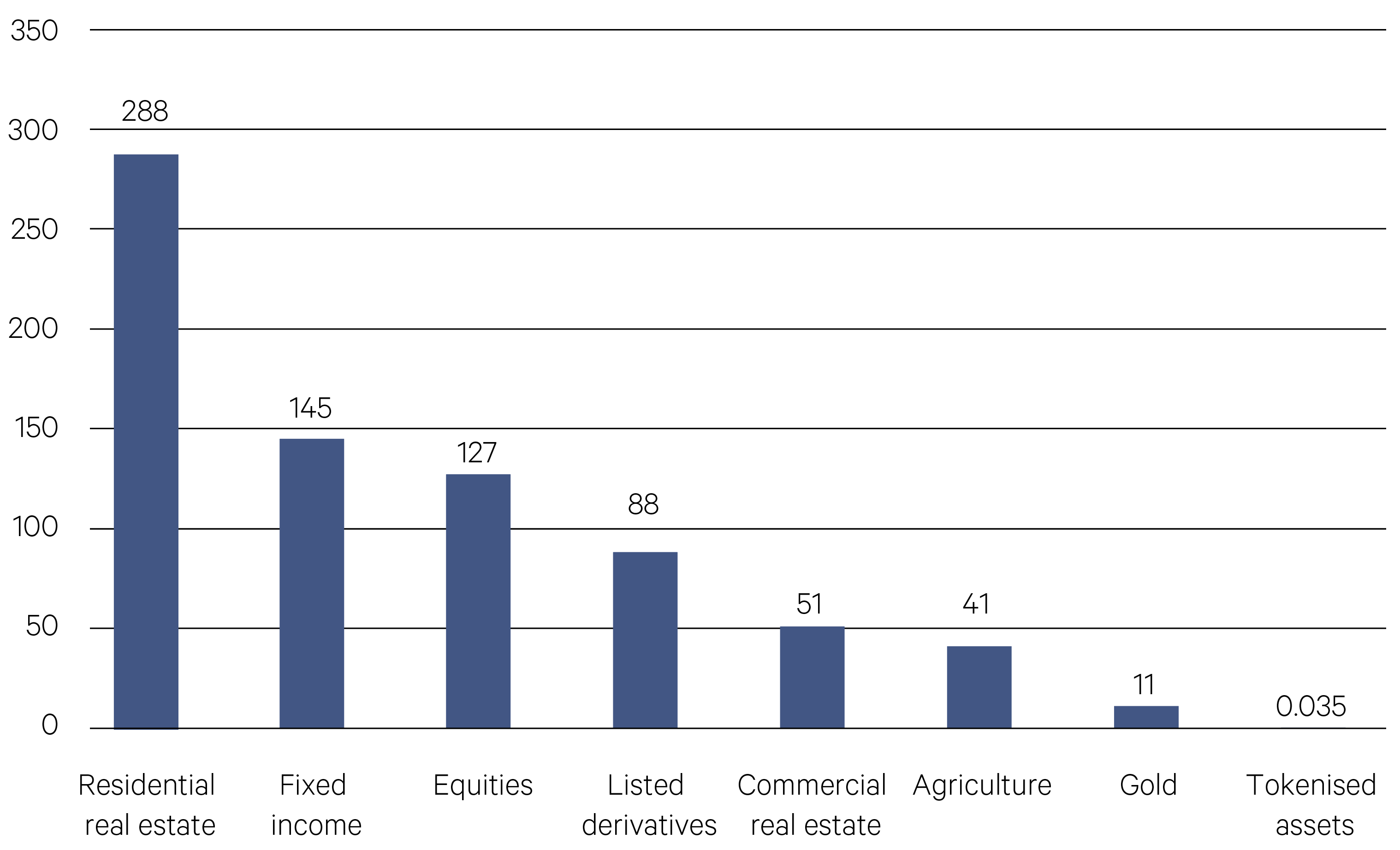

Tokenised assets vs traditional markets ($UStr)

Source: Greyscale Investments

In the same way, the regulation of stablecoins gives confidence to transact ‘on–chain’.

Stablecoin–specific legislation and regulatory frameworks are now being adopted or worked on in other jurisdictions including Australia.

Asset managers are responding with more and more funds being tokenised. In March 2024, BlackRock launched an Ethereum–based tokenised money market fund. Within a year of launch it had reached US$1 billion in size. Today it stands at almost US$2 billion. Blackrock’s digital assets under management currently stands at US$80 billion.

J.P Morgan, Amundi, Franklin Templeton, Janus Henderson, Fidelity, Goldman Sachs and Bank of New York Mellon are also developing tokenised funds. Nasdaq has also sought approval to allow tokenised stock trading on its exchange in an attempt to address the inefficiency caused by T+1 settlement for public equities.

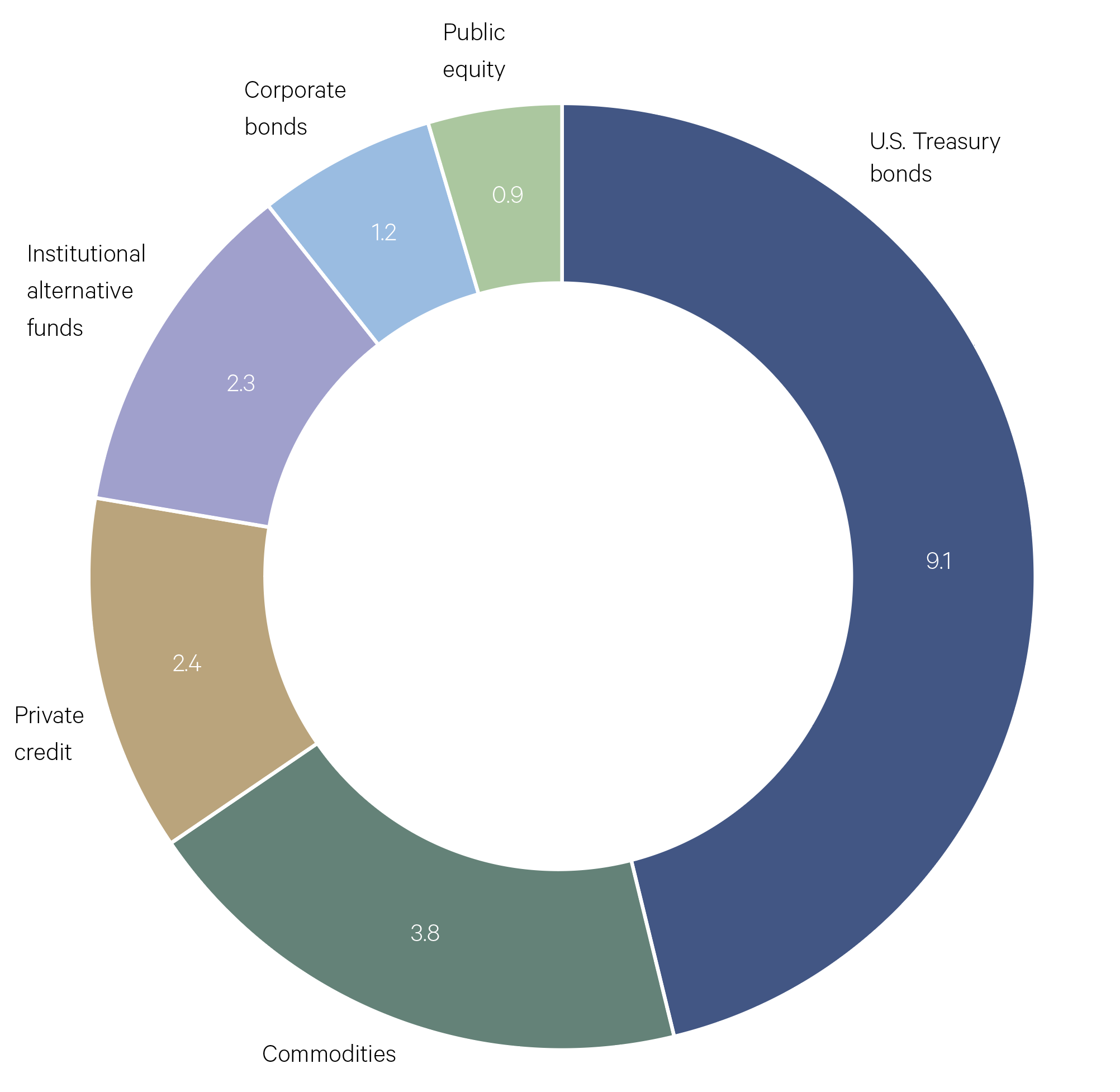

Tokenised real world assets ($USbn)

Source: RWA.xyz as at 17/01/2026

According to RWA.xyz the tokenised asset market was worth US$2.9 billion in 2022. By November 2025, it was worth US$36 billion. Most of that growth has been concentrated in private credit and U.S. Treasuries, which together account for nearly 90% of tokenised value. By 2030 it is expected to be in the trillions.

What does this mean in real life for investors?

- Less friction: Currently, managed funds come in different structures and sit on platforms – Australian Unit Trust, Cayman, UCITS, etc. Accessing some of these structures is difficult, time consuming and can be costly. Tokenisation simplifies operations and streamlines distribution. Funds will move from being platform based to being ‘wallet’ based.

- Bigger universe of funds: It significantly opens up the universe of possible funds clients can invest in. For example, an Argentine fintech startup lets soccer clubs sell tokens to invest in the careers of individual footballers and earn a cut of any transfer fees.

- Higher returns: Settlement period moves from T+3 for most funds to T+0. This means less cash drag and therefore higher returns.

- Shift operational risk: Assets will be held by a digital custodian in ‘w allets’ controlled by ‘keys’. Operational risk becomes more about technology and ‘key’ governance and less about people and process failure.