-

Overview

The space industry has transitioned from a once government–centric sector to a dynamic and commercially oriented field. The space economy comprises a wide array of activities, technologies, and services that integrate space-based capabilities with practical terrestrial applications, such as satellite communications, global positioning systems, earth observation, and new initiatives including space tourism and asteroid mining.

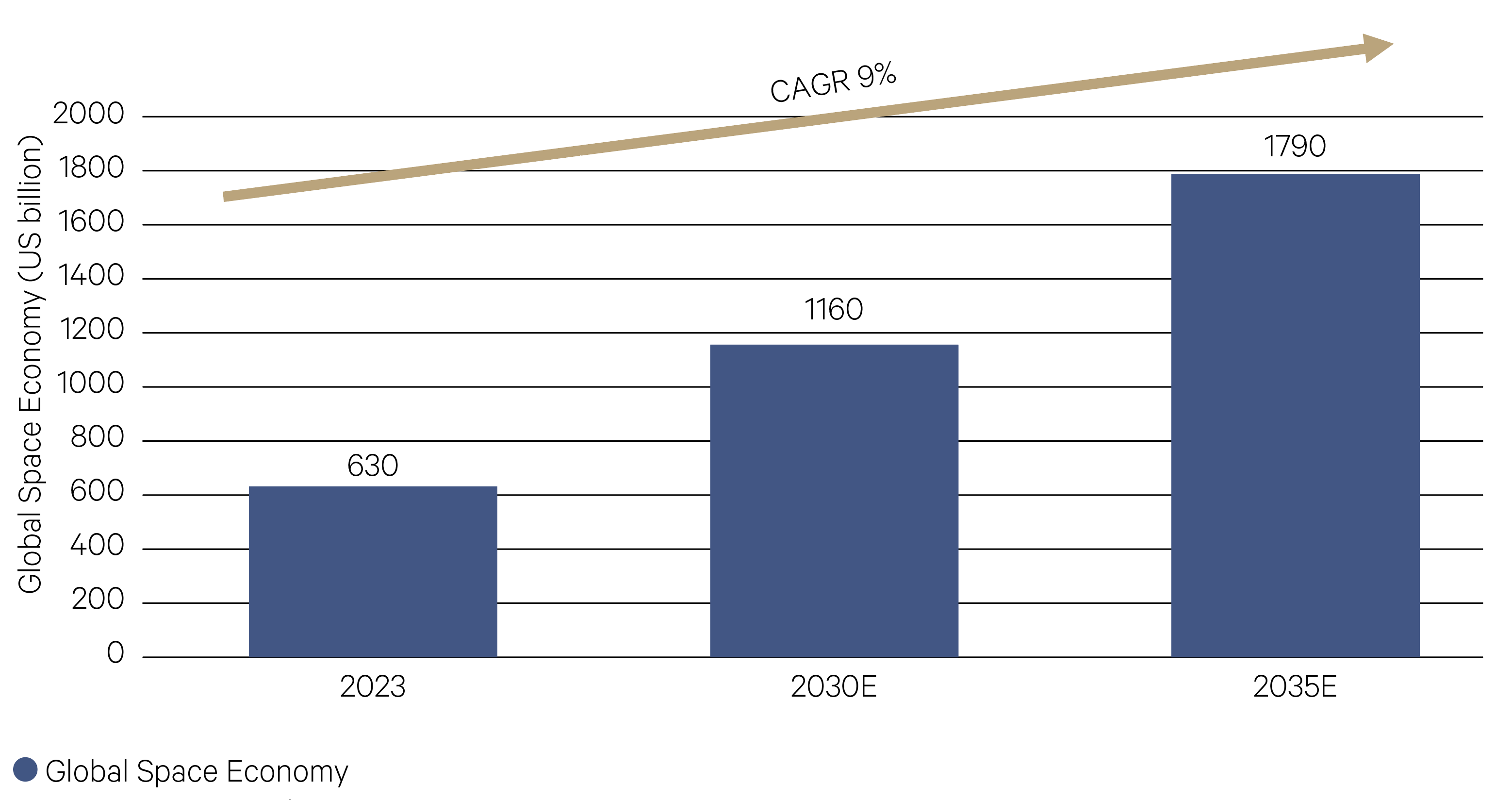

McKinsey & Company projects the global space economy will rise from US$630 billion in 2023 to almost US$1.8 trillion by 2035, with a yearly growth rate of 9%.

This figure covers both backbone applications like satellites, launchers, broadcast TV, and GPS, as well as reach applications where space technology helps businesses generate revenue. For instance, Uber uses satellite signals and smartphone chips to link drivers with riders and offer directions.

—

US$1.8tr – forecast size of global space economy by 2035.

Source: McKinsey & Company

—

Expected growth of the global space economy

Source: “Space: The $1.8t opportunity for economic growth”, McKinsey & Company

Several factors are driving the acceleration of the space economy which is built across multiple segments.

- Infrastructure and advanced technologies like AI, machine learning, sensors, and cloud computing are helping extract valuable insights from satellite data. When you use services such as Google Maps, satellite TV, or check the weather, you’re relying on this technology. Examples of satellite data applications include climate risk modeling for insurance, shipment tracking in logistics, infrastructure monitoring for utilities, and precision farming in agriculture. For instance, U.S. corporation John Deere collaborates with SpaceX to provide satellite internet for advanced agricultural practices in remote areas.

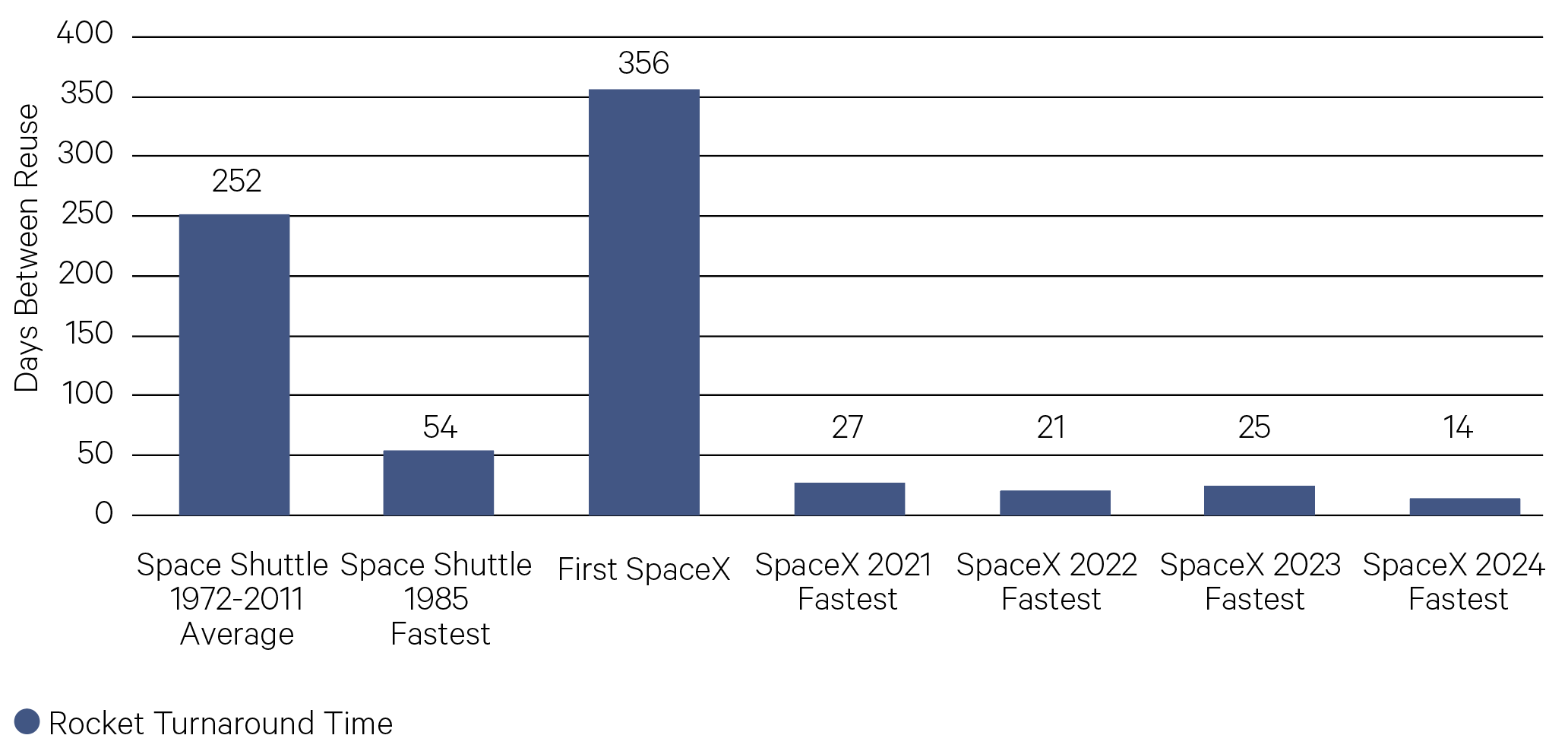

- Within manufacturing and launch services, the cost of accessing space has been declining steadily over the past decade thanks to innovations in rocket and launch technologies. Notably, reusable rockets have drastically reduced launch costs. Founded in 2002 by Elon Musk, Space Exploration Technologies – better known as SpaceX – pioneered reusable rocket technology. Today, SpaceX is the world’s second-most valuable startup after OpenAI and anticipated to pursue an IPO in 2026 with a possible valuation of up to US$1.5 trillion.

- The frontier segment covers ventures like space tourism and lunar missions, aiming to commercialize human spaceflight. Companies such as Blue Origin and Virgin Galactic are building experience to make space travel more accessible.

Rocket turnaround time

Source: ARK Investment Management

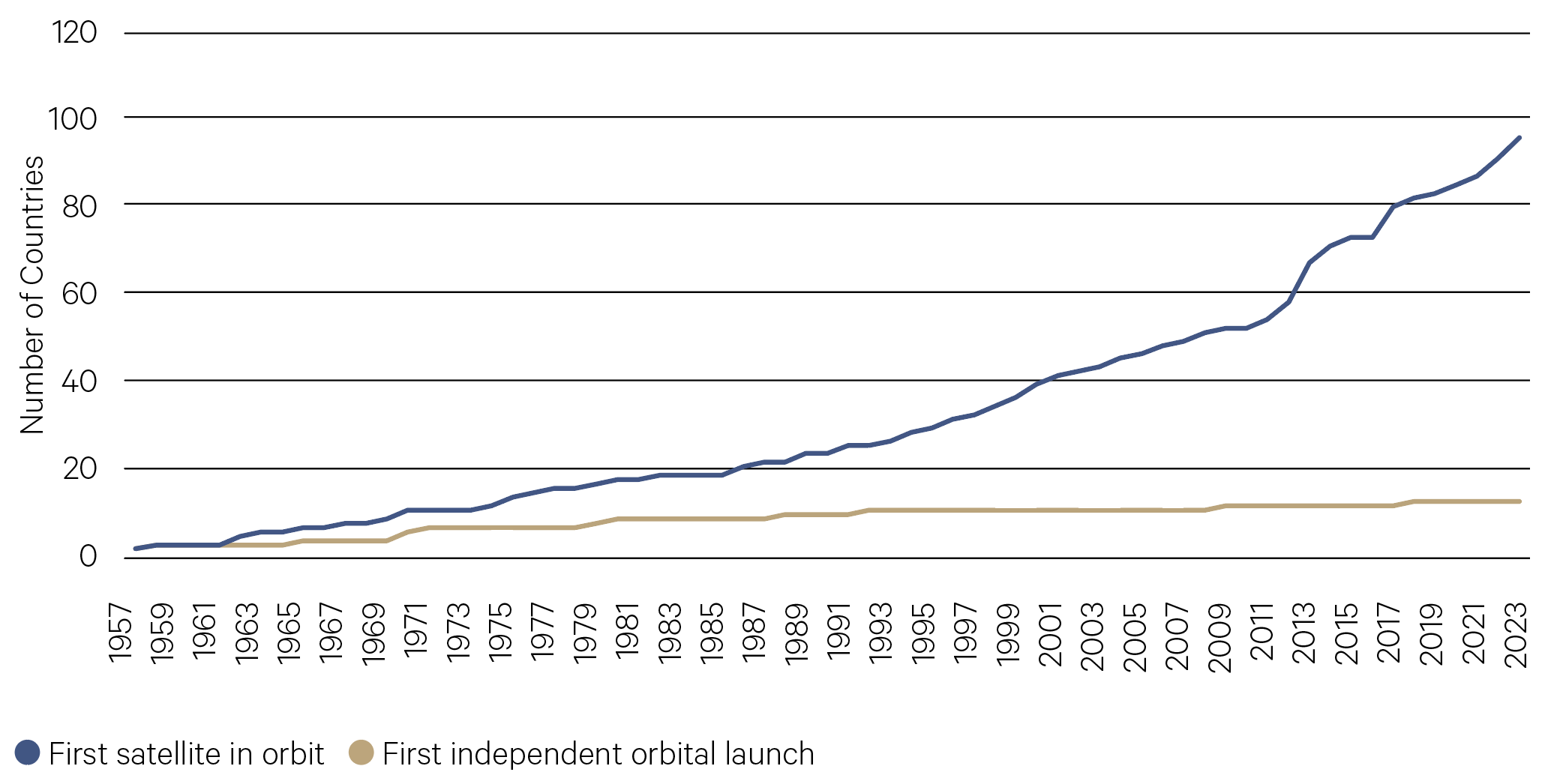

Number of countries with satellites in orbit, 1957-2023

Source: Organisation for Economic Co–operation and Development (OECD), The Space Economy

—

US$47bn – private capital invested in space startups since 2015.

Source: Norton Rose Fulbright

—

The financing landscape for space technology is evolving, blending government investment, public–private partnerships, and private capital. Public spending still far exceeds private capital and is crucial for supporting new ideas and projects.

Government spending exceeds US$135 billion a year, with more than half going to defense. This funding supports early-stage research, national security, and major infrastructure. Recent policies like the U.S. Executive Order on space superiority and the EU Space Act highlight increased backing for commercial space and regulation. By late 2023, almost 100 countries on four continents had operated a satellite at some point in time, with a distinct jump after 2012.

Likewise, public–private partnerships, led by NASA and the European Space Agency (ESA), are accelerating adoption and reducing risk for early-stage ventures.

Investors can access the space sector through public or private markets. Public markets offer ‘pure play’ space stocks like AST and SpaceMobile, which derive most revenue from space activities, as well as ‘indirect’ options such as Boeing, Lockheed Martin, Northrop Grumman, and Raytheon Technologies, which have diversified portfolios but also invest in space.

Private markets, venture capital, private equity and infrastructure can all provide access to the space technology sector.

Since 2015, over US$47 billion of private capital consisting of equity, debt and acquisition finance has been invested in space startups and growth-stage companies, with venture capital accounting for the majority.

With costs declining, demand broadening, and applications multiplying, space technology is transitioning into a mainstream commercial platform. With a potential SpaceX IPO on the horizon and major governments increasing space and defense spending, the next decade is expected to be a defining period for the industry, offering significant opportunities for investors as space technology becomes increasingly embedded in everyday industries.