-

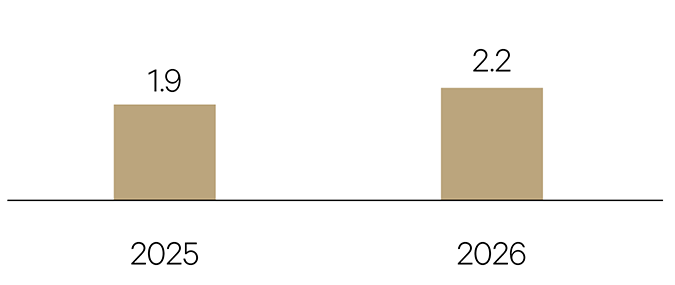

United States

There is potential for upside surprise to growth in the U.S. economy in this mid-term election year. The drag from trade policy uncertainty is fading, fiscal policy is expansionary, AI adoption is broadening, and a combination of productivity acceleration and softer hiring will keep monetary policy accommodative.

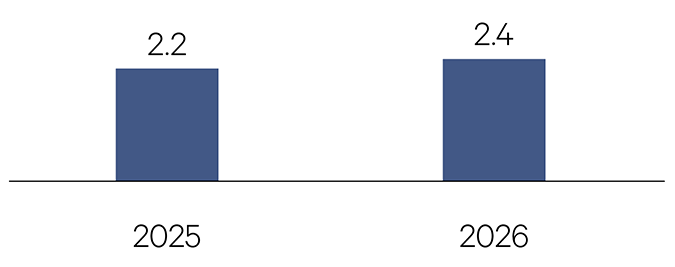

GDP %

-

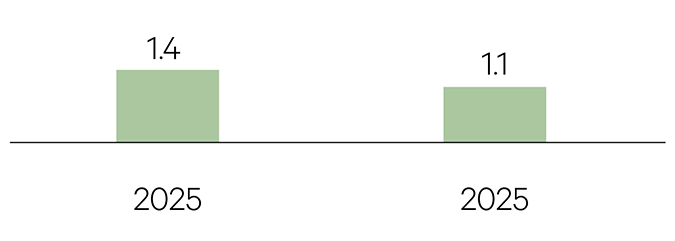

Europe

Eurozone growth is likely to remain weak despite increased defence spending in Germany. The potential for a stronger euro will be a headwind. Inflation will likely undershoot the 2% target, keeping rate cuts on the agenda.

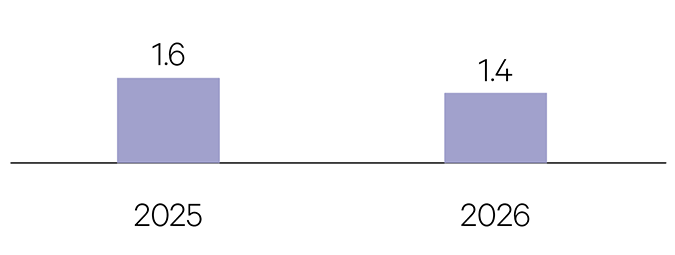

GDP %

-

China

China is expected to deliver annual growth near the government’s target of 5% in the near–term as it intensifies its efforts to open–up to foreign investment. The government vows fiscal policies will be more active, with a focus on expanding domestic demand and productivity.

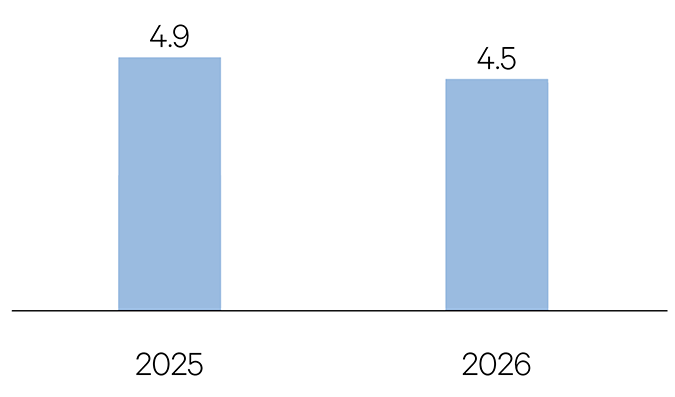

GDP %

-

Japan

Growth in Japan may surprise to the upside as the new populist Prime Minister brings down the largest stimulus package since COVID and reboots defence spending and investment in nuclear energy generation. This will likely leave monetary policy biased toward tightening further.

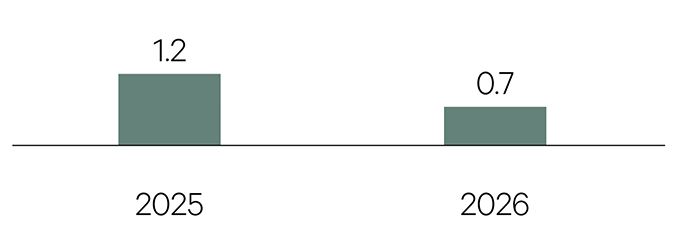

GDP %

-

Australia

The Australian economy is on an improving trend, with consumer and business spending showing resilience. The labour market has softened over the last six months, with some spare capacity opening up, but hiring intentions remain robust. This means interest rates are likely on hold for much of 2026.

GDP %

-

United Kingdom

The UK economy continues to stagnate with activity and labour markets weakening. Growth drivers are likely to shift from fiscal to monetary policy during the year as higher taxes drag on growth. Expect interest rates to be cut.

GDP %

Source: Bloomberg, consensus data as at 31/12/25