-

Overview

Alternative assets continue to play an increasingly important role in helping to diversify portfolios and gain access to different types of exposures not otherwise available through traditional investment markets. EY estimates that global alternatives will exceed US$23 trillion by 2026 (up from US$20 trillion in 2024).

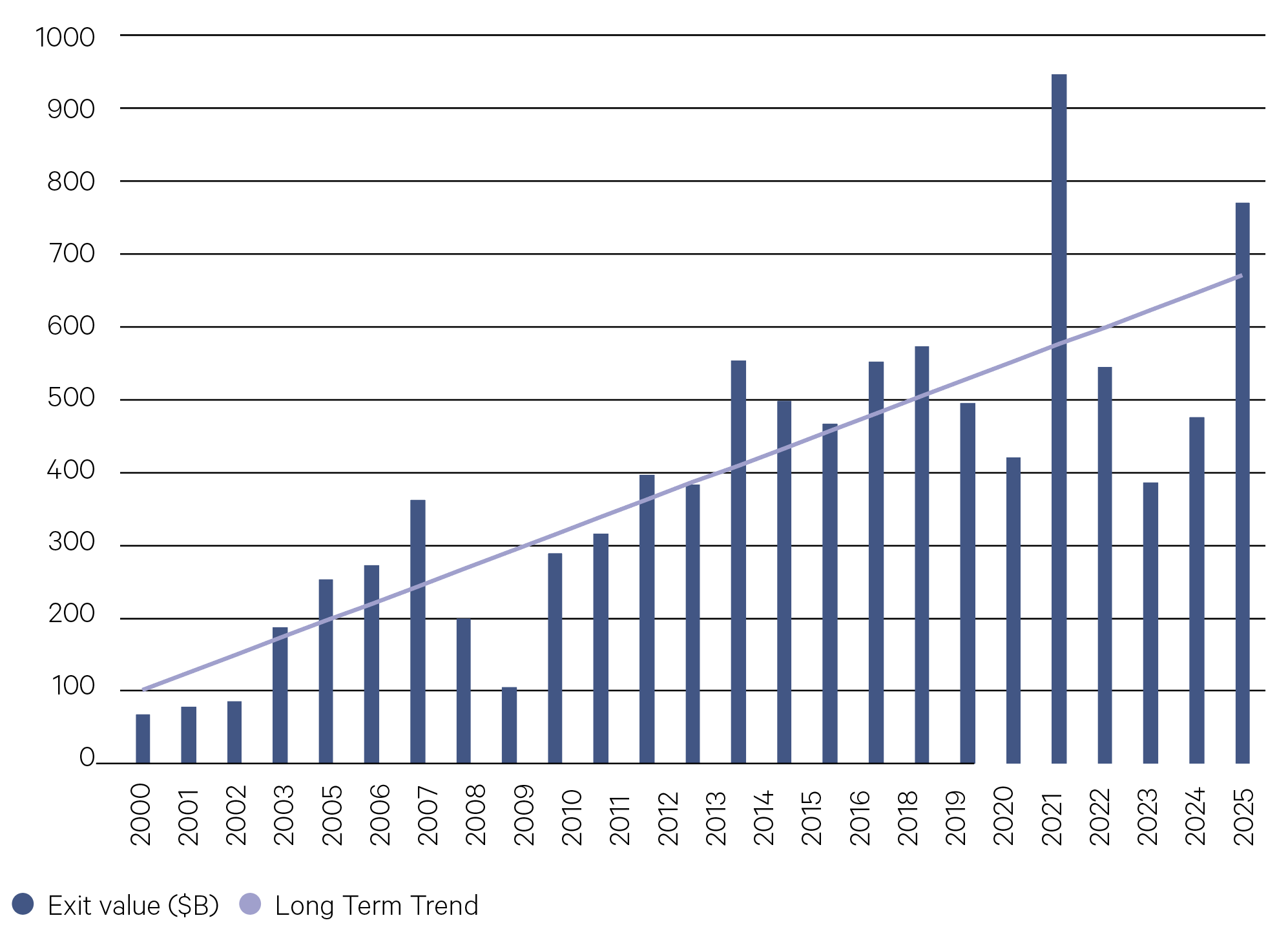

Private equity

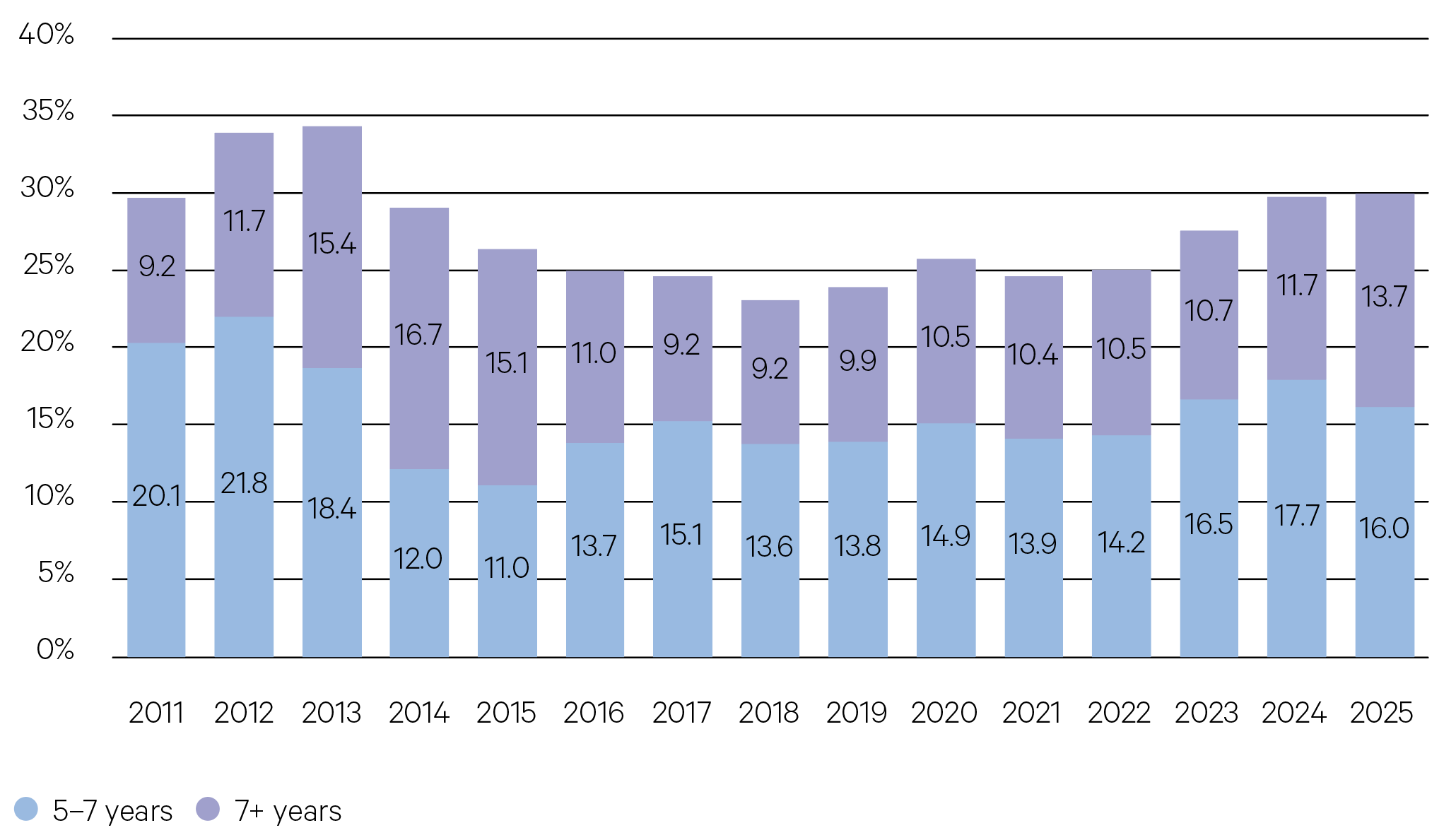

Private equity investment and exit volumes, after several years of slower activity, have picked up momentum globally. In 2025, there has been a significant rebound in both exits and values, surpassing previous trends. This positive trajectory is likely to persist into 2026, thanks to better conditions for mergers and acquisitions, lower interest rates, and growing interest from buyers. Investment hold periods have also shortened; the typical PE buyout now lasts six years, compared to 6.4 years in 2024 and seven years in 2023.

U.S. and European mid–markets are presenting attractive opportunities, as debt financing multiples have dropped compared to earlier years. Additionally, a revival in IPO activity and closer bid-ask spreads between sponsors are fuelling further growth. Private equity is expected to maintain its momentum in 2026, with opportunities across a range of sectors.

U.S. buyout exit value ($USbn)

Source: Pitchbook, 30/9/2025 (extrapolated to 31/12/2025)

Holding period of U.S. buyout backed companies (%)

Source: Pitchbook, 22/10/2025

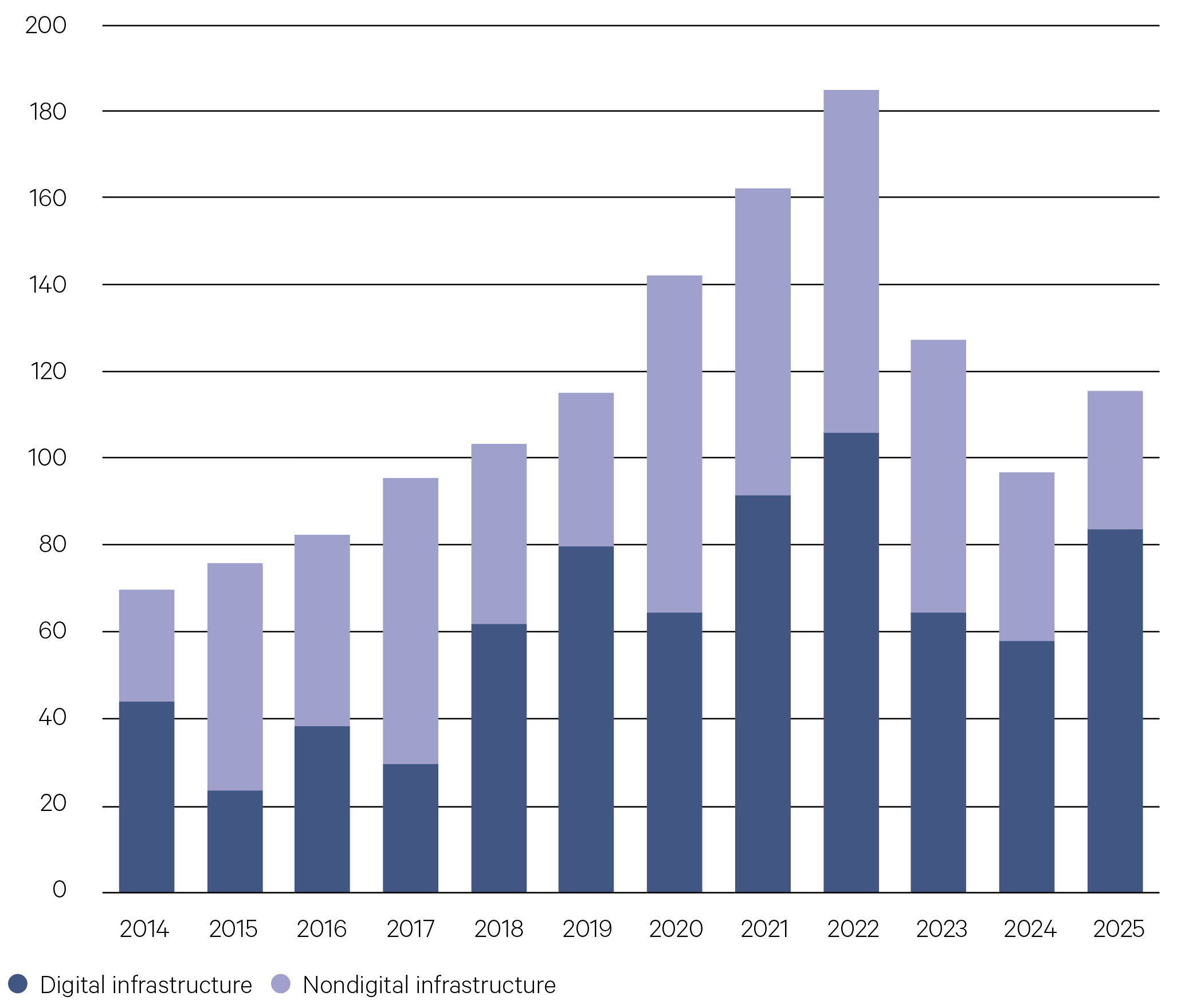

Infrastructure

Real assets such as infrastructure are increasingly attractive in the current macro environment. Many infrastructure investments are underpinned by long-term contractual cash flows that include inflation-adjustment mechanisms. This enables income streams to rise in tandem with inflation, preserving purchasing power and supporting real returns.

Secular trends including AI–driven data center demand, energy security, and power generation underscore the sector’s long–term structural strengths. The increasing requirement for powering AI computing is reshaping projections for global electricity consumption. By 2030, worldwide electricity usage by data centers is anticipated to exceed Japan’s total electricity consumption in 2024.

The demand for AI computing and associated data centres has also introduced an interesting new dynamic that includes non–IT areas and providing a range of investment opportunities across:

- Property (e.g. land, asset ownership, and facility leasing)

- Infrastructure (e.g. cooling systems, water supply, communications equipment, and backup power)

- Energy (e.g. grid interconnection, collocated power generation)

Accelerating adoption of AI and non–AI technological needs and the corresponding appetite for power will require both renewable and conventional energy. Datacenter global electricity demand is expected to more than double from 415 terawatt-hours (TWh) in 2024 to 945TWh by 2030, reaching 3% of total electricity consumption. This has wide–ranging implications for infrastructure and energy investments.

Infrastructure capital raised by investment type ($USbn)

Source: Pitchbook, 22/10/2025

—

Electricity demand from global data centres is expected to more than double by 2030.

Source: Pitchbook Q3, 2025

—

Private credit

Private debt fundraising continues to see strong inflows, with steady deployment and repayments. Although returns have moderated as base rates normalize, market conditions remain favourable: leverage and default rates are low, and downgrades are moderate. We favour globally diversified sectors— software, healthcare, business services, education, and consumer staples— which offer many opportunities.

Despite rates declining, yields remain at attractive levels and private credit continues to present a compelling risk return profile.

Hedge funds

Hedge funds are well positioned to adapt in today’s market environment. More normalised interest rates, higher stock volatility, and wider equity market dispersion, support a favourable setting for alpha generation, making the current environment attractive for hedge funds. Ongoing equity market volatility is providing stock–specific opportunities for both long and short investments across all market caps.