-

Overview

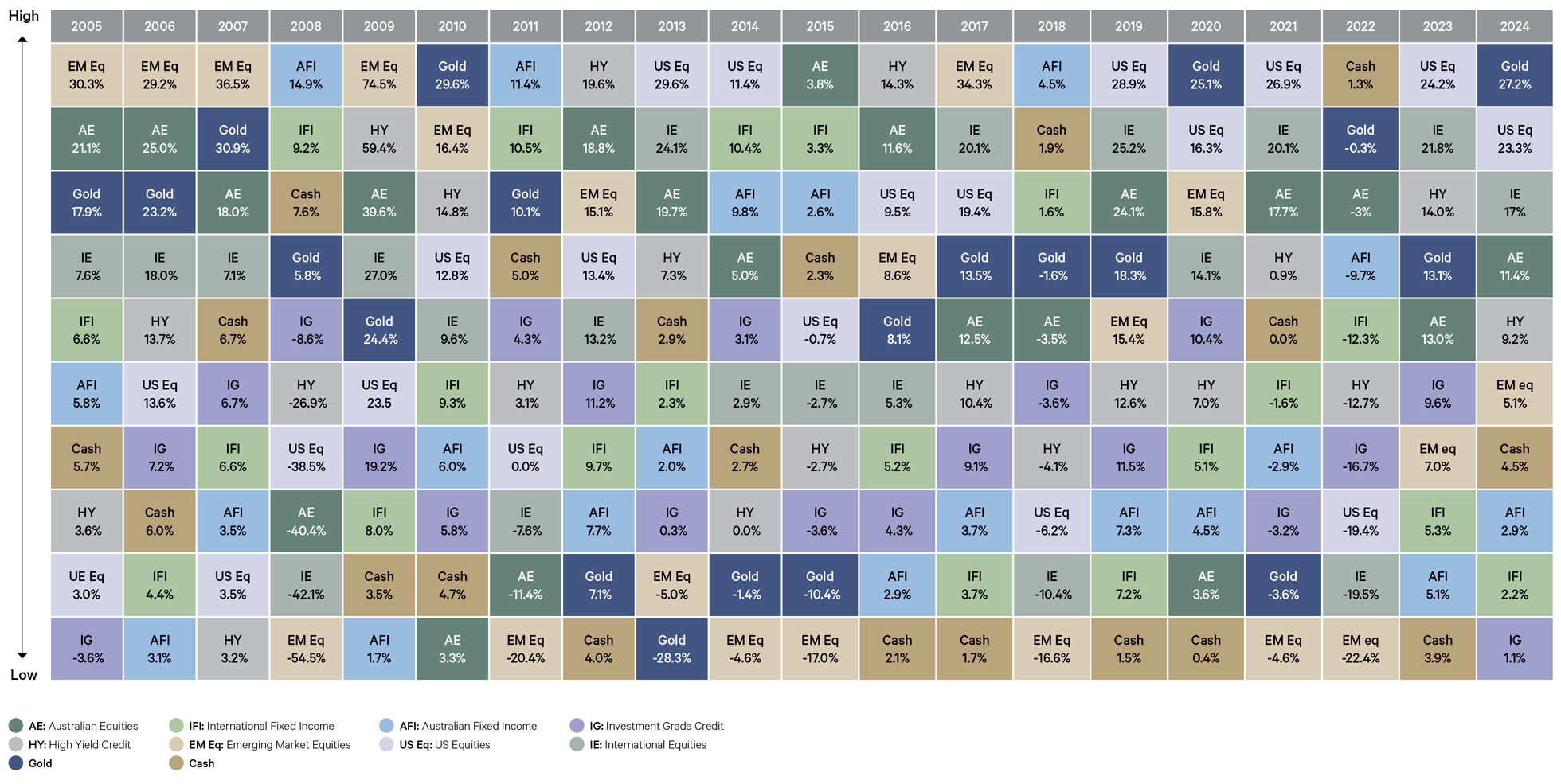

2024 saw a remarkable performance across various asset classes, with all generating positive returns for the second consecutive year. Gold emerged as the standout performer, reflecting heightened geopolitical risk and uncertainty. Ongoing conflicts in Ukraine and the Middle East, coupled with political instability, pushed investors towards this safe-haven asset.

US equities also had a stellar year, with the AI boom propelling stocks to new highs. The end of the hiking cycle provided additional support to equities both domestically and internationally.

Emerging market equities, led by India and Taiwan, posted gains despite concerns over slower economic growth in China.

US equities have topped performance charts a record five times in the last two decades. However, emerging market equities, though out of favour recently, have also been top performers five times in the same period.

Diversification matters – every asset class has taken its place in the top performers for a given year over the last two decades. Conversely, every asset class has taken a turn at the bottom. A diverse, actively managed portfolio drives returns when times are good, and offers protection when times are more challenging.

Asset Class Quilt of Market Returns (2005-2024)

Source: Bloomberg, 2024 data as at 31/12/2024