-

Overview

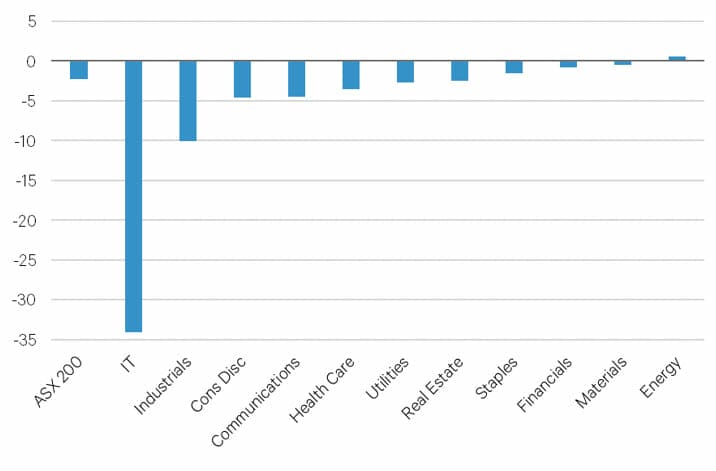

With earnings trends positive in the first two months of 2022, equity market weakness can be explained by a broad decline in valuations across nearly all sectors of the Australian market. Higher growth sectors, however, have suffered the largest valuation re-adjustment, with a greater impact as a result of the rise in interest rates that was triggered by a change in guidance from the Fed (the ‘Powell Pivot’). This has been most visible in the domestic information technology sector where the forward PE ratio has fallen by 34 points.

Chart 1: High growth sectors de-rate on Powell Pivot (PE change since start of year)

Source: Bloomberg

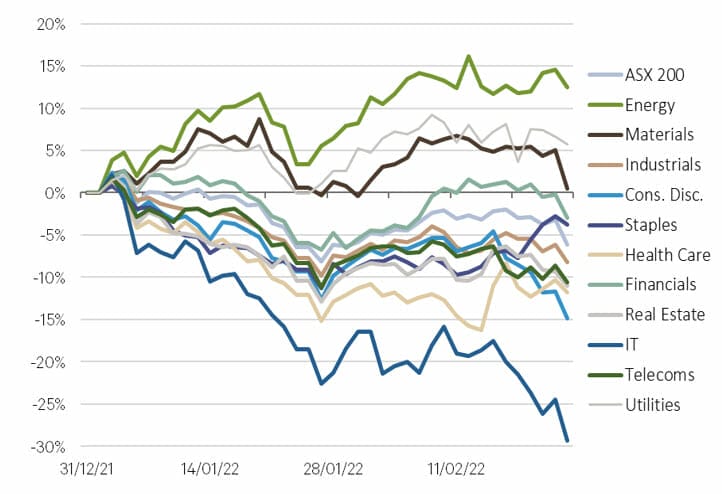

This has led to a significant level of dispersion in returns across the sectors of the Australian market in the first two months of 2022. The two resources sectors (energy and materials), along with utilities, have all managed positive performance year to date. Meanwhile, the key growth sectors of IT, health care and consumer discretionary have all recorded significant underperformance of the benchmark.

Chart 2: Australian equities: Sector dispersion in 2022

Source: Bloomberg

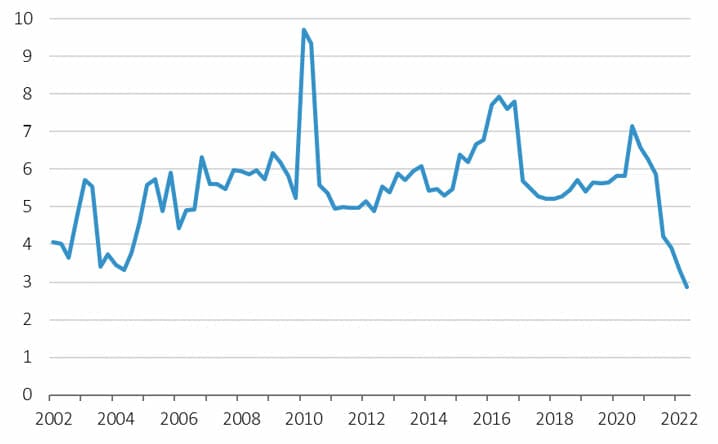

While Australian households remain susceptible to tightening monetary policy with prevailing high debt levels, the opposite is true of large corporates. Companies have emerged from the COVID crisis in good shape, having built up cash balances with reduced or suspended dividends, cuts to capex spending and government support. The net debt to EBITDA ratio for the ASX 200 now stands at less than 3x, which is as low as any point in the last two decades.

Chart 3: Corporate balance sheets in good shape (Net Debt/EBITDA)

Source: Bloomberg