-

Overview

With central bankers increasingly crowding investors out of public markets, private markets will increasingly become an attractive option. Such an option brings with it some illiquidity risk but used in moderation at the total portfolio level we believe there are attractive risk adjusted returns to be had over the coming year. This will result in an extension of the trend that has been evident since 2020.

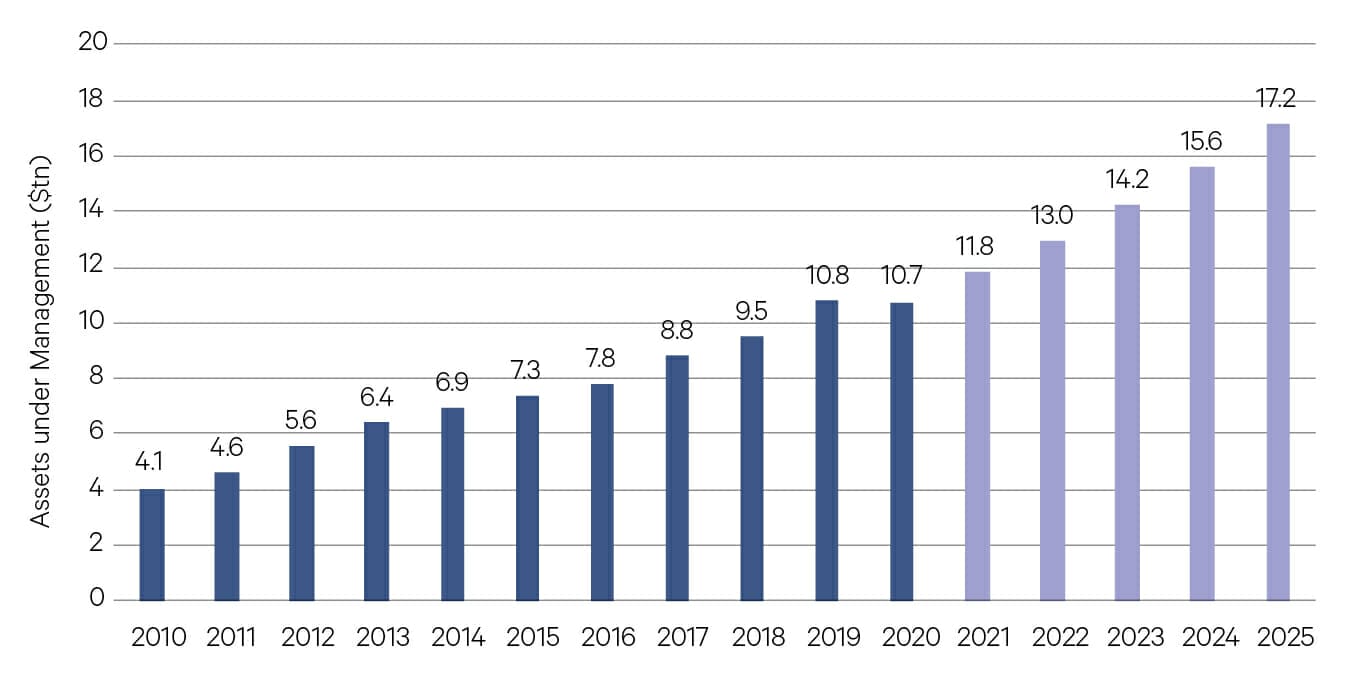

Alternative Assets under management and forecast 2010–2025*

Source: Preqin

*2020 figure is annualized based on data to October. 2021–2025 are Preqin’s forecasted figures.

Alternatives total assets forecast to grow 60% by 2025.

The total investment in alternatives is expected to grow at an annualized rate of 10% over the next 5 years. Private equity will gain the lion’s share of this growth with investors expected to increase their allocation to the space by around 15%p.a. over the next five years.

Within private equity we like global managers that can achieve good diversification across deal type from direct equity, secondaries and co-investments, as well as investment style from early stage growth to more mature buyout style investments. Partners Group and Hamilton Lane are two such managers.

Investment in private debt is also expected to increase in the coming years according to a survey by Preqin. Dislocations caused by changes to bank lending practices has led to increased opportunities in the space. Within private debt we like managers focused on the top end of the capital structure with the ability to achieve diversification across industry, issuer and geographic locations such as Merricks Partners Fund.

While we expect the infrastructure sector to improve versus 2020, certain sub-sectors have a more uncertain outlook. For airports, 2021 should see a rebound but volumes are likely to be well below 2019 levels. Toll roads rebounded strongly when restrictions were eased and container volumes at US and European ports recovered quickly.

We are most positive on the outlook for digital and renewables infrastructure.

We are most positive on the outlook for digital and renewables infrastructure. The pre-crisis structural growth trends in digital infrastructure will accelerate significantly in coming years. The global cloud computing market size is expected to grow from USD 371.4 billion in 2020 to USD 832.1 billion by 2025. Demand to build hyperscale data centres required to facilitate this shift is growing at more than 20% annually.

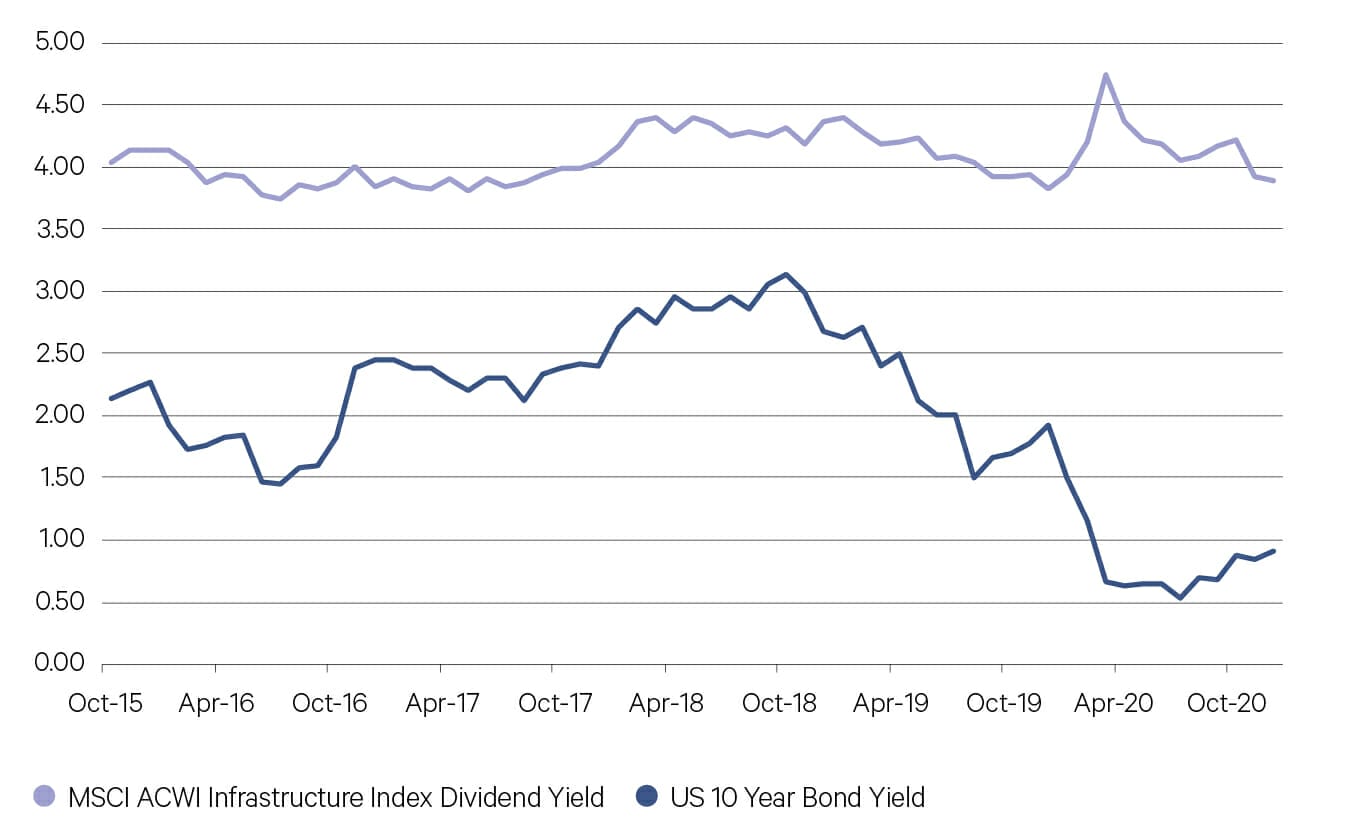

Infrastructure dividend yield vs US 10-year bond yield (%)

Source: Bloomberg

With bond yields sitting close to historic lows investors searching for yield are forced to look further out the risk spectrum to achieve the same level of return. Infrastructure is one such area.

Growth in renewable energy sources will continue in the coming years and improvements in energy grid stability and storage technology will be central to the continued growth of investment into wind and solar. It is estimated that USD 3.4 trillion will be invested globally in renewable energy by 2030. We see significantly investment opportunities in this area for our clients.

Real assets such as direct property can add defensive characteristics to portfolios whilst also providing a decent level of income. Should we experience any bouts of unexpected inflation in the near-term real assets can provide some protection with incomes typically linked to the consumer price index.

The commitment to environmental, social and governance (ESG) principals is growing within the alternatives asset class. Over the past decade USD 3 trillion has been raised across more than 5,400 funds managed by firms subscribing to ESG principles. The world’s largest fund managers are leading the way on this front; of the funds raising USD 1 billion or more in the market 70% had ESG commitments attached to them.